Diversification is a crucial part of a sound investment plan. While the bond market is generally considered a safe haven for investors, it does come with a few risks. One such risk is an interest rate hike. If the interest rate appreciates, your investment goes down. If the interest rate is steady, however, you can expect a good return.

However, if your goal is to invest long-term, this risk would not be a concern. Investment research firm Morningstar.com stated that long-term government bonds historically provide five to six percent yearly yield.

Some financial experts say that safety, not return or income, should be your primary goal when investing in bonds. Because your capital will see growth by the maturity date, your money has gained value to fight inflation. If you look to put money in bonds for retirement preparation, that will be a great idea.

Is bond investing still worth it? You will find the answer in this article. You will also learn about bond diversification and understand the pros and cons of such investing.

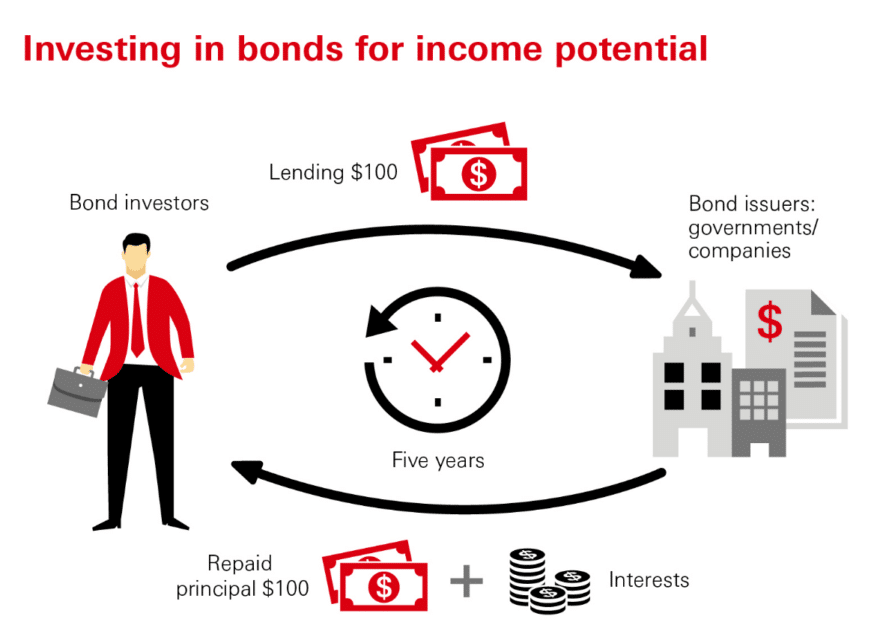

What is a bond?

It is a loan granted by a loaner to another party, which can be a government, company, or another entity. Buying a bond means you loan money to be repaid with fixed interest at a specific later date. See a schematic of how it works in the image below.

When planning to invest in bonds, you have to consider three main elements:

- Price

The bond price fluctuates in response to supply and demand.

- Maturity date

This is the time when your bond provider must return your money with interest.

- Fixed interest rate

The interest rate is set during bond issuance and is normally fixed.

Take note that both interest rate and price affect the yield you are bound to receive upon maturity.

How to diversify bonds?

When diversifying, consider the following three factors: type, maturity, and sector.

Bond type

Various types of bonds exist. Putting your money in multiple bonds is a way of achieving diversification.

Treasuries

The federal government creates bonds to generate funds for its operations. Because the US government is obligated to pay back treasuries, this type of bond is regarded as one of the most secure bonds. Treasury bonds mature from several days to 30 years. See an example in the image below.

Municipal bonds

Municipalities or states create municipal bonds to raise capital for local operations and projects. For instance, if a state intends to construct a dam or a railway, it could release bonds to fund the project.

Corporate bonds

It is not only governments that issue bonds, but private companies do as well, for likely similar reasons. If a company plans to expand its operations or engage in research, it could pull money for the project by releasing bonds.

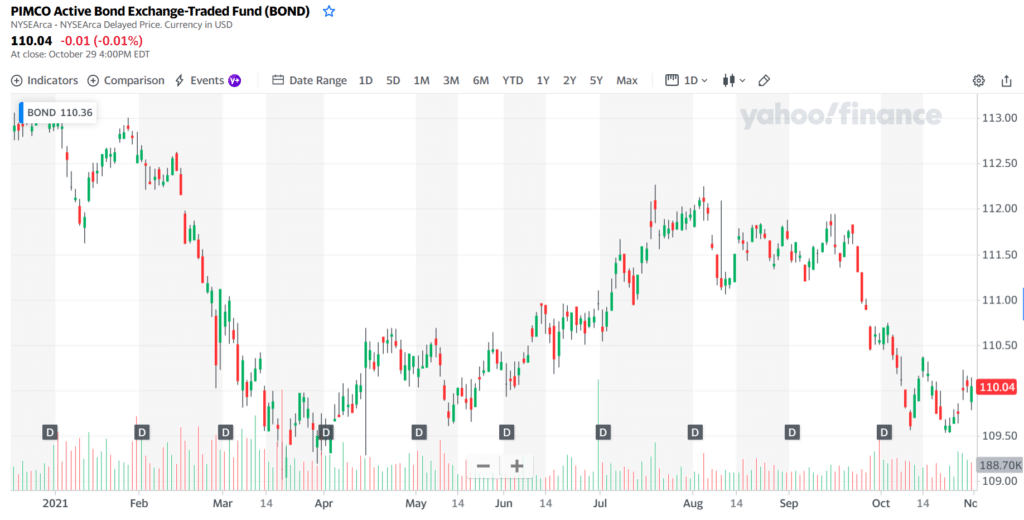

The chart below shows a different type of bond that does not belong to the three main categories. There are other types of bonds besides those presented above.

Bond maturity

The maturity date is the agreed date wherein the issuer must pay the loaned amount (or par value). This expiration date is often agreed during the bond issuance.

Bonds have three categories in terms of maturity:

- Short-term bonds mature from one to three years.

- Medium-term bonds mature from four to ten years.

- Long-term bonds mature in more than ten years.

Whatever duration is agreed upon, the issuer must fulfill its commitment at the bond’s expiration. Then you will get the principal amount loaned plus the final interest.

Bond sector

Below are some bond sectors you can choose when looking to buy some bonds.

US treasury

This sector covers all traditional fixed interest-rate debt securities provided by the US Treasury. Treasury notes and treasury bonds are some examples of bonds in this sector. See an example in the image below.

US agency

This sector contains fixed-income assets provided by government institutions, such as FNMA and FHLMC to acquire capital and fund operations.

Mortgage pass-through

This sector stakes a claim to the operation and profits earned from a pool of mortgages. As a bondholder, you will get a portion of the profits made when homeowners pay their loans.

Mortgage ARM

This sector covers fixed-income assets supported by residential home loans, wherein the interest rate is adjusted regularly in consideration of a benchmark.

Convertible

As the name suggests, you can convert this bond to a stock trading at a specific price and for a set number of shares.

Cash

This sector includes a certificate of deposits, cash in the bank, money market, or currency holdings. Any fixed-income asset that matures in less than one year belongs to this sector.

Upsides and downsides of bond investing

| Upsides | Downsides |

| Expect a fixed return. You know how much yield you can get at the end of the bond term since the interest rate has been set at the outset. | Expect a fixed return. While your bond investment is safe, you can get higher returns when you have invested your money in stocks. |

| Bonds are safer than stocks. Apart from receiving a fixed return, bondholders are prioritized to get paid over shareholders when the bond is liquidated. | You need a big capital to get started. While it is possible to buy a bond with as little as $1,000, some other bonds are substantially expensive. Regular investors might find bond investing out of reach. |

| Bonds are less volatile than stocks. Bond prices may fluctuate based on inflation and interest rate. However, bonds do not fluctuate much, unlike stocks. | The interest rate risk is real. Unlike stocks, bonds are heavily affected by variations in interest rates. However, if your goal is only to hold the investment toward expiration and receive interest, this matter might not be an issue for you. |

Final thoughts

If your reason for investing in bonds is to save for retirement, this type of investment is worth it. Rather than putting your money in a savings account that is eaten by inflation over the years, putting it in a bond can give it the power to fight inflation. This idea makes even more sense if you have maxed out your workplace 401k already.