Wall Street is becoming more optimistic about the long-term prospects for quantum computing, with several pure-play stocks likely to go public. Quantum computing technology makes use of the superposition phenomenon, which occurs at the subatomic level, to boost computer speed.

According to International Data Corporation, the quantum computing sector will grow from $412 million in 2020 to over $8.5 billion in 2027.

Between now and 2027, the compound annual growth rate (CAGR) will increase by a mind-boggling 50%.

This article highlights the top three quantum computing stocks: best guarding new technologies and high profit.

Why is it worth investing in quantum computing stocks?

Quantum computers, which maximize the potential of quantum physics to solve specific problems, are capable of feats that even the world’s largest and most powerful conventional supercomputers cannot match.

In this new technology, multidimensional spaces are utilized to clarify enormous concerns. Quantum computing has the potential to be a trillion-dollar business, with implications for a wide variety of sectors, from robotics and artificial intelligence to cryptography and the pharmaceutical industry.

Quantum computers will enable the next significant leap forward in computing capability. This is why it is worthy of investing in quantum stocks.

How does it work?

The world’s largest FX trading platforms are used to purchase and sell these stocks to maximize profits while trading in the stock market and grasping the fundamentals of stocks and markets.

Although quantum computing is still in its infancy, it has the potential to resonate in the same manner that the personal computer revolution did. Quantum technology can fundamentally alter how artificial intelligence is deployed in our daily lives. Quantum is expected to exert the most effectiveness in five to ten years.

Instead of bits, quantum computers make use of qubits. Quantum bits are not binary; they can be either “on” or “off.” They can exist in a condition known as “superposition,” they are simultaneously on and off.

How to start?

Investors can buy and sell the quantum stocks on the official market of the exchange at any time of day or night, including state holidays. Moreover, purchasing and holding a quantum stock on the FX trading platform entitles you to be regarded as the legal owner of that specific stock in the digital market.

Top three quantum computing stocks to buy

Here is a list of the top three quantum computing stocks to make a good profit.

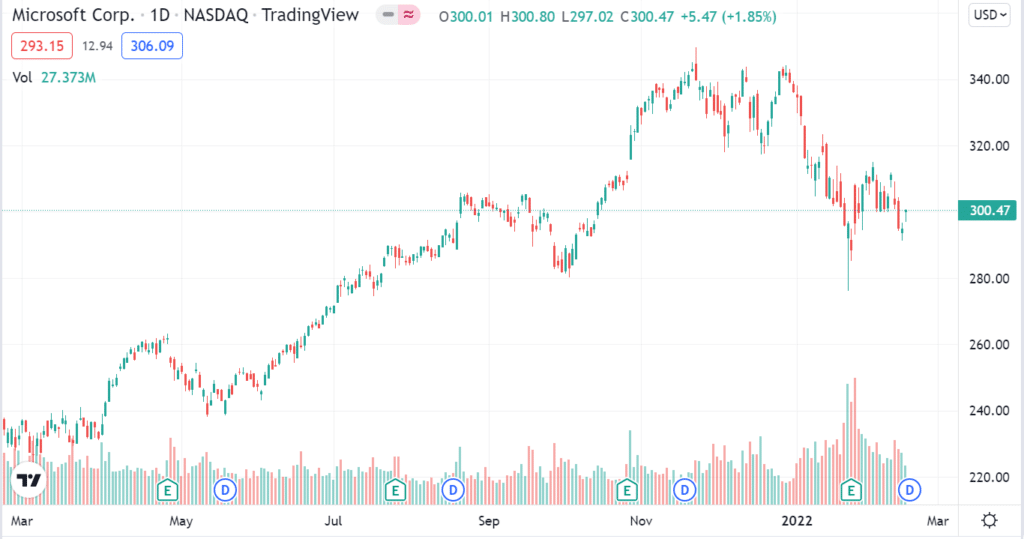

Microsoft (MSFT)

52-week range: $224-$349

1-year price change: Microsoft stock reached a yearly high of about $349 in mid-November 2021. Even though the asset’s price reached a yearly low of $224 in March 2021, it increased by 50% by the end of 2021.

Forecast 2022: $330-$411

There are a lot of new technologies being worked on by the software company, including quantum computing. Microsoft’s labs work on making unique cooling, small hardware, and software for quantum computers and other items. Thanks to Microsoft’s cloud platform, Azure, Quantum computing services are now available to the general public.

Many people don’t expect Microsoft to be the primary driver of computer technology in the next few years, but the company is still working to improve quantum computing.

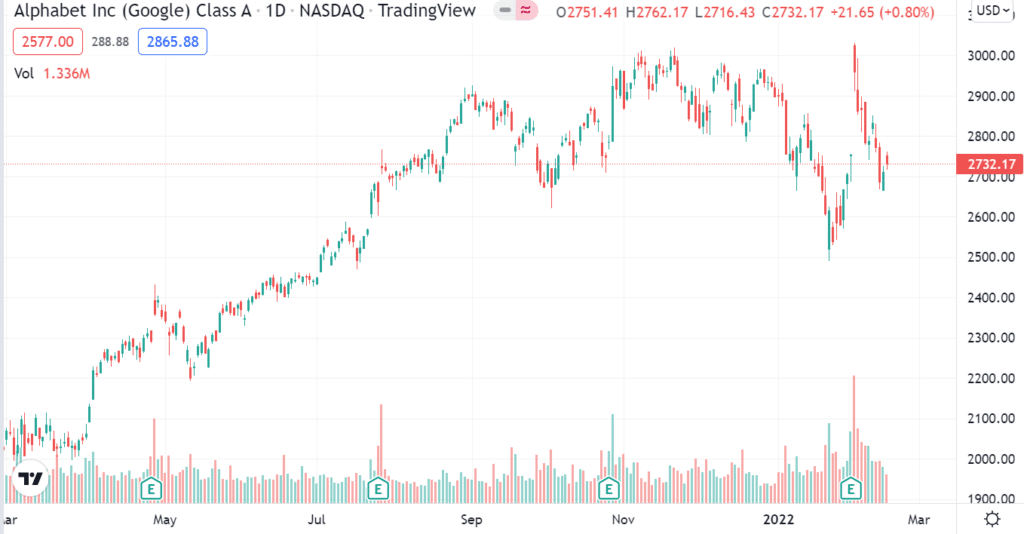

Alphabet (GOOGLE)

52-week range: $1990-$3030

1-year price change: The Alphabet stock saw a yearly high in mid of Nov 2021, around $3030. The asset marked a low yearly price of $1990 in March 2021.

Forecast 2022: $3100-$3541

Alphabet Sycamore (Google’s brand of quantum computer chips) is the third-largest platform in public cloud computing. In addition, quantum computing is being used to make artificial intelligence software systems.

Because Google is the most popular search engine on the internet, it has a lot of interest in making computer processes more efficient, faster, and smarter. Digital data management is the company’s bread and butter, and it stands to make a lot of money if it helps businesses of all kinds use that data. In addition, Google is trying to get better at quantum computing and AI, which could help the company improve the performance of big computer systems.

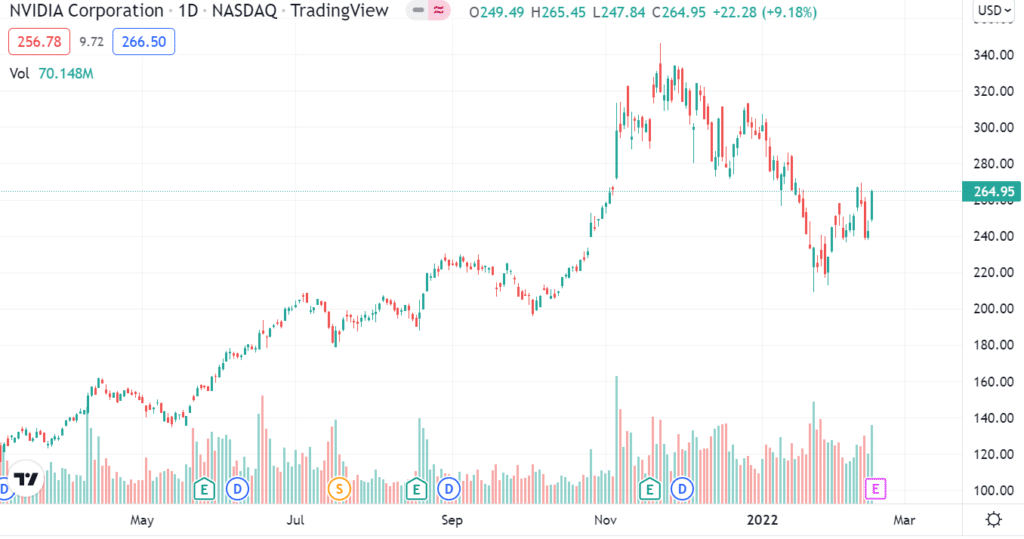

Nvidia (NVDA)

52-week range: $115-$346

1-year price change: The NVDA stock reached a yearly high at the start of Nov 2021, around $346. Despite the asset having a low annual price of $115 in May 2021, its price increased by 125.29% by the end of 2021.

Forecast 2022: $300-$410

Nvidia’s graphics processing units (GPUs) help computers do more work, and the company is quickly becoming the world’s leader in complex semiconductor designs. Because of this, Nvidia is still a leader in developing innovative circuits. Also, the market is good at AI and machine learning.

Nvidia uses the software made for its graphics processing units to make progress in quantum computing. As a result, it is now possible for software developers to create processes and programs that use quantum computing using quantum.

Upsides and downsides

Here are significant upsides and downsides of investing in quantum stocks.

| Upsides | Downsides |

| As you can see from long-term patterns, the quantum stock market has mostly gone up over time. | The stocks have the risk of higher volatility. |

| When investors invest money in the stock quantum market, they get a lot of information. This information comes in the form of a lot of study and analysis. | Lack of knowledge and research in the quantum stock market leads to heavy money loss. |

| Quantum stock market investing has several advantages over other stocks regarding profit and transactions. | Investing in the quantum stock market is not comparable to gambling. To identify potentially lucrative stocks, you must do research and investment analysis, and that’s time taking. |

Final thoughts

Researchers and software developers may now use quantum computers owing to cloud computing, which has increased the accessibility of quantum technology.

As the digital economy expands, the need for computing power increases, and by the end of the next decade, global cloud computing expenditure is estimated to exceed $1 trillion per year. Quantum computing might become a crucial technology within the next decade.

As a result, the market will remain limited and research-oriented until a universal quantum is built. Nevertheless, the quantum computing market will reach more than $283 million in value by 2024.