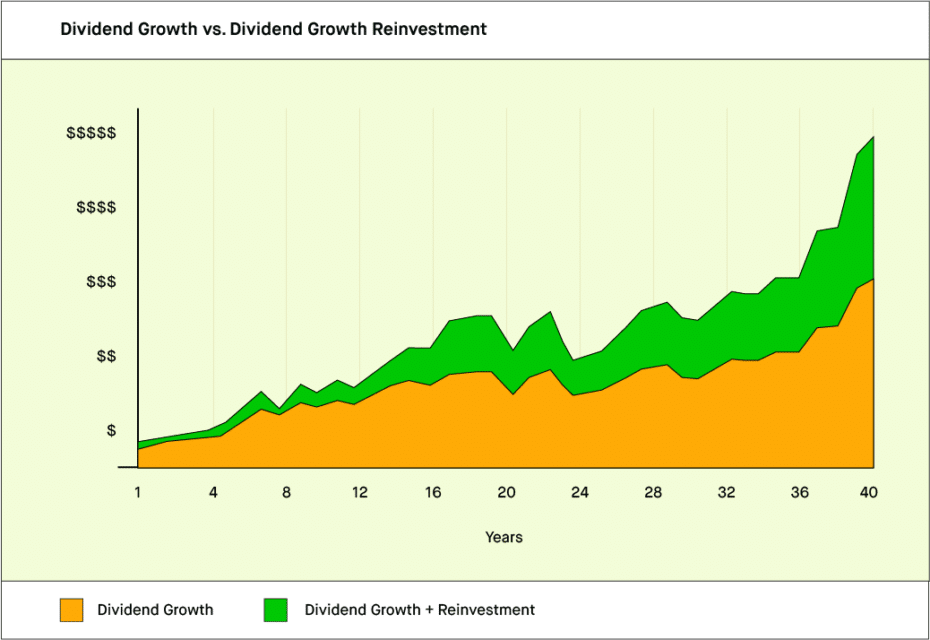

Investors find dividend investing as a lucrative strategy primarily for one reason. It can give you two ways to earn an income: dividends and capital growth. Dividends are yours to keep, and you can use them as your source of income. Alternatively, you can reinvest your cash dividends to grow your investment fast.

Let us use an example to understand how it works. Suppose you buy 1,000 shares of a stock that trades at $15 per share, each share paying an annual dividend of $0.40. Your investment in this stock would then be $1,500 (1,000 x $15). In one year, you would earn $40 in dividends. A gain of 4% from dividends is exclusive of your yearly return rate from your investment.

Another great thing about this investment strategy is the assurance of distributions regardless of the stock’s performance. This is true so long as the company keeps giving out dividends to shareholders.

If that sounds interesting, let us understand how it works. Then let us take a look at three great stocks that pay dividends.

How do dividend stocks work?

Companies use dividends as a way of rewarding shareholders for supporting the stock and keeping the investment. When you qualify for such distribution, you would typically receive cash, which you can use in various ways, including:

- Reinvesting it to own more shares of the stock

- Buying stocks from other companies

- Savings

- Investing in other ventures

- Paying bills

- Spending it on leisure travel

The above uses mean that the dividend is yours to keep. It is up to you whatever you do with your money. When you reinvest your cash dividends, your investment will grow faster than relying solely on stock price valuation. This is depicted in the graph below.

How are dividends taxed?

The majority of dividend stocks issue qualified dividend payouts. This means that your cash dividend is subjected to 0% up to 20% of tax, depending on your tax category. This tax range is markedly lower than regular income taxes, which start at 10% up to 37%.

Some dividends are categorized as ordinary income; hence, regular income tax applies. However, not all dividend payments fall under qualified income and, as such, involve lower taxes. Generally, a high dividend yield will entail a high tax obligation for the shareholder. Such a scenario is often seen in dividend stocks operating in real estate and publicly traded partnerships.

Examples of dividend stocks

Here are three stocks that pay dividends. Each stock is a recognized brand, has a solid customer base, and has a promising demographic trend. Consider these stocks in your next investment activity.

1. Realty Income Corp. (O)

If you want to invest in real estate to earn a consistent income and long-term growth, this is the stock you might be looking for. The company is an owner of a wide range of real estate properties resistant to e-commerce threats.

These properties are generating income from tenants paying rentals on long-term contracts. Realty Income made it to the ranks of Dividend Aristocrats in January 2020. This came from providing 25 years of continuously increasing dividend payouts to investors, including 50 consecutive years of monthly distributions.

2. Johnson & Johnson (JNJ)

The company holds a portfolio of brands that manufacture in-demand products, particularly healthcare items. JNJ has multiple profitable operations producing medical and pharmaceutical devices, generating a vast and steady income.

As a result, the company can provide dividend increases for 58 straight years. The company’s embarkation in diversified businesses, namely pharmaceuticals, healthcare, and medical equipment, is responsible for its continued growth and profitability.

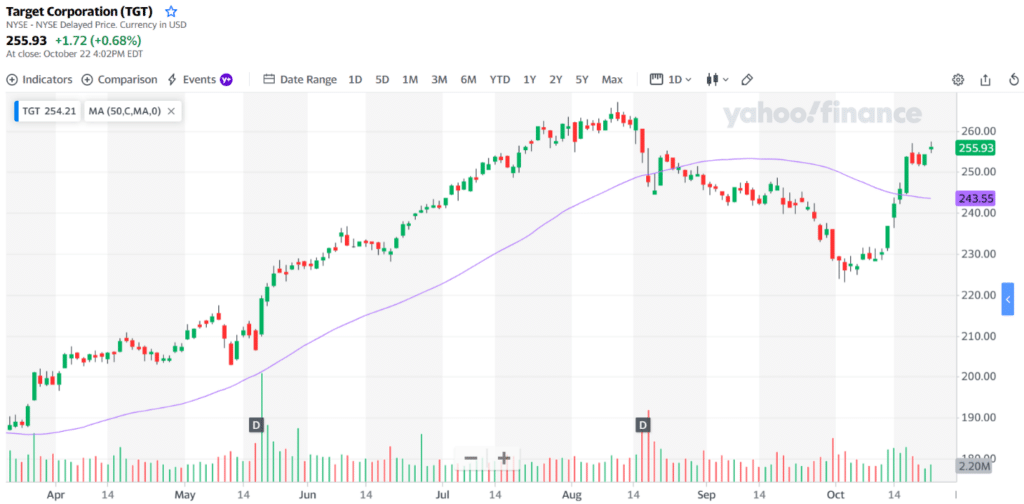

3. Target Corp. (TGT)

For several years, Target has demonstrated that success in the retail business is not about competing on price. It has generated more profits than its competition for years already and has achieved some of the highest operating incomes the retailing industry has ever seen. Due to its emphasis on improving its in-store and e-commerce offerings, profits and sales keep pouring in at a fast rate. Target has been giving investors increasingly higher dividends for 49 consecutive years.

The table below contains information about the annualized dividends of the three dividend stocks discussed above.

| Company | Industry | Annualized Dividend Yield |

| Realty Income | Real estate | $2.8 per share |

| Johnson & Johnson | Healthcare | $1.06 per share |

| Target | Retail | $3.6 per share |

How to evaluate dividend stocks?

Before you commit money to a dividend stock, make sure the investment is worth it. You have to evaluate the merit of each stock using specific metrics. These metrics can give you an idea of how much dividend yield you can expect, how likely you are to receive a dividend, and what red flags to avoid.

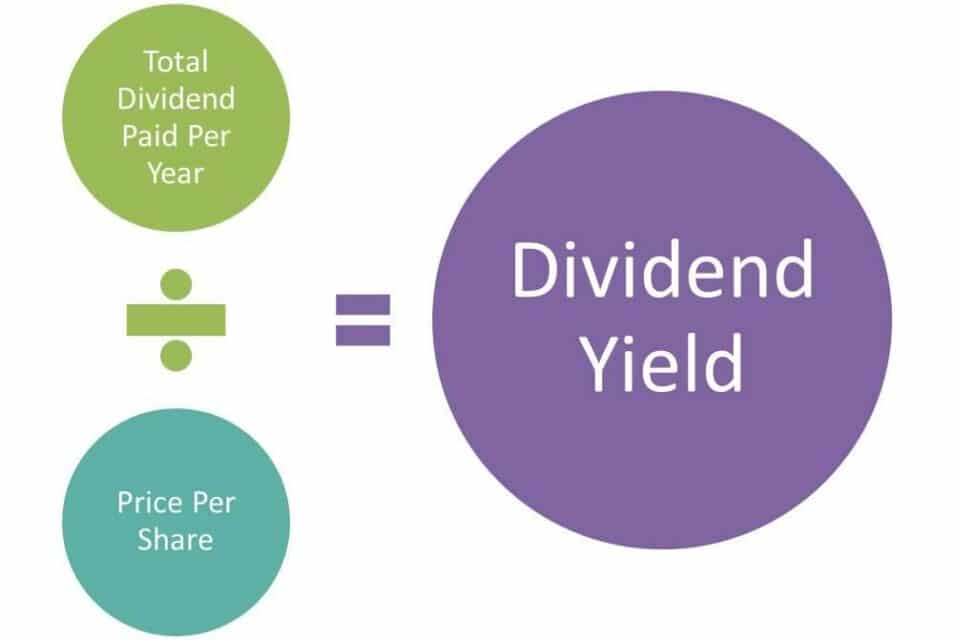

Dividend yield

Dividend yield refers to annualized dividends and is expressed as a percentage. For example, if a stock gives a $2.5 annual dividend and trades at $45 per share, the dividend yield is 5.5 percent ($2.5/$45). See the formula below.

Payout ratio

The payout ratio is a percentage of the company income. For instance, if a stock generates an income of $2.5 per share and gives out $0.80 per share of dividend, the payout ratio is 32 percent ($0.80/$2.5). Generally, a lower payout ratio will result in a more sustainable dividend payment scheme.

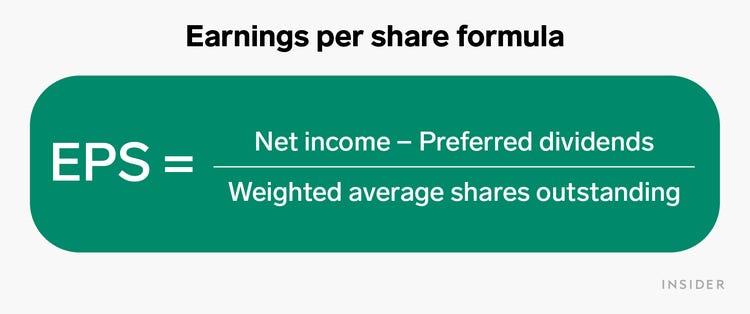

Earnings per share (EPS)

A good dividend stock can consistently grow the earnings per share over time, resulting in a dividend increase. You can obtain this metric by subtracting the preferred dividends from the net income and dividing the outstanding shares. See the image below.

Price-earnings ratio (P/E ratio)

You will get the P/E ratio by getting the stock share price and dividing it by the EPS. You can use this metric in tandem with dividend yield to determine if a dividend stock has a fair market value.

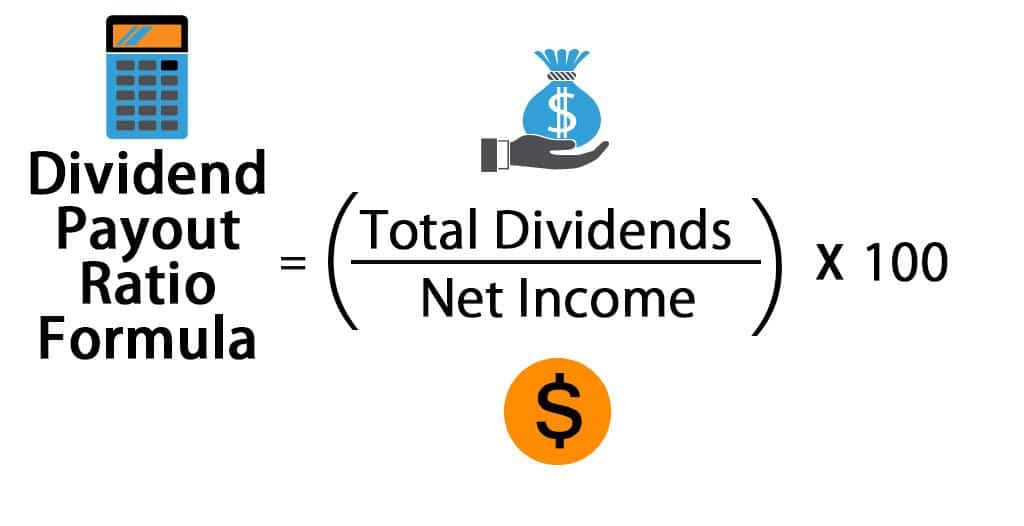

Dividend payout ratio

This metric defines the portion of net income allocated to dividend distribution for a specific period. The formula is as shown below. You can gauge the sustainability of a dividend distribution approach by examining the dividend payout ratio and the basic payout ratio.

Upsides and downsides

| Upsides | Downsides |

| Generate passive income. | Unless you buy a dividend stock via an IRA, you will not enjoy tax benefits. |

| Reinvesting dividend payouts increases compounding returns. | Stock investing in general carries risks. This occurs when the stock price goes down. |

| Capital growth can fight the negative effect of inflation. | The company may decide to stop issuing distributions as the situation requires. |

Final thoughts

Even if a dividend stock provides two avenues for income generation, there is still a risk of losing money. This will happen when the stock in question has gone down in share price. The dividend payouts you received might not be able to offset the losses you would incur as it happens. You must spread your investment among multiple dividend stocks and select only the best with proven track records to mitigate the risk.