The emergence of cryptocurrencies has been aided by several reasons, including secrecy and anonymity. Because of a variety of technological means, crypto transactions are entirely anonymous. Members of the community are disputing if the procedure is the best way to create the most private coin. Some of them can be used to conceal users’ identities and transactions. Many of these cryptocurrencies, for example, outperform Ethereum in terms of anonymity.

Despite the security and anonymity provided by Bitcoin and other cryptos’ blockchain technology, certain coins manage to keep transactions even more hidden. Therefore, examining some of the most popular private coins with built-in privacy features would be beneficial. The following are the top three most private cryptocurrencies to invest in by 2022.

Why is it worth investing in these private coins?

Recently, governments have strengthened their hold on the economy, increasing spending and taxes while also interfering with the private lives of individuals. This renewed interest in personal privacy can be traced back to increased governmental meddling. In light of contemporary issues, it is wise to invest in these coins.

How does it work?

The privacy aspect of blockchain platforms is challenging because most public blockchains are built to facilitate visible transactions with public verification requirements. Therefore, both security and privacy must coexist harmoniously in the system’s data storage and transmission design.

How to start?

The coins mentioned are available on various crypto exchanging platforms; you can buy these from there.

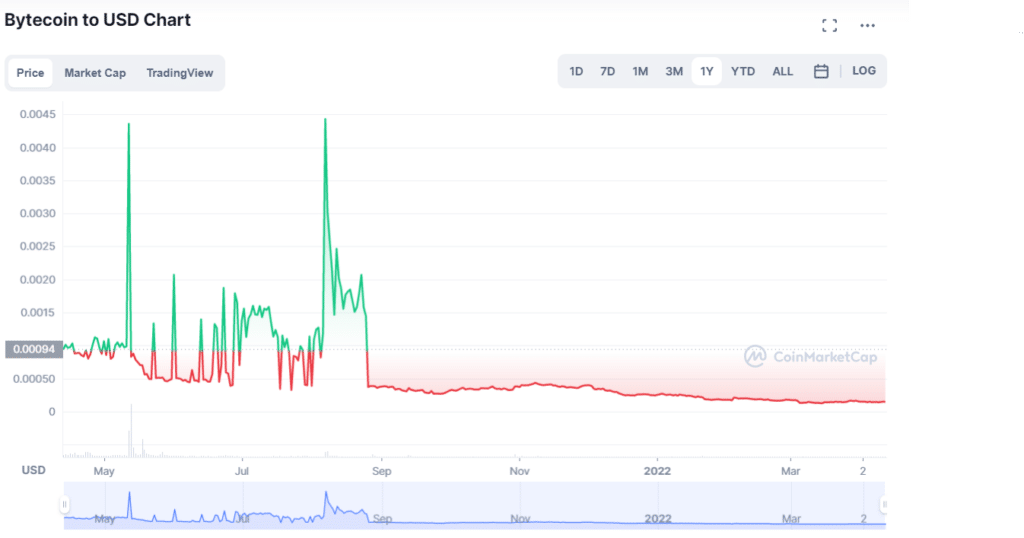

Bytecoin (BCN)

52-week range: $0.000118-$0.011917

1-year price change: if we look at its price change in terms of percentage for the past year, we can conclude that the BCN underwent a price change of -84.58% in the previous year.

Forecast 2022: the cryptocurrency market is gearing up for the alt season to begin early this year, with the currency expected to hit $0.000389 in 2022, killing another zero. Bytecoin’s price action appears to be headed in a neutral direction from a macro perspective.

Based on CryptoNote technology, Bytecoin claims to be the “first private, untraceable currency.” For CryptoNote, the goal was to ensure that transactions were neither traceable nor linked.

A transaction cannot be traced back to its originator, and a transaction cannot be linked to another transaction if both originate from the same source. Untraceable transactions are made possible through the usage of ring signatures.

The ring signatures prevent viewers from knowing who sent the transaction, its worth, or received it. In addition, the use of ring signatures makes it more difficult to tell one transaction from another.

CryptoNote uses one-time keys to ensure that no two transactions can be linked together. However, a public key can still see transactions that several signatures have signed with ring signatures (wallet address). CryptoNote generates a one-time key to address this issue whenever a user gets the money. In addition, an encryption mechanism known as Diffie-Hellman Key Exchange is used to allow two parties to share confidential information.

One-of-a-kind codes generated by the sender are used in the transaction when sending Bytecoin to another Bytecoin address. To the user, it appears as though the funds are being sent to an entirely different crypto wallet every time.

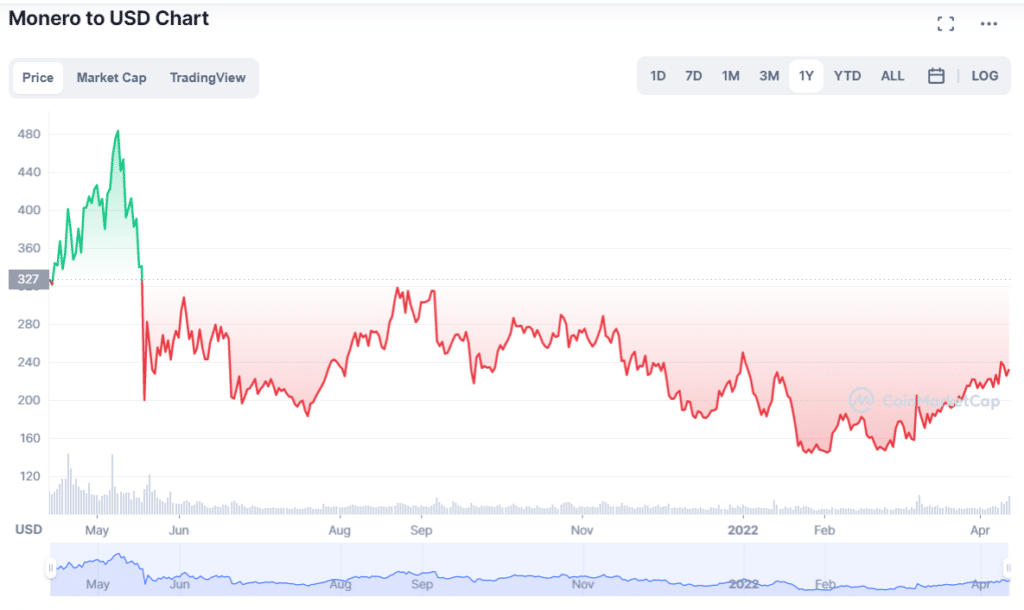

Monero (XMR)

52-week range: $132.69-$517.62

1-year price change: if we look at its price change in terms of percentage for the past year, we can conclude that the XMR underwent a price change of -27.0% in the previous year.

Forecast 2022: based on our technical price research, current crypto market conditions, and historical price performance, XMR might achieve a minimum price of $300 and a maximum of $500 before 2022.

All transactions in Monero are encrypted with the Bytecoin cryptographic protocol. Thus it’s like Bytecoin in that respect. In addition, an offshoot of BCN, XMR, was created. As a result, most of the fundamental attributes of Bytecoin and Monero are shared by both.

Bytecoin, unlike most mineable cryptocurrencies, started with a relatively low supply when it was launched in 2012, with 80% of the total quantity previously mined.

Bytecoin’s network was difficult forked seven times by seven Bytecoin engineers. As a result, Bitmonero, which means “currency” in Esperanto, was given the name of this new coin, which was later renamed Monero.

Zcash (ZEC)

52-week range: $82.28-$370.14

1-year price change: -34.5%

If we look at its price change in terms of percentage for the past year, we can conclude that the ZEC underwent a price change of -34.5 in the previous year.

Forecast 2022: we may expect Zcash to have a successful year in 2022 because of the Zcash network’s ongoing development. Because of this, we may expect Zcash’s bullish price projection of $301.6 by the year 2022. In contrast, the bearish ZEC price forecast for 2022 is $56.5.

Zero-knowledge succinct non-interactive knowledge arguments, or “zk-SNARKs,” are used by Zcash.

The specifics are almost as complicated as the name would have you believe. However, because zk-SNARKs let one party verify something to another without revealing anything specific, this technique is well-suited for private cryptographic transactions, as it should be.

Zcash, on the other hand, does not have a built-in privacy mechanism. Therefore transactions are not always done anonymously. When using Zcash, you can choose from four different kinds of transactions, each with a different amount of confidentiality.

The advantages of Zcash include some of the most robust privacy protocols available and the second-largest market capitalization of any coin on this list. However, some Zcash users may feel that all transactions are private because of the many types.

Upsides and downsides

| Upsides | Downsides |

| The tokens, as mentioned above, have market capitalizations in the billions of dollars, demonstrating that many active users and investors feel privacy cryptocurrencies are advantageous. | Privacy token values have stayed low compared to other large-cap tokens, which have managed to rebound multiple times. |

| The primary source of this growing obsession with privacy is increased government intervention. | Regardless of how efficient they are at guaranteeing privacy, these cryptocurrencies will only be helpful to the general public if they are regulated. |

| The cryptocurrency world has been concerned about hazards to user privacy as concerns about data privacy have grown, yet, these crypto coins have come as a blessing. | Privacy will almost certainly be jeopardized, and finding the right balance between regulatory compliance and privacy will be a considerable challenge. |

Final thoughts

While privacy is a much-anticipated feature of the virtual world, it also bears the possibility of increased criminal activity. Cryptocurrency managers must be wary of malicious members’ hacking attempts. In addition, law enforcement and regulators are more prone to scrutinize people who make substantial transactions.

Despite its popularity, Bitcoin is being used by government agencies. Observing BTC exchanges has given users a significant incentive to migrate to more private digital currencies because they’ve gotten pretty good at that. For this reason, government agencies continue to designate and supervise exchanges that use Bitcoin to verify customer identities. Customers have a strong incentive to switch to more private digital currencies like those described here since they’ve become skilled at monitoring Bitcoin exchanges.