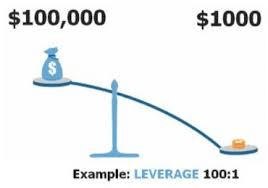

Before you begin trading FX, you should familiarise yourself with the concepts of leverage, margin, and equity. You can increase your trading earnings by using leverage, but only if you have the know-how. One of the primary causes of novice traders blowing up their balances is the use of excessive leverage, which increases both your gains and losses. Gaining a better grasp of leverage may help even more experienced traders to avoid heavy losses.

Members of forex brokers may trade with more money than they have in their account thanks to the practice of “leverage.” A forex broker that offers leverage lends money to trading customers who desire to be “leveraged.” However, there are limits to the amount of leverage that a broker may give its clients, depending on their business jurisdiction.

FX traders use leverage to handle more money than they have on hand. There is a lot of information in this article about the operating leverage formula and how to use it wisely in the FX market?

What is operating leverage?

A trader who deposits $100 with a broker and initiates a trade in the USD/JPY currency pair with a position size of 1 micro-lot is an example of leverage in FX (equal to 0.01 lots). A micro-lot of USD/JPY is worth $1,000 since many USD/JPY equals $100,000.

“True leverage” refers to the trader’s ability to borrow money at a rate of 10 to 1 despite depositing just $100. The trader can accomplish this because the forex broker permits maximum leverage of ten to one on USD/JPY transactions.

Fixed costs are incurred and must be paid regardless of a company’s sales success or production volume, and they may be defined as such. This means that fixed expenses are more or less stable. In addition, fixed costs are not dependent on sales volume, such as rent for office space, since the terms of a long-term contract set the payment amount.

In the real world, leverage in FX trading is seen as both a blessing and a curse. There are times when leverage works in your favor and generates bigger profits, but there are also times when leverage works against you and does great damage to trade positions and your trading account.

How to calculate operating leverage?

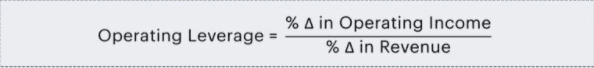

It can be calculated in a variety of ways. However, the formula for calculating operating leverage, or the degree of operating leverage, DOL, is most often derived by dividing the change in operating income by revenue.

Operating leverage is an indicator of a company’s exposure to risk based on its percentage split between fixed and variable costs. In addition, it measures the sensitivity of those earnings based upon the change in “top-line” revenues.

Numerator and denominator may refer to the year-over-year change (YoY) expressed as the delta symbol, which can be calculated by dividing the current year balance by the prior year balance and subtracting by 1.

By way of example, if operating income increases from 10k to 15k (50%) and revenue increases from 20k to 25k (25%), the operating leverage will be 2.0x. With a 2.0x operating leverage, if revenue increases by 10.0%, operating income is predicted to increase by 10.0%. Conversely, if revenue declines by 10.0%, operating income drops by 20.0%.

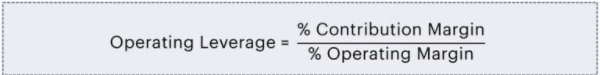

Divide the percentage contribution margin by the percentage operating margin as a second method for calculating operating leverage. Here are the two formulas for calculating operating leverage:

Contribution margin% = Revenue – Variable costs / Revenue

Operating Margin % = Revenue – Variable Costs – Fixed Costs / Revenue

Basically, the contribution margin represents what remains after subtracting out just variable costs, while the operating margin represents what remains after subtracting out both variable and fixed costs.

However, most companies do not divulge in-depth breakdowns of their variable and fixed costs, so this formula is less feasible unless confidential internal company data is readily available.

How to use operating leverage?

The foreign exchange market handles over $5 trillion in currency transactions every day. FX trading involves buying and selling currency exchange rates hoping that they will move in favor of the trader. Bid and ask prices are used by the broker to quote or display forex exchange rates. Investors are told the asking price when purchasing or selling a currency and the bidding price when they want to go long or buy a currency.

Leverage is a tool used by investors to boost their FX trading profits. The broker lends money to the investor in the form of leverage. For investors, the FX market provides one of the greatest levels of leverage possible.

The trader’s forex account is set up to trade with borrowed money or on margin. Depending on the broker, novice traders may be limited to a certain level of leverage. However, the broker requires the first margin, which is a proportion of the trade’s market valuation.

Upsides and downsides

| Upsides | Downsides |

| Profits from forex trading have increased. | If a transaction is canceled, there may be a liquidity issue because of the enormous fixed expenses associated with big volumes. |

| Increases in the efficiency of capital investment. | It results in significant losses. |

| In forex trading, leverage has shown to be extremely effective for periods of low volatility. | Leverages are seen as ongoing liabilities. |

Final thoughts

You won’t be afraid of leverage if you learn how to manage it. However, you should only use leverage if you can step back fully from the situation. Leverage, on the other hand, might be profitable if properly managed.

Be careful while working with leverage. By utilizing smaller amounts of actual leverage per transaction, one can achieve a larger but more realistic stop and sustain a less financial loss. In high-leverage transactions, due to the large lots, your trading account is quickly depleted. Traders may use any amount of leverage they wish.