What comes to your mind when you hear the term “vertical spreads”? Is it a math thing? Or is it a complex concept of trading? Well, it is a combination of both.

Vertical spreads explained

This tool combines the buying and selling of call or put options at the same expiration but with different strike prices. The y-axis depicts the vertical lines in a graph, as you have undoubtedly learned in Math class. Similarly, the term vertical refers to the location of the strike price, which indicates whether you can purchase or sell contracts.

For example, the special price of a put option is the price to sell the options contract. The striking price of a call option, on the other hand, is the price at which you can purchase the options contract.

The vertical spread, like other options strategies, contains sub-strategies. There are four of them.

| Debit spreads | •Bull call |

| • Bull put | |

| Credit spreads | • Bear call |

| • Bear put |

Like a difference between the debit/credit cards, with debit, you have to pay to open a position. Credit spreads, on the other hand, pay you money to open the position.

Now that you know what vertical spreads are, we want to answer how you can use them in your options trading strategy.

Bull spreads trading strategy

Bull spreads have two types:

- Bull call

- Bull put

The first one allows you to purchase a call option. Simultaneously, you sell the call option with the same expiry but a higher strike price.

Because the bull call is a debit, your profit is the difference in the strike price minus the premium you paid to initiate a bull call. A bull buys one bull option and sells another with the same expiration date but a lower strike price. A bull put is a credit, and the premium you receive when you open the put option is your profit.

Let’s use the Nike example to define the bull spreads trading strategy.

On June 24, you purchase Nike shares with a call at $150 and strike price for $30 per contract. Assume that Nike hit a one-year high at 154.32 on June 25 after climbing $4 compared to the previous day. In addition, Nike released its earnings report, and the company is generating profits.

Nike is sitting comfortably at the top with the possibility of continuation of an uptrend. However, the market is in an uncertain state. You do not know if Nike will continue the trend or take a dip.

You think that Nike will trade sideward to up 5%, while the upward move is under pressure. So, if you risk $1 in return for a potential profit of $2 per share, then with the help of vertical spread’s bull call, you can buy the Nike stock with the higher break-even.

If the Nike stock climbs above $154.32, then the bull call spread will get you a gain of $4. It is important to note that this profit does not include commissions. Your maximum risk is $1, including the commissions.

If the Nike stock dips below the 150-mark and you hold the position till the expiration, then you’ll suffer a loss. This is an example of a bull call spread. You can also apply this for the bull put spread.

Bear spreads trading strategy

A bear call is similar to the traditional bearish strategy in that it allows you to sell one call option while simultaneously purchasing another call option. The option you are buying will have the same expiration date but a higher strike price.

It is important to note that the bear call is a credit spread. A bear put strategy allows you to sell one put option and buy another with the same expiry date but a lower strike price. Bear put is a debit spread, and you are familiar with debit spreads.

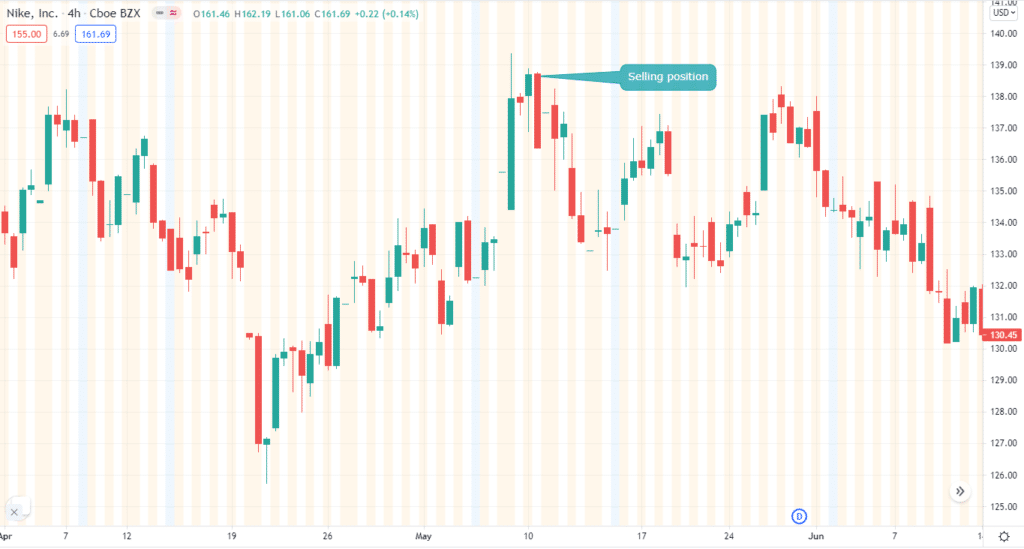

Let’s use the Nike example again to explain the bear spreads trading strategy.

On May 10, you sell Nike shares with a put at $138.61 and a strike price of $30 per contract.

Assume that Nike hit a one-year low at 135.75 on May 11 after dipping $3 compared to the previous day. Nike released its earnings report, and things are not looking great for the sportswear giant.

Nike is losing the interest of buyers, and there is a possibility of continuation of a downtrend. However, the market is in an uncertain state. You do not know if Nike will continue the trend or go upwards. You are confident that Nike will move up to 5%, while the downward move is under pressure.

So, if you risk $1 in return for a potential profit of $2 per share, then with the help of vertical spread’s bear put, you can sell the Nike stock with the higher break-even. Your maximum risk is $1, including the commissions. If the Nike stock dips below $135.75, then the bear put spread will get you a gain of $3.

It is important to note that this profit does not include commissions. If the Nike stock goes above139, and you hold the position till the expiration, then you’ll suffer a loss.

This is an example of a bear put spread. You can also apply this for the bear call spread. A lot of time, people scratch their heads on which approach they should take for vertical spreads.

Well, it depends! When volatility is strong, a bull call spread is a solid option. On the other hand, a bear call is your go-to source when the market is making downward moves. With a bull put, you can earn higher premiums.

Finally, a bear put is a good option if you expect substantial volatility.

Final thoughts

Experienced traders do not forget that they are just people, and their forecast of price change direction may be wrong. In the event of a mistake, having a position in the vertical spread gives them a clear advantage over traders who have taken positions in the underlying market. By correctly assessing the volatility, the options trader will decide what is best: to have time on his side or not.

If a trader prefers to have time on his side, then he will be able to make a profit even when the trader with the underlying contracts incurs losses or, at best, is content with a break-even. If a trader prefers time to work against him, then his losses in the event of an erroneous forecast of the direction of market change will be less than losses from a position in the underlying contract.