Professional crypto advisors are experts who help investors to make more brilliant moves of money with these digital asset classes. As blockchain technology is booming with its products in the financial market, it makes sense that you want to become a professional cryptocurrency advisor.

However, cryptocurrencies are comparatively a new product in the financial market; to become a professional advisor in this sector requires gathering some knowledge and education about these digital assets. This article is about professional crypto advisors, why anyone should become one and how to achieve this goal.

Who is a professional cryptocurrency advisor?

They are financial experts who have specialties in cryptos and relative products of blockchain technology like NFTs. They advise or suggest crypto investors invest their money in efficient and profitable ways at crypto assets.

Crypto advisors have sufficient knowledge and skills about crypto pricing and trading. They guide crypto investors to make remarkable profits from the crypto market by utilizing their expertise and knowledge. Crypto advisors usually conduct extensive market research to help investors or their clients make the right investment choice in cryptos. These entities usually have in-depth education, knowledge, and training in core aspects of crypto, decentralized finance, blockchain technology and products.

Why does anyone choose to be a professional crypto advisor?

There are dozens of financial advisors available that you can find on many marketplaces or communities to guide investors in making the right choices of investments in many financial assets. Cryptos are emerging rapidly in the financial market as blockchain technology is booming.

It may be challenging to find a professional advisor for cryptocurrency trading. Blockchain technology introduces crypto assets that have become so popular among investors and users for containing various attractive features. Many experts predict that this emerging sector can replace the traditional banking system in the future. So the demand for professional cryptocurrency advisors will rise. So no wonder this marketplace draws attention to financial organizations, governments, and many other communities and organizations.

Moreover, crypto investors don’t have to attend the 09:00 am-05:00 pm office; they can serve remotely through the internet. The payment structure is also excellent for crypto advisors with their capabilities and efficiency. So these flexibility factors attract individuals to become professional cryptocurrency advisor.

How to become a professional cryptocurrency advisor?

You already have an idea about professional crypto advisors and their roles. This career can help you achieve your financial goal by investing, trading, or giving services to others who need them. The next question is how to become a professional cryptocurrency advisor. We reckon it is not easy to become a successful one if you don’t follow specific guidelines.

The following section describes the step-by-step procedure for becoming a professional cryptocurrency advisor.

Step 1. Bachelor’s degree to get crypto training

Cryptos are digital assets that use data packages as money, and total procedure occurs on the internet. So it is better to have a bachelor’s degree in finance, technology, or engineering to start a career with these digital assets.

Individuals can develop their knowledge through many blogs, websites, and communities on different related subjects to the whole blockchain technology, cryptography, cryptos, NFTs, etc., alongside a bachelor’s degree. As this sector is a new addition to the financial market and changing continuously, there is no alternative to learning to become successful in this sector.

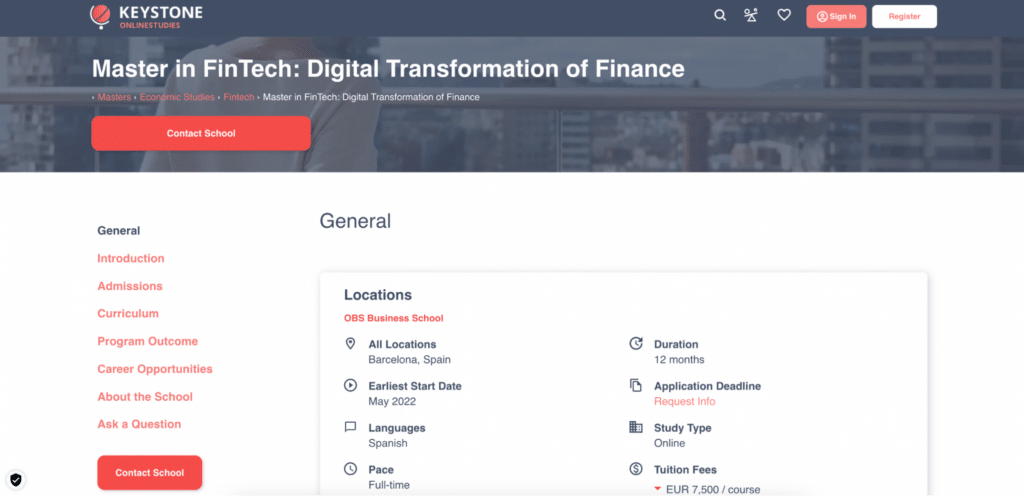

Step 2. Master’s degree in Bitcoin consulting

A Master’s degree in this sector is not a mandatory requirement to become a professional cryptocurrency advisor. Still, you will get an advantage over other candidates with your degree. It will help you achieve a wider range of knowledge about these crypto-assets, technology, investors, the community behind projects, etc. Additionally, some financial farms prefer a master’s degree in relative subjects when hiring an advisor.

Step 3. Internship under crypto experts

You already have basic knowledge about the crypto market and the participants. It is time to get some implementation or practical knowledge. The best way to achieve that goal is to hand on working under any crypto advisor/expert.

Get an internship or a beginner/entry-level job in any well-established financial institute to build a cryptocurrency advisor mindset. It will help you achieve practical knowledge about the cryptocurrency market and advisors as you will spend more time with the sector from inside an institution.

Step 4. Gain experience in crypto advising

As time goes on, you will continue to gather knowledge and skills on cryptocurrencies. 6-8 years of experience in this field will take it to the highest level in this sector. Continue to take challenging roles to move on the upside through the ladder and make yourself capable of handling more responsibilities. Enroll for additional certifications and training to create your profile potential for applying as a cryptocurrency advisor.

Step 5. Get certified by crypto consulting groups

Some institutions offer training and certifications on cryptos, Bitcoin, blockchain technology, NFTs, etc. Although these certificates are not yet widely accepted due to the unregulated nature of cryptocurrency certificates. Still, these certifications enable individuals to gather knowledge and skills in this field.

The top available cryptocurrency certifications are:

- Certified crypto expert

- Certified crypto auditor

- Online degree in crypto and trading

- Certified crypto trader

- Crypto security standard auditor (CCSSA)

- Certified digital asset advisor (CDAA)

- Certificate in blockchain and digital assets (CBDA)

The top ten services you can offer as a professional crypto advisor

As the crypto market is overgrowing, the demand for professional advisors in this field also increases. The top ten available consultant services are:

- Bitcoin consultant

- Crypto analysts

- Crypto advisor

- Altcoin advisor

- Crypto advisor journalist

- Crypto expert marketing manager

- Crypto expert research analyst

- Blockchain consultant

- Bitcoin certified professional

- Crypto advisor technical writer

Final thought

Crypto advisors guide investors to invest in the right assets at the right time. The sector is rapidly growing, so anyone entering at this time will be more beneficial than others who will enter in crowded and challenging times. Crypto advisors can provide service from anywhere in the world remotely.