There are many ways you can grow your hard-earned money other than stock investing. Why would you choose to invest in stocks when you invest in bonds or other instruments? The most obvious reason is the return potential. In terms of return, there seems to be no other investment type that works better in the long term than stocks.

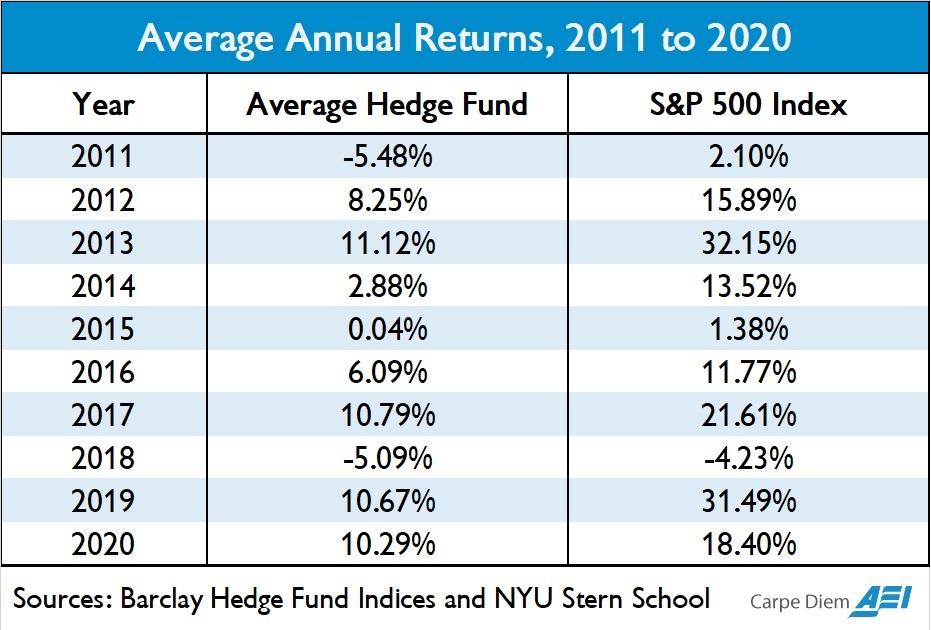

Goldman Sachs stated that the stock market had given an average 10-year return of 9.2 percent in the last 140 years. The market has even performed much better than this in the past decade. Used to represent the stock market’s performance, the S&P 500 index (SPY) returns 13.6 percent annually over the past decade (i.e., from 2010 to 2020).

Investing in the stock market is one of the fastest ways to generate wealth that beats inflation. However, the key to stock market investing is the average holding time, like any type of investment. You cannot make a good return if you keep your holdings in less than five years. One-year investing will not work if you make a sizable return in relation to your capital.

This article will find out if you could become a millionaire after one year of stock investing. You will also see what your investment portfolio is like if you choose to go in this direction.

Stock market average yearly return

SPY includes 500 of the most extensive stocks in America, and most investors use this index as a benchmark when determining yearly returns. Because this index covers the top-of-the-line stocks, it represents the whole stock market.

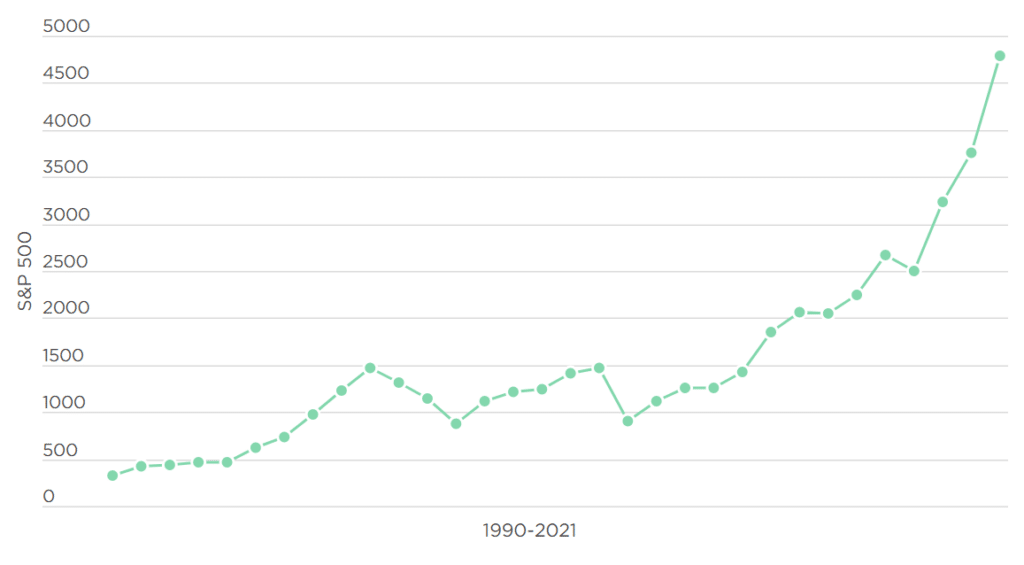

The graph below shows the performance of SPY over 30 years (i.e., from 1990 to 2021). The index is not moving straight up in all of those years. There were a few bumps along the way, but it managed to give a positive return to date. A ten percent yearly return is still an excellent estimate to this day.

Stock investing challenges to consider

In order to become a millionaire in one year out of stock investing, there are assumptions we must make to simplify the process. Below are some of the things that will likely get in the way toward building a million-dollar investment portfolio:

- Variable ROI

- Untimely entries

- Inflation

- Taxes and commissions

Variable ROI

You can think of ten percent as the stock market’s average return, though it varies year after year. If you invest money today and hope to make ten percent growth after one year, that is possible. You can make more or less than that as the market provides.

Untimely entries

Be aware that there is no guarantee that the price will shoot up right away and keep going when you buy shares. There is no telling if the price would turn around shortly or at all in a given year. In many situations, you could enter at bad times when stocks are correcting to the downside. In this case, your account could depreciate rather than appreciate.

Inflation

Take note that the ten percent benchmark does not consider inflation. Inflation may reduce the purchasing power of your investments by two or three percent each year. You can expect to get less than ten percent return yearly with this factor taken in.

Taxes and commissions

Trading the stock market as opposed to investing can have a negative impact on your profits. This is because taxes and commissions factor in when you hold investments in the short term. Note that short-term investments involve higher taxes than long-term investments. Holding trades for less than a year qualifies them as short-term investments.

Can you become a millionaire in a year through stock investing?

There is no way you can become a millionaire in one year through stock investing alone. The main reason is that one year is too short of building wealth. With this time frame, it is impossible to compound returns to generate wealth fast. You cannot even apply compounding in your stock investing if the duration is one year only.

In this case, you can only use simple interest. If you do, you will need $10 million to make $1 million in a year, assuming an ROI of ten percent. Expectedly, you have less than one million right now, and you want to grow it to one million through stock investing. Doing this defeats the purpose of learning how to become a millionaire in one year.

How many stocks do you need to become a millionaire?

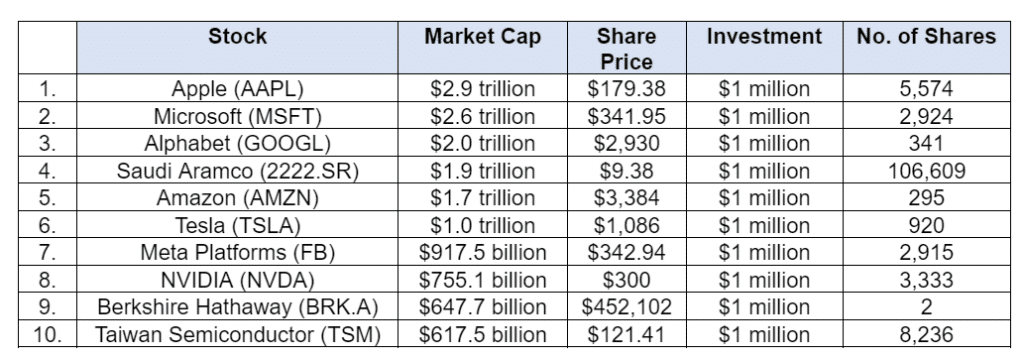

To answer the question raised by the title of this post, let us make a sample computation. We will assume you have a $10 million investment fund, and you expect a return of ten percent. Note that the number of stocks you should own depends on the price of the individual stocks you would like to buy.

To mitigate risks, let us diversify your portfolio. We will buy ten different stocks and divide your capital equally for this example. We will choose the top ten stocks with the largest market cap.

From the above table, the total number of shares you have for ten different stocks, investing $1 million for each stock, is 131,149. If you use a different set or number of stocks, then you will get a different result. Still, you will have invested a total of $10 million at the outset and hope to generate an income of $1 million in a year’s time.

A practical way of making one million dollars

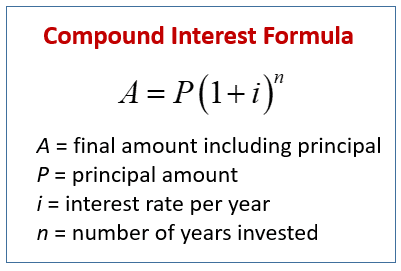

The easier way of making one million if you have a small capital is to take advantage of compound interest. This is possible in stock investing. You need to be in this game long enough to grow a small investment into something big. We are talking about a time horizon of at least five years. The longer the duration, the better.

Let us study the compound interest formula below to understand how much capital you need and how long you should invest.

As you can see, the compound interest formula has four variables. If our goal is to get the total investment amount after some years, we will solve for A and need inputs for three variables (P, i, and n). To simplify the calculation, let us keep the interest rate constant at 10% so that the value of A depends on the principal amount and number of years only.

Sample investment scenarios that lead to one million

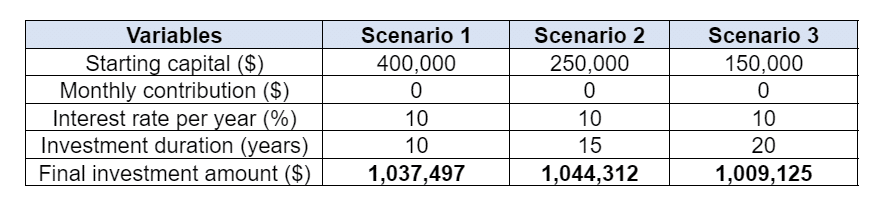

Using the formula and our assumptions above, we get the data shown in the table below. Here we assumed further that you did not add any amount at any point from the start to the end of the investment term. Carefully analyze the three scenarios below.

Therefore, the race to one million dollars involves a balancing act. If you want to hit one million fast, you need to put a large initial capital. If it is not possible for you to put up a large capital, you will need more time to reach your goal.

Final thoughts

As this post has explained, you need to invest time to grow a small capital to one million. Making one million dollars in one year through stock investing alone is impossible to attain if you have less than ten million dollars right now. We are assuming here a ten percent return.

If you are lucky, you can get more than ten percent ROI in a year. At other times, the ROI is lower than ten percent. We assume further that you time your investments sufficiently. If your entries are not optimal, you might not be profitable in one year.