Conservative investors prefer short-term funding mostly. Thus, they think of long-term investments as risky. But, considerably, the risk of a higher interest rate is more remarkable in such investments.

Therefore, investors are not primarily willing to lock their shares for a long time, and with frequent investing, it also becomes time-consuming to achieve goals. However, many investors also prefer long-term bonds like real estate ones. So, it depends from person to person.

Well, are you confused about what will be the best investment option for you? Then let’s discover what to choose and under what conditions.

When should you roll over long-term investment over short-term?

The assets kept for a few months or a year at least are known as short-term investments. The long-term investment includes holding assets for years, or to say, more than a year. Investors opt for both. Let’s see what conditions call for this investment type.

Planning for nine to ten years of a financial plan

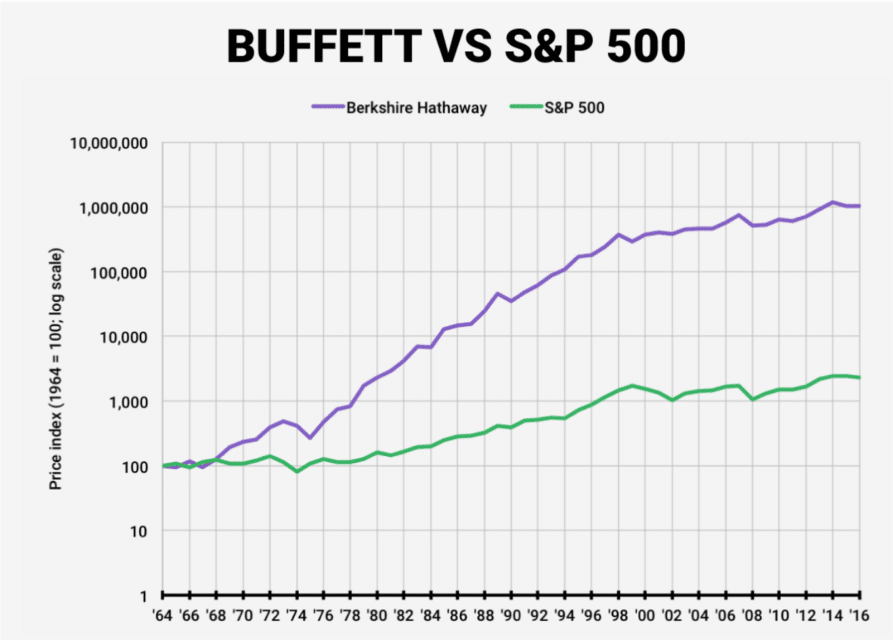

As Dein Stein records, earning money doesn’t call for a long time. However, you can avail of the opportunities like investing in stock to make more by investing in bits for a longer time. It depends on how much you want to fund and when you want your shares back.

If you have planned your financial goals for eight years or more and don’t need money any sooner, then a long-term investment opportunity like stocks or real estate investment is for you.

You don’t have any retirement plan near

If you aren’t likely to be retired from your permanent job sooner, then the long-term investment is for you. However, it requires proper attention and diligence of its users, such as stocks or real estate.

Through this, you get time to invest more and earn more by rectifying the mistakes that new investors usually make.

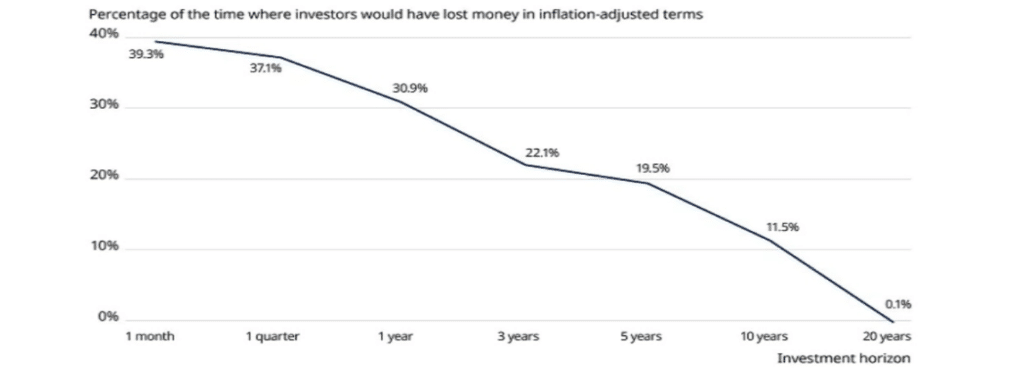

Long-term investments, in turn, reduce risks and thus boosts wealth as the investors get enough time for rectifying mistakes.

Want to save yourself from getting into debt or inflation

The annual yield of long-term investment is higher than any other investing plan. So, it can save you from becoming inflation’s prey. In this way, it becomes easy to manage or maintain purchases and generate income. There are other long-term investing activities than stocks like I-bonds, identified by Dein Stein, which offers more benefits.

I-bonds have a fixed income yield. Yet, the interest rate of I-bonds increases after 30 years if you don’t cash the money before it. However, you have to keep your shares on hold for a minimum of five years to avoid getting your first three months of interest.

When to go for short-term investment over long-term?

Let’s now learn when to use a short-term investment plan to have a better yield.

Looking forward to making more money in a short time. If you have to pay rent of your house, clear down payment on the properties, or have soon-to-be acquired financial goals, you can confidently go for short-term investment.

For instance: investing in credit or debit cards is a safe chance as you can invest, get your dividend shares, and withdraw the shares anytime as per your choice.

You don’t even have to worry about changes in market trends or market losses.

A source of daily income and moderate returns

With this, you can invest and earn your interest within no time. In addition, several short-term investment opportunities offer a long income generated to guarantee ultimate financial growth. However, such opportunities do have expensive fees, and the prices are usually tax-deductible.

So, if you are looking forward to regular money earning opportunities, you can manage bonds with high yielding or any other thing. With this, you can increase your wealth.

Want to preserve assets or capitals

If you only want to save your money for immediate goals like saving for a new car or property, short-term investment is preferable.

It offers you an average return of investments, allowing you to get money in your hands within a short time and save your earned money or assets. Yet, it doesn’t include market appreciation as it doesn’t mark any increment in returns with the increase in the market rate.

Upsides and downsides of short-term and long-term investments

| Upsides | Downsides |

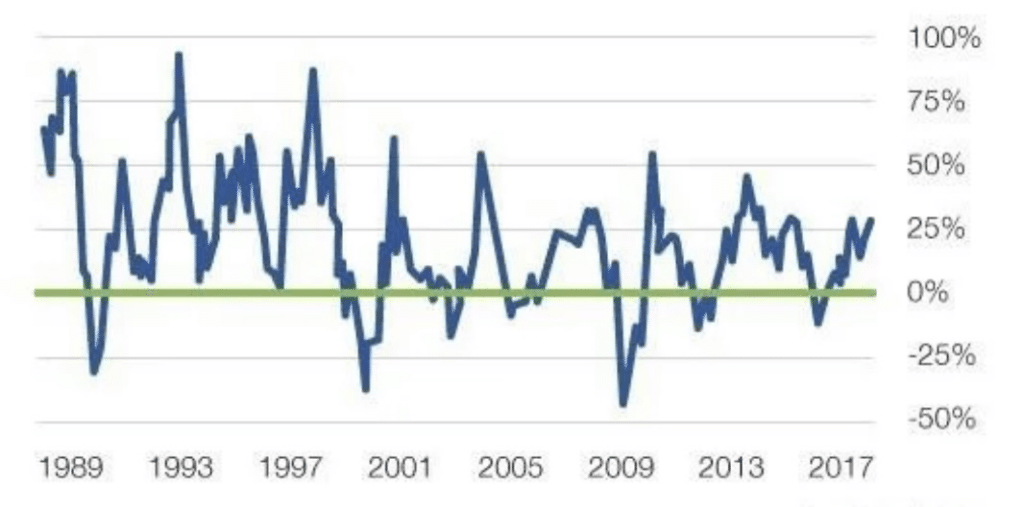

| Short-term investment is the quickest strategy for earning money. While long, the term is less stressful and doesn’t call for regular management. | Short-term investment is at risk of volatility. Long-term investment holds dividends for a longer period so, you can miss out on the possible changes in market prices. |

| Short-term investment is less risky because it doesn’t hold an amount for years. However, long-term investment saves time and also offers reinvestment of shares to generate more profit. | As a long-term investor, you should have comprehensive knowledge about your chosen investing activity. On the other hand, short-term investors are more prone to stress as you can’t predict the future of your earned capital. |

| A long-term investment strategy calls for a minimum of 15% taxes. | To make calculated decisions, you have to keep the market trends in check-in short-term investment strategy. In addition, long-term investment also requires you to do your research before you invest for a longer period. |

Long-term vs. short-term bonds: which is worth investing in?

Before investing, you should consider both the long-term and short-term investments and choose the one suitable for your financial goals and timeline.

The long-term investment allows you to invest and generate wealth for the goals lasting for a longer period or require more income like retirement, real estate or school funds, etc. On the other hand, the short-term investment strategy is for smaller goals or for people who want to earn regularly or need their returns at the earliest.

Both these strategies have their own merits and demerits. So, it is better to experience both investment strategies to check what’s best for you.

Final thoughts

Like the conservative investors, if you also want to preserve your capital or look for a regular income source, invest in short-term activities. Yet, if you don’t want to get stressed or have time to manage or research regularly, then go for long-term investing activities.

Of course, both have their ups and downs. So, it depends on the individual’s preference. However, the mixed portfolio widens your expertise in investing.