In the post-pandemic era, the mining sector will be one of the most promising investment opportunities. The importance of nickel mining will increase in the following years. The price increased from 2016 to 2018 from $8,000 to $19,000 without boosting the economy.

While the bulk of nickel is used in corrosion-resistant alloys, the growing demand for electric car batteries is driving up the price of this metal. Tesla’s CEO has openly offered a multibillion-dollar contract to any company that can create enough nickel to meet Tesla’s environmental standards for the next several decades.

What are the best investments for 2022? The industry relies heavily on nickel, and now is the most significant time to become involved. Find out now by continuing to read.

Why is it worth investing in nickel stocks?

In contrast to other metals, nickel is a silvery-white metal that is hard and flexible. For more than 3,500 years, nickel has been utilized in everything from coins to showerheads to electric car batteries.

A significant portion of the lithium-ion batteries used in electric vehicles is composed of nickel. Mining giant BHP estimates that a lithium-ion battery for an electric car comprises 40 kg (88 lbs) of nickel. The use of lithium-ion batteries to store renewable energy is also possible. Battery storage is becoming more critical as we generate more power from weather-dependent renewables like wind and solar.

The importance of nickel may be summarized as follows: when the batteries have a higher nickel content, the vehicle may go longer between recharges. The increased battery power provided by nickel is critical for larger electric vehicles, such as trucks. Today, batteries require around 7% nickel; the remainder is used to make stainless steel. As a result, the proportion of nickel-based batteries in electric vehicle batteries will likely climb.

According to the International Energy Agency, EV and battery storage demand would rise from 81 tons in 2020 to 3,352 tons in 2040 under a sustainable development scenario.

How does it work?

Firms that extract or sell nickel have stock that is called nickel stock. Nickel is a crucial component in creating electric car batteries, and as a result, these stocks are on the rise. Since their production began, nickel, cheaper and more energy-dense than cobalt, has replaced cobalt as a critical component in lithium-ion batteries.

According to industry estimates, there are already 7,2 million electric vehicles. It is expected to rise to 245 million by 2030.

However, stainless steel producers now get the vast bulk of nickel. Thus, the supply is skewed heavily in their favor. Despite this, the economy’s recovery has led to an increase in the size of this sector. Because suppliers cannot keep up with demand, the sector faces significant difficulties.

In the short and long run, this shows a situation where nickel demand is high enough that the price will climb, rewarding investors.

How to start?

You can start by doing some market research and getting an idea of current market trends. Once you get done with research, you should choose which stocks you plan to invest in by considering their pros and cons. Finally, you should find a reliable and trusted financial broker to invest in the stocks.

Sibanye Stillwater (SBSW)

52-week range: $10.51-20.64

1-year price change: SBSW share’s price on 30 May 2021 was $16.90. A year later, the share’s price closed at $13.12.

Forecast 2022: the forward dividend ratio of the firm is 1.30, and the dividend yield is 11.38%. Consequently, before the firm releases its earnings report, investors may wish to see a price increase in the stock.

Analysts predict the company’s earnings per share will be about $1.51 in 2022. According to the data, EPS growth in 2022 is predicted to be 30.20%, while the following year is expected to be 15.00%.

It is a precious metals mining company with subsidiaries in South Africa, the United States, Zimbabwe, Canada, and Argentina. Sibanye Stillwater Limited There is several different commodities made by the company, including gold and platinum group metals (PGMs) such as palladium, platinum, and rhodium. With its East Boulder and Stillwater mines in Montana and its Columbus metallurgical complex producing PGM-rich filter cake and reusing recycled PGM, it has many Montana assets.

In the last 12 months, Sibanye Stillwater generated USD172.2 billion in revenues and employed 80,000 people.

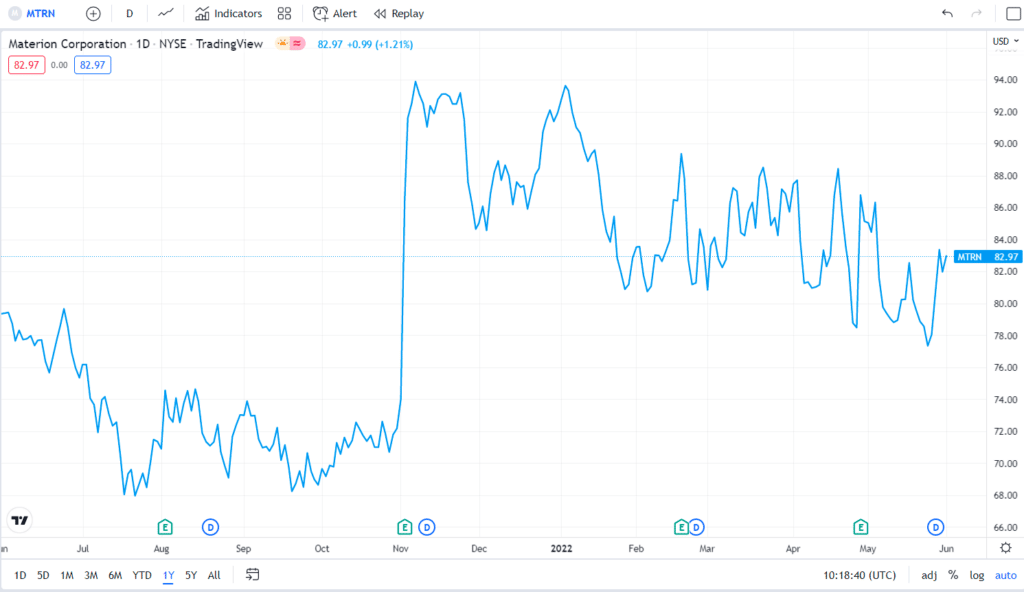

Materion Corporation (MTRN)

52-week range: $66.92-$96

1-year price change: MTRN share’s price on 30 May 2021 was $78.32. A year later, the share’s price closed at $83.37.

Forecast 2022: the stock is in a broad downward trend in the near term. Additional falls within the trend are expected too.

With the present short-term trend, the stock will likely lose 6.56% over the next three months. With a 90% likelihood, conclude the period with a price between $72.09 and $80.28.

One of the world’s leading manufacturers of semiconductors, industrial, aerospace, and military products is Materion Corporation, which has subsidiaries in the United States, Asia, Europe, and the rest of the world.

The company’s three segments are performance alloys and composites, advanced materials, and precision optics. Beryllium and non-beryllium alloy systems and custom-developed components in the strip, bulk, rod, plate, bar, tube, and other customized forms are provided by the performance alloys and composites division.

Materion Corporation’s revenue was around $1.6 billion at the end of the fiscal year, with 3,443 people.

Nickel Mines Ltd. (NIC)

52-week range: $0.88-$1.79

1-year price change: NIC share’s price on 30 May 2021 was $0.99. A year later, the share’s price closed at $1.27.

Forecast 2022: The consensus forecast for 2022 has been revised upwards. From the US $0.09 to the US $0.010, the EPS forecast for 2022 has been raised. At $1.09 billion, revenue is expected to remain stable for the foreseeable future. The Metals and Mining business in Australia is expected to increase by 37% next year, while net income is expected to rise by 88%.

Mining and producing nickel pig iron are two of the main activities of Nickel Mines Limited, an Indonesian and Singaporean corporation. Morowali Regency in Central Sulawesi is home to the 5,983-hectare Hengjaya Mine, 80% owned by the company. It also owns 80% of the Ranger Nickel project and 70% of the Angel Nickel project. It may also buy a 70% interest in the Oracle Nickel project for its use.

Australian Securities Exchange-listed Nickel Mines has a trailing 12-month revenue of around AUD 645.9 million (ASX). All of the pricing is in Australian dollars.

Upsides and downsides

The upsides and downsides of investing in these stocks are as follows.

| Upsides | Downsides |

| Several nickel stocks have returned more than 2500%. That’s why nickel stocks are a wise investment. | Stock sales that result in a profit are subject to taxation. |

| As demand for electric vehicles grows, nickel usage will climb as well. | Rivalry with institutional and seasoned investors. |

| Due to battery advancements, nickel is projected to play a more significant role in energy storage systems. | An emotional roller coaster ride. |

Final thoughts

As important as picking the right market and company is, so is picking the right broker. If you don’t have a broker’s account, you still need to perform some research.

In the long run, the nickel industry will continue to grow. Demand now outpaces supply in this business, and this trend does not seem to be decreasing anytime soon. For now, nickel will remain an essential component of batteries unless battery research advances significantly in the next few years. There will still be a demand for nickel even if this happens.