Bonds are typically considered as fixed-income utensils with some interest rates. These are distributed to help the governments or businesses borrow from stockholders to raise funds or construct new projects. Until adulthood, the bondholders have to pay the interest rate as a paying back amount of investment to the bond issuer.

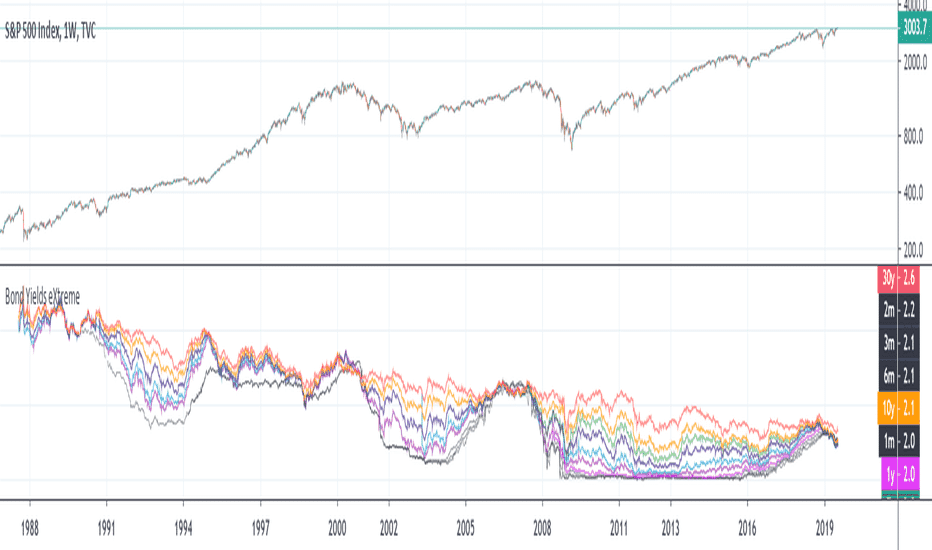

Investing in bonds is not profitable every time. As interest rates rise, the bond prices usually fall or decrease. This might be the cause of losing more money to bondholders. But once a strategist is always a strategist. Everyone doesn’t need to lose money. 1000s of people have become business tycoons by getting bonds of till maturity at the right time.

Playing with strategies while investing in long-term bonds is essential for enjoying high returns. A bond strategy is a bond portfolio to maintain a certain return regarding the changes in bond pricing factors. As bonds are less volatile, the strategy permits you to take benefits of prices when they are high-rise.

Before investing in bonds, you should know about the bond investment strategies to gain your economic goal.

Here are a few smart strategies listed below that might help you to understand the investing plan.

Bond laddering

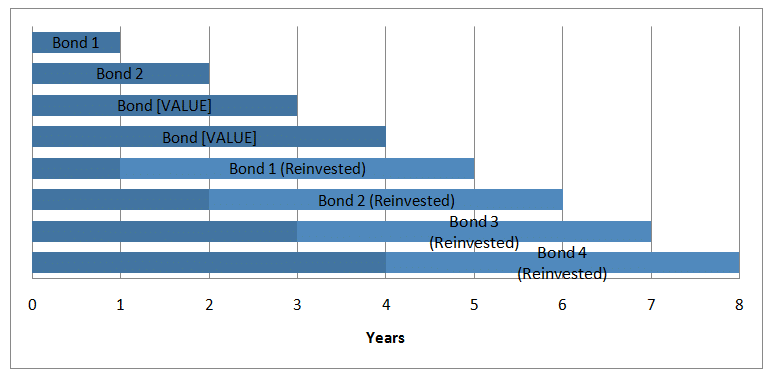

Laddering is an investment methodology that allows you to buy bonds with different maturity dates. It’s a clever technique as if you spend all your money purchasing the bonds with the same maturity date, the chances of receiving high-yield are increasing. But your bonds can mature too before the rates rise.

Ladders are security shields because they offer protection from the probability that rising rates can cause bond prices to reduce. It’s an effective strategy that offers maturity weighting because, by staggering maturity weights, investors start to open the lock of receiving the single interest rates. The variation in interest price is helped by ladders because depending upon the number of rungs in the ladder, bonds are mature every year, month, or quarter.

Since a laddered bond includes fixed income securities with different maturity dates, the investor cannot lock with single interest rates. It gives the flexibility to adjust one’s cash flow position as per the prevailing market conditions. It also provides a steady stream of income. The portfolio is divided into equal parts and invested in laddered style maturity.

Bond laddering also helps lower risks because of the diversification of the portfolio. It reduces the reinvestment risk associated with the maturating bonds and allows the investors to gain from the increases in interest.

Laddering also protects you against inflammation because you can renew your investment. The more rungs in the ladder, the more stable your return is. Rungs are the total amount you plan to spend, intending to extend the ladder. For example, $900,000 to buy individual bonds could be invested with ten rungs of $90,000 each.

Reinvestment of interest income

The reinvestment rate can simply be defined as the interest earned from one fixed investment and put into another.

Reinvesting in earnings can be done in various ways, including through mutual funds. However, you need to put each coupon payment you receive to earn interest apart from spending it by buying individual bonds. And instead of giving coupon payments, some bonds impulsively reinvest the coupons into the bonds.

Reinvestment is important for any business person or entrepreneur to sky-rise their revenue or profit by developing new projects to attract and hunt the consumers.

The reinvestment rate is the returns an investor expects to earn from cash flows from a previous investment. It’s an effective bond investment strategy to earn high returns with flexibility. It’s also a great way to increase the value of a stock, mutual fund, or ETF investment over time.

Upsides and downsides of smart bond strategies

| Upsides | Downsides |

| Interest rates on bonds are higher than saving rates at banks. | Rising interest rates and credit risks are the major drawbacks. |

| Bonds are less risky, but the chances of earning more revenue begin when using strategies. | Bonds yield lower than stocks. |

| Bonds provide a predictable income stream. That’s why they are the number one choice of investors. | Their rate of return is also very low and long. |

Final thoughts

As previously mentioned, once a strategist is always a strategist. So, the one who’d implement smart strategies while investing in bonds in 2022 will enjoy high returns with less market volatility. Bond laddering and reinvestment of interest charges are the two techniques of a bond investment. These two are going to be the famous bond strategies of 2022.