FX Classic Trader is a trading solution that was developed by a no-name designer. The main page informs us that this solution is a creative Forex expert advisor and that it can be the best solution for clients. Let’s check it out.

The highlights of FX Classic Trader

The devs have some features explained in their presentation:

- FX Classic Trader can cover us with executing orders automatically without a need of human supervision.

- The system looks for the price moves between support and resistance levels.

- We can execute orders only on the MT4 terminal.

- It’s possible for the system to set proper SL and TP levels.

- The advisor received a proper and well-designed money-management system.

- We can work with any broker that we want.

- It can follow NFA and FIFO rules.

- The support will be for lifetime if we have any question about the advisor.

- An ECN account is a good option to decrease spreads and slippages.

- We have to work with leverage of 1:50 or higher.

- The best one for automatic trading is 1:500.

- The system supports 5-digit brokers either.

- We should have over $200 on the account to get started.

- It can be used on a VPS service to run charts 24/7.

- The robot works on the following types of the account: Standard, Micro, and Mini accounts.

According to the develop of the robot, these are the core features of FX Classic Trader:

Strict regulation

The system can execute orders, following NFA and FIFO rules at once.

Money management system

The robot cares about orders from the beginning to the end, placing SL and TP levels for each.

Trading strategy of FX Classic Trader

- The system works with a price action strategy that seeks for trading opportunities within the tunnel of support and resistance levels.

- Most likely, it can work with any cross pair and time frame, but this wasn’t mentioned.

FX Classic Trader reports

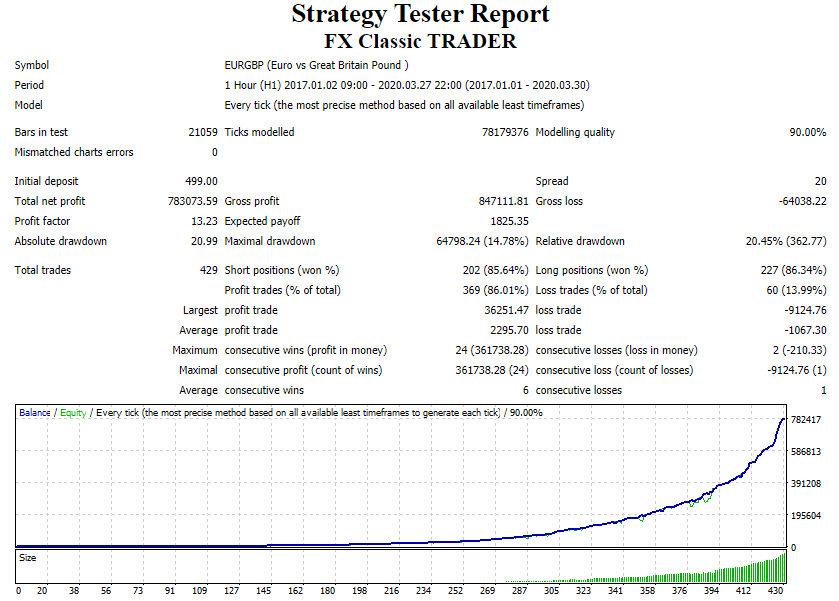

The system was tested on EURGBP on the H1 time frame. The data period was chosen between 2017 and 2020. It had a modeling quality of 90.00% with 20-pip spreads. An initial deposit was $499. It has turned into $783,073 of the total net profit by the advisor. The profit factor was 13.23. The maximum drawdown was 14.78%. It was lower than 20%, so, it’s good. There were 429 deals executed. The accuracy was 85% for shorts and 86% for longs.

Trading results in real time

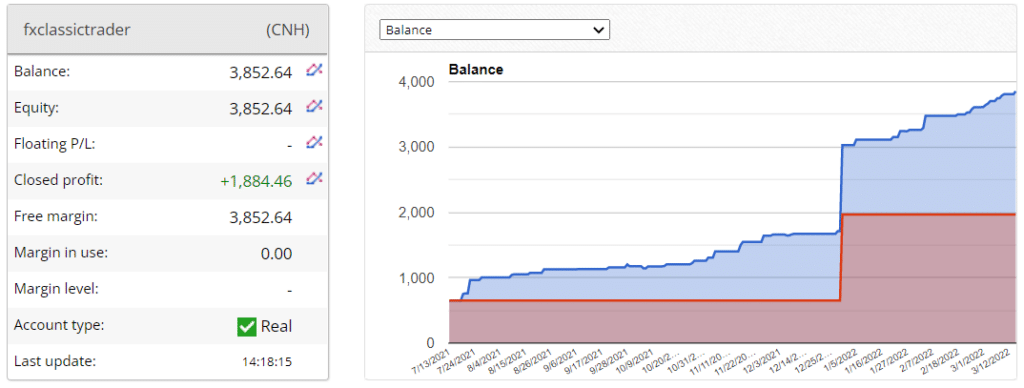

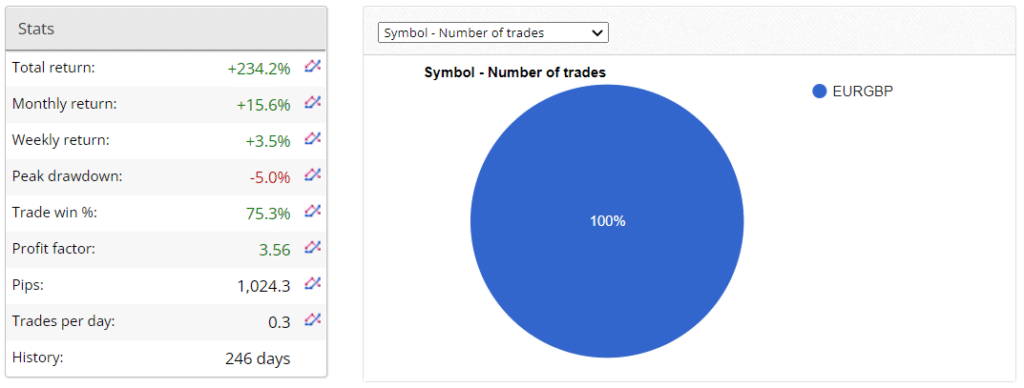

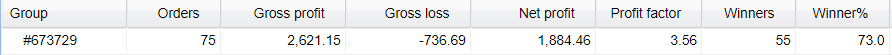

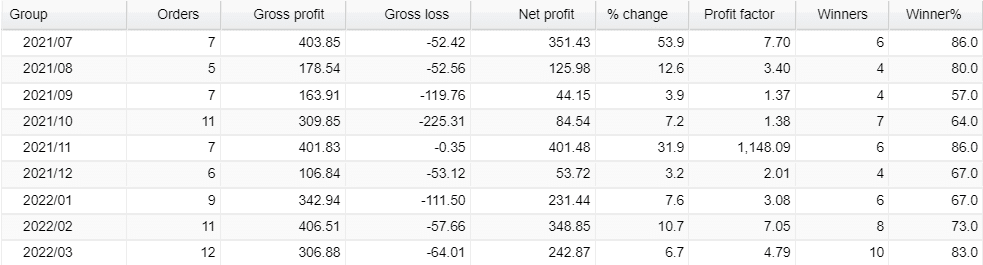

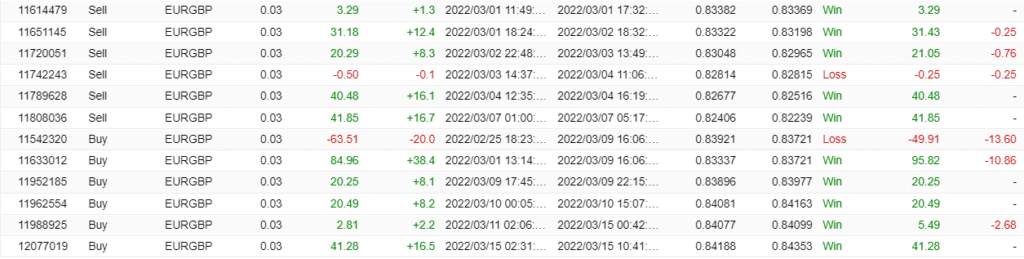

FX Classic Trader was set to work on the account that was created on July 13, 2021. The system provided 1884 CNH of the total net profit. The account type is real, so the system works on the real market. There are no floating orders on the market available.

The total return has become 234.2%. An average monthly return is 15.6%. The maximum drawdown is 5.0%. We have accuracy at 75.3%. The profit factor is 3.56. An average trade frequency is 0.3 trades daily. The system has been trading for 246 days.

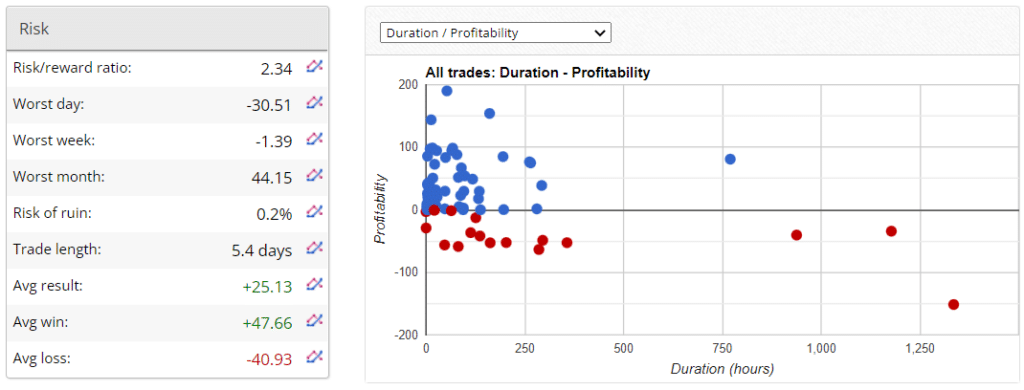

The risk of ruining the whole account is 0.2%. An average trade length is 5.4 days (it was twice lower). An expected win is 47.66 CHN when an average loss is -40.93 CHN.

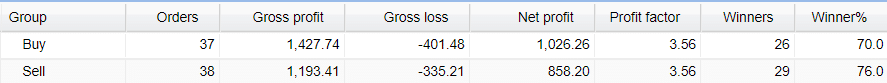

The system works completely equally in both directions.

The advisor works with 3.56 of the profit factor.

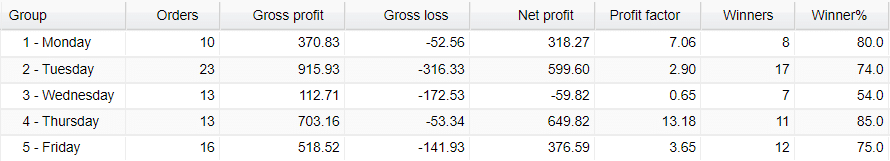

It prefers opening trades on Tuesday with 23 deals closed. The most profitable is Thursday with 649 CHN.

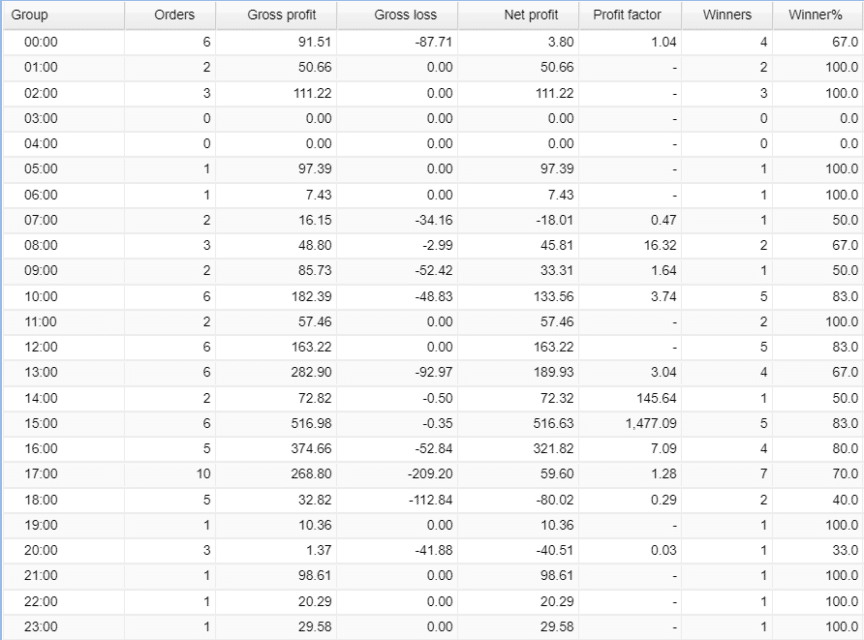

The system prefers placing orders at 5 p.m. Anyway, there’s a lack of closed orders to be convinced what trading session is the best for the advisor.

The robot opens 5-12 orders monthly on average.

FX Classic Trader works without Martingale and Grids of orders. The system can add extra orders with their own trading goal.

FX Classic Trader price

We have three packages introduced that vary by a price and number of licenses. The Basik package is available for $109 for a single real account license. The Business pack can be purchased for $129. The package is featured by two real and two demo account licenses. The Premium package costs $149. There are three real and demo account licenses. We shouldn’t rely on a refund policy because the developers didn’t cover us with a money-back guarantee.

Customer support

The developers provide below average support because they don’t mind answering our questions quickly via email.

Are traders happy with FX Classic Trader?

We don’t know for sure, because we don’t have testimonials written about this.

People say that FX Classic Trader is …

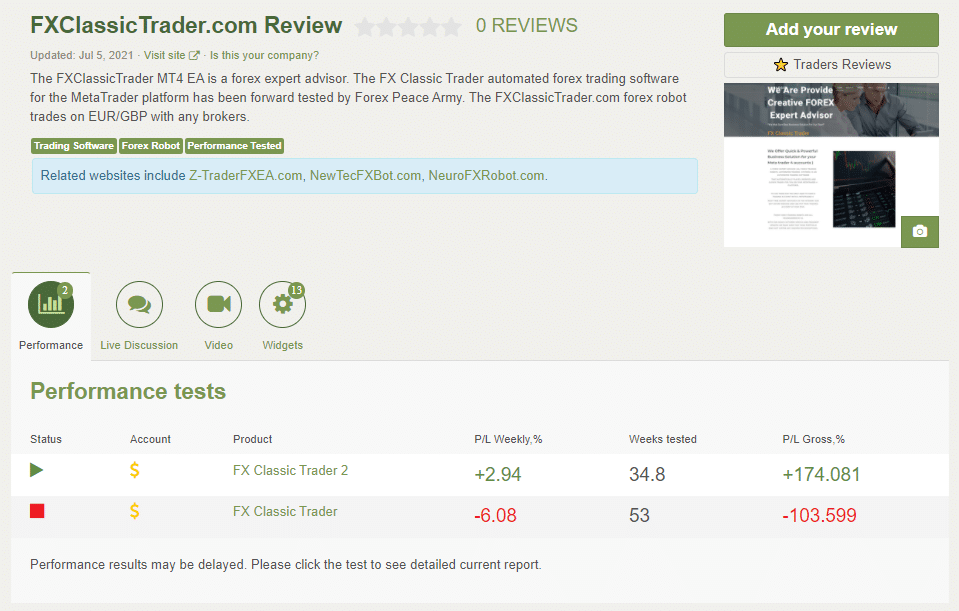

The developers created a profile on the Forex Peace Army site. There are no reviews published, but we have two accounts connected where one of them was blown.

FX Classic Trader

FX Classic Trader-

Profitability3/5 Neutral

-

Strategy3/5 Neutral

-

Reliability2/5 Bad

-

Price2/5 Bad

-

Customer Testimonials2/5 Bad

Advantages

- Backtest reports published

- Trading results shared

Disadvantages

- No team revealed

- No risk or money-management advice given

- Low trading frequency

- The previous account was blown

- No testimonials written

- No refund policy provided