In trading, there is a belief to ‘buy low and sell high.’ Well, momentum trading goes against this belief to some extent. Since momentum trading is like riding the wave, so to speak, you jump in the middle of the trend when it picks up speed and ride it up or down until it runs out of momentum.

It’s a common trading technique among investors and traders. Richard Driehaus is known as the father of momentum investing; he was not the first momentum investor. But he used the strategy in his investment portfolio. He thought that you could make a profit more if you buy high and sell higher. His theory was to buy the winning stocks and sell the losers.

So, let’s see what momentum trading is and how it works in trading?

What is momentum trading?

It refers to how fast the price accelerates in one direction. To fully grasp the concept of momentum, think of pushing a trolley downhill. When the trolley starts, it runs slower, but as soon as the hill becomes steeper, the speed increases, and it runs down faster. It then slows down towards the bottom of the hill. The speed of the trolly can be affected by the load on the trolly and how hard you pushed it.

The same way price moves with momentum. When the price is declining, initially, the rate at which it decreases will be slow. But as more traders start selling, they increase the trading volume similar to the trolley’s weight; the price will hurry until it reaches a point of exhaustion when it slows down again.

How to spot momentum on a price chart

Momentum trading involves following the movement of an asset and then taking a position during the movement.

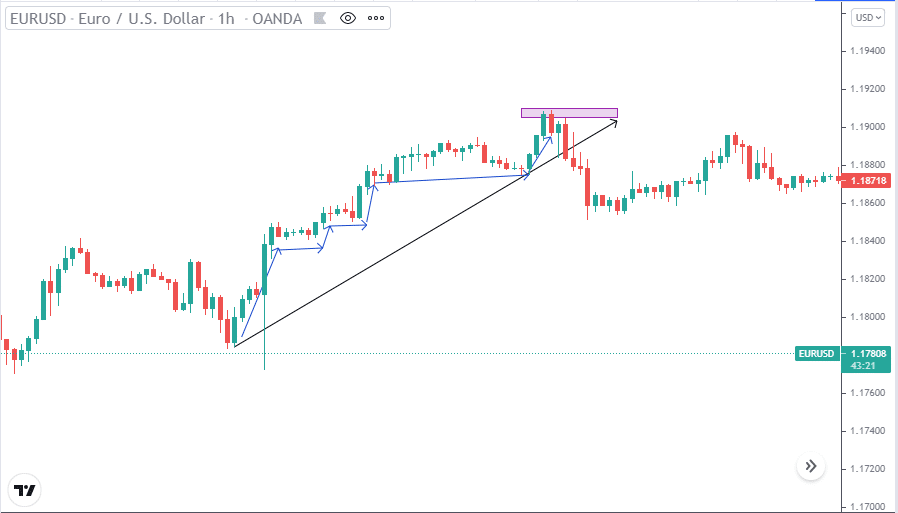

You can identify momentum in the price by looking at the size of the candlesticks. When the market trends up or down, it doesn’t necessarily mean strong movement in either direction. The price can move up over a long period, and you will notice this by looking at the bodies of the candlesticks. Let’s look at this in the below chart.

We can see in this EUR/USD chart that there is an overall long upward trend. However, the speed of the price moving up is relatively slow, noticeable from the small candlestick bodies.

The price moves up, then sideways, and pushes up again for a few sessions until it reaches the top and reverses direction.

Now, we will look at an example where price moves upwards at high speed.

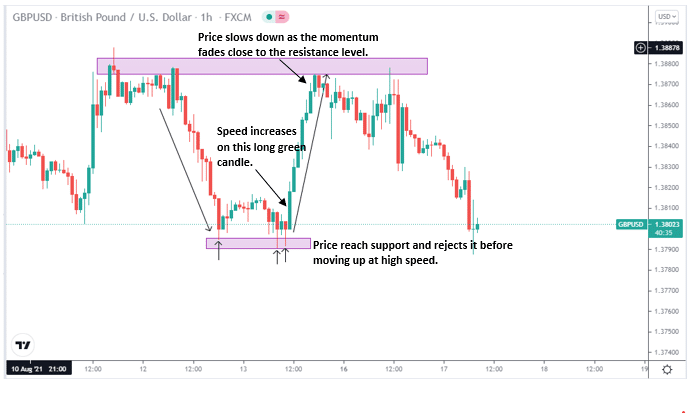

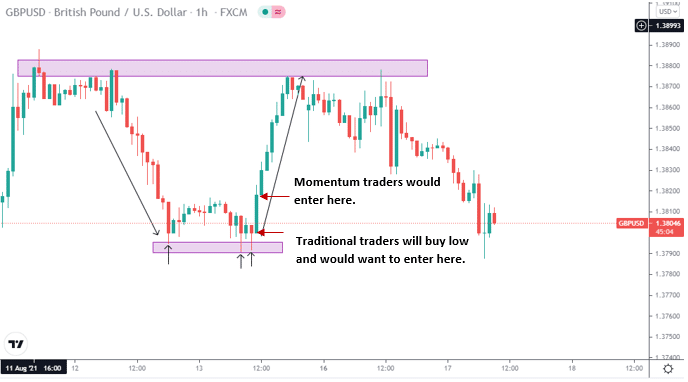

Here in this GBP/USD price chart, we can see that the price came down to a support level. The price rejected this level three times before moving up. We can see the upward move is very strong because the candlesticks have long bodies. Then the speed decreases as it approaches the significant resistance level, an indication that momentum is fading. The price then reverses downwards from there.

Looking at the first green candle, we can see a strong push; traditional traders will think they have missed a buying opportunity and would have entered the market at the support level since they intend to buy low and sell high.

However, this is precisely where a momentum trader would enter the market because, as we can see, the next candle moves up, and there is no wick forming showing the push is strong upwards.

Momentum traders will be in and out quicker than trend following traders.

Pros and cons of momentum trading

Momentum trading is a popular strategy, but it requires skill and knowledge since you are buying or selling in the middle of the trend. Therefore, you need to consider these pros and cons.

Pros

- You can profit quickly

Since the price moves at a high speed, momentum trading allows you to profit relatively quickly. This strategy is suitable for all styles of traders, from scalpers to swing traders.

- No fundamental analysis is required

As a momentum trader, you aren’t required to analyze fundamentals. Because it’s a short-term strategy, you don’t have to study the fundamentals of the asset over a long period, and you can use technical analysis as the basis for your decision.

- High volatility is good

When price moves rapidly in a specific direction, it creates volatility, which is an opportunity to benefit while the price is in this strong up or down movement.

Cons

- Requires constant monitoring

When you trade momentum strategies, you have to monitor the charts frequently to catch an opportunity. It is, therefore, time-consuming.

- Market sentiment is bullish

Market sentiment for momentum trading seems to be more bullish; therefore, you will have to wait for a solid upward momentum to occur if you want to maximize your profits.

- False sign of momentum

If we consider our example of the GBP/USD chart and enter the position after the first green candlestick, hypothetically, the price then pulls back to the support level. However, this is a false sign of momentum, and traders often can be victims of this false momentum.

Final thoughts

Momentum trading is a powerful trading technique which many professional traders utilize daily. However, it requires a good understanding of the market and in-depth technical analysis. As we have shown you, it can be risky if you cannot spot the right moment to enter a position.

Due to the fast pace of this type of strategy, you need to be able to control your emotions, and this strategy is not suited for everyone. Many methods are just as profitable, and you have to familiarize yourself with the one that best suits your trading style and discipline.