Aeron (Scalper+Grid) is a trading solution with a combo of Grid and Martingale strategies on the board. The presentation doesn’t provide us with good explanations about how the robot is going to be profitable because it lacks backtest reports and features explanations.

The highlights of Aeron (Scalper+Grid)

The system has some details, features, and settings explained.

- The advisor performs a scalping strategy on the market.

- It works with a high trading frequency.

- The system has good money-management on the board that will provide our orders with relevant SL and TP levels.

- The lot sizes will be calculated either.

- It manages to work with various market conditions.

- We can trade through the MT4 terminal.

- We should work with a VPS service to increase execution speed.

- It doesn’t open orders during high impact news periods.

The dev shares with us some core features of Aeron:

Various cross pairs

We can work with five cross pairs diversifying risks of losing one cross pair.

Many strategies are applied

It’s possible to work with conservtive as well as risky strategies.

Drawdown control

The system can provide us with a relevant drawdown control.

Trading strategy of Aeron (Scalper+Grid)

- It works with the following strategies like: Grid, Scalping, Hedge, and Martingale.

- Trading is possible on EURUSD, EURJPY, USDJPY, CADJPY, and USDCAD.

- We may work with M1-M5 time frames.

Aeron (Scalper+Grid) reports

The developers don’t provide us with relevant backtest reports that would help us to understand how well the system was tested. It’s a con because we don’t have win rate, risks, and other details explained.

Trading results in real time

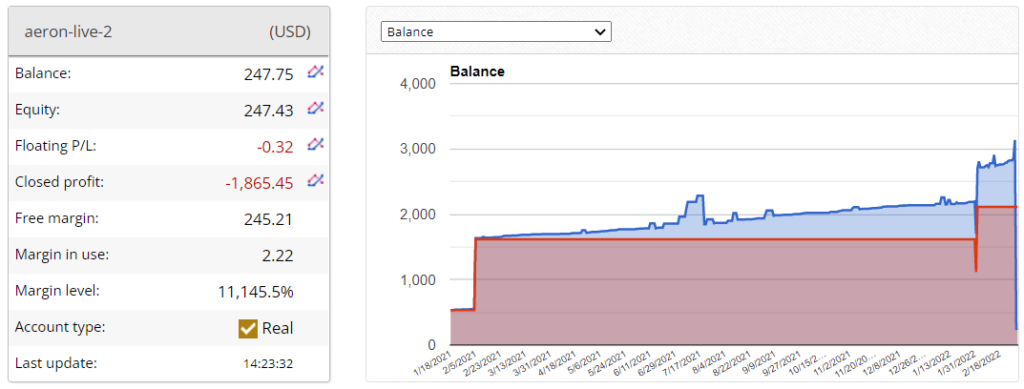

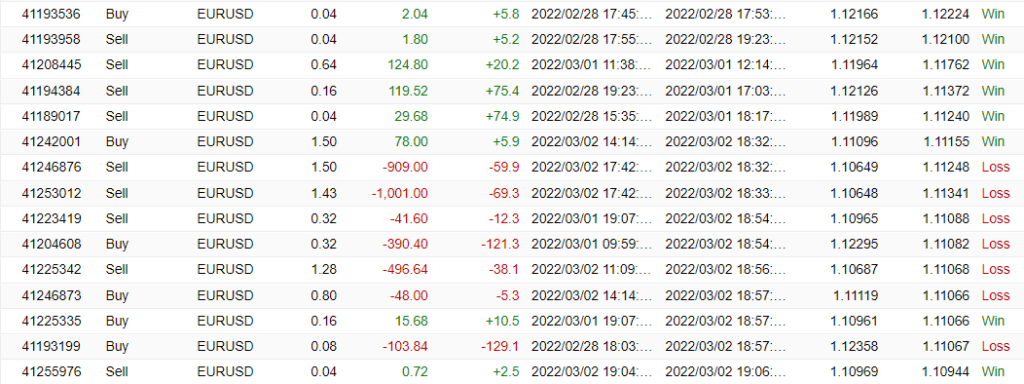

The advisor has been working on the almost blown account. The closed profit is -$1865.45. There’s a floating loss of -$0.32. The current balance is $247.75.

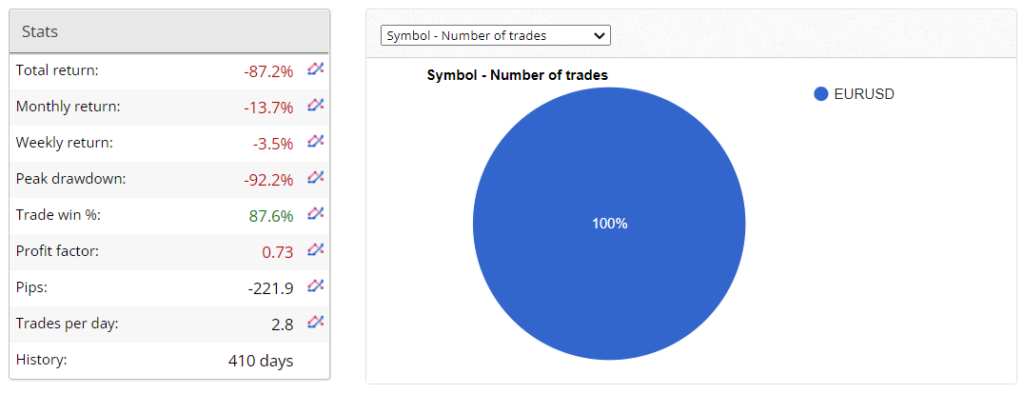

The total return is -87.2%. An average monthly return is -13.70%. The maximum drawdown is insane -92.2%. An average win rate is 87.6%. The profit factor is 0.73. An average trade frequency is 2.8 deals daily.

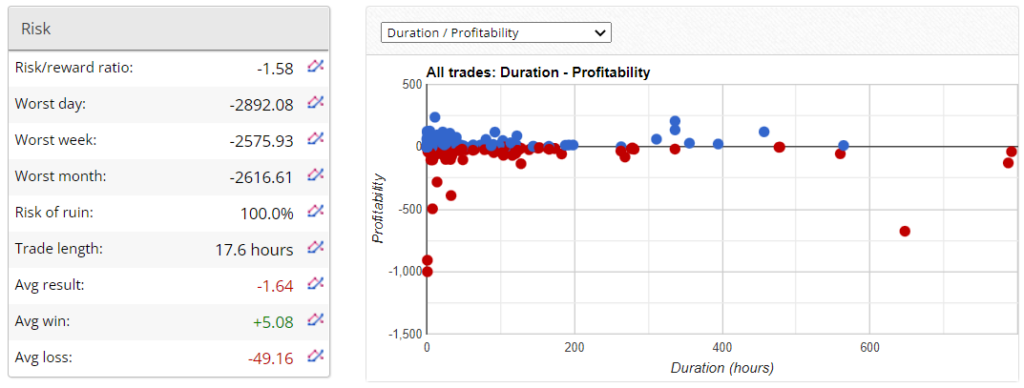

The ROI is -1.58. An average win is $5.08 and an average loss is -$49.16.

Huge losses occurred in both directions.

We have two magic numbers on the board available.

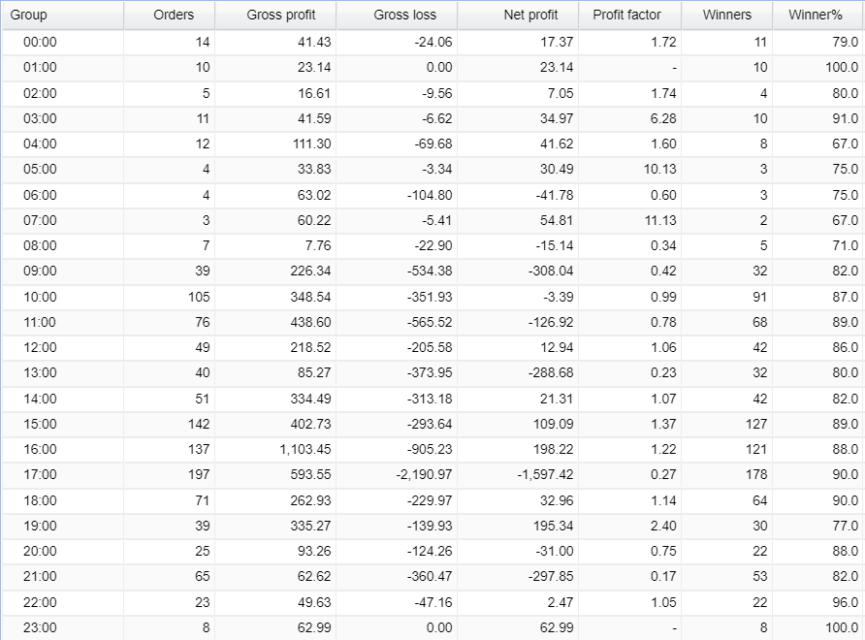

The most preferable hours to trade are the European and American ones.

The system trades with Hedge and Martingale. It is a risky combo.

Aeron Scalper and Grid price

We can purchase a copy of the robot for $230. The developers mentioned that this price is only for the first 50 copies and the next one will be $349. Money-back guarantee is not on the board.

Customer support

The developers provide below average support because they answer questions within a day or even two.

Are traders happy with Aeron Scalper and Grid?

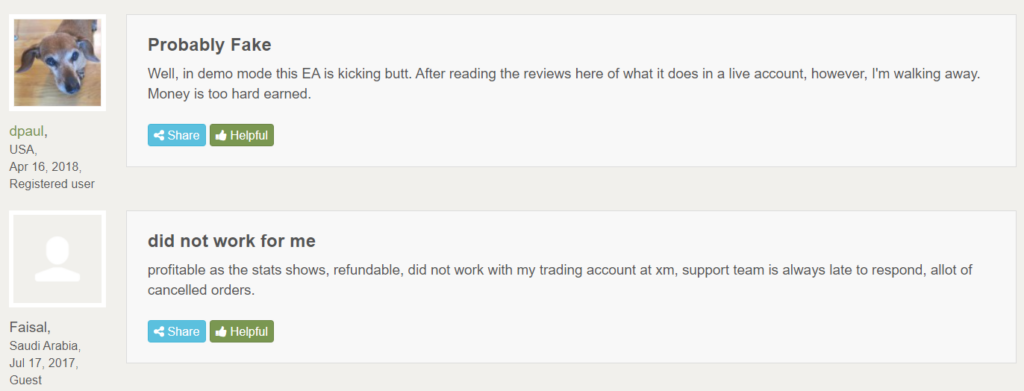

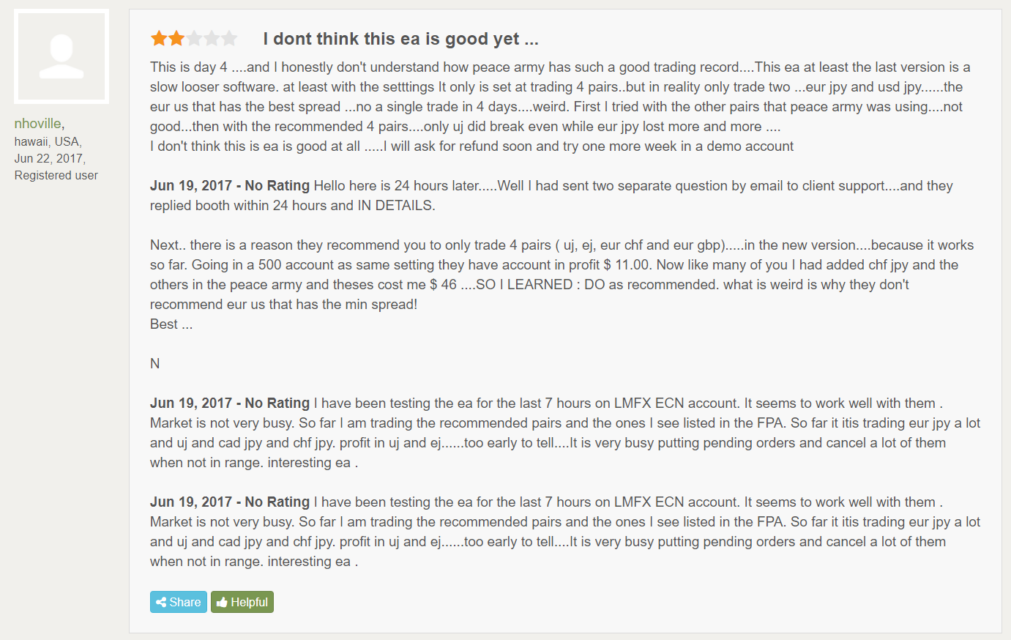

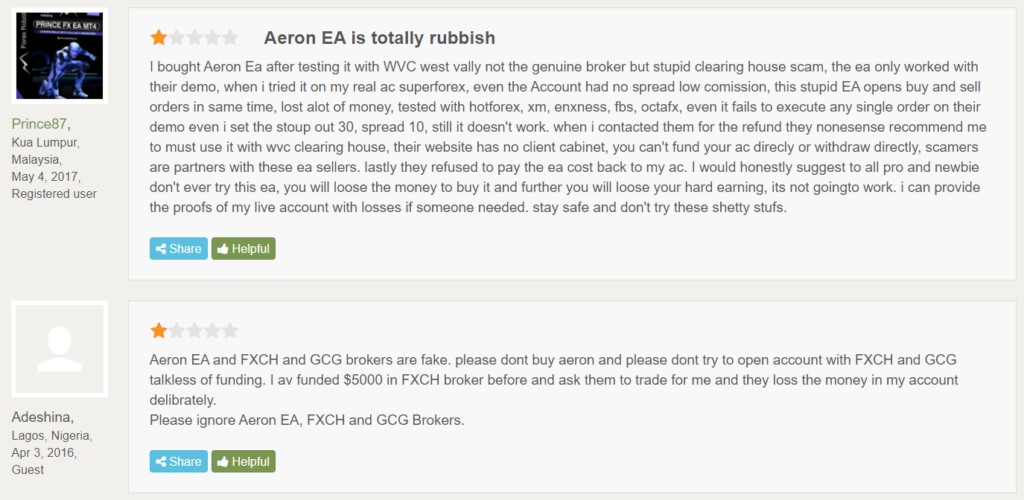

We have plenty of negative testimonials about how the system works and what we have to expect from it.

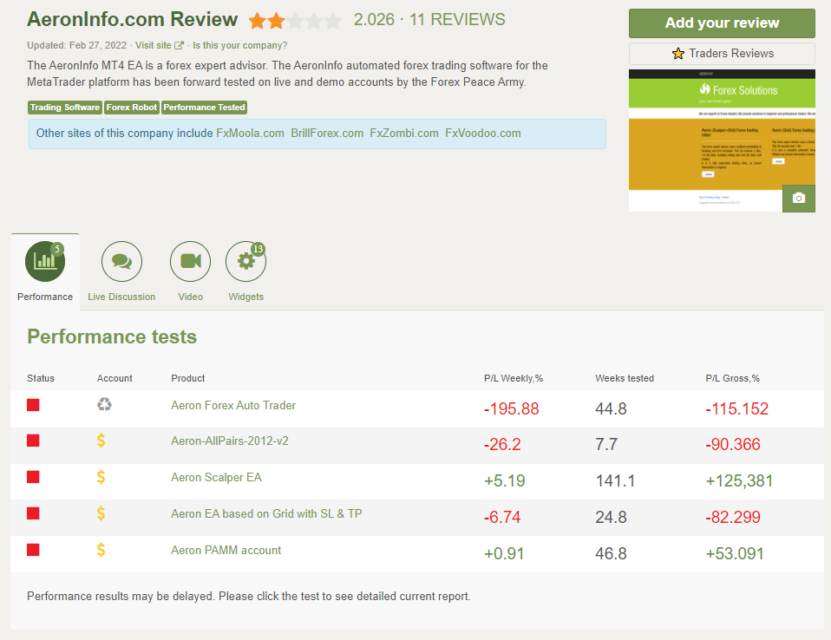

The developers created a page for Aeron robot on Forex Peace Army. We can note three blown accounts and six stopped accounts in general. The total rate is 2.026 based on 11 reviews.

Former clients aren’t satisfied with the results they had. This matches well what we saw from the trading account.

Aeron (Scalper+Grid)

Aeron (Scalper+Grid)-

Profitability2/5 Bad

-

Strategy2/5 Bad

-

Reliability2/5 Bad

-

Price3/5 Neutral

-

Customer Testimonials2/5 Bad

Advantages

- The devs shared trading results with us

Disadvantages

- No team revealed

- No settings explanations provided

- The advisor works with a Hedge and Martingale combo

- No backtest reports provided

- The real account is almost blown

- No refund policy applied

- Many negative testimonials written