Is it a good idea to put money into penny stocks? This is a question that many folks ask themselves; are you asking yourself the same question? A great deal is riding on your success or failures as a trader. Low-priced stocks sometimes carry a more significant risk than more expensive ones. This is because slight price changes result in more considerable percentage fluctuations.

Stocks as little as a penny can soar, and numerous well-known companies like Ford and Monster Beverage Corp. have done so. This article will walk you through the top three penny stocks and how to invest in them.

Why is it worth investing in penny stocks?

Penny stocks, especially those that have shown promise, may surely deliver significant growth opportunities. In addition, these enterprises can produce long-term benefits for investors through novel items, unique positioning, or differentiating advantages.

To gain the most out of them, you must first identify the ideal low-priced stocks before they explode in value. But bear in mind that the difference between a successful deal and a terrible loss could be razor-thin. Although you may have hedged your bets on a winner, many traders still lose money because they do not apply effective market timing techniques. So although we’ve included some of the most excellent penny stocks to buy for less than ten cents each below, you should always conduct your due diligence before making stock.

How does it work?

A penny stock is a high-risk investment with a small market capitalization that trades for a low share price outside the leading exchanges. Instead, investors open accounts with top discount brokers who specialize in these high-risk investments to make the most reasonable decisions feasible.

How to start?

Once you’ve decided to take a chance with your money, search the penny stock market for companies with recent news and exciting products or services. Keep in mind that these stocks are very speculative, so as a general guideline, don’t risk any money you can’t afford to lose.

Most penny stocks do not trade on the NASDAQ or other significant exchanges owing to listing requirements unless the company’s exchange-traded stock has recently failed to satisfy listing rules. Instead, these assets are sold on the OTC Markets Group (OTCBB) for the most part. In addition, Penny stock quotations have traditionally been issued in “pink sheets,” a quotation publisher that utilized pink-colored paper to print the quotes.

Keep in mind that due to the nature of these stocks, spreads may be significant. Therefore, a minimum trading block of 10,000 or 100,000 shares is necessary for many situations. Nevertheless, a day profit of hundreds of percent is possible under certain conditions despite the risks.

Global Fiber Technologies Inc. (GFTX)

52-week range: $0.0002-$0.0128

1-year price change: the stock maintained a downtrend from April 21 until October 21. After that, the asset picked up some pace and gained more than 11% so far.

Forecast 2022: the GFTX price is expected to hit $0.01 by the end of 2022. The stock has a potential rise as the company profile improves, and investors find it a low-cost stock with a handsome return.

This penny stock is worth less than ten cents and is used to create apparel. It has three key business channels in particular.

The first category is devoted to fan gear. There’s even a section titled “Event Worn, Reborn.” It digitally encodes the fibers from a piece of clothing worn at an event into a brand of fan gear. Customers may buy clothes “worn by” their favorite athletes and players.

The company’s Eco Tek 360 division is its second primary focus. They collect discarded suits and ties from the corporate world. In the end, they’re repurposed into brand-new clothes and accessories like uniforms and suits. A wide range of industries and uniform types use this technique.

The third is a Fiber Chain. This is the world’s first clothing-buying and-selling marketplace based on blockchain technology. The project is still in progress. Despite this, it promises to connect buyers and sellers of fiber in minutes rather than days or weeks, as other competitors claim.

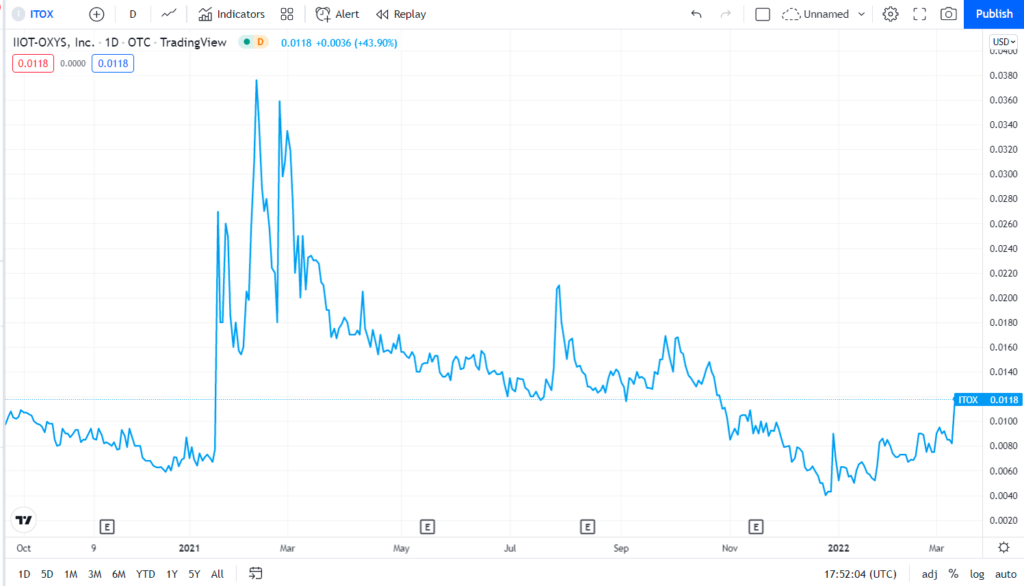

IIOT-OXYS, Inc. (ITOX)

52-week range: $0.0032-$0.0263

1-year price change: the ITOX maintained a downtrend until the end of 2021. However, the asset found a bottom at $0.003 and has been rising since then.

Forecast 2022: the 2022 forecast for the stock is to maintain a range between $0.00746-$0.112. Since this is a technology stock, the probability of gains is quite high. Moreover, the entire sector has seen remarkable growth in recent times.

IIOT-OXYS is a penny stock in the technology sector that trades for less than 10 cents. It was initially known as Gotham Capital Holdings. Manufacturers are now the primary emphasis of the business. AI is very prevalent in IIOT. In addition, blockchain and other technologies are being employed to aid manufacturing in enhancing output and quality.

The Industrial Internet of Things (IIOT) is an abbreviation for “Industrial Internet of Things.” So you can see how the Internet of Things (IoT) is evolving. It’s just going to become more significant and more diverse as time goes on. It’s beginning to carve out niches and combine with other specialty areas.

They are in charge of administering IIOT software for customers and supplying products and services. They do so so that these clients don’t have to spend as much time learning new technology. In addition, the firm will be able to focus more on offering value to its customers.

Metrospaces, Inc. (MSPC)

52-week range: $0.0002-$0.0028

1-year price change: the MSPC stock has seen a huge drawdown over a year. The prices have been in the consolidation zone since 2022 started.

Forecast 2022: we expect the asset price to stay between $0.00030-$0.00930. The asset price has become too low to be a great investment opportunity to buy the dip and hold.

PropTech company Metrospaces is a penny stock with a market valuation of fewer than 10 cents. If you’re unfamiliar with the word, PropTech stands for Property Technology. It primarily relates to technologies that aid in the real estate market.

Metrospaces’ mission is to locate the world’s most desirable homes. Then, these cutting-edge tools are put to use in new and inventive ways.

It is the owner of not one but two companies. One is already functioning, while the other is still in the works. Metrohouse creates a terrific tenant experience by merging AI and blockchain. It provides AI-based tenant matching, for example.

Metrocrowd is the other. The Ethereum network will be utilized for this. Other technologies are being used to automate real estate negotiations. It also covers the buying and selling of real estate on occasion. This is an outstanding penny stock under 10 cents if you like dealing in real estate.

Upsides and downsides

Now, let us take a look at the upsides and downsides.

| Upsides | Downsides |

| Despite their degree of volatility, penny stocks provide exceptional profits. | Because of the low market price, the company’s market capitalization is also low. |

| They have the potential to produce significant development in a short period, and as a consequence, they have become one of the most popular investment alternatives. | Holders find it difficult to cash out owing to a lack of liquidity. In addition, due to a lack of buyers in the market, an investor may not sell his shares at the correct time. |

| With a minimal amount of money invested, you can earn a lot of money. But, as their name indicates, they start tiny. Then, as a consequence, they can make it big. | In most cases, they’re exchanged in minor amounts. |

Final thoughts

It’s possible to buy several stocks for less than one penny each. The bulk of these shares trade for less than 10 cents all year. New ones arrive every day if you wish to invest less than 10 cents in further stocks. We hope you found this article helpful.