With increasing global wine consumption, investing in wine stocks could provide significant long-term returns. Why, may you ask?

Because the wine industry has survived the test of time and has produced substantial returns over the years. However, deciding which wine stock to invest in can be difficult with only a few publicly traded wine companies.

To assist you, we’ll illustrate the top three wine stocks and discuss a better way to make wise wine investment decisions.

Why is it worth investing in wine stocks?

Annual wine spending is in the tens of billions of dollars, and projections for the next decade indicate an average annual growth rate in the mid-single digits.

However, investing in wine stocks can be advantageous for investors seeking more stable returns and dividends. The typical holding period for wine stocks is between five and ten years, but it can generate healthy returns even over shorter periods.

How does it work?

In some cases, investing in wine stocks provides you with a tangible asset that has the potential for future growth. Generally speaking, if the price drops or the performance falls short of expectations, you can at least drink the wine and enjoy its flavor.

Although there are no exchange-traded funds or mutual funds dedicated to the wine industry, funds focusing on sin stocks, luxury goods, or the broader consumer essentials sector may provide exposure to businesses involved in the wine market.

How to start?

Instead of buying wine bottles, you could invest in the wine industry by acquiring the stocks of wine merchants or producers. When investing in wine stocks, it is irrelevant whether a given bottle contains investment-grade wine. Instead, you are betting that people’s interest in purchasing alcoholic beverages will grow.

Investing in wine stocks can be a financially lucrative endeavor. The following companies are among the best investment options.

Constellation Brands Inc. (STZ)

STZ price chart

52-week range: $207.35-$261.52

1-year price change: 2.55%

Forecast 2022: $207.59-$261.52

It is a global producer and marketer of alcoholic beverages such as beer, wine, and spirits. Founded in 1945, the company is best known for its Mexican beer portfolio, including Corona, Modelo, and Pacifico.

Constellation was a fast-growing firm until 2021, thanks to its beer business, which accounts for roughly three-quarters of total revenue. However, its portfolio of alcoholic beverages has matured, which is likely to be more of a slow-and-steady business.

Constellation has proven to be an effective investor in various alcohol businesses, and its portfolio has grown over time. Over the last few years, the company’s cellar of wines and other adult beverages has generated well over 30% operating profit margins. This brand has a 1.26% annual dividend yield, the same as the wine industry average of 1.34%.

The dividend payout of Constellation brands has been consistent, never falling by more than 10% in the last ten years. Over the last decade, its dividend has grown steadily.

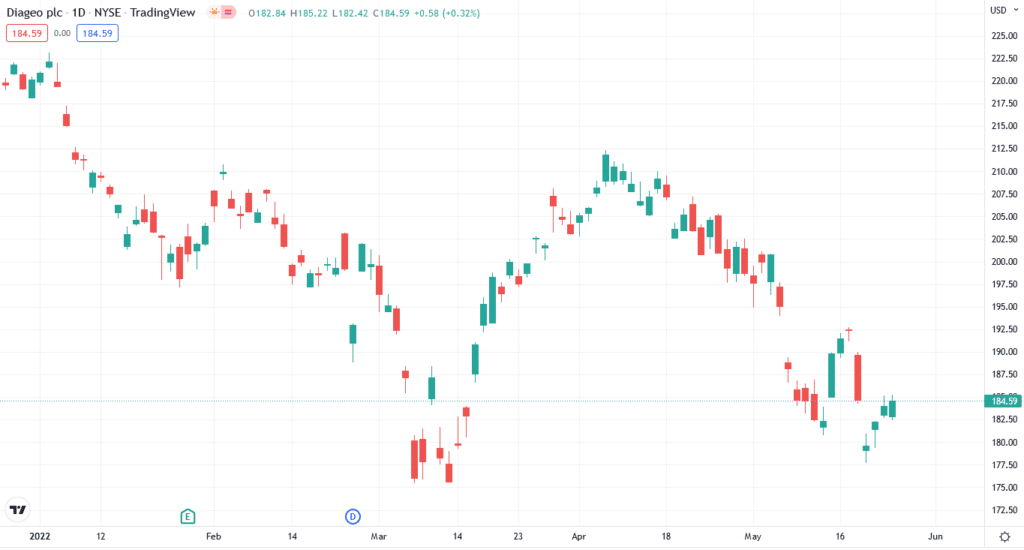

Diageo PLC (DEO)

52-week range: $175.46-$223.14

1-year price change: -3.93%

Forecast 2022: $175.60-$212.33

Diageo PLC is a major brewing and distilling company headquartered in London. Although Diageo is best known for its beer and distilled liquor labels, it is also heavily involved in wine. Diageo PLC is the brains behind several well-known liquor brands. Only a few examples include Johnnie Walker, Captain Morgan, and Smirnoff.

You’d think Diageo PLC is a profitable company to invest in with such well-known brands. Your assumption is correct. Over the last five years, the company’s dividend yield has averaged nearly 3%. It has a 2.19% annual dividend yield, which is one percentage point higher than the wine industry average of 1.34%.

Diageo’s dividend payout is volatile, having fallen more than 10% ten times in the last decade. Over the last decade, its dividend has not grown consistently. However, Diageo’s dividend payout ratio of 59% indicates that its dividend yield is long-term sustainable.

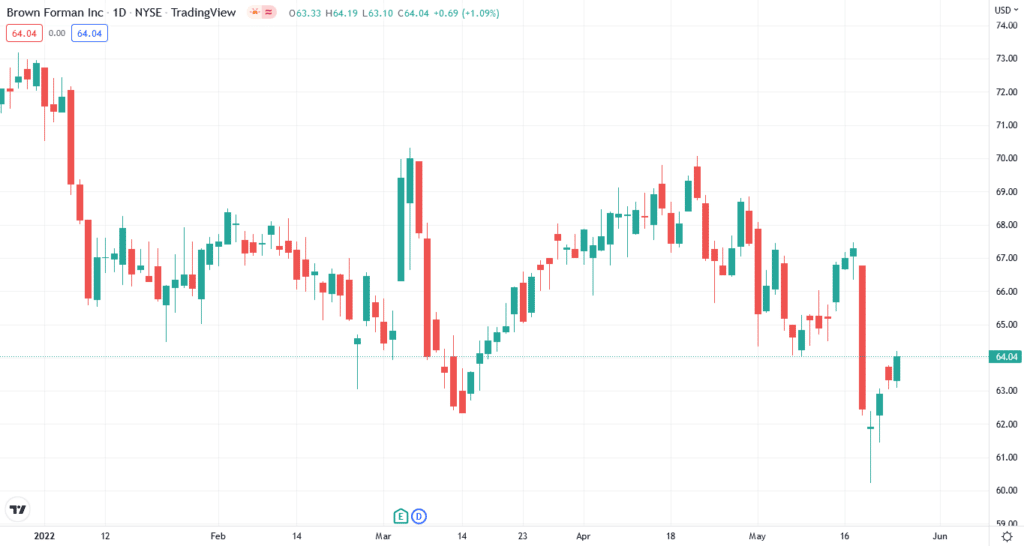

Brown Forman Corporation (BF.B)

52-week range: $60.23-$81.57

1-year price change: -19.74%

Forecast 2022: $60.25-$70.32

Brown Forman is among the largest publicly traded wine companies in the world. The company was founded in 1870 and produced whiskey (Jack Daniel’s), tequila, and other liquor types.

The company reports only one operating segment, with whiskey accounting for more than 80% of revenue, supported by Jack Daniel’s brand and liquors such as Woodford Reserve and Old Forrester.

Over the last decade, the company’s dividend has grown steadily. It has a 0.56% annual dividend yield, which is -1% lower than the wine industry average of 1.34%. Its dividend payout is volatile, having dropped by more than 10% twice in the last decade.

The company had a profit margin of 21.17% and a return on equity of 28.80% in the previous year. Brown Forman’s dividend payout ratio of 32% suggests that its dividend yield is long-term sustainable.

Upsides and downsides

| Upsides | Downsides |

| These assets provide a great option for portfolio diversification. | Wine stock investors must conduct extensive research and analysis on multiple public companies to identify the best ones to invest in. |

| The wine industry will not slow down, which means wine companies will benefit from this demand. | When the stock market is volatile, wine stock prices can fluctuate multiple times in a single day. |

| They can increase massively in the long term. | These stocks can take several years to pick up their pace. |

Final thoughts

Wine stocks are not suitable for everyone. Like other food and beverage industries, wine is not the fastest-growing industry. However, as the global economy grows, wine may offer some gradual growth in the coming years, and a few wine-holding companies also pay dividends.