The mood of the market rules cryptocurrencies. Greed tends to lead to bullish movements, whereas fear leads to bearish trends. Predictably, human psychology is irrational since so many people respond in similar ways in certain circumstances. It is the goal of sentiment analysis. It takes into account human psychology when assessing the mood of the market.

It generates conclusions and analyzes to forecast the direction of price behavior. FOMO (fear of missing out) is an example of this kind of behavior, which often occurs in conjunction with substantial price changes and leads market participants to act on the spur of the moment.

Price fluctuations may be forecasted using trade volumes and historical data techniques. However, is it feasible to benefit by merely being contrarian and acting differently from others in some situations when individuals react the same way? It is where the Crypto Fear and Greed Index (FGI) comes in.

What is the Fear and Greed index?

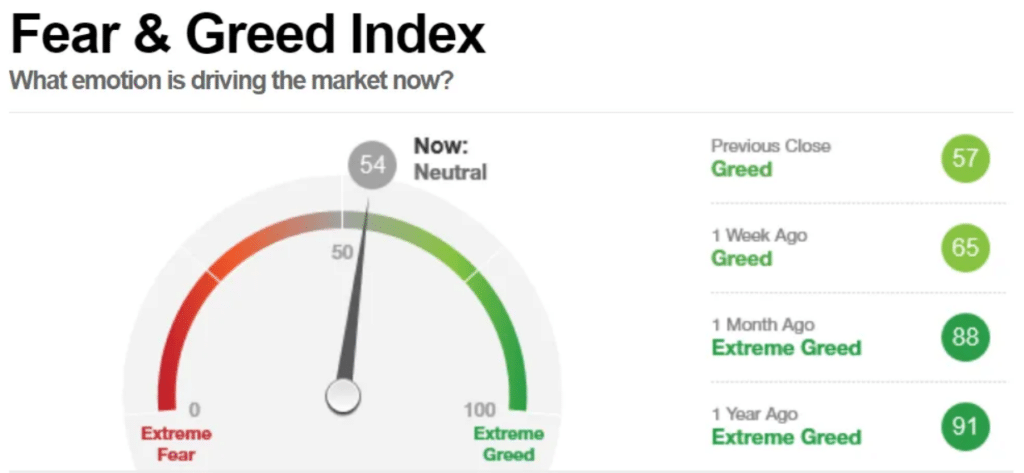

CNN Business developed the stock market’s FGI. It’s a quantifiable measure of the market sentiment. Several factors are at play, each of which has a special significance. For example, it is possible to score 0 (fear) and go as high as 100 (greed), with a neutral score of 50 being considered average.

To get an accurate result, you need high-quality data. Consequently, any faults in the analysis might render it invalid. Thus, lousy market selection and positioning may be pretty expensive.

You can take advantage of the Bitcoin market’s uncertainty. Fear in the market is frequently a good indicator of a downturn. Investors may be looking at an excellent time to buy the decline and, as a result, a good time to invest. On the other side, extreme market greed might herald the end of the bullish trend in the market. It’s a wise idea to sell at this point before the market crashes.

Sentiment analysis relies heavily on the behavior of the most important crypto exchanges. As a result, other market participants pay attention to these, first, significant price changes. Although order books may be difficult to reproduce in an index, their analysis substantially impacts trader behavior. The Bybit exchange’s real-time order books may be used to analyze price changes in short periods.

How does the Fear and Greed index function in cryptocurrency?

It’s possible to construct your FGI if you so choose. As a prerequisite, the data must be accurate and well used. For example, a basic knowledge of market events and reactions is required to examine the ramifications of certain occurrences effectively. Weighing the different components is an essential consideration in the study as well.

On the index chart and slider, various zones have different meanings. The index is calculated as follows:

- 0–24 = extreme fear

- 25–49 = fear

- 50–74 = greed

- 75–100 = extreme greed

On the index chart, fear (a score of 0 to 49) signifies the undervaluation of the crypto asset. Conversely, overvaluation and bubbles are more likely to occur if a person has a Greed score of 50 or above. The FGI is recalculated at 00:00, 08:00, and 16:00 UTC. To figure out its worth, we gathered information from six different sources.

What do extreme Fear and Greed tell you?

An increase in the index’s fear readings has always been an early warning indicator of a rise in the price of cryptocurrencies. Since most traders and investors are dumping their cryptocurrency holdings, markets are at a low point, pushing prices down even more. Traders that are well-versed in the market may take advantage of the current situation. This indicator accurately predicts price reversals in cryptocurrencies. After reaching a point of extreme concern, it has predicted a turnaround in crypto values.

Like overbought market prices, excessive greed, usually motivated by FOMO, creates the latter. Accordingly, it’s possible that the bubble may burst sooner rather than later and that staying in the market would only have limited benefits. In most cases, it’s a signal to either sell your crypto assets or short the market. It is often seen as overzealousness before a downward trend.

According to these statistics, extreme market sentiment seems to be a solid indicator of a crypto price reversal. This is because extreme greed usually changes into bearish patterns in crypto markets, while extreme fear generally transforms into bullish ones.

Is it possible to predict market movements using it?

Use the FGI to see when crypto prices are lowest and most likely to rise again. When used correctly, it’s an excellent tool for predicting market shifts and price reversals in the cryptocurrency market. However, when the index reaches a level indicative of acute anxiety, the trend will go in the other direction. First signs of greed begin to appear at this time, and then full-fledged greed takes hold.

The Fear and Greed Index for cryptocurrencies might help you keep tabs on market mood swings. The ability to join or exit the market ahead of the general market during large market fluctuations benefits from trading in volatile markets. However, the index doesn’t work well for long-term analysis of crypto market eras. A long-term bull or bear market experiences waves of Fear and Greed. These changes will be beneficial to swing traders.

Upsides and downsides

Now, let’s look at some positives and negatives of it.

| Upsides | Downsides |

| • Market changes are reliably predicted by behavioral economists using this method. | •A barometer for market timing, rather than an investing research tool, is how it is seen by most. In an environment of fear and greed, investors are more likely to trade often, resulting in more unpredictable markets. |

| • It’s a valuable tool for making smart investment choices, and it’s free. | •The tool is not a standalone gauge to trade cryptocurrencies. |

| • Using this index, an investor may take advantage of purchasing and selling opportunities. | • The dependence on technical tools still remains intact. |

Final thoughts

The crypto Fear and Greed Index, a valuable tool for judging cryptocurrencies, should not be utilized in isolation. The price of a product may be affected by a variety of factors. For example, emotions have little impact on technical or fundamental analyses like those used by FGI. In addition, there may be new financial or geopolitical events that scupper any research.