Several high-flying growth stocks have been trading down, and the electric vehicle market is no exception. The market’s broad sell-off has lowered the value of electric vehicle stocks. As a result, many investors appear to have forgotten about the electric car sector’s potential.

No one can predict how these companies will perform soon, but recent sell-offs may provide investors with the opportunity to acquire them at significant discounts.

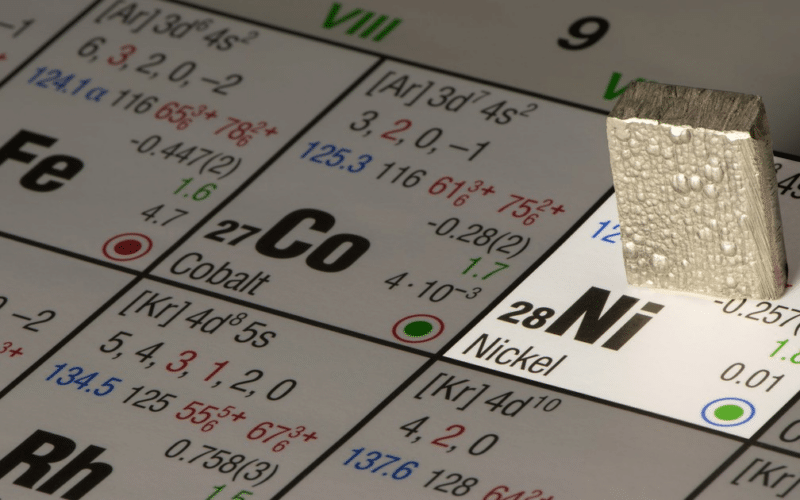

Why is it worth investing in nickel stocks?

Sales and profitability are essential for a business to do well in the forex market, and nickel stocks have both. For profit-making, yearly percentage revenue growth and EPS growth are critical factors. These are the top mining stocks.

Thus, evaluating car companies only on their growth rate puts the ranking at risk of being skewed by accounting irregularities of the quarter, such as changes in tax law or restructuring costs.

A lot of nickel stocks have made more than 2500% profit. That’s why investing in nickel stocks is a beneficial move to do.

How does it work?

Nickel consumption will continue to rise as demand for electric cars increases. These automobiles’ batteries use a substantial quantity of metal. It enables improved energy density and storage capacity to be delivered at a lower cost.

Nickel is also expected to play a more significant part in energy storage systems due to future battery improvement. This is most likely why Tesla and others seek long-term supply deals.

Although the market for electric vehicles is still in its infancy, the potential is huge. The following five nickel stocks might provide substantial returns over the next few years. Additionally, several other metals are necessary, as previously noted.

How to start?

Although EVs currently represent a relatively tiny fraction of vehicles on the road today, the trend is gathering speed. By and large, more manufacturers and consumers are embracing an electric future. This is a robust trend, which is favorable for nickel stocks.

On the official market of the exchange, investors may buy and sell nickel stocks at any time of day or night, including on national holidays. Your ownership of a particular digital asset is legally established when you buy and hold it on a forex trading platform.

Top three nickel stocks

Here is a list of the top three nickel stocks to make a high profit in 2022.

Tesla (TSLA)

52-week range: $539.4-$1243.4

1-year price change: at the end of September 2021, the TSLA stock achieved a yearly high of roughly $1243. Despite an annual low of $539 in March 2021, the asset’s price grew by 49.76 % in 2021.

Forecast 2022: $970-$1050

Tesla has been at the forefront of the electric vehicle revolution for a long time. It is also a producer of renewable energy and manufactures electric cars. As a supplier of electric cars and battery energy storage, Tesla is an all-in-one company.

Tesla is also a large solar system installer in the United States through its subsidiary Tesla Energy. The company posted better-than-expected quarterly profits this week.

Profits per share adjusted, estimated to be $2.36, were $2.52, above analysts’ estimates. Moving on, analysts forecasted $16.57 billion in revenue, while the actual figure was $17.72 billion.

This is a 65 percent growth in revenue year over year. Additionally, Elon Musk, Tesla’s CEO, emphasized that the company will concentrate on engineering and tooling for the future autos it intends to create.

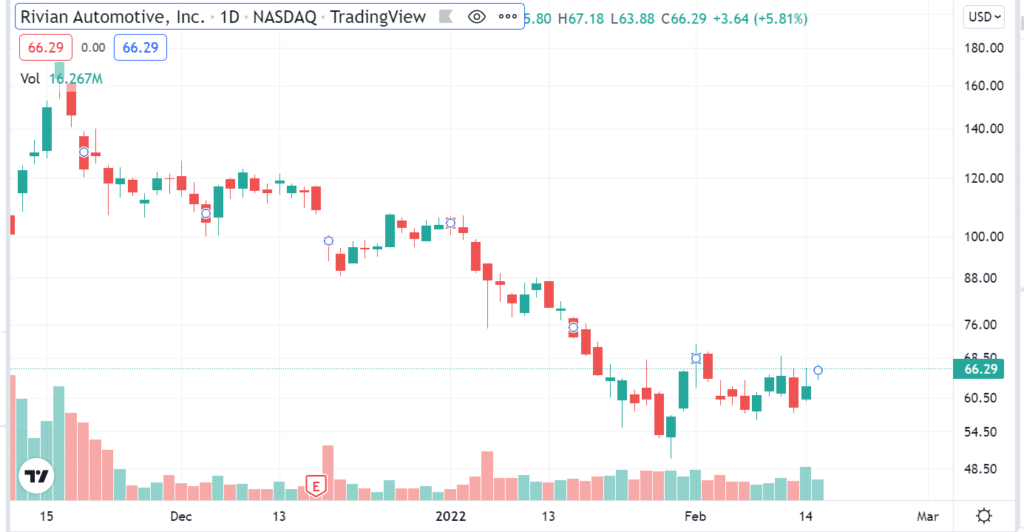

Rivian (RIVN)

52-week range: $50-$179

1-year price change: The RIVN stock reached an annual high of roughly $180 in early December 2021, and its price increased by just 3% in 2021 from its launching date till the end of 2021.

Forecast 2022: $132-$149

Rivian is an electric car startup that recently went public. While Tesla is the undisputed leader in the electric car business, Rivian looks to be following suit by manufacturing everything in-house.

They can arrange to finance and sell the automobiles they have designed and constructed through their dealerships. The company’s main product line is all-electric pickup trucks and SUVs.

Amazon and Ford have invested despite its fresh startup. After a week-long pause in production, the company claims to be back on pace. Rivian has been ramping up manufacturing to around 200 delivery-ready devices each week since last week’s announcement.

Because the business faces a more difficult struggle than most other startups, it is critical to maintain it in context even though that amount looks modest.

As of December 15, 2021, around 71,000 pre-orders for the R1T and R1S have been placed. In addition, Rivian has committed to selling 100,000 electric delivery vehicles to Amazon as part of a contract, including 10,000 this year.

Nikola (NKLA)

52-week range: $6.5-$22.04

1-year price change: The NKLA stock hit a yearly high of roughly $22 in May 2021 and a yearly low of $6 in January 2022. And unfortunately, the price of NKLA declined by 61% in 2021.

Forecast 2022: $17-$27

Nikola is an electric car startup to revolutionize transportation. The company’s primary focus is on zero-emission batteries and hydrogen-powered vehicles.

Additionally, the firm is developing vehicle components, energy storage systems, and infrastructure for electric vehicles and hydrogen stations. Moreover, some clients have already signed letters of intent to buy the EV manufacturer’s trucks.

Upsides and downsides

Here are the significant upsides and downsides of nickel stocks investment.

| Upsides | Downsides |

| The cash flow increases following the economic growth. | Profitable stock sales are taxed. |

| Maintain a one-step lead above inflation | Competing against institutional and experienced investors. |

| It’s easy to purchase, and you don’t need a significant quantity of cash to get started. | Ups and downs in an emotional situation. |

Final thoughts

The electric vehicle (EV) business is in its infancy; the potential is enormous. Therefore, investors should consider the nickel stocks listed above over the next few years.

However, many investors fear they’ve missed the bus, untrue. The majority of research organizations forecast that the market for electric cars will grow at a compound annual rate of about 10% each year through 2030, even though electric vehicles now account for only a tiny fraction of total worldwide vehicle sales.

In other words, the electric car industry is still in its infancy, and specific stocks appear to be on the verge of an unstoppable bull run.