The best time to trade is when the market is moving. During this market condition, the chance to make money fast exists. On the flip side, you run the risk of losing big money if you make a bad call. Losing is part of the game, but there is a way to limit the downside.

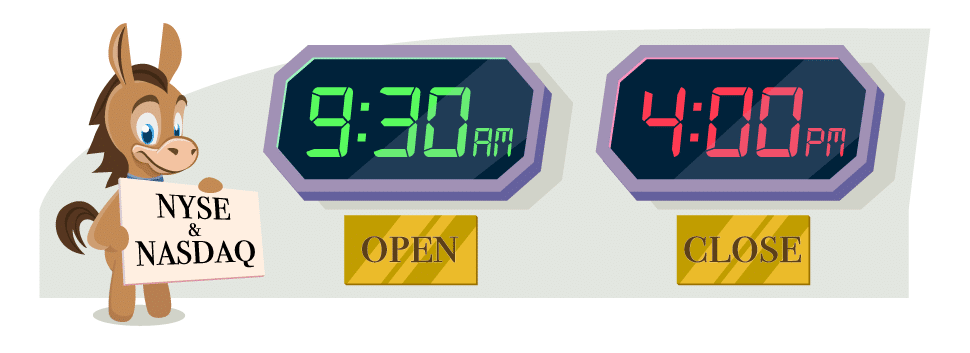

The stock market is relatively volatile during the opening and closing, which are generally regarded as the power hours. The market usually opens around 2:00 PM to 3:30 PM GMT and often closes around 8:00 PM to 9:00 PM GMT.

While knowing the specific times when market activity picks up is helpful information, trading success requires more. You have to put that knowledge to work. Therefore, you must develop a trading strategy around the power hours.

This post will discuss some strategies you can use to trade during power hours. You will also learn some tips on approaching trading power hour stocks. Before that, let us understand what power hour stocks are.

What are power hour stocks?

As already mentioned, each trading day has two power hours. Although the morning power hour is a very active market hour, the afternoon power hour is generally more active. Take note that the power hours are dependent on the specific open and close times of the stock exchange you are trading.

Morning power hour

You will see large price movements such as spikes during the morning power hour. If the market moves fast as it usually does during this time, then you can execute your trade plan. Be aware, though, that there are times when the market is less active or sluggish. There is nothing you can do about it. When this happens, you can research and find other potential setups.

Afternoon power hour

Like the morning power hour, the afternoon power hour has a big trading volume, hence high volatility. However, you can see bigger moves during this time. Therefore, you can make more profits trading the afternoon power hour, assuming you make the right entries. One strategy you can use to trade this schedule is to find stocks whose current prices are close to taking out the previous day’s high. When you buy these stocks, you are likely to liquidate the position before the trading day ends. This way, you can avoid paying overnight commissions.

Four things you should know about power hours

Seasoned investors who have been trading stocks for a long time have learned critical lessons about trading power hour stocks. The four points below are some tips you should know.

- The most active power hours occur on Mondays and Fridays. On Mondays, volatility is high because there is no trading during the weekend, and traders come to the market with great excitement. Another possible reason is news announcements released over the weekend. However, Friday is generally the most volatile day because traders are closing out positions before the trading week ends.

- Stocks with scheduled news announcements over the weekend may move actively during the power hours on Friday. Meanwhile, stocks with large volumes of options trades may move violently on Friday.

- Trading during power hours can be helpful in your trading campaign. While you are not trading outside of the power hours, you can use the time to research and analyze stocks. Spending more time studying charts and fundamentals than trading is favorable to your trading results.

- Long-term investors are not concerned with power hours. For them, what is more, vital is the average holding time of their investment rather than timing entries. However, trading when the market is moving is critical for stock traders.

Strategies you can use to trade power hour stocks

Strategy 1. Scalping

Scalping the stock market might make sense to you if you are starting and you have limited capital, to begin with. The essence of scalping is making a profit by taking several trades rather than opening a few trades with large volumes. To achieve this, you will be executing many small trades with short durations.

Scalpers usually keep a trade open for a few minutes and close it out the moment it turns green. With this trading approach, trading with the trend still holds value. Therefore, you must trade the trend in the time horizon you are looking at.

Strategy 2. Day trading

As the name suggests, day trading involves opening and closing trades within the day. If you use this trading style, you must close all trades before the trading day ends whether the floating profits are positive or negative. Be aware of the closing time of the exchange you are trading in. For NYSE and NASDAQ, the closing time is 4:00 PM EST.

As you can see, this trading approach gives more attention to the time factor than the profit factor. Trading during the power hours allows you to take trades that often reach trade targets quickly. If you have a certain profit or loss target per day, then you can stop trading for the day when this target is reached.

Strategy 3. Swing trading

Swing trading is primarily a technical approach to stock trading. When you trade this approach, your goal is to capitalize on short-term or medium-term swings of price movement. Trading in this manner often keeps trades open for a few days until they run the whole course. Trading during the power hours can prove essential to getting the most benefit.

Final thoughts

Several stock traders think of the power hour as an excellent opportunity to make fast money on a trading day by capitalizing on those times when the market is moving fast. Please note that power hour trading can be more challenging than it looks. While the chance to make money fast is possible, the high market volatility might work against you if you are not careful.

Because of the inherent risk, what you can do is exercise caution while trading power hour stocks. You will know if this approach is right for you if the following items are true:

- You are comfortable with the idea of losing money as part of trading.

- You intend to make quick profits.

- You have enough capital and time to devote to trading the stock market.

- You trade with a game plan to avoid making arbitrary trading decisions.