As soon as people start investing in cryptocurrencies, they often make the same mistake that many others do. In actuality, they haven’t been completing their homework properly. It was more common for individuals tossing coins into the air to see which ones would fling themselves. Their losses were in the hundreds of thousands of dollars or probably a lot more than that. These losses can be easily avoided if you learn the basics of finding and researching cryptocurrency treasures.

Let us walk you through finding and researching cryptocurrency treasures in this article. It does not need any special knowledge or abilities on your part. A little persistence and patience are all that is required.

How do new coins work?

Companies launch new coins to raise funds for their projects. This process is called Initial Coin Offering (ICO). Investors buy the coins against Ethereum (mostly), providing funds to the developers and founders of the coins to propel their business venture.

Now let’s find out the top three steps to find new coins.

Step 1. Begin with the fundamentals

Start with well-known cryptocurrencies like Bitcoin and Ethereum if you’re new to cryptocurrency. Internet resources abound, and most of them are free.

Start with Satoshi Nakamoto’s original Bitcoin Whitepaper if you can. Andreas Antonopoulos’s book, Mastering Bitcoin, is another recommended one. Skip this section if you’re not interested in learning how programs work. Instead, read everything else to have a well-rounded understanding of Bitcoin and blockchain.

As a result, you’ll need a good grip of crypto-related terms like wallets, addresses, private keys, and public keys. Once you’ve obtained enough expertise with large-cap cryptocurrencies, you may explore smaller-cap initiatives. There are hundreds of different projects and currencies in the crypto ecosystem today.

Step 2. Do a research

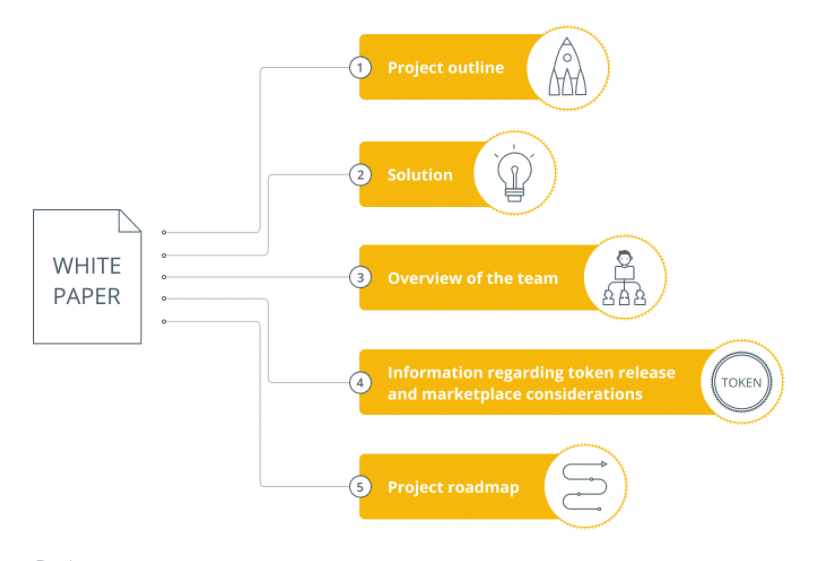

Cryptocurrency information is not as readily accessible for larger and more established platforms for most new or weaker currencies. As a consequence, you must do extensive study. To get started, you’ll need to collect some basic data. Look no farther than the project’s official website and whitepaper for a place to start. Here are some things to keep a lookout for.

- Is the project’s website reputable?

- What problem is this currency or initiative seeking to solve?

- Is there a specific reason why the currency or token was created?

- Coin or token, which is it?

- Using an existing blockchain or developing a new one?

- Consensus for the crypto project chain: what is it?

Why is it important?

For example, blockchains may be used to eliminate the need for centralized servers by decentralizing routine tasks. However, the people in a network and their faith in the institutions significantly impact them.

One or a few “whale” firms may control a blockchain’s nodes depending on the algorithm. But, as this implication suggests, a tiny group of individuals has enormous influence over the whole system. For example, they could go back and undo all of the chain’s transactions.

What else should you consider?

People behind a coin or a project should be thoroughly researched. You should only invest in anything as long as you’re certain that the team can handle any potential problems.

What is a road map of the project?

Using a project’s road plan, you may learn how long the project expects to complete its goals. Unfortunately, it is not uncommon to run late due to projects’ complexity.

Don’t be fooled by a few logos. If a project’s website indicates several major partners, do more research to verify its authenticity. Find out about the collaboration’s nature through press releases or other external sources.

Don’t stop learning. An organization’s website and whitepaper should be filled with as much information as possible on their working project.

Step 3. Decide on buying

Look at the big picture after the project’s minutiae has been worked out. Extend your research beyond the producers’ materials and consider other choices.

- Investigate the competitors of a coin

It is a good technique to understand better the project’s strengths, weaknesses, and other aspects. You may also use this information to find additional worthwhile projects.

- See if you can find any additional sources of information

Developers need to do an excellent job of promoting their products, but it’s more important from your perspective to hear what other people are saying.

- Learn about a crypto project is via social media

Check to see whether the project is being talked about on social media. It might provide you with a wealth of information.

People look for the silver lining despite the barrage of bad news in this climate. Those who put their money into a cryptocurrency or a token are more likely to be enthusiastic and emotionally invested. It means that you must always have a calm attitude.

The fundamentals are sound. You’re certain you’ve stumbled onto a hidden crypto-coin hoard. However, remember that even the best crypto project will be ineffective without aligning specific financial components.

- Find out what to buy

How to get my hands on a token or coin? On an exchange or via a contract, are they available for purchase? Unfortunately, you may lose money due to technical issues or fraudulent activity when you choose the latter option.

- Note the market cap

It shows that the price may be easily controlled by individuals who have gathered a great quantity of money if the market cap is small. As a result, several pump-and-dump systems may be used.

- Decide which wallet to use

The way you store your money and tokens will be affected by this. Hardware wallets often only handle well-known cryptocurrencies. In general, you may use specialized wallets or trade your currency for smaller projects by putting them in a wallet. Both have their risks, so do your research before making a choice.

At this point, you should be armed with a wealth of knowledge. Now that you’ve gathered all of your data, it’s time to analyze it.

- Some of your findings may be less reliable or trustworthy than others. For instance, an opinion posted on Reddit should have less weight than a news statement.

- You’ll be able to use some of the information you obtained more than others. Priority should be given to breaking news of a breach or any other event that may threaten the security of your investment.

- List each characteristic of the crypto project with a separate column for favorable and poor aspects. Each piece of data and information should be broken down into bullet points. Afterward, place them in the corresponding column. With this format, it’s easy to get a wide overview and compare different aspects.

Based on your choices, you’ll be able to find solid arguments for and against investing in a certain crypto project or currency.

Upsides and downsides of new crypto coins

| Upsides | Downsides |

| •High-profit potential The ROI is muli-fold in new crypto coins as the price suddenly pumps up. | •High-risk The risk of loss is too high. |

| •Low investment venture You may get new coins at a low price during ICO or ore-sales. | •Hard to find It takes too long time to find a legit new coin. |

| •Quick returns You do not have to wait too long for your investment to mature. | •Probability of scam New coins are always susceptible to scams. |

Final thoughts

You should be aware that this kind of research might take a long time to complete. If you can’t cover every one of the criteria laid out in this guide on studying cryptocurrencies and projects, your objective should be to cover as many as feasible. The bottom line is to protect your money and not make the same mistakes that others do.