Safe-haven assets are those assets that remain stable during market turbulence periods. Financial investors usually seek safe-haven assets to limit their losses exposure when the market remains on a downtrend, to keep their investments safe. These assets allow investors to diversify portfolios and obtain benefits during a market crash.

However, these assets show potential as “safe haven investments” during specific types of downward markets depending on several factors. This article is about safe-haven assets in the financial market, and it will introduce you to safe-haven assets and the top three of them other than Gold and Bitcoin.

Why is it worth investing in safe-haven assets?

The price of safe-haven assets remains stable or increases during uncertain market conditions. Financial investors turn their capitals into safe-haven assets as the market faces uncertainty. For example, the recent corona pandemic made a depreciating impact on the financial market. Many assets, like fiat currencies, stocks, etc., keep declining. In contrast, ”Gold”, the safe-haven asset, remains on a smooth uptrend during the whole period of the pandemic till the innovation of the vaccine.

How does it work?

The price of safe-haven assets remains stable as investors keep faith in these assets during market turbulence. The price of Gold keeps rising as it has store value and physical assets. It is not the first time that Gold has shown this characteristic; the price of Gold shows the same behavior during the crisis of 2008.

How to start?

When investing in safe-haven assets that depend on the asset type, for example, when investing in Gold, you can do it by storing physical Gold or simply investing through brokers or institutes by spending some transaction fees. Brokers offer ETF, CFD, etc., options to invest in this precious metal.

Top three Safe Haven investing ideas beyond Gold and Bitcoin

You can list many safe-haven assets depending on the type of declining market and various relative factors. So when grouping any asset among the list of safe-haven assets as different assets have different features, prices, historical info, and capabilities. The top three safe-haven assets beyond Gold and Bitcoin are-

- U.S. 10-Y Treasury Bond

- Ethereum

- Platinum

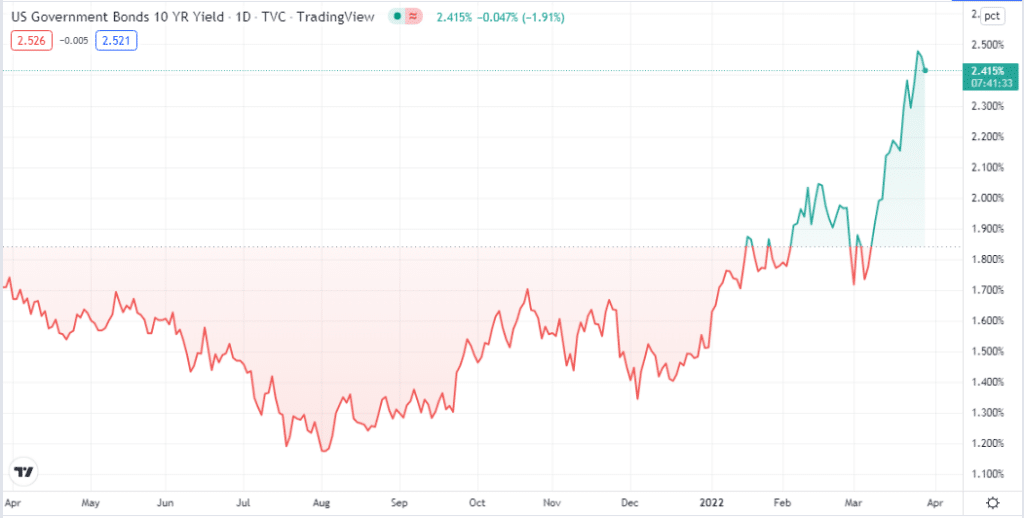

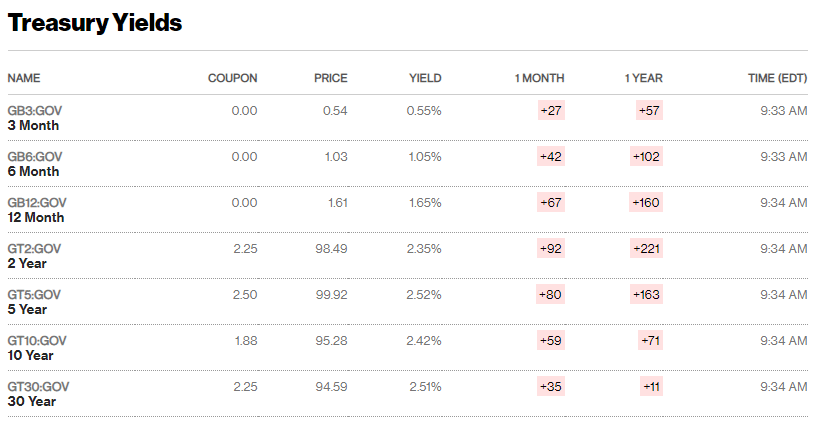

U.S. 10-Y Treasury Bond

- 52-week range: 1.132 – 2.547

- 1-year price change: 72.25

- Forecast 2022: Expect to rise between 1.5% and 2.0% by Dec 2022

The United States treasury issues four types of U.S. Treasury securities to raise the money that the federal government needs to operate as an alternative to taxation. The four types of securities are Treasury bonds, Treasury bills, Treasury Inflation-Protected Securities (TIPS), and Treasury notes.

Investors usually consider T-bonds as a safer investment as the credit and full faith of the U.S. government guarantees to pay back the principal payment and interest. Moreover, almost all Treasury securities are liquid assets, so you can easily sell the asset for cash or fiat currencies. Individuals can purchase Treasury notes, bills, bonds, TIPS, or FRNs from security markets or government auctions.

Otherwise, purchase through brokers or financial institutes. Suppose someone purchases T-bills offering 26 weeks maturity worth $10K for $9750 and holds the asset until maturity. Then $250 will be the interest amount.

Ethereum (ETH)

- 52-week range: $1,662.213- $4,865.426

- 1-year price change: +1,794.969 (+107.83%)

- Forecast 2022: Expect to rise between $6,500 and $7,500 by Dec 2022

Ethereum is an open-source, decentralized blockchain platform with its native coin, ETH, the second-largest crypto coin, only next to Bitcoin in the crypto industry according to the market capitalization data. This blockchain works as a platform for numerous other cryptocurrencies, DApps, and the execution of Smart Contracts. Vitalik Buterin first described Ethereum in 2013, and this blockchain platform has a total of eight co-founders. The ICO of ETH was $0.311, which puts the ROI over 270%.

ETH is currently floating near $3446.07 today with a 24-H trading volume of $21,303,367,171. This token is currently available on many major crypto exchange platforms, including Bybit, Binance, FTX, OKX, and CoinTiger.

Let’s check the basic data of ETH at a glance:

- Fully diluted market cap: $415,446,812,410

- Live market cap: $413,332,095,339

- Circulating supply: 120,158,854.12 ETH

- Total supply: 120,158,854 ETH

- Max supply: Not available

- Volume / Market Cap: 0.05136

Platinum (XPT)

- 52-week range: $895.99 – $1,271.66

- 1-year price change: -215.94 (-18.27%)

- Forecast 2022: Expect to reach nearby Dec 2022

Platinum is usually a precious metal that is rarer than Gold. Typically the price of Platinum should be approx. 1.25 times the Gold price, but it has kept disappointing investors for the last five years. Whereas gold price is floating near $1800, XPT should reach at least $2,250 per ounce, but the price is hovering near $972 per ounce. So it’s trading lower than half of the expected price. We list Platinum on the list of safe-haven assets depending on the utility and demand factor.

This precious metal has demand in the car industry, jewelry, and the same reasons people purchase Gold and silver. The car industry uses Platinum to oxidize carbon monoxide in diesel engines in catalytic converters. When looking at the historical price performance of XPT, it was above the price range of Gold as the supply is centralized; more than 70% of supply comes from South Africa. It has demand in the industrial and automotive industries. Historically XPT has a store value and demand in several factors, so it involves a considerable potentiality of increasing value in the near future.

Pros and cons

| Pros | Cons |

| These assets help investors to diversify their portfolios. | These assets usually involve low liquidity, so they are no good as short-term investments. |

| You can keep your investments safe with these assets during economic instability. | No financial asset is safer or a safe haven if it involves non-stability. |

| Anyone can invest in these assets. | Safe-haven assets are attractive during market turbulence, but when it is normal, the value of these assets can depreciate. |

Final thought

This list of the top three safe-haven assets beyond Gold and Bitcoin can help you generate income while other financial asset values are declining. However, according to our research, we make this list depending on several factors, such as historical performance, future potentiality, supply-demand, etc.