Coin price stability is a big problem in the crypto space as it is new and still evolving. Terra was one such decentralized protocol that took the initiative to use stablecoins to power and stabilize the price of crypto coins. It promotes the development of decentralized financial infrastructure, allowing you to easily spend cryptocurrency with businesses, generate stablecoin income, and replace most of your banking needs with one DeFi protocol.

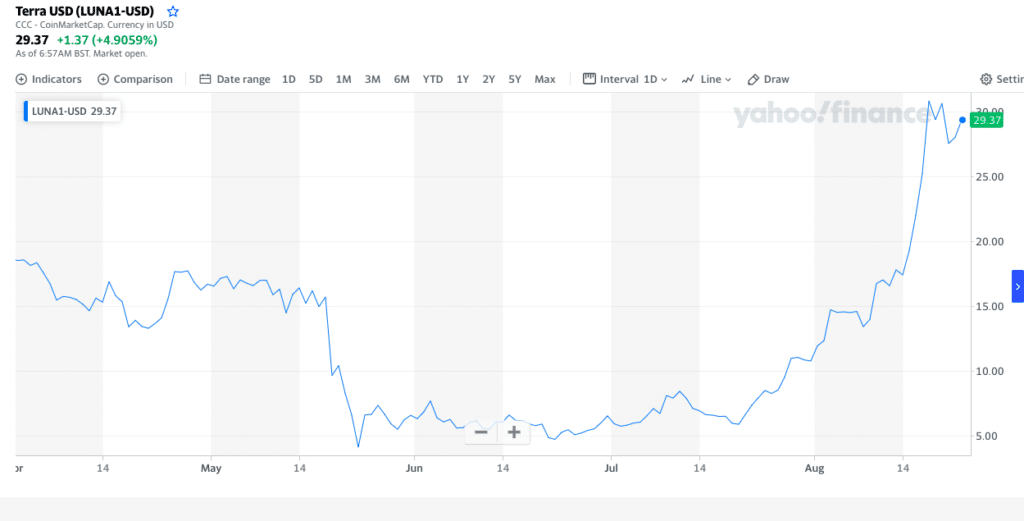

LUNA’s market cap jumped to about $6 billion from $300 million in less than five months as people are showing interest in the innovative idea and real-time usage of LUNA coin.

LUNA serves as a management marker and is used as an algorithmic balancing system that helps stablecoins maintain their pegs. For example, when TerraUSD trades above $1, users can send a $1 LUNA to the system and receive 1 UST in return — a trade that helps bring the stablecoin price back in line.

If you are planning to make a significant investment or hold this crypto coin for a long time, the article will give you an idea of the expected growth of your investment.

What is cryptocurrency?

The word “cryptocurrency” came into existence in the 21st century and came from the Greek word “kryptos,” meaning “secret.” Crypto is a digital form of currency that uses cryptography to keep the transaction secure.

Simpler it is the medium of exchange of goods and services. Blockchain, the technology on which cryptocurrencies are built, is a distributed ledger technology that enables users to use its decentralized platform transparently.

Blockchain is highly secure, and it’s nearly impossible to temper it. You can think of a cryptocurrency like a fiat currency, but the only difference is it is available digitally, which means you cannot touch, see or feel it. That is just like digital assets, silver, and gold.

What is a Terra?

LUNA is an official token of the Terra blockchain that utilizes fiat-pegged stablecoins to energy the global payments systems.

Stablecoin here means the coins with their value tied up with a fiat currency such as the USD or gold. As you may know, cryptocurrencies like BTC, ETH, TXR, AAVE are widely used as a medium of exchange of goods and services, but it is so volatile that its price fluctuates quickly. This frequent price change makes it hard for its users to maintain the price stability for exchange.

Daniel Shin and Do Kwon founded Terra in January 2018 from South Korea. The two founders invented the Terra project to stimulate the speedy encouragement of crypto and blockchain technology. This growth was to be pushed by focusing on the price stability and usability of the crypto coins.

Kwon, himself, is a big name in South Korea. He has worked as a software developer in Apple and Microsoft and was also the CEO of Anyfi, a startup providing decentralized wireless mesh networking solutions. Currently, Kwon is shitting on the throne as a CEO of Terraform Labs, the company behind Terra.

Terra here consolidates the price stability and wide adoption of fiat currencies with the censorship-resistance of Bitcoin and offers fast and affordable settlements.

How is LUNA unique?

There are many ways Terra is unique and could be one such coin that you must have in your wallet. Terra here consolidates the price stability and wide adoption of fiat currencies with the censorship-resistance of Bitcoin and offers fast and affordable settlements.

Terra makes itself different by combining the maximum advantages of cryptocurrencies with the price stability of fiat currencies by utilizing the fiat-pegged stablecoins. The demand and supply are kept in check through its complete proof one-to-one channel algorithm.

The process is carried out by stimulating LUNA holders to swap and stablecoins at beneficial exchange rates, as needed, to either increase or decrease the stablecoin supply to match demand.

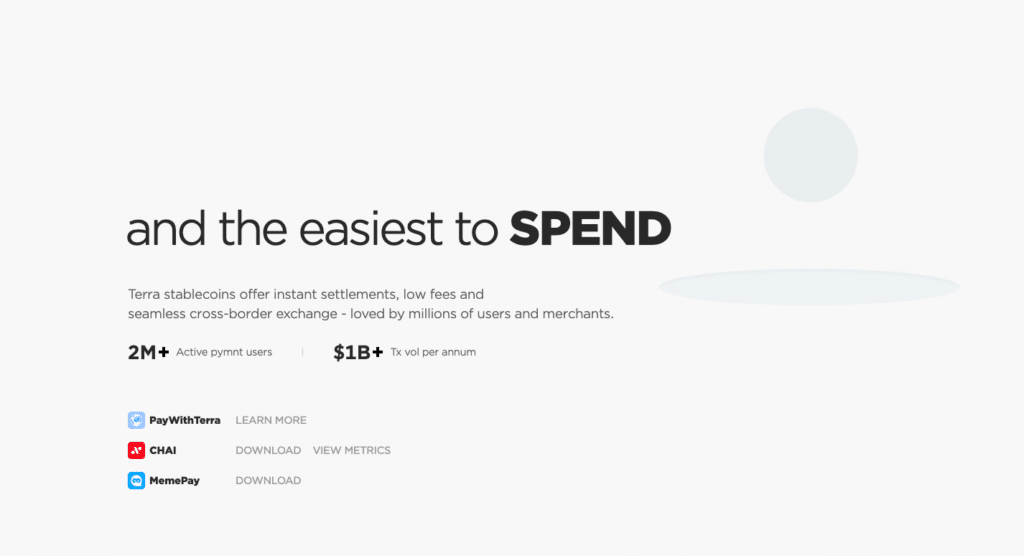

What makes Terra more unique is the wide range of partners for payments platforms, especially in the Asia-Pacific region. Also, Terra is already a partner with a South Korea-based mobile payments application, known as Chai. The setup works so that the transaction made by the application on e-commerce platforms is via the Terra blockchain network.

The average fee charged for each transaction is around 2%-3%.

Why may you choose to invest in LUNA?

Let’s go through the main reasons.

Terra LUNA: help balance out its stablecoin’s prices

This digital asset keeps its stablecoin prices at check and where they should be. Working with all Terra’s stablecoin allows trading between LUNA and stablecoin to increase or reduce the stablecoin supply.

LUNA tokens: for staking and governance of the project

You will get rewards if you keep your LUNA tokens at stake. When you keep your tokens on a pledge to the network, the blockchain will use it to verify the transactions.

The cut you will receive will be from the transaction fees that Terra collects on the use of its stablecoins.

The LUNA protocol: multiple stablecoins bound to different currencies

Generally, stablecoins preserve equivalent prices making it a better option for transferring funds and exchanging goods and services. As already discussed, Terra aims to concentrate on and use stablecoins to stabilize Luna and other cryptocurrencies.

The LUNA blockchain: revenue ranks in the top five

This cryptocurrency is still not on the top ten list on CoinMarketCap. But revenue-wise, it’s almost on the top.

How to invest in LUNA?

Investing in LUNA could be the right decision, as predicted by many crypto experts. LUNA is unique and has real-life usage in the decentralized space. Over said this, you can trade, invest, or even mine this coin.

Investing is very easy; you will need a fiat currency such as BUSD or UST; you also can trade LUNA with ETH and BTC. You can then hop to Binance or any local cryptocurrency exchange and buy it.

Final thoughts

There are hundreds of good crypto coins that you can access once you have good knowledge and do your research right. Investing right depends on your style and overall needs.

Investing in any form is risky and may lead to loss of your capital; at the same time, as crypto is still evolving, it gives a lot of opportunities to scammers. Investing is an excellent practice to fetch you a better return in the future. Terra has a great concept that makes it unique and worth keeping as a long-term investment.