Many people start trading forex with the idea that they can get rich overnight. After all, it’s possible, you only have to take a significant risk on the price direction of a currency pair, and you’ll be in huge profit.

Sounds pretty straightforward, but it’s not. And although there are people who have made a lot of money overnight, they either had large sums, are pro traders with in-depth knowledge of the industry, or were just very lucky.

Yes, trading forex is somewhat of a betting game; although the pro traders will tell you it’s not like gambling in a casino, there is a tiny amount of luck involved.

However, for the most part, you need good knowledge to become successful. Therefore, we have identified key things you should know and keep in mind when investing in forex.

Overview on forex investing

Forex is the term used for the exchange in currency pairs. Each country has its legal currency that its citizens use for transactions. The global banking network runs the FX across the four major forex centers, London, New York, Tokyo, and Sydney.

This market operates 24 hours, five days a week. It’s the buying and selling of one currency for another. Many factors influence the value of a currency; these include local politics, socioeconomic, and geopolitical events.

The trading in forex goes back to the Babylonian period, and people have been exchanging money for goods and services for centuries.

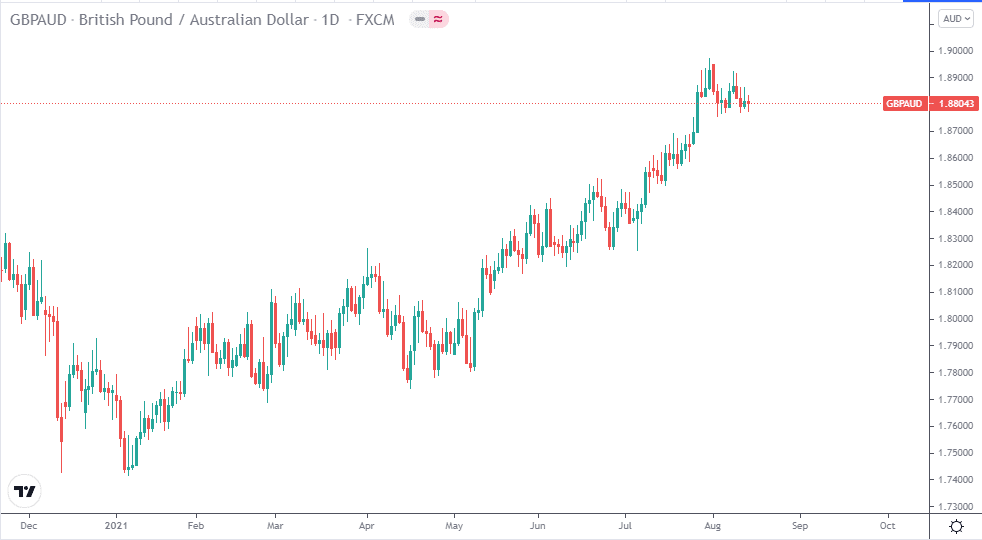

Exchange in forex, as we mentioned, is done to conduct transactions; for example, if you are traveling to Australia from the UK, you have to exchange your GBP for the AUD. Once you enter Australia, you can only use AUD to purchase goods or pay for services. Once you return to the UK, you then convert the AUD back to pounds.

Also, note that the bank sells the currency to you at the current trading rate when you exchange the money. And the difference in these rates is what makes forex investing interesting.

What is forex investing?

When you travel and exchange your money, you are participating in trading. Let’s explain it practically; we will use the same travel example.

You are traveling to Australia, and you have to exchange British pounds for Australian dollars. So, for your trip, you have £1000 for Australian dollars. At the time, the one British pound cost 1.88. Now, you have to buy Australian dollars. The bank sells it to you at £1.88; you, therefore, get 1881.27 A$.

While in Australia, you spend the money on hotel accommodation, food, and entertainment. Upon your return to the UK, you still have 500 A$ left. Therefore, you exchange the AUD to the GBP. At the exchange time, the price is still £1.88, and you exchange the money.

Now the bank sells you the pounds, and you obtain (500A$ / 1.88) £266. This is how the exchange of currencies works.

Where could you make a small profit?

When you returned to the UK, the pound was weaker due to insufficient economic data that affected the pound’s value. The Australian dollar gained some value against the pound and is now worth £1.50. Therefore 1 A$ will now cost you only £1.25.

So, you now exchange your 500 A$ for pounds, and you get (500 / 1.25) £400. If you had paid £1.88, you would only have received £266; you, therefore, made a profit of £134.

This is how FX works, and in the simplest form, this is how trading works. However, as a retail trader, you cannot always travel to a different country to find the best exchange rates to profit; this is not practical.

Retail investors trade forex through brokers who deal with the markets directly. The broker is the go-between for the trader and the banks. And therefore, you have to pay the broker a fee for their service. These fees can be in the form of variable spreads, commission, and overnight swap fees.

Now that we gave you an overview of forex, there are certain things to consider when investing in FX.

Five things to keep in mind when investing in forex

1. Is forex trading legal in your country?

Before you embark on investing in forex, you have to check if trading forex is legally allowed in your country. Some countries do not allow forex trading, and some do allow it but limit which currency pairs you can trade. Therefore, you need to consider this before taking any further steps.

2. Choose a proper broker

Before signing up with a broker, there are a few things you need to check about the broker:

- Does a financial authority regulate them?

- What spreads do they offer?

- Do they have good customer reviews?

- Which trading platforms do they support?

To summarise, you would prefer a regulated broker, and a reputable financial authority should monitor their operations. In addition, a broker that offers low spreads and has a high customer satisfaction rating. In addition, you can check which trading platforms they support. Most brokers use MetaTrader 4 and MetaTrader 5 and web-based platforms, which are becoming more popular.

3. Learn the forex market

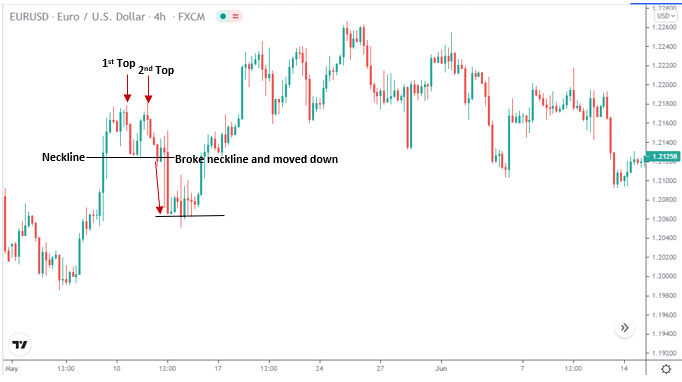

It would help if you gained an in-depth understanding of the markets and what factors influence the currency rates. In addition, you have to familiarise yourself with the price charts. The market makes different structures that form patterns. Traders study these patterns to predict the price movement. There are many strategies, and each trader uses their own according to their abilities and success rate. You will have to find the right strategy that works for you.

EUR/USD 4-hour price chart. When we talk about patterns, one famous among traders is the double top, a sign of price trend reversal. Usually, after an uptrend, when a double top forms, the price is predicted to go down — the pattern is in the form of an M formation.

4. Understand margin, leverage, and risk

Margin and leverage are essential terms in trading that are underrated. Leverage is a loan that the broker offers you to increase your capital. However, you require a certain margin in your account, the minimum funds to keep your account out of the red. Therefore, overleveraging can be dangerous as you take higher risks, and you should learn these theories before starting to trade.

The forex market is highly liquid, meaning there are millions of trades happening every second, creating a form of high volatility. The volatility brings about more risk, which means you have to be aware of the risk you take when you are trading. Since you bet your money on a specific price direction, you risk losing some of it if it goes the opposite way.

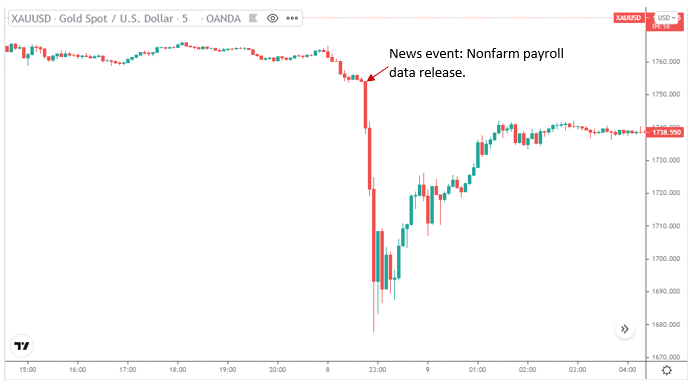

5. Keep track of news events

News events play a vital role in the FX; they are critical drivers of a currency’s price. And here, we do not refer to general economic news, which influences as well. There are specific reports that countries release daily, which are indicators of a nation’s financial health.

Here are a few examples:

- Jobless claims

These are several people filing for unemployment benefits. In the USA, it’s a strong indicator of whether employment increases or decreases, impacting the US dollar strength.

- FOMC interest rates

The FOMC decides where to set the short-term interest rates, which is released periodically throughout the year. This event is one of the most important on the US economic calendar, and traders observe it.

- Consumer price index (CPI)

The CPI measures the change in the price of goods and is an indicator of consumer spending habits. It is a type of inflation. Inflation has a significant impact on the strength of a currency. The higher the inflation, the less buying power the currency has, and the lower the inflation, the more buying power it has. This report is released monthly.

This XAU/USD 5-minute chart shows the high impact news has on the price. In this case, the US dollar was robust, and the price of gold dropped significantly.

Pros and cons of forex investing

FX trading involves high risk, which can be good and bad. However, there are other advantages and disadvantages besides risks to consider.

| Pros | Cons |

| •Generate passive income Forex trading, if done correctly, can create a good source of passive income. And if you maintain the same discipline and money management, you can consistently make good profits. • Time and location freedom Due to the technological advancements in the trading industry, you can trade from anywhere and anytime. You require a stable internet connection and can trade on the go. • High liquidity This market has a trading volume of over $6.6 trillion a day. Therefore it has high liquidity, which presents many trading opportunities across many currency pairs. | • Leverage risk Leverage is not bad, but you are taking on more risk if you decide to use it. Since it can inflate your profits, it can also increase your losses. • Volatility risk High volatility can be extremely risky, especially if you are a new trader. The price movements can happen very quickly, and if your account cannot maintain the drawdown, you can lose it all. |

Final thoughts

Considering all the risks involved, investing in currencies remains a popular choice among many new and experienced traders. The number of retail traders has surged in the last decade, as more people know about trading profitability. However, one should consider things to know before starting to trade since the forex market is highly complex.