Blockchain-based DeFi (DeFi) is the next gold rush in cryptocurrency, with millions of people flocking to the sector.

Since most prior decentralized exchanges used the order book model, liquidity pools are a critical component of DeFi (DEXs). We’ll be looking at the top five liquidity pool providers in DeFi for other protocols, such as Uniswap, Balancer, and Curve.

It’s a good idea to acquaint yourself with the project’s concept and liquidity pools before beginning. Start with knowing what LP tokens are and then look at the top three-LP tokens to invest in 2022.

Why is it worth investing in LP tokens?

Token holders benefit from a wide range of revenue opportunities due to their participation in the liquidity pool of the network. These users get a portion of the trading fees that the platform collects. In addition, an average 0.2 percent tax is passed on directly to holders of LP tokens at a rate of 0.17 percent.

How do LP tokens work?

High reserves are required for transactions in a decentralized currency market, which requires many currencies for each transaction. As a result, users provide liquidity in return for a percentage of the exchange’s transaction fees, typically 1% of the total value of each transaction.

The people who invest in these reserves are liquidity providers (or liquidity pools). If you put money into the pool, you’ll be given a token in return, and you’ll be able to contribute how much or how little you’d want. In addition, liquidity providers may claim ownership of a particular pool piece by exchanging their LP tokens for the initial monies they invested.

Each transaction in the pool incurs a small fee, which is paid directly to the liquidity providers in the pool. These expenses are calculated according to the number of trades; the length of time held by a position. The pool’s size and value are augmented because of the transaction fees credited to the LP token. As a result, long-term holders of LP tokens in high-volume pools may see a considerable return on their investment.

A derivative asset has its value determined by its parent asset’s market value. Liquidity provision in fluctuating asset pools increases the danger of momentary loss, despite LP tokens representing equal assets being relatively stable. Stake DAO, for example, is developing new financial products on top of AMMs, so LP tokens may be staked to generate a high annual percentage income (APY). To encourage users to keep their native assets, liquid protocols employ yield farming as an incentive technique.

How to start?

If providers want to get LP tokens, they must add both from the pool pair. For example, one must give the pool equal amounts of Cake and USDT to get a Cake-USDT LP token. To estimate how many tokens you should transfer to the pool, you may use the conversion rates for both tokens. If you want LP tokens, you’ll need both BTC and ETH. If you don’t already have them, you may buy them via the exchange or transfer them from another exchange.

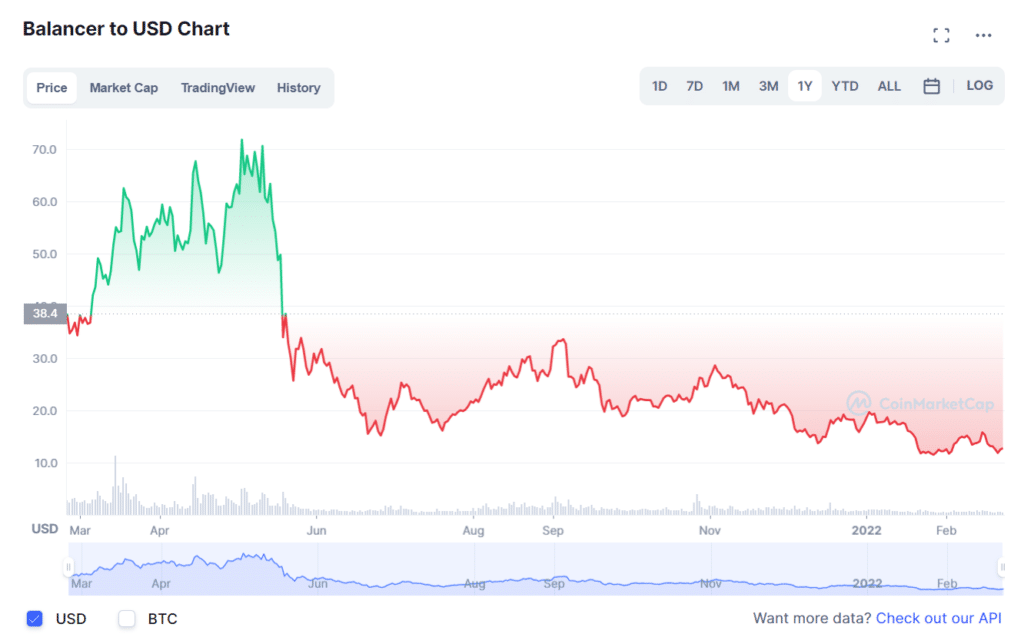

Balancer (BAL)

52-week range: $10.47-$74.77

1-year price change: The BAL hit an all-time high of around $75 in May 2021. However, the price of assets could not sustain and fell around $10.

Forecast 2022: $23.54-$25.76

An Ethereum-based portfolio manager, liquidity provider, and price monitor are available on the Ethereum platform. Trading fees may be earned by anybody who wants to create or contribute liquidity to their private liquidity pools.

Private, shared, and intelligent pools are all options in the Balancer protocol’s library of pooling situations. However, it is solely up to the pool owner to provide liquidity, change settings, and update the pool. Unlike private pools, the specifications of a shared pool — such as weights, tokens, and fees — are predetermined from the get-go.

Because anybody may contribute liquidity to the pools, no special rights are granted, and the Balancer Pool Token is used to register ownership of the pools. There is also a smart pool, a private pool where smart contracts govern transactions. On the other hand, the Balancer Pool Token may be used to track the source of the liquidity.

Newly allocated BAL governance tokens have just been given to liquidity providers via a process called liquidity mining.

DIA/USDC, USDC/BAL, and NMR/WETH are just a few of the liquidity pools available via Balancer.

Uniswap (UNI)

52-week range: $9.63-$44.97

1-year price change: The UNI reached an all-time high around $44 on May 21 but failed to sustain and fell back to a single digit.

Forecast 2022: $15.36-$17.77

Decentralized ERC-20 token exchange Uniswap supports 50 percent Ethereum contracts and 50 percent token contracts from the Ethereum blockchain. In addition, ETH may be exchanged for any other ERC-20 token without going via a central exchange, thanks to this.

Anybody may start a new trading pair in a new liquidity pool for any token on its open-source exchange, which charges no fees for doing so — the platform levies exchange fees of 0.3 percent, which is split with liquidity providers. You can examine the current token list here, and you can also create a new one if you choose.

Uniswap is a cryptocurrency liquidity pool that accepts deposits in return for Uniswap tokens. There are equal numbers of Uniwap tokens to be had when you put DAI, for instance, into your account.

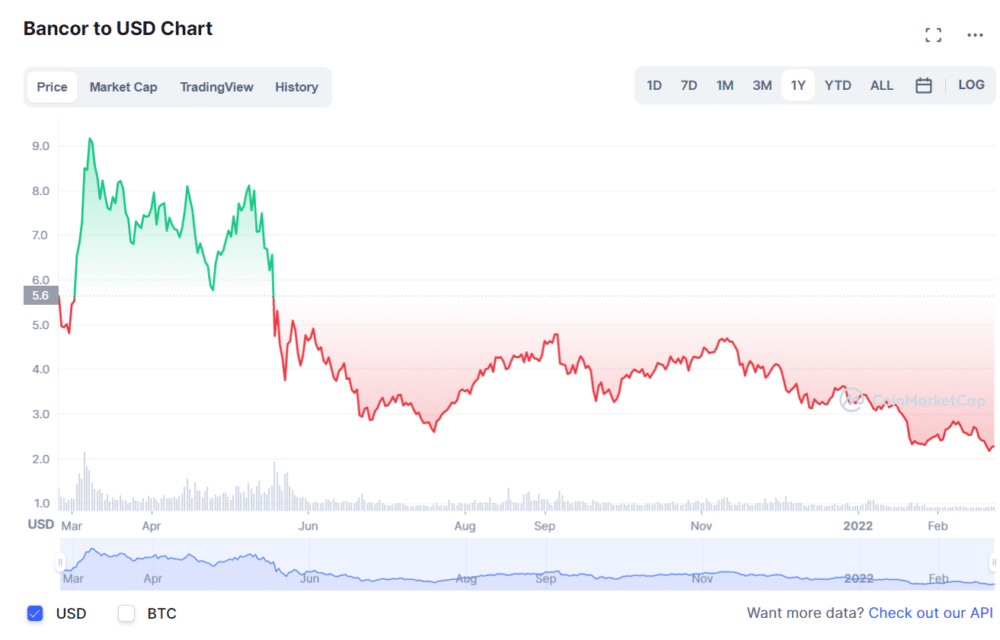

Bancor (BNT)

52-week range: $2.06-$9.33

1-year price change: The BNT hit a yearly high above $9 on May 21 and then fell towards $2 by the end of the year.

Forecast 2022: $3.30-$3.92

Bancor is an Ethereum-based blockchain system that uses collective liquidity. Algorithmic approaches, such as those used by Curve, Uniswap, and others, ensure liquidity and proper pricing by maintaining a consistent ratio with connected tokens and altering their supply, similar to what is done with “Smart Tokens” on these platforms.

One of its liquidity pools is called the Bancor relay. As a result, the native token’s dependency on BNT is addressed by adding the Bancor stable coin. Consequently, the BNT token, Ethereum, or EOS token and its stable currency enable liquidity pooling (USDB). Because of this, BNT is used to facilitate the movement of data across other blockchains, like Ethereum and EOS. In contrast to Uniswap, Bancor charges between 0.1 and 0.5 percent of the pool’s value for switching.

Upsides and downsides

Let’s look at the upsides and downsides of liquidity pools and token providers.

| Upsides | Downsides |

| Liquidity pools have the advantage of not needing a buyer and seller to agree to exchange two assets for a fixed price. As a result, even the most illiquid trading pairs may be traded with low slippage if a large enough liquidity pool exists. | Because there are no third parties in DeFi, your assets in the pools are safeguarded by a smart contract. Therefore, if anything goes wrong, your financial status may suffer. |

| Liquidity pools offer a near-constant supply of liquidity for traders who desire to utilize decentralized exchanges. | If a significant transaction occurs unexpectedly, the pricing mechanism may induce slippage in smaller pools. |

| They also allow you to become a liquidity provider and earn transaction fees on your Bitcoin holdings. | Your assets’ value may be reduced by the AMM. |

Final thoughts

Historically, the development of decentralized finance may be traced back to liquidity pools. The cryptocurrency ecosystem has always relied heavily on liquidity, and DEXs are continually looking for innovative ways to increase liquidity. A profound grasp of liquidity pool providers and their features is suggested for a better user experience.