Green energy is taking over the world at a faster rate than expected just 20 years ago. Uranium seems to be one of the best ways to power cities and nations in a carbon-neutral environment.

While industrialized nations have committed to being carbon-neutral by 2050, the world still runs on oil and fossil fuels in less than three decades. As a result, America, Europe, and even Japan are turning their heads back to nuclear energy as a sustainable solution to solve the world’s environmental problems.

Companies are joining this vast effort to save the world and make a whole new economic order out of this change. The next few years could see many of the world’s most influential and wealthy men emerge from this business. Keep reading to learn how to invest wisely in this revitalized industry that will take over the energy sector.

What is investing in uranium stocks?

Investing in these stocks puts down part of your capital in buying shares of companies involved in the uranium business for energy production.

- Uranium is not for nuclear weapons

Although you may have heard of uranium as a dangerous element for nuclear weapons, the truth is that the power contained in uranium is used frequently to power cities around the world.

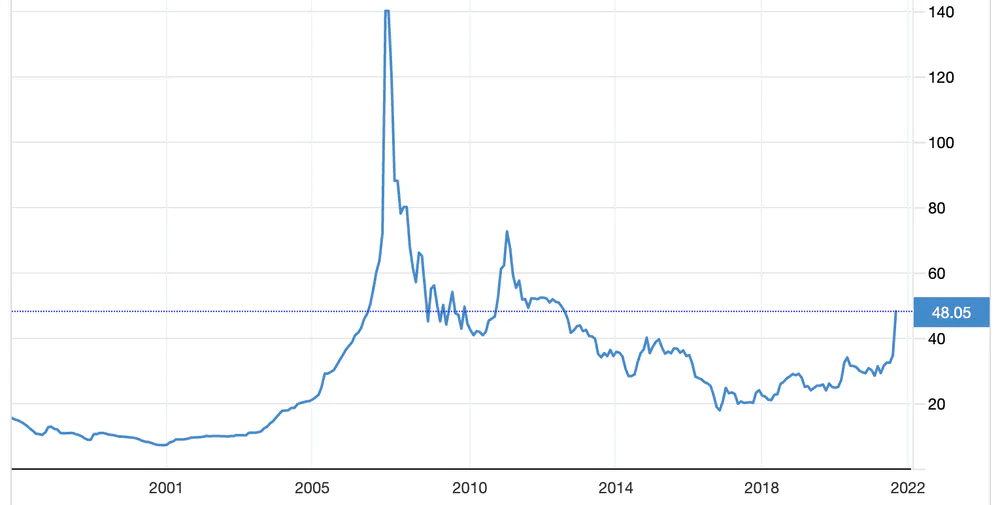

- Uranium prices

Right now they are at their highest level since 2013 due to the increase in the demand and future developments of plants like the one in France, where nuclear energy accounts for more than 70% of the electricity supply in the country.

- Nuclear accidents have set back nuclear development

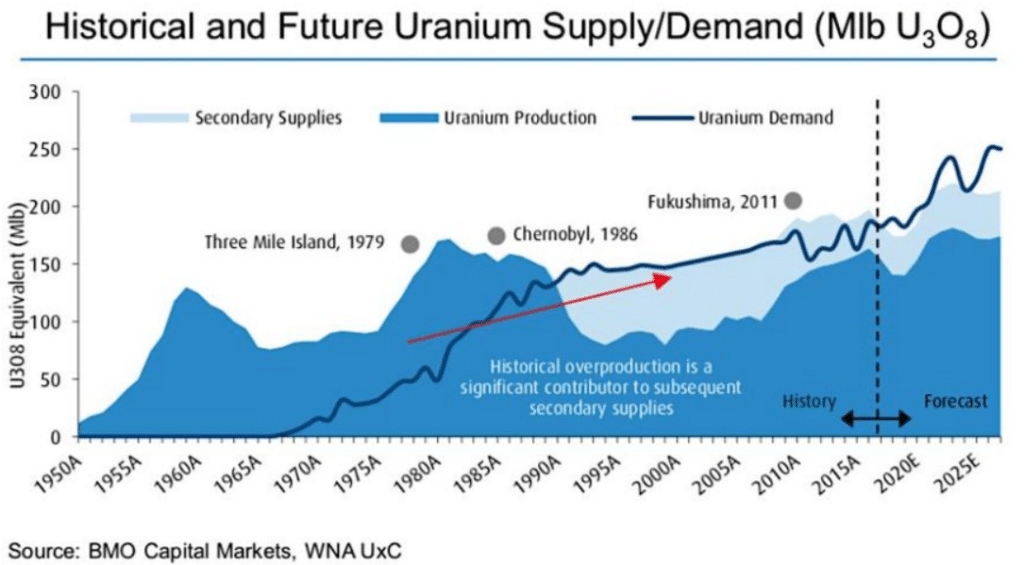

The Fukushima accident made many nuclear power enthusiasts reevaluate their position about nuclear energy as a source of power that could solve the energetic problem of a world without fossil fuels.

- Neither solar nor eolic energy can replace it

However, the industry has finally admitted that despite years of investing money, effort, and time into solar and eolic energy, they cannot address the issue alone due to their instabilities. There is no solar power at night, and there is electric power without wind, so you can’t trust any of those sources to power systems constantly. We need a reliable option to be there when solar and eolic energy fail to cover the demand.

- The world is ready for nuclear power

It seems that after the low point that signifies the Fukushima accident, the inability of other renewable resources to give cheap and reliable energy has brought nuclear energy back on the table.

What should the trader know before investing?

In contrast to other materials like gold or silver, you can not trade uranium directly as a commodity in the market. Instead, an easy way to invest in uranium stocks is to buy stocks in companies involved in the business, like nuclear energy companies or mining companies that extract uranium.

This is, of course, a good choice, but like any stock, it comes with many risks involved. When you invest in a company, you are not just betting on the sector’s future but the performance of that company. It doesn’t matter how well the industry is doing or how high the uranium price is if your company goes bankrupt. You will lose your money anyway.

Also, even when the world’s reality has forced governments to turn back to nuclear energy, this is not happening without opposition. Around the world, many voices are being raised to stop nuclear energy developments. This is a thread for the business and gives uncertainty to the investors. Since this is such a political issue, the change in the political pendulum can affect the development of projects as countries change political preferences.

Nuclear energy is a highly technical enterprise, so not many companies can develop sustainable nuclear developments. This means that the investment options are narrow compared to other industries.

Upsides and downsides

As we have exposed, uranium stocks have many benefits, but it also involves risk for investors and humanity. The world has had a volatile relationship with uranium for many years. Even when there are incentives on behalf of world politics to make nuclear plants today, we do not know what can happen in the future.

To help you make the right call on uranium stocks, let’s see the top three upside and downsides of such investing.

Upsides | Downsides |

| Global green trend Uranium is a dangerous element, but it is still considered one of the major energy sources in the future, and the reason for that is the environmental component of its nature. Of course, one nuclear accident can do a lot of damage to the earth and our civilization, even more than oil spills. However, when handled properly, unlike oil, the damage to the environment is considerably lower. | Strong oppositionAlthough nuclear energy has survived scandals, the debate is far from over, and many sectors of society oppose uranium-based energy production. |

| Price The price of uranium has been rising for a while now. Even when you wish to invest in uranium directly, investing in the right stocks could be even better. It will impact the profitability of companies, especially mining companies. Like in any other dynamic, some companies will outperform others, and if you choose right, you may end up getting better returns than those you would have by just buying uranium as a commodity. | Price Nuclear energy is cheaper than coal in some countries, but the more significant competitor to nuclear power is not coal or oil but solar energy. Today, solar is an inexpensive renewable energy source. When talking about environmental factors, solar energy is also better. |

| Difficult times After the accidents of Chernobyl and Fukushima, it seemed that we were over nuclear power. Nevertheless, other energy sources haven’t been able to match nuclear reliability. So the capacity to survive those scandals is a strong point for nuclear energy. | Volatility Uranium stocks can be very volatile in the long term. They are especially sensitive to political developments. As we learn from Trump’s presidency, countries can be susceptible to all kinds of radical changes. No matter if we are talking about a third-world country or the first economy of the world. The posture of any major leader can affect uranium prices more than the market would like. |

Final thoughts

Investing in uranium stocks seems like the right move in the next few years. Solar energy faces big reliability problems, so electrical sources like hydroelectric plants and nuclear plants compete to be that clean energy that supports the system when solar and eolic fail.