Alphi is a program where the vendor trades on behalf of investors at a performance fee. The service was previously known as AVIA. For some strange reason, the team deemed it fit to rebrand it to Alphi. They also got rid of the previous accounts and added another one. Anyway, let’s see what’s on offer.

Alphi is the work of Michael J. Harding, the President and CEO at LEFTURN Inc. This company was launched in 2017 and is registered in Toronto, Ontario, Canada. There are claims that Michael taught students to trade the financial markets between 2012 and 2017. Nonetheless, there is no information about the experiences and qualifications of the team he works with.

The highlights of Alphi

Here are some features that according to the developer sets Alphi apart:

A 30-day free trial

This is meant for traders who are unsure if the program is right for them. In essence, this option enables you to connect your demo MT4/MT5 account with the company. As a consequence, you are able to comprehend how the strategy works in real-time with zero risk involved.

No lock-in periods

This feature makes it possible for you to withdraw your funds as often as you want.

Drawdown control

The team lowers the monthly target for all new accounts to protect your principal investment. After a few months of conservative trading, the risk parameters can be adjusted slightly to attain the target of 10% monthly profits.

Trading strategy of Alphi

The Alphi program is described as a semi-automated program with 30% discretionary and 70% automated with EA. This suggests that the company is applying manual strategies along with automated ones. Other than that, we could not find any useful information regarding the exact approach the vendor focuses on.

Obviously, traders would want to know what method these so-called professionals are using to trade their accounts. The devs’ failure to reveal this info is very suspicious. It means that the approaches applied are either ineffective or dangerous. And lucky enough, we later found out that the grid method is present.

Backtesting reports

The vendor does not showcase any backtesting reports. There are higher chances that the grid strategy in use generated some pretty bad outcomes that displaying them would make potential traders lose interest in the company’s services. So, it seems that they have felt that the best way to approach this is to keep traders guessing about the long-term performance of their trading logic.

Trading results in real time

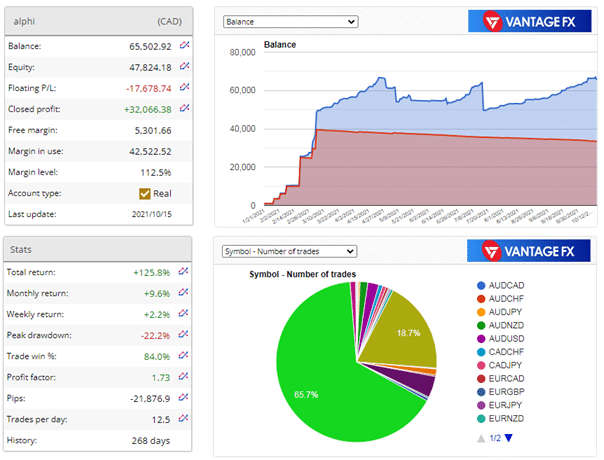

This account was opened on January 21, 2021, and was last active on October 15, 2021. So, it traded for 268 days, and during this period, a profit of $32,066.38 was realized. However, a loss of -$17,678.74 was made.

The total return was 125.8%. Although the peak drawdown rate (-22.2%) was not very high, it showed that the strategy used carried significant elements of risk. The profit factor was 1.73 and illustrated the low profitability rate of the account.

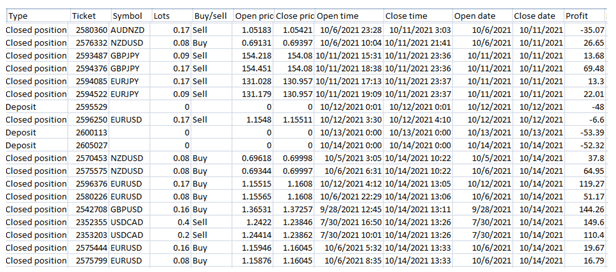

Different lot sizes and the grid strategy were used.

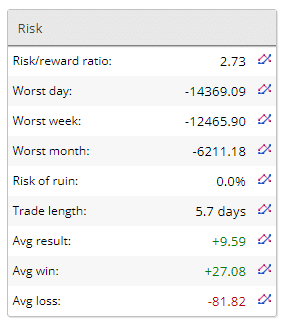

This account has a risk/reward ratio of 2.73. Fortunately, it is not at risk of being ruined. The account makes more losses compared to wins. We see this through the average win value ($27.08), which is 3 times lesser than the average loss (-$81.82). The worst day and month recorded losses of -$14,369.09 and -$6,211.18, respectively.

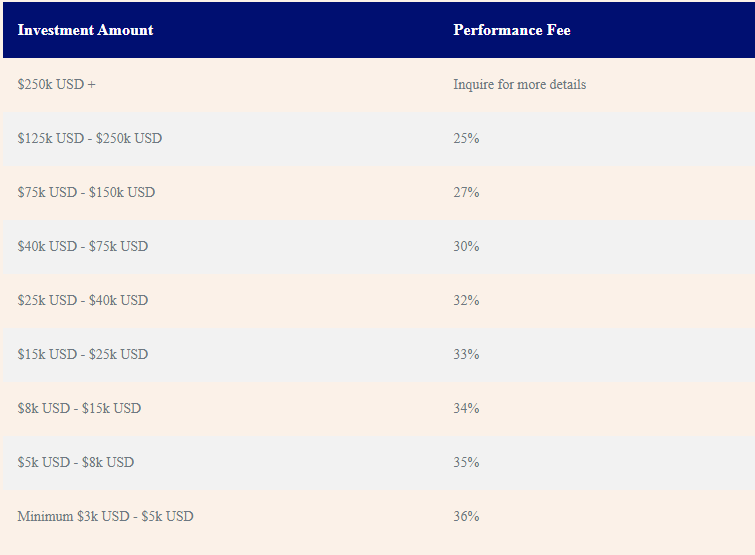

Alphi price

This vendor offers different investment packages. The investment options range between $3k and over $250k. The performance fee charged depends on the package selected. In particular, the fee reduces as the amount invested increases.

Customer support

Any client who has questions about this program is requested to visit the FAQ page or call the company. You can also email the support team, although it is not clear what address you are supposed to use since this info is missing. Another available alternative is the live chat window on the company’s page.

Are traders happy with Alphi?

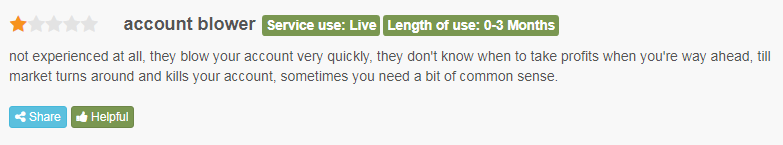

No, they are not. We managed to find one customer review for this company on FPA. According to the customer, the team behind the program is composed of amateurs and will blow your account very quickly.

AVIA (Alphi)

AVIA (Alphi)-

Profitability2/5 Bad

-

Strategy2/5 Bad

-

Reliability2/5 Bad

-

Price3/5 Neutral

-

Customer testimonials2/5 Bad

Advantages

- A 30-day free trial is available

- Verified trading results are present

Disadvantages

- No backtest results

- Unclear strategy explanation

- Insufficient vendor transparency