Since 2020, cryptocurrencies backed by metals like gold and silver have become increasingly popular. However, the idea of backing cryptos with treasured metals is not new. Perth Mint developed the first gold-backed cryptocurrency in 2018. This was done to allow investment in precious metals. Silver-backed crypts have grown in popularity because the coin’s value will be at least equal to the current price of the metal.

The crypto’s price may rise above its present level if the coin looks to be trendy. However, stablecoins, i.e., those linked to the dollar or these metals, persist in overpowering the market.

Crypto backed by silver is also gaining more and more appreciation.

Why is silver-backed crypto worth investing in?

People often do not give silver the importance it deserves. After all, it is a lesser expensive metal than gold. Silver is cheaper than gold, so the spot price is relatively low. But silver-backed crypto is worth the buy.

The reason for silver gaining the spotlight is that because it is cheaper and the coin will cost the same as the spot price, people prefer using this instead of gold. More and more users have started opting for silver instead of silver for investment purposes.

According to the CEO of US Global Investors, this is because silver is one and a half times more volatile than gold.

How does silver crypto work?

There are several silver cryptos; each works slightly differently from the other. SilverCoin is one example, which was the first silver-backed asset. It does not require any identification to buy it. All that is needed is an Ethereum wallet address. Silverlink, another type of silver crypto, permits investors to buy digital silver like any other cryptocurrency.

Through silver-backed crypto, investors can take advantage of the market’s volatility by investing in them that, if popular, might generate significant returns on investment when they rise above the spot price.

How to start investing?

First, you need to pick the type of silver-backed asset. For example, for Silverlink tokens (LKNS), there is a set fee on every order to holders of LNK tokens. SilverToken lets investors have direct ownership. You can convert your silver-backed crypto to physical bullion if you choose this. You can also sell coins back to SilverToken.

AurusSilver (AWS)

So, AurusSilver is the first on our list. But first, let’s take a closer look at the silver-backed crypto. AWS is a silver-backed ETH token produced by a group of experienced traders from the existing precious metals industry. Each AWS token is backed by 1 gram of 99.9% LBMA-accredited silver, stored in insufficiently insured and regulated vaults, and then redeemed.

Looking ahead to 2022, AWS has a strong potential to grow because of the company’s fundamental aspects. In April 2021, AurusSilver was traveling at 0.87. Creating highs and lows, the price is 0.79 at writing.

In comparison to the previous year, AWS has dropped by 9.19%. The crypto’s 52-week range is 0.50-1.00.

SilverCoin (SC)

SilverCoin’s fractionalized form and its security measures and inclusive nature make it a popular investment option. SilverCoin is the first fractionalized silver-backed asset globally. You can buy it using currencies or crypto. Due to SilverCoin’s fractionalized nature, you may buy any amount.

With one of the highest trade volumes among silver-backed cryptos, SilverCoin is one of the most popular. You may exchange SilverCoin for pure silver in our vault at any time. For example, SilverCoins may be exchanged at a 1:1 ratio of 100 SilverCoins for one ounce of silver.

As you can see, if you had invested in SC a year ago, you would have lost money; in fact, you would have made a loss. In April 2021, the price of SilverCoin was 0.017. The price is currently hovering at 0.0023 at the time of writing.

In comparison to the previous year, SC has dropped by 86%. It’s a little less than last year, but the project has the tendency to advance, and if the price drops any further, it may be a good time to invest. On the other hand, SC offers an excellent buying opportunity due to its total volume. The SC’s 52-week range is 0.0015-0.0030.

Silverway (SLV)

SLV was founded in 2018 and has been around for quite some time. Silverway is part of the Slavi project, which aims to build a digital infrastructure for cryptocurrencies.

Slavi intends to support as many blockchain protocols as feasible to give consumers a full solution. The Slavi DApp, built on the Web-3.0 project, enables direct connections between wallets and protocols, eliminating third-party involvement and giving customers control over their cash.

According to the Slavi project’s monetization strategy, the SLV token is the primary carrier of value and payment source for the platform’s operations and capabilities.

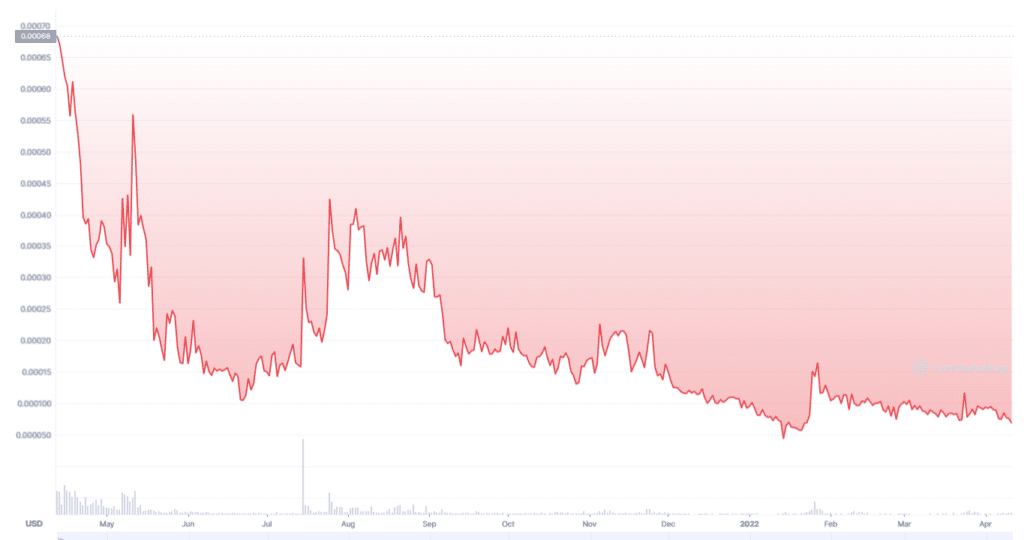

The SLV currency is now in a negative trend, with the price hovering around 0.0000068. On the other hand, the SLV token is a terrific buy-and-hold opportunity with solid fundamentals.

In comparison to the previous year, SLV has dropped by 98%. The crypto’s 52-week range is 0.0000010-0.0000068.

Upsides and downsides

| Upsides | Downsides |

| It has a lower spot price. | There is a fee levied on some silver-backed investments. |

| It is much more volatile than gold. | Understanding the different types of silver assets may take time. |

| It can bring substantial returns for investors as the capital rises above the spot price. | There is always a risk of system failure and/or bankruptcy. |

Final thoughts

All of the silver-backed cryptos we’ve discussed have a lot of room for development. However, because the market is prone to significant fluctuations, it’s necessary to have a sound plan before investing in these assets.