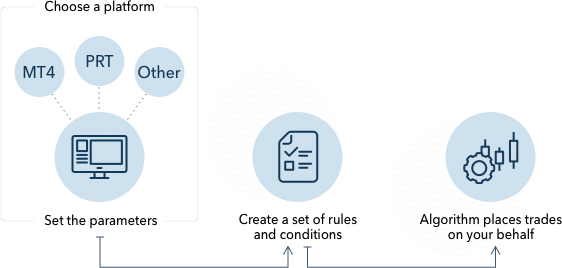

Automated trading strategies may revolutionize all aspects of the trading process, making it a lot more result-oriented. In this system, computers are loaded with a set of rules and instructions, known as an algorithm, and they carry out transactions under those rules and instructions.

Minimal time is required for the trades to be performed at the price and volume requested. This strategy reduces the time lag between placing the order and executing the order.

Human emotions have little impact on the trading decisions made by automated systems. However, because of the risk of losing money, human traders may choose not to continue a losing trade or give up on a winning one because they are afraid of losing. This article highlights the auto trading strategy and the top five tips to create.

The five top auto trading strategies

In the following paragraphs, you will learn about five automated trading strategies that may help make the most of this form of trading. As long as they’re done correctly, these strategies may result in substantial returns in the stock exchange.

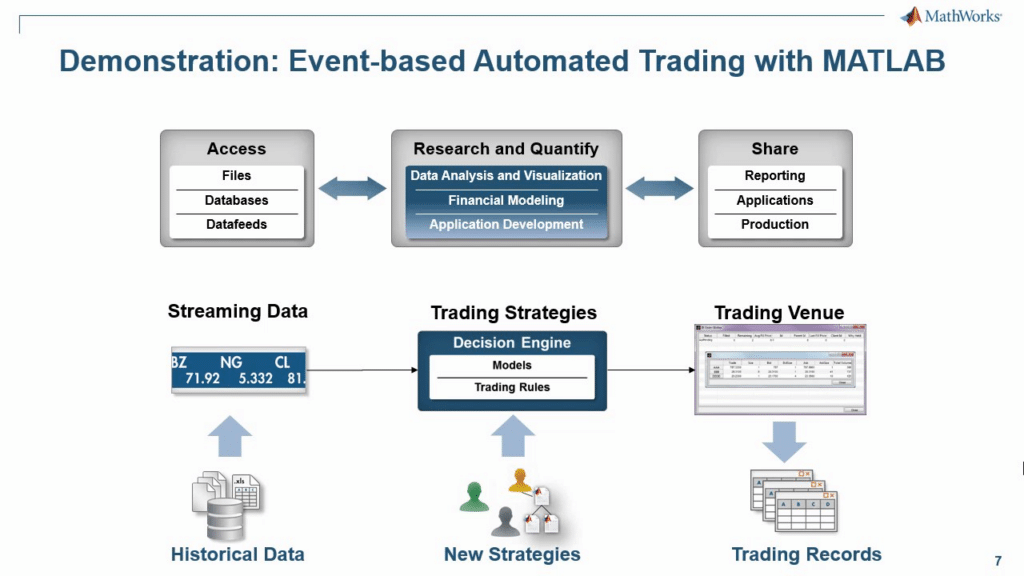

Strategy 1. Events and trends based strategy

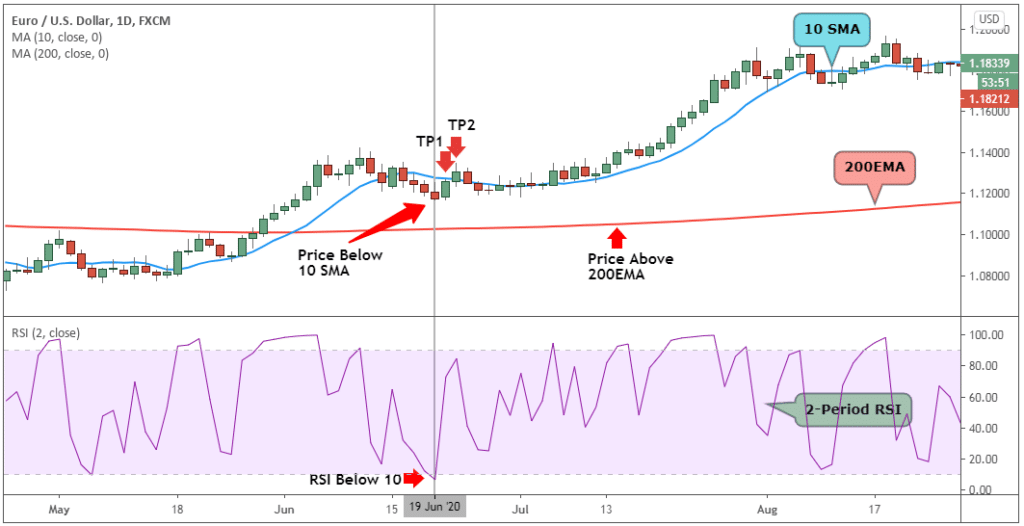

In terms of ease of use, these automated trading techniques are the most popular. They trade following the market’s current trends and momentum. Technical indicators such as moving averages and price fluctuations determine whether to purchase or sell a certain stock.

According to the technical indicators, these orders are automatically executed when they meet a specified set of parameters. Additionally, this method considers historical and present price data to determine whether or not the current trend is likely to continue.

How to avoid mistakes?

Straightforward trend tracking is all that is required, with no need for complicated forecasts. Only a transaction is completed if the specified event occurs. It is Alpaca’s goal to make asset management more accessible to the general public. We’re a technology firm that’s revolutionizing asset management by breaking it down into modular components. By following the alpaca strategy, you can manage your risks.

Strategy 2. Arbitrage strategy

When there is a price discrepancy between securities listed on different stock exchanges, arbitrage possibilities arise. By identifying and executing trades if certain conditions are met, arbitrage strategies can take advantage of these opportunities.

The input algorithm immediately recognizes a price discrepancy if a stock is offered at a lower price on one exchange and a higher price on the other. Afterward, the algorithm conducts a transaction on the low-priced exchange and the high-priced exchange.

Automated trading can attain speeds and precisions that humans find difficult, perhaps impossible, in these types of situations.

How to avoid mistakes?

To make a substantial profit, even if the price difference between two exchanges isn’t huge, the volume of these transactions must be large.

Any time a price difference between two listings is substantial enough for the algorithm to notice, an order is automatically placed to purchase the lower-cost listing. Likewise, a sell order is immediately placed to the higher-cost listing.

The trader receives arbitrage gains after executing the transaction and managing the risks.

Strategy 3. Mean reversion strategy

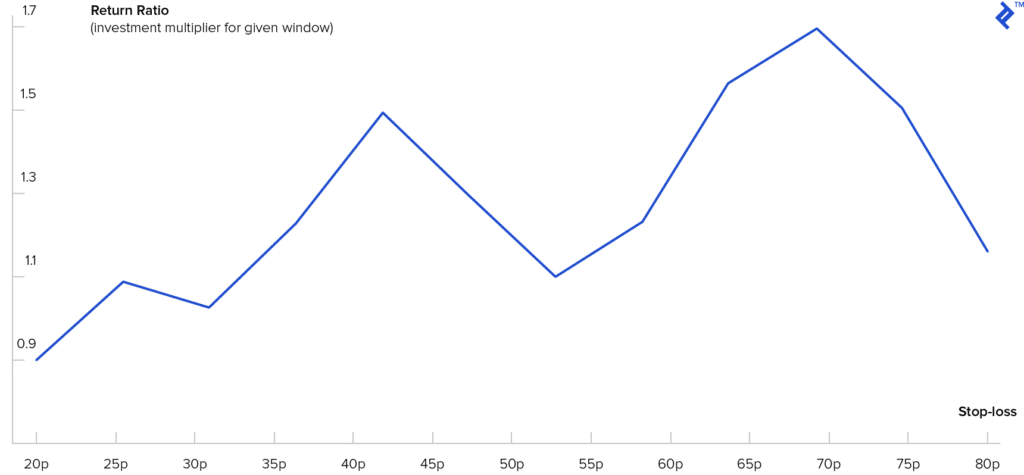

Automated trading systems, such as the mean reversion, are based on the premise that although stock prices may vary, they will ultimately settle back to an average or mean value with time. It’s also known as the reversal strategy or the counter-trend approach.

After identifying a stock’s upper and lower price limits, the algorithm runs to execute orders as soon as the price exceeds the typical range. The algorithms use past data to calculate an average price and then make a trade based on the assumption that prices would eventually return to this point.

How to avoid mistakes?

If prices are too high, they’ll go down; if they are too low, they’ll go up. To benefit from volatile market patterns, traders may use this automatic trading method when prices are at their extremes.

However, if prices don’t reverse as quickly as expected and the moving average catches up with the price, this method might backfire, resulting in a worse return to risk ratio. So, by following the reversion strategy, one can avoid mistakes properly.

Strategy 4. Statistical arbitrage strategy

A short-term automated trading approach known as statistical arbitrage is based on this method. Price inefficiencies or misquoting the price of the available securities provide trading opportunities; hence this strategy is focused on such possibilities.

This occurs when two or more securities are related to one another or are otherwise comparable. Inefficiencies and misunderstandings cannot persist for long; it has become clear over the years. Since these changes happen quickly, automated trading makes it easier to find and benefit from them.

How to avoid mistakes?

Algorithms are made up of complicated mathematical models that recognize price inefficiencies quickly and execute the transaction even before the prices have had a chance to fix themselves.

Even if a human trader is dedicated and diligent, he may not detect these changes. However, because of the established instructions in the algorithm, it can follow these events as soon as they occur.

When a stock price falls, the algorithm promptly purchases it and then sells it when it rises, resulting in a profit. This method is known as statistical arbitrage. As a result, Alpaca’s online traders may trade commission-free and avoid making mistakes in trades when they visit the Alpaca website.

Strategy 5. Average price strategy

One of the best automatic trading methods is based on this method. Both time-weighted average price and volume-weighted average price are used in the calculation. There are a lot of orders, but they’re not all being released at once. Instead, the orders are distributed in several ways, including historical volume characteristics of the stock or particular explicitly specified time intervals.

How to avoid mistakes?

To avoid mistakes while trading, this method executes the order as close to the volume-weighted average price or the time-weighted average price as possible to reduce market effects.

Final thoughts

It’s getting more and more popular to use automated trading or algorithmic trading. From the comfort of your own home, you can now put up an algorithmic trading system. This was unimaginable only a few years ago.

Most of the volume in today’s financial markets is traded using automated systems. In most cases, high-frequency trading is responsible for the bulk of this activity. In this article, there is no mention of a home solution for high-frequency trading; most people will not be able to use this. Instead, our discussion has been about developing a plan that works for you automatically.