If you think you are too young to begin investing in stocks, think again. In this era of digital technology, the younger generation is already starting to engage in stock investing earlier than the previous generation. Thanks to technological advancement, anyone has access to information with a few mouse clicks.

Most stockbrokers require investors to be at least 18 years of age to open an account in their name. However, there are options available for younger investors, and we will cover that in this article, so keep reading. Regardless of your investing experience or age, it is never too late or too soon to begin investing.

Why do people start investing before 18?

Younger individuals engage in stock investing to support their college education. They want to avoid resorting to taking student loans to finance their studies. Since there are brokers allowing individuals below 18 to open a brokerage account, the age of people getting involved in stocks is going down. However, it is usually the parent or guardian who opens the account under the name of the minor.

How old do you have to be to invest in stocks?

Thanks to the proliferation of online investing platforms, investing now is easier than ever before. To open a brokerage account on your own, you must be of legal age (i.e., 18 years old) at minimum. Plus, some brokers offer no commissions and no minimum deposit requirements. Examples of such brokers include Fidelity and Robinhood.

If you are 18 years old or above, opening an account in these two brokers is reasonably quick and easy. You can start small, with any amount, and gradually build positions over time. Starting in this manner allows you to learn the trade without absorbing too much risk.

Apart from providing brokerage accounts for individuals below 18, Fidelity offers zero commission on your trades.

Where to start investing?

You should create an account in a brokerage firm first. A brokerage account is similar to a local bank account. You will perform all financial transactions related to your investing activities in this brokerage account. Thus, you can buy and sell stocks.

How to choose your brokerage: 5 tips to consider

A stockbroker is your entry pass into stock investing. You cannot invest in stocks without connecting to one such broker. However, brokers are not made equal. Some brokers are superior or inferior to others in an area or another.

Choosing a broker is a crucial decision to make as an investor. To help you in this regard, we list down five points below to consider when selecting a brokerage firm.

Tip 1: Educational materials

If you are new to stock investing, you need to learn the ins and outs of this business venture. You do not have to enroll in a course and pay tuition to achieve this. Brokers normally provide learning resources for traders and investors. If that is not provided in a broker being considered, move on to another that does.

Tip 2: Trading platform

Try to find a broker that offers a platform that is easy to use. Do a quick online search about this for a particular broker, and check what other users say about it. If that broker gets a lot of positive feedback, check out for yourself by opening a demo account.

Tip 3: Overhead costs

This is one of the most critical factors to consider when choosing a broker. Most brokers charge a commission. Find out what other costs are being charged, such as transaction fees, bid-ask spread, and so on.

Tip 4: Customer support

Check out if the broker provides channels for clients to communicate concerns. Usually, live chat support is available. Find out what other communication channels are in place. Its customer support should be responsive, accommodating, and knowledgeable about client issues.

Tip 5: Minimum balance

Like a bank savings account, most brokers require investors to maintain a minimum balance in the brokerage account. The lower the minimum requirement, the better. Take note that you will incur a penalty if your account balance goes below the minimum amount.

You are not old enough: how can you get started investing?

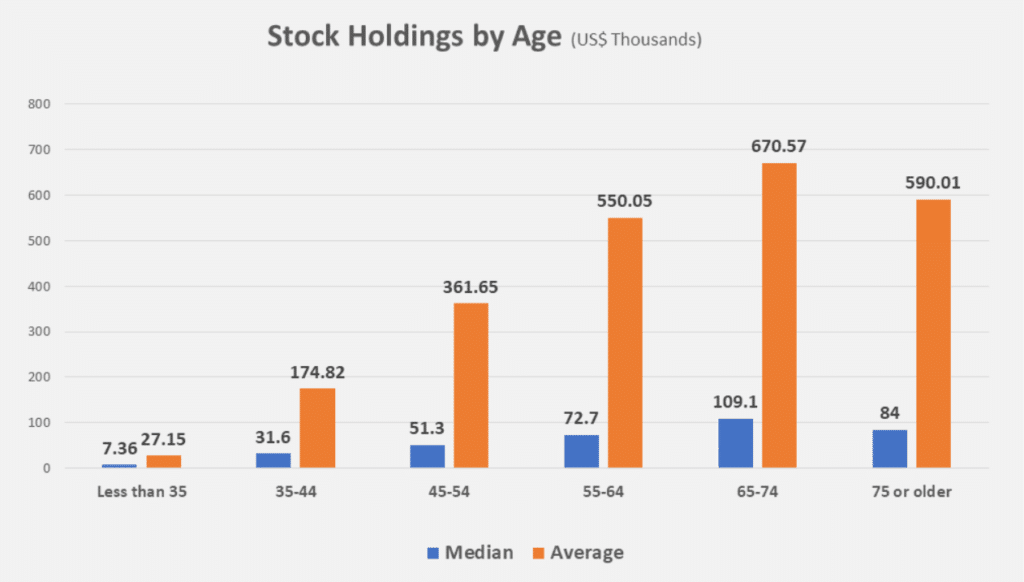

More and more youngsters gravitate toward stock investing for some reason. Whatever the reason, starting your investing journey as early as possible will significantly benefit you over the long term.

If you are below 18 years old right now, you can start investing following the steps below:

- Find a broker that offers a brokerage account for minors. One such broker is Fidelity. In May 2021, Fidelity launched a brokerage youth account intended for teens aged 13 to 17.

- Ask your parents or guardian to open an account for you. Since you are a minor, you cannot open an account yourself. A grown-up must establish an account under your name.

- Start buying and selling stocks. Since you are learning the ropes, you must trade-in moderation. Familiarize yourself with the brokerage platform and consume educational content available.

Are the stocks worth investment?

It is worth investing in stocks even if the world is currently facing uncertainties. The stock market is still performing well compared to its counterparts, such as bonds, commodities, etc. One cool thing about stock investing is that you can get a return that will beat inflation. This means the buying power of your profits in the future will not be hurt by the rising cost of necessities.

Keep in mind that stock investing is a marathon, not a sprint. You are bound to see significant returns when you keep your investments for long instead of short-term investing. To make it a reality, you should buy and hold stocks belonging to stable or blue-chip companies. The power of compound interest will significantly manifest in such companies.