Arbitrage trading has been around for quite some time in the financial markets. It’s not a new thing in the crypto market too. Crypto traders seek arbitrage opportunities by buying and selling crypto on different exchanges. It allows them to profit from varying prices for the same asset.

This guide will talk about what is it and how it works.

What is a crypto arbitrage?

It is a method in which you buy crypto in one market and sell it for a more excellent price in another market. Thus, you profit from minor price differences between digital assets traded on various platforms or exchanges.

Arbitrage options are becoming more common in the crypto market, and they provide you with an appealing option to increase your profits while carrying on less risk. This trading purchases a digital asset on one exchange and sells it on a higher-priced exchange.

How to trade using crypto arbitrage?

Various market factors might lead to this trading method. However, you will see that the discrepancy in trade volumes between the exchanges is one of the key issues. The trading volumes of cryptos on larger exchanges may be relatively substantial, resulting in lower prices.

Whereas, on other exchanges with low trading volume, the price of crypto coins might be fairly high. People have bought cryptos on smaller exchanges and sold them on larger ones for arbitrage purposes.

You can record how much money you’ll gain by buying and selling on multiple platforms in your order book and then decide based on that information.

Major coins require about 15-20 minutes to confirm the transaction. If the market price falls within this time range, you may find less arbitrage. Because the crypto market is so volatile, simultaneous arbitrage is uncommon.

You may wait a few days to complete the perfect trade. It is the situation with a single-side trade, in which you acquire BTC but cannot sell it for arbitrage.

Finally, make sure you don’t make any mistakes when performing this method. Make sure you double-check your study of the exchange purchase and sell listings. Take a closer look at the trading volumes as well.

You might be able to discover programs that do the arbitrage work for you, but they may not be as effective as you would like because there are numerous issues to consider, such as security.

To engage in crypto arbitrage, you must first create accounts on several exchanges. It may expose you to a security risk, as some platforms may be hacked, or the exchange may simply steal your funds if they are untrustworthy.

What are crypto arbitrage trading strategies?

The same asset might often be priced differently in two different marketplaces. This is where it comes in, as traders spot market distortions and profit from the price discrepancies.

In contrast to the traditional financial business, where such flaws are difficult to overcome these days, the crypto market frequently offers significant arbitrage opportunities. As a result, we’ve compiled the greatest three techniques.

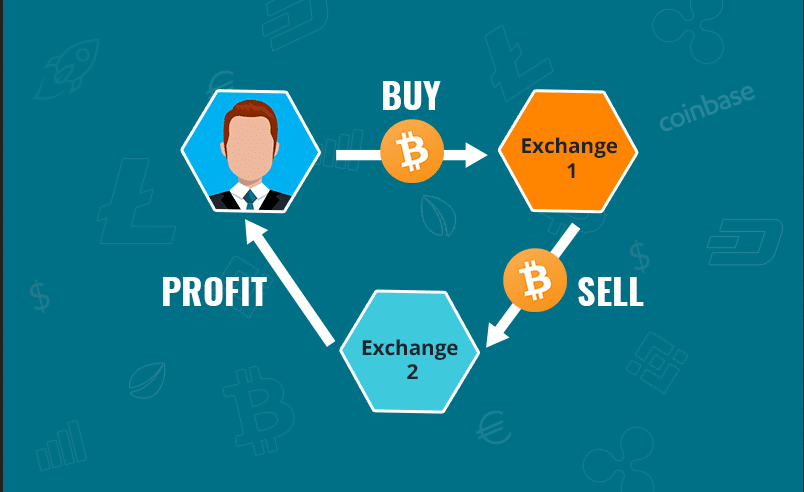

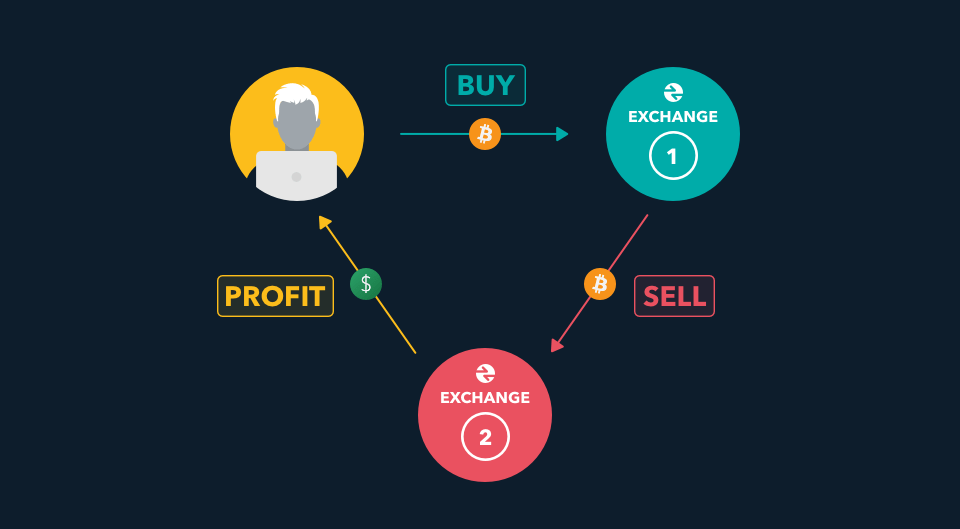

1. Spatial arbitrage

It is the simplest and most popular strategy out there. It entails examining the same instrument across two separate transactions.

If the crypto is listed at different prices on these exchanges, you can buy from the cheaper exchange and immediately sell from the more expensive one, profiting from the difference.

You may take note that the most straightforward method is to buy crypto on one exchange, transfer it to another, and then sell it.

Unfortunately, this is inefficient, as it takes longer to complete the transfer and costs more money. You can avoid this problem by keeping their fiat cash on one exchange and their cryptocurrency on the other. When the chance arises, the same purchase and sell orders can be made simultaneously on both exchanges.

This would provide you with additional fiat dollars while keeping your crypto capital intact. This strategy allows your exchanges to be completed without switching from one exchange to another, saving time and money.

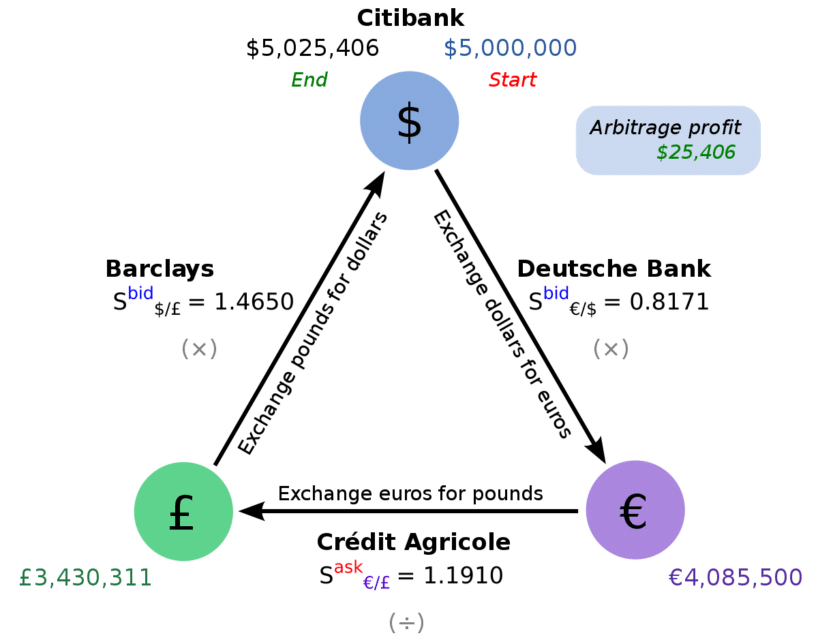

2. Triangular arbitrage

It can take place on numerous exchanges or the same platform, tries to profit from inefficiencies in three different cryptos.

For instance, when the BTC/USDC pair is trading at 60,000 USDC and one ETH is worth 3,000 USDC, but the BTC/ETH pair is inefficiently priced at 25 ETH instead of 20 ETH, an arbitrage opportunity exists.

In this case, the method is implemented as follows:

- You deposit with the exchange and buy 1 BTC for 60,000 USDC.

- You next trade the BTC/ETH pair to convert your Bitcoin to 25 ETH in the second phase.

- The 25 ETH are sold for 70,000 USDC.

As you can see, with a 20% ROI on three trades, this opportunity would have netted you $10,000 USDC in profit. This type of chance is extremely rare, and it must be seized swiftly before the exchange’s algorithm changes.

3. Yield arbitrage

You can profit from interest rate inefficiencies between two DeFi loans or staking platforms by using this method. Because the decentralized financial industry is still relatively new, though rapidly expanding, it’s fairly uncommon to see interest rate or yield abnormalities.

You may utilize yield arbitrage to borrow funds from a virtual currency with a lower annual percentage yield for borrowing, then exchange it for another virtual currency with a greater supply of APY and lend the cash to others.

| Upsides | Downsides |

| Significantly faster than traditional trading. | Larger purchases generate higher profits than smaller trades. |

| Because cryptos are so fragile, large price differences across markets might occur, offering a chance for arbitrage. | Transactions may take time, resulting in a loss. |

| Because crypto is still in its early stages, there is a lot of inconsistency, discontinuity, and a lack of data transfer across exchanges. | Because there may be more traders looking for arbitrage, competition may restrict it potential for others. |

Final thoughts

In crypto arbitrage, traders base their decisions on price differences rather than technical or fundamental analysis. This is a low-risk strategy and is suitable for beginners.