Kapola Trader EA claims to be a winning FX EA that generated stable monthly profits without any loss. As per the vendor, the system uses proven strategies that help it consistently outperform the market. The system can generate seriously high income with its efficient design. We could not find info on the company like its founding year, team members, the experience and expertise of members, other products, and more.

The highlights of Kapola Trader EA

Here are some features that according to the developer, set Kapola Trader EAapart in the market:

Money management

The FX robot uses powerful money management, which helps to keep you assured of profits even in the most adverse situation and in the case of market cataclysm.

Generates high income

The vendor claims that this is a powerful automated system that trades successfully. It reduces risk while boosting profits with its unique approach.

Drawdown control

The money and risk management measures of the system are very effective. They ensure the drawdown is very low and the winning ratio is 3:1. A trailing stop is used which ensures high profits.

Trading strategy of Kapola Trader EA

According to the vendor, the system uses the Bollinger Bands approach. The approach methods help you identify the right entries and exits. The FX robot also uses the prevailing market price info to assess the accurate entry points. For exiting a trade, the EA uses the moving average and CCI indicators.

Backtesting reports

No backtesting reports are present for this FX EA. Backtesting helps in knowing about the strategy’s effectiveness. The absence of a strategy tester report makes it difficult to assess the system.

Trading results in real time

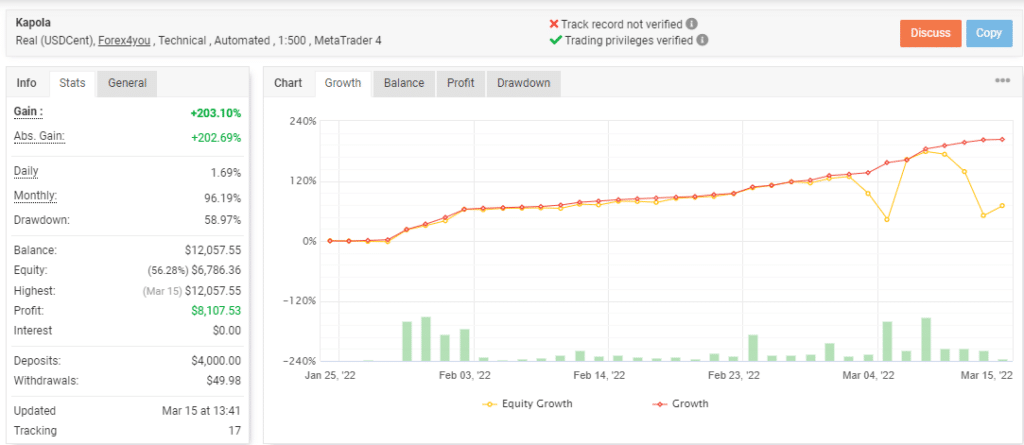

A real USD Cent account using the Forex4you broker and the leverage of 1:500 on the MT4 terminal is present. The account has trading privileges verified by the myfxbook site but its track record is not verified.

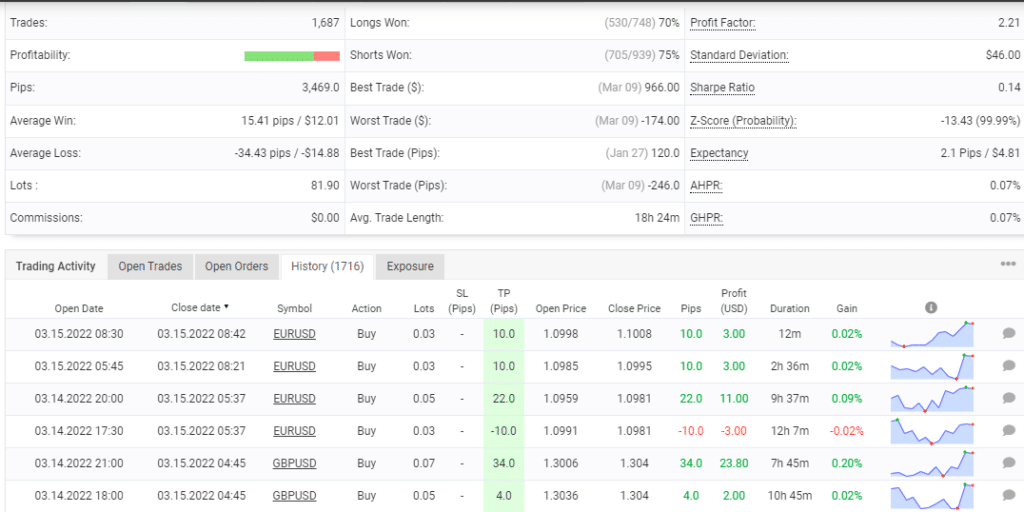

The above stats show a total profit of 203.10% is generated for the account which started on January 25, 2022. For a deposit of $4000, the system has generated a profit of $8,107.53. The daily profits are 1.69% and the monthly profits are 96.19%. A drawdown of 58.97% is present. For a total of 1,687 trades, the profitability is 73% and the profit factor value is 2.21. From the trading history, we can see lot sizes ranging from 0.03 to 0.07 are used. The big lot sizes and high drawdown indicate a risky approach. Traders will not be willing to allow such a high drawdown that can make them lose their capital. While the monthly and overall profits are excellent, they cannot be relied upon. This is because the sample size provided is very small. The high profits shown may be random and not reflect the true performance of the system.

Kapola Trader EA price

A bronze ($99) package, a silver ($149) package, and a Gold ($249) package are present for this FX EA. All three plans have lifetime access, 24/7 support, and free updates. They differ in the number of real and demo accounts they offer. While the bronze comes with 1 real and 1 demo account, the silver package provides 2 real and 2 demo accounts. You get 4 real and 4 demo accounts with the gold package. A 30-day money-back guarantee is present for the product. When compared to the market average, we find the price is not expensive.

Customer support

For support, the vendor offers an online contact form. There are no other methods like a live chat feature, FAQ, phone number, email address, etc. present.

Are traders happy with Kapola Trader EA?

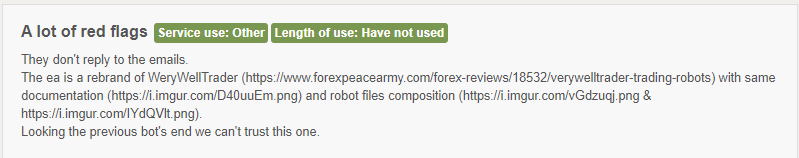

We found a user review for this FX EA on the Forexpeacearmy site. Here is a screenshot of the feedback:

From the above review, it is clear that the support is poor and the user claims that this is not a trustworthy system.

Kapola Trader EA

Kapola Trader EA-

Profitability2/5 Bad

-

Strategy2/5 Bad

-

Reliability2/5 Bad

-

Price4/5 Good

-

Customer Testimonials2/5 Bad

Advantages

- A fully automated software

- Money-back guarantee

Disadvantages

- High drawdown

- Small sample size

- No vendor transparency