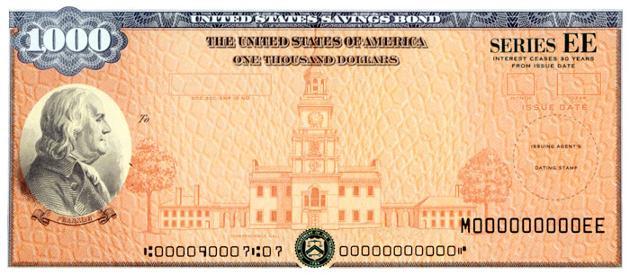

Long-term investment with low risk is the other name of purchasing saving bonds. US saving bonds are considered the best investment option. It’s a loan to the government issued by the US Treasury department.

It takes 30 years to fully mature, but you can redeem them after one year of purchase. Although, in this case, you’ll not be able to take the last three months’ interest. Businesses and consumers can guarantee their interest rates by purchasing saving bonds.

Saving bonds are free from any street or local taxes. As a result, they sell at a reasonable rate, and their value keeps increasing until they reach maturity (30 years after).

Why are saving bonds so popular?

The longer you hold the bond in a tight grasp, the more it’s worth. This is because whenever you buy the bond, you’re depositing your money into the government’s Treasury with the agreement of paying back the interest till maturity.

US saving bonds are debt issued to American citizens to help fund federal expenditures. Investors find it attractive as saving bonds provide a formularized income tactic. A well-versed bond portfolio can be the reason for high returns with less volatility. In addition, bonds can make more dollars than market funds. These are the main factors behind the saving bonds’ popularity.

Long-term saving with bonds is also famous because there are no hidden fees or other expenses. And an average paid employee can purchase the bond with a minimum rate of $25.

How do I set up a saving bond?

Treasury Direct is a financial website controlled by the Bureau of the Fiscal Service under the United States Department of the Treasury. To set up your savings bond, you need to access the Treasury govt website in electronic form.

It has a consumer rating of 3.3, which shows that numerous customers are satisfied with its services.

When you buy a savings bond, you can choose between $25 to $10,000. In addition, you will get the option of whether you want to purchase series EE or series I bond. Series I bond has a limit of $5,000.

Steps to open an account in Treasury direct:

Step 1. Open your browser and type the website name. Then, click on the Treasury direct.

If you only want to purchase the saving bond, make sure you have these things:

- A United States address of record and a social security number.

- A checking or savings account.

- An email address.

- A web browser that supports 128-bit encryption.

Step 2. Click on apply ‘Now’, choose the ‘Individual’ option or the type of account you want to access, then tap on ‘Submit.’

Step 3. Complete the online application with authentic details.

Step 4. Click ‘Submit’ and choose & caption your account image. Then, tap on the ‘Submit’ button.

Step 5. Choose your password and security queries, then click the ‘Submit’ again.

After following these above steps, you will receive a confirmation message instantly with further passcodes or email instructions.

Best long-term investment facility by purchasing saving bonds

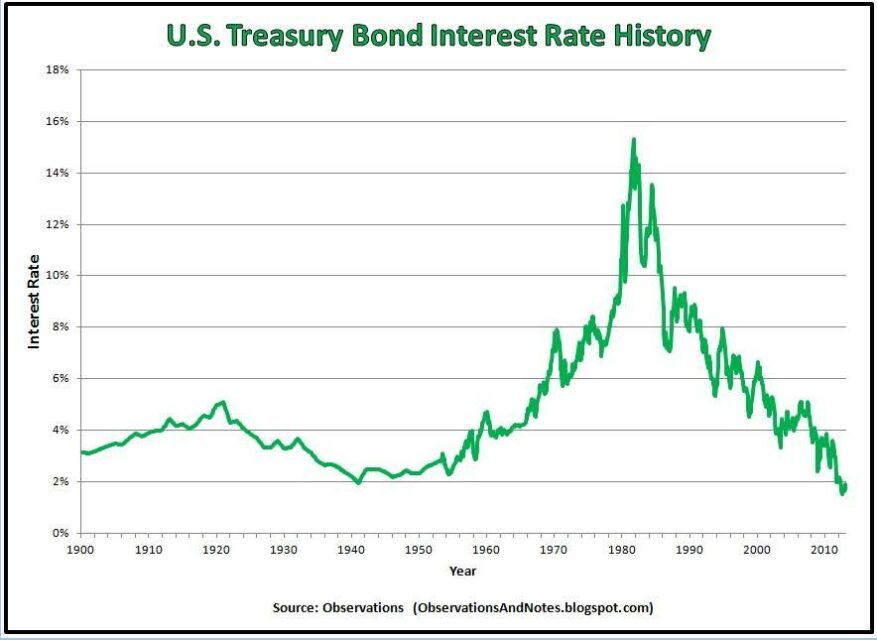

Bonds with maturities of one to ten years are effective for long-term investors. The yield generated from short-term bonds is more in long-term bonds, but the short-term bonds are less volatile.

By purchasing long-term savings bonds, the chances of earning higher interest increases due to the longer duration. This is known as the maturity risk premium.

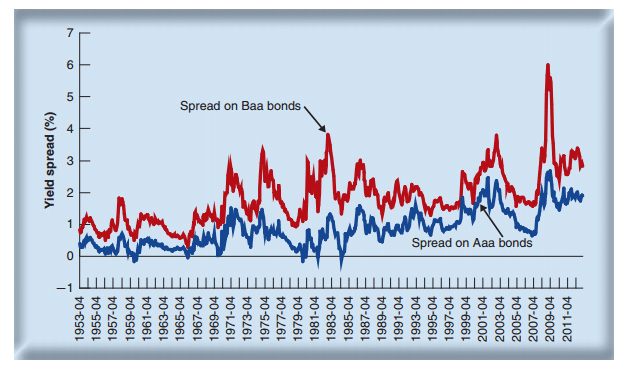

Bonds are often considered less risky than stocks. But it doesn’t mean that you can’t lose money on it. US treasury bonds are declared the safest one for all kinds of purposes.

Who will benefit from savings bonds?

Savings bonds have countless benefits mentioned below:

- You’ll receive the complete value if you hold the bond until maturity. Or you will also be receiving the interest rates before maturity.

- You can sell the savings bond at double the price than buying it.

- Bonds are beneficial from person to person depending upon their profession.

- Investors usually purchase high-yield bonds to predict their income streams for future investment.

- Businessmen like investors are attracted to long-term saving bonds as they pay interest twice a year.

- Fixed interest rate payments make bonds safer than stock or market instruments etc. Bonds also promise the investors to pay back the amount with security till maturity.

Upsides and downsides of saving bonds

| Upsides | Downsides |

| Bonds are less volatile. Volatility often refers to the amount of uncertainty in the security of the bonds. | The major drawback of saving bonds is low rate returns. Even high-yield savings accounts pay a higher interest rate than saving bonds. |

| Saving bonds are less risky because some bonds pay a fixed interest to the bondholders as a promise. | Credit risk is the biggest loss of bondholders. Credit risks are calculated based on the borrower’s ability to repay a loan. |

| For purchasing a savings bond, you can start buying with $25. This is the minimum rate and is best for retailers or new investors. | Savings bonds won’t help much if you have a large amount to invest, say from an inheritance or the sale of a house. |

Final thoughts

Purchasing savings bonds is profitable but sometimes risky too. So before investing your money into a long-term asset, make sure to check out all the benefits and drawbacks. It’d help you to make the right and profitable decision.

Although, US bonds provide numerous facilities to its customers. That’s why it’s considered safe. Treasury bonds are best for those searching for fixed-rate investment with safety until the bond’s maturity. They are not subject to local or federal taxes.