Stellar is a decentralized network that allows users to generate, transmit, and trade many forms of currencies. It was founded in 2014 and released in 2015. While the Stellar platform accepts all forms of money and crypto assets, it does have its crypto called Lumens, or XLM, which serves as the network’s basis.

This guide will discuss XLM price prediction for the next five years and how the project will look overall.

XLM fundamental analysis: let us dig deeper

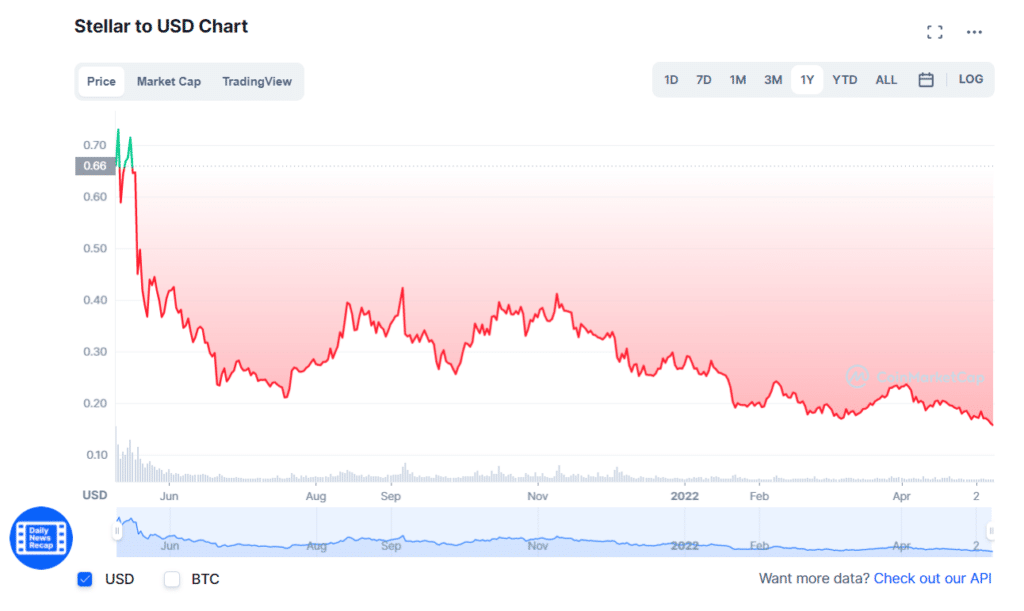

Rising inflation, the Ukraine crisis, and tighter Fed policy have weighed on crypto assets this year. The most popular cryptocurrency, Bitcoin, has dropped almost 44% from its all-time high in November. Ethereum, the second-largest crypto, has experienced a similar slump, falling 42%.

So, what are the chances of XLM?

Stellar is ranked 31st on CoinMarketCap’s top market capitalizations list. Stellar is reliable crypto. It is supported by a solid team and solves an essential real-world problem. The hefty fees associated with overseas payments. It has several major relationships, including MoneyGram, Circle, and IBM.

On May 5, 2022, Grayscale Investments, the largest crypto asset manager, submitted a registration statement on Form 10 with the US Securities and Exchange Commission. If SEC approves this, Stellar Lumens Trust will become part of the SEC-reporting companies. So, XLM fundamentals look on the bullish side.

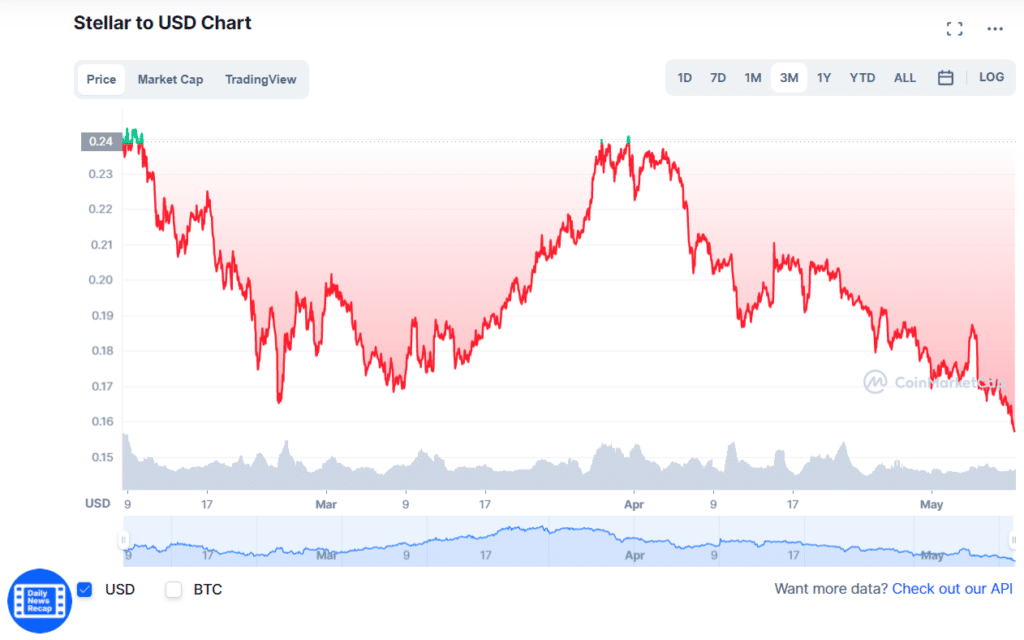

XLM technical analysis

Stellar is down 5,31% in the last 24 hours. At the time of writing, it is trading at 0.157. XLM/USD is now hitting the 0.142 level. A fall below 0.142 will bring the token towards the 1.42 support level. If the pair falls below this level again, it will challenge the next support level, 0.138.

On the upside, XLM can go towards the next resistance level, around 0.185. A break over 0.190 will pave the door for a test of the following resistance level of 0.206.

In addition, there were indications that the coin was in an accumulation phase. As a result, long-term investors may want to load up, expecting a rally above the $0.24 area highs in the coming weeks.

XLM price prediction for 2022

According to the estimate, the price of this crypto will reach the $0.23 level. Stellar can reach a minimum cost of $0.21 before the end of the year. Furthermore, its price has the potential to reach a high of $0.23.

XLM price prediction for 2023

According to the forecast, this coin’s price will reach the $0.24 mark. Stellar can get a minimal charge of $0.22 by the end of the year. Meanwhile, its price has the potential to reach a high of $0.26.

XLM price prediction for 2024

According to the prediction, the crypto price will reach the $0.28 level. Stellar can get a minimum cost of $0.21 before the end of the year. Additionally, its price has the potential to reach a high of $0.29.

XLM price prediction for 2025

According to the estimate, the price of this crypto will reach the $0.32 level. Stellar can reach a minimal cost of $0.29 by the end of the year. Besides this, its price has the potential to reach a high of $0.37.

XLM price prediction for 2030

According to the predictions, the price of this crypto will reach the $0.76 level. Stellar can reach a minimum price of $0.76 before the end of the year. Additionally, its price has the potential to reach a high of $0.84.

How much will XLM be worth in 5 years?

Looking at the price history, its price can cross the 0.35 barrier. The average price of Stellar can reach $0.39.

- XLM hit an all-time high of $0.875563 on Jan 03, 2018.

- XLM had an all-time low of $0.000476123392 on Mar 05, 2015.

XLM staking APY

Staking a crypto asset often includes locking it up to become a participant on a certain blockchain by confirming transactions and ensuring the network’s security. In exchange, you will earn a yearly percent yield.

The amount XLM holders will earn in rewards will be determined by the amount of asset locked in, the holding time, and the APY your selected crypto exchange gives. While some deals might reach an annualized incentive rate of 8%, others can be as low as 3%.

How to stake XLM?

Step 1.

Open an account with a reliable crypto trading exchange. There are eight exchanges where you may stake Stellar and earn up to 10% APY.

Step 2.

Deposit XLM tokens into your trading platform’s wallet.

Step 3.

Buy XLM directly on the exchange or transfer any existing tokens into your exchange wallet. Navigate to your exchange platform’s “Staking” page and pick “XLM.” Most exchange systems now allow you to choose your staking length. This term, similar to a fixed deposit at a bank, defines how long your XLM tokens will be locked away.

You will not earn the staking benefits if you withdraw your XLM before the conclusion of the staking period.

How to mine XLM?

Unlike other cryptos, Stellar uses Stellar Consensus Protocol rather than the PoW and cannot be mined. However, you may earn incentives through crypto exchanges’ earn or lend programs.

To start earning rewards on your XLM, you must first choose an exchange with a suitable APY, satisfy the minimum balance requirements, and set a stacking duration. You can withdraw your XLM with the flexible option, but not until the locking period expires with the latter.

Summary

Stellar is frequently seen as an undervalued crypto investment. However, it displays real-world usefulness and has formed some great collaborations. The Stellar network is expanding, with year-over-year payments increasing by 378% from 2020 to 2021.

Stellar’s excellent staff, reasonably lengthy track record, and compelling use case suggest that it has the potential to do well in the long run.