Currency assets are subject to high market volatility while the cryptocurrency industry is still developing. As a result, investors rush to the industry as prices rise, but they lose a lot of money when the market collapses. On the other hand, professional investors use a variety of strategies to benefit from BTC.

As the most popular method of making money, cryptocurrency trading is hazardous due to its extreme volatility. However, there are alternative methods to make money with cryptocurrencies owing to the market’s immense growth potential.

Why to invest in cryptocurrency markets?

When it comes to storing Bitcoins, a software wallet is like a physical wallet. When it’s ready, use it. As with a savings account, depositing Bitcoin into a savings protocol is like depositing money. It compensates you for using the service the same way banks do with interest on certain savings accounts.

Token trading on a cryptocurrency exchange is comparable to stock market stock trading. Tokens symbolize blockchains, while stock-like protocols represent companies. Storing cryptocurrency and borrowing from yourself is like putting money into a retirement account or getting a loan from it.

Cryptocurrency strategies: how do they work?

Online transactions may be made using Bitcoin, a decentralized payment system. However, the market is flooded with the best cryptos to invest in, from the well-known Bitcoin, Ethereum, and Litecoin to the meme currency Dogecoin.

The same coin can’t be used more than once since all cryptocurrency transactions are recorded on a blockchain. Hundreds of devices make up the blockchain network, and the owners of this equipment may receive BTC in return for their labor.

New coins are “mined” by computers reading complex mathematical nuances to verify the legitimacy of a blockchain transaction. Even though many people use cryptocurrencies to make transactions, they are also utilized as an investment instrument, with whole websites devoted to monitoring the value of a Bitcoin.

Coinbase, Coinmarketcap, and BlockFi are among the most popular exchanges for converting cash into cryptocurrency, and users can expect their investments to appreciate much like stocks.

Based on your total taxable income, the amount of capital gains tax that you pay on Bitcoin cash or other cryptocurrency income will be determined. Anyone making less than $40,000 per year will not be taxed on their Bitcoin earnings. According to the rules, income up to $441,150 is taxed at 15%, while income over that is taxed at 20%.

Investors love cryptocurrency because it’s easy to buy, sell, and exchange it online. Large corporations may announce that they will accept cryptocurrencies as a payment method, mining methods may change, or celebrities like Elon Musk may endorse particular crypto assets. It is all possible. When demand increases and supply is limited, its value may also rise.

However, there is an end to mining when there are 21 million BTC in circulation. For instance, businesses may cease taking cryptocurrencies as payment, or many users may try to sell them all at once, causing their value to plummet.

How to start?

You can take start in a few easy steps:

- Register your account with any regulated crypto exchange.

- Complete your KYC process.

- Deposit funds into your wallet. It is advisable to fund the USDT or any other stable wallet. So, you may save against the risk of abrupt movement in the markets like BTC, ETH, etc.

- Start investing in any coin or token according to the strategy.

Let’s go through three basic crypto strategies to keep in mind while investing.

Dollar-cost averaging

This strategy has received widespread support on the internet. Similar to the SIP technique of investing in mutual funds, it involves regularly acquiring specified amounts of Bitcoin. However, in this case, one does not even think about the price; rather, one purchases to accumulate investment dollars at predefined intervals.

Consider the possibility that you are intrigued by Ripple’s long-term potential. With a few cryptocurrency exchanges, you can easily set up a monthly buy for a certain amount of Ripple. For example, you may automate your Ripple purchases so that you acquire $100 of the cryptocurrency on the first of every month.

Who is this strategy for?

If you are investing in cryptocurrencies for the sole purpose of making money, then going with this strategy is a good choice for you. The latest sensation is something you don’t want to miss out on. Forget about checking the charts and want everything to happen automatically. Dollar-cost averaging would have worked well in the last year.

The only reason prices have risen so rapidly is due to the previous year’s dramatic spike in the value of almost every kind of cryptocurrency. As the trading of digital currencies gets more active, dollar-cost averaging becomes riskier.

This approach has several downsides, despite common perceptions.

Litecoin has a huge volume in a short time. As a result, we’ve seen a significant drop in the price graph. One such instance is the drop in the diagram by the arrow. Prices dropped from $412 to $103 in only 14 trading days.

If the price of Litecoin plummeted from $1500 to $750 over a few weeks, would you still stay in? Maybe.

Anyone would be justified in their panic in such a situation. That isn’t a sound risk management plan. However, going in at $103 is an excellent investment since it lowers your chance of losing money. Is there any way it could go any lower? Yes, without a doubt.

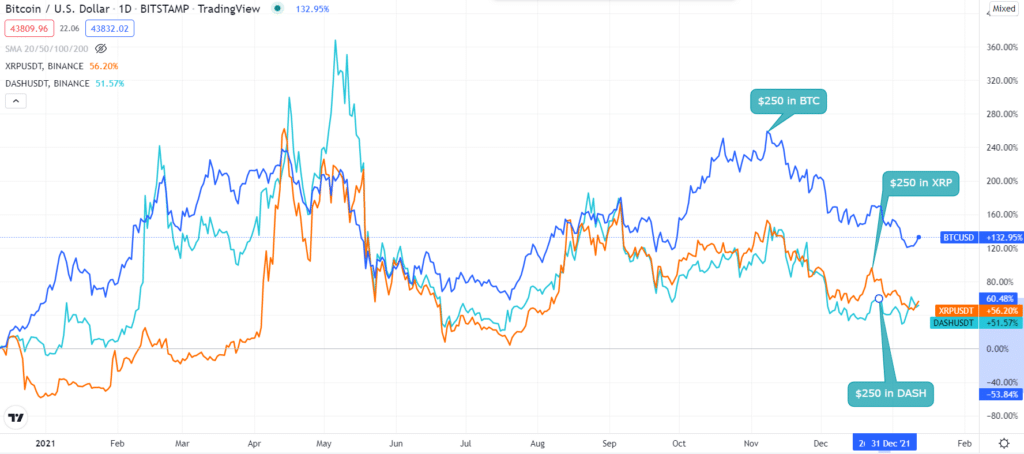

Balanced portfolio

Using this strategy, you would purchase an equal amount of each currency in terms of US dollars. To put it another way, if you had $1,000 to invest in four different currencies like BTC, XRP, and DASH, you would allocate $250 to each one. The four currencies would be equally divided in any future investments.

You’d wait for the price to come together into a Baseball Cap before making each purchase (as mentioned above).

Who is this strategy for?

Using this method, you may build a varied portfolio of coins without worrying about whether or not any of them would perform well. Instead, it exposes you to a few currencies with the best chance of success at a fair fee.

This method, contrary to common opinion, has several drawbacks.

If you employed this investing strategy, you would not optimize your investment in the currencies expected to beat the others. While it’s impossible to predict which ones will flourish, this method gives variety.

Unbalanced portfolio

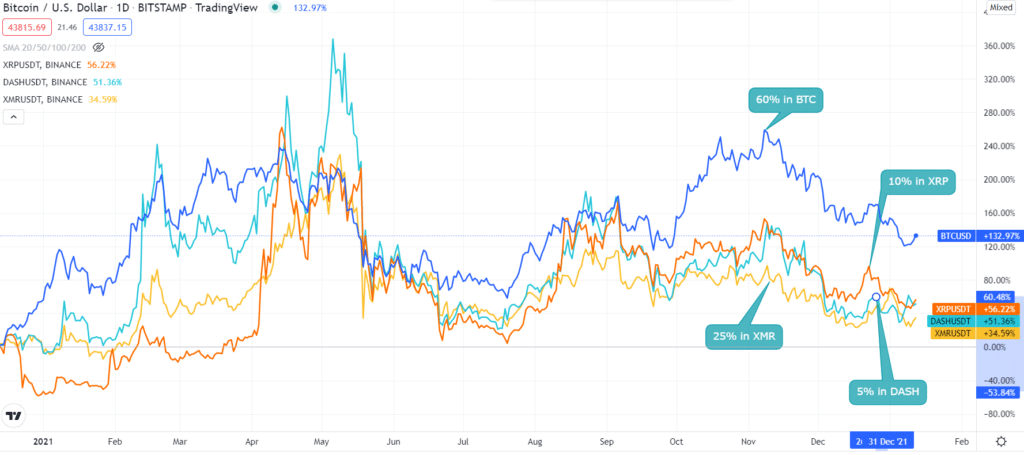

It’s possible to benefit from the best-performing currencies by using an unbalanced portfolio strategy based on how well you think each currency will do. This system would disperse your investments accordingly.

You may have the following allocations if we continue to utilize the same portfolio as before:

BTC (60%), XMR (25%), XRP (10%), Dash (5%)

It’s best to invest most of your money in Bitcoin if you feel it will outperform the rest. This is because these percentages would then be applied to all future investments. But, of course, you wouldn’t buy any cash until you saw one wearing a Baseball Cap.

Who is this strategy for?

This is for people who have done a lot of research on currencies and know which ones will do well. Changing the proportion allocated to each currency that you previously agreed on can only be done if you have a sufficient reason to do so.

However, contrary to common assumptions, this approach has certain downsides.

The only drawback is that you run the risk of investing too little in the currency that has performed the best. A balanced portfolio strategy is the best alternative if this one fails. Only use this strategy if you are somewhat particular about your projections.

Final thoughts

Investing in crypto requires an in-depth knowledge of the technologies involved. To make a secure and rewarding investment, you must first do thorough research. Twitter is the best place to go regarding current crypto business news.

Investing in Bitcoin is a major endeavor requiring careful planning and attention to detail. Keeping an eye on the market’s fluctuations is essential. Before embarking on your journey, make sure you have your wallet on hand. Make sure you’ve considered all of your choices before deciding to invest.

Before making a purchase, make sure to monitor the cryptocurrency’s progress in the market. The study results are divided into two categories: long-term and short-term. Consequently, you must do considerable study and keep an eye on the cryptocurrency’s past and present performance.