There is no alternative to buying an asset from the discounted price and holding it with the price gain in practical cryptocurrency trading. Therefore, you need to ensure where the bull run is happening, and your strategy should allow you to join the bull runs from the beginning.

The following sections are for you if you want to know what trading strategy you should use to find a bull. Today’s lesson will discuss everything about catching the crypto bull run, including how to spot the price zone with the list of profitable crypto tokens.

Why invest in a crypto bull run?

Many people wonder to see a 500% or 1000% gain on the crypto price and wish to profit like this. However, it is accessible to the price that has already made a move. On the other hand, cryptocurrencies that are trading at a discounted price have the potential to move up. Therefore, in the crypto bull run, the main aim is to find a crypto token that completed its bear run and got ready to move up.

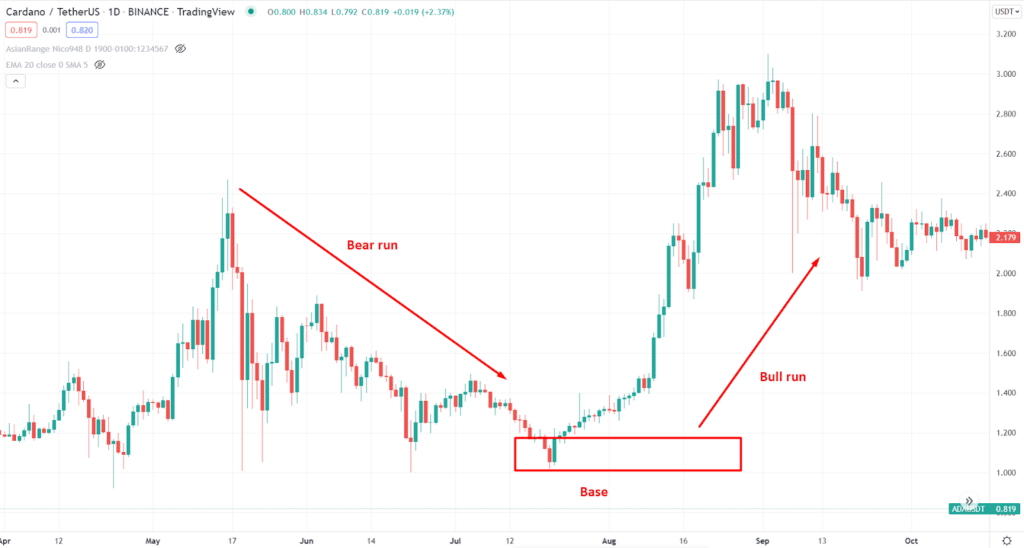

Here, we can see the daily chart of ADA/USDT, where the bearish trend found the bottom at the base and started a bull run. This strategy will see how to join the bull run and what cryptocurrencies are trading on the base with a higher potentiality.

How does it work?

The global cryptocurrency market is a decentralized marketplace where the volatility is extreme. However, like other financial markets, it follows some rules. One of the major rules is that the price does not move in a straight line. It creates zigzag swings by allowing investors to buy or sell the instrument.

If the price wants to move higher, it should come lower to provide the buying opportunity.

In this method, we are interested in the section where the long-term projection of a crypto token is bullish, but its price came lower by creating an opportunity to join the bull run.

How to start?

You cannot buy an asset just by looking at its fundamental perspective. The BTC is trading at $40k, and you are confident that the price will reach the $100k level, but when?

It is easy to look at the project’s outlook and say its future price, but it is hard to say when the bull run will happen. In that case, investors should follow three steps, as shown below.

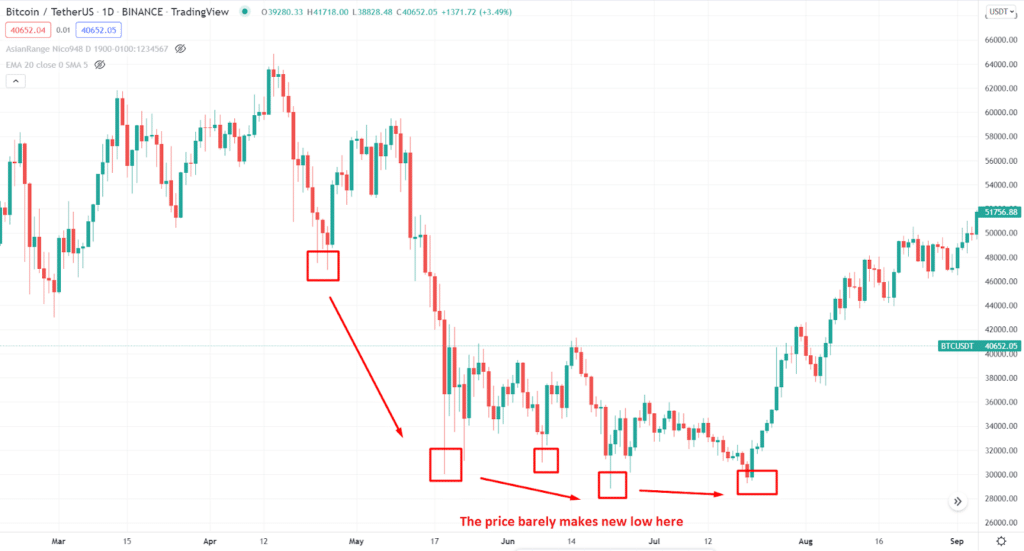

Wait for bears failure

If the price moves down, it is good news for bulls because the bearish pressure will allow investors to open a buy trade from the discounted price. However, can you guarantee that the price will not decrease further from your buying price?

We can determine the future price direction by looking at the price action. In this step, the bear run should weaken like this.

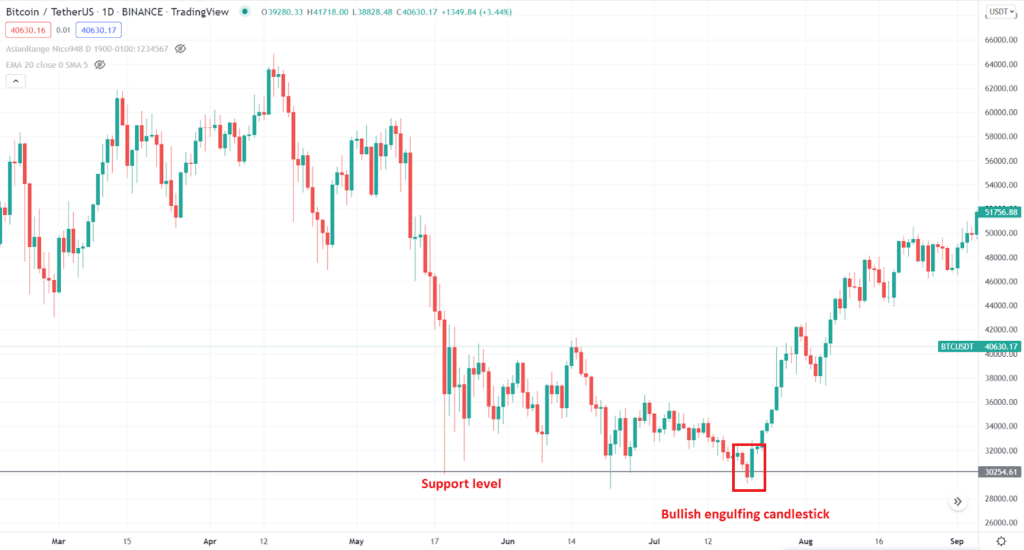

Wait for the base

You cannot consider buying an asset from a random place. For example, if an asset’s price made a 50% loss, you may find it as a lower price by moving from $100 to $50. However, it is wise to wait for the price to find any near-term support level or psychological level.

Join the reversal

Although it is a simple strategy, most traders fail to follow it and make trading complex. The reverse should come from the support level. Moreover, it would help if you found it with the naked chart by looking at candle formations. Make sure to buy the instrument once the candle closes.

Now let’s check three cryptocurrencies trading at the bottom, and likely show a bull run in 2022.

Ripple (XRP)

52-week range: $0.42-$1.96

1-year price change: + 368%

Forecast 2022: $1.70

XRP is a native token for the Ripple network, created by Ripple Labs Inc. where the major aim of the institute is to become a rival to the global money transfer system. People can use this channel to send money at a lower cost. Moreover, the transaction speed is affordable, and any transfer can happen within five seconds.

The recent surge in crypto usage is likely to increase the XRP price in 2022, but the current drawback is its legal trouble with the US regulating authorities. Still, the lawsuit is unsolved, but any positive news regarding the lawsuit might be a bullish factor for the XRP price.

At the beginning of 2022, XRP/USDT price tested the bottom at 0.5500 level before moving higher as a primary wave of the possible bull run. The impulsive bullish pressure from the bottom awaits taking out of near-term swing levels before showing the actual buying move in 2022.

VeChain (VET)

52-week range: $0.03-$0.28

1-year price change: – 32%

Forecast 2022: $0.18

VeChain started operation as a private consortium chain that went public in 2017 with its ERC-20 based token VEN. Later on, it launched its mainnet and changed the ticks ar VET. This network aims to use distributed governance and IoT technologies in multiple global industries. Trustless data made VeChain build a stock digital backbone by providing smooth data sharing services.

Although the VET price showed a decent bullish pressure in 2021, it failed to hold the momentum and went to the bear market from May 2021. As the current price passed a long consolidation, any buying attempt from 0.3000 to 0.6000 will likely provide a higher success rate.

Tezos (XTZ)

52-week range: $2-$9.17

1-year price change: – 18%

Forecast 2022: $6.2

Tezos is a smart contract-based blockchain network, similar to the Ethereum ecosystem. However, the main purpose of this network is to offer more advanced infrastructure without the fear of a hard fork. Its smart contract language has a higher accuracy that is needed for use cases.

XTZ/USDT price completed its bull run in 2021 and remained within a corrective bearish pressure since October 2021. However, the long bearish trend with volatility at the 2.500 bottoms might grab buyers’ interest in this token.

Upsides and downsides

| Upsides | Downsides |

| Risk vs reward In the crypto bull run, the possibility of the trend continuation is substantial with a good RR. | Uncertainty As it is based on probability, there is a risk of unexpected stop loss. |

| Trade management After taking a buy trade it is easy to set the breakeven. | Volatility The excessive volatility in the crypto market might make trading difficult. |

| Varieties The crypto bull run method applies to any crypto pair. | Technical analysis Traders should have the basic knowledge of technical analysis in this method. |

Final thoughts

The crypto bull strategy applies to those tokens that moved down and found a base before aiming higher. It creates an opportunity of grabbing the full benefit from the price swing. However, investors should remain cautious about the excessive volatility of the market where further bearish pressure from the entry price is possible. In that case, make sure to use stop loss in every trade.