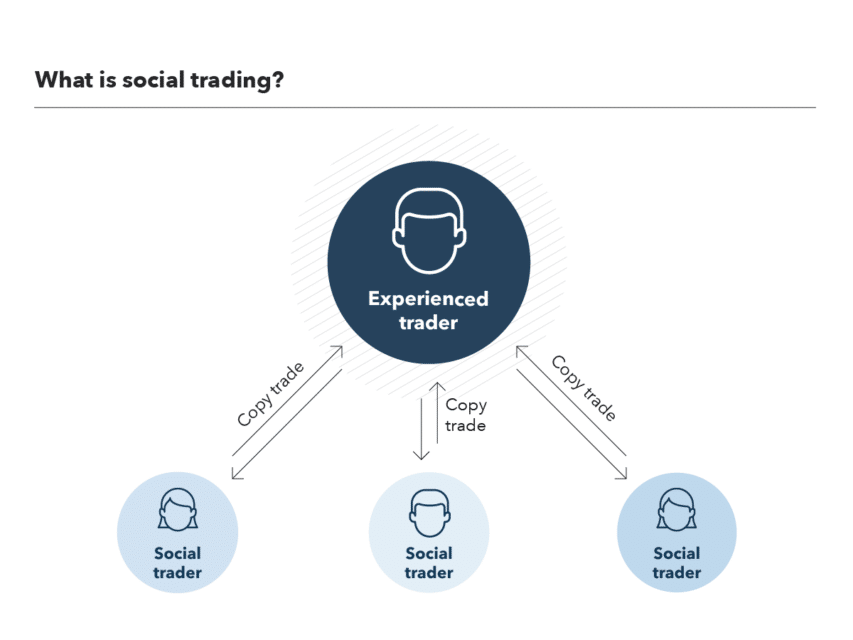

For investors who want to copy the positions of other market participants, copy-trading is a kind of automated trading. Investors might benefit by copying fortunate traders. A success fee or a percentage of investor numbers copied by market participants is paid to them in return.

There are now hundreds of platforms that allow crypto investors to copy-trade. Beginners are apprehensive about this area since there are so many functions, and their value is unclear. As a newbie investor, you’ll want to know what to watch out for when choosing a platform.

This article explains copy trading platforms and the five most essential tips to choose.

What is copy trading?

The term “people-based portfolio” has been used to describe traders who invest in other traders or investors rather than making their trades.

Best way to use copy trading

The process of copying trades, on the other hand, isn’t as simple. To make trades, you attach a portion of your portfolio to a single trader rather than your whole portfolio.

If you want to gain more from FX trading, you shouldn’t invest all your money in one signal. Investing more than 20% of your money in a single trader is highly suggested.

Top five tips to choose

Here are a few tips to opt for the best copy trading platform.

Tip 1. Choose API supported platform

The phrase “Not your keys, not your coins” has become more relevant than ever before. It’s essential to have a sense of security at all times. Even so, you’ll prefer to send money to an established exchange rather than an unrecognized business. We may use this technology to link a personal exchange account and manage money without transferring them to third-party services.

How to avoid mistakes?

With our worldwide network of top-performing FX market participants, you will have access to a strategy follower or copy trader who can assist you in trade with a winning strategy and earn and develop your passive income in the FX market.

You will be able to adjust a maximum loss in your trade amount even though you will be copy trading.

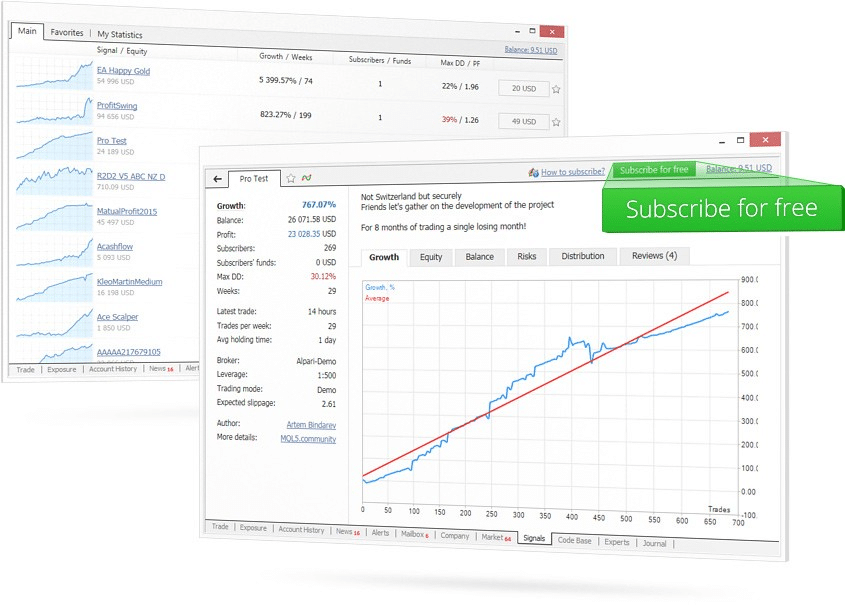

Tip 2. Check the statistics of traders

It’s great when a trader makes money, but the key is to figure out how he does it. Please include information about the original amount, average yield, and drawdown %. Withdrawing $300,000 in three months from a trader’s account is nothing compared to withdrawing $300,000 in five years from the same trader’s account.

Get signals from someone willing to put their own money on the line. If this is the case, they’ll be more cautious in their trading.

How to avoid mistakes?

In FX market, a drawdown occurs when the equity balance is less than the account balance and vice versa. You may find out how much a trader has lost. Just look at how much of their total account balance has been lost over a certain time.

Even if the same approach is utilized, the drop is likely to happen again. A trader’s portfolio description in CopyPip displays the trader’s greatest drawdown. This can assist you in distinguishing between various traders.

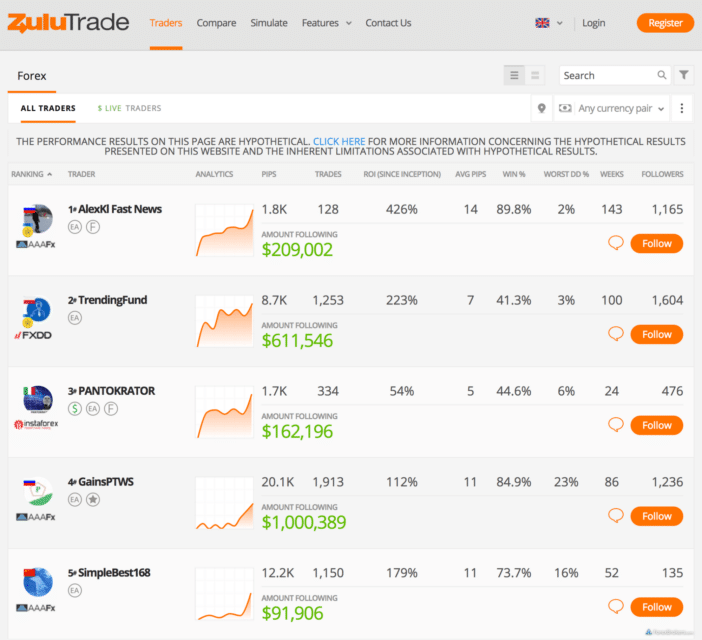

Tip 3. Test the platform before choosing

It’s wonderful when the platform is open to everyone. Unfortunately, this isn’t always the case. Copy-trading sites use the subscription model. There are designated periods during which you may test the product’s functioning and assess its capabilities. The testing process lasts anywhere from three to fourteen days.

Try emailing the contact address and requesting that the trial period be enabled if this function doesn’t work. There are a few things to keep in mind while reviewing a company’s performance chart.

How to avoid mistakes?

You don’t have to take on the massive risk of losing your money if you can’t afford it when it comes to copy trading. For risk assessment, be sure to look at whether and at what distance stop levels are put on each transaction started. Do not mimic someone who has no stop levels since this corresponds to unlimited risk.

Tip 4. Analyze the founders and teammates

A team of people supports trading services. Make an effort to learn more about the developers of the project you’re interested in. Find out what their history is and why they came up with this idea. It is common for project founders’ information to be found on social networks like LinkedIn or AngelList.

Understanding the motive of the developers and the future possibilities of the project will be easier with this knowledge. For example, an active trader with many followers on social media might indicate a good model to follow.

How to avoid the mistake?

The best source of information is to get it from people who use the platform you’re interested in. Never put your whole faith in a faceless Joe on the internet. Instead, analyze those reviews that provide helpful information about the service’s performance and value. An excellent place to look for reviews is Trustpilot or Bitcointalk.

5. Build a strong community

Since many copy-trading platforms are just beginning, they’ve had little opportunity to establish themselves in the market. There are several exceptions to the rule. It’s already deemed to be a community when there are at least 300 people in it.

There are more than 5000 members in the community, indicating a broad audience for the service. Beginners have a massive advantage since they can meet other traders and learn more about trading in a robust community. The community, on the other hand, is a valuable source of information for platform growth.

How to avoid the mistake?

You may learn more about a project via marketing efforts. However, the greatest method to reach an audience is not via invasive advertising and an aggressive attitude. If a project begins aggressively advertising its services to you, ask yourself if the project needs users or needs to sell the service despite its quality.

Upsides and downsides

| Upsides | Downsides |

| Investment community with a lot of activity that is great for social trading. | Withdrawal costs are charged inside the platform. |

| Tools that are specifically designed for social trading. | Some platforms offer restricted asset choices and high minimum deposits. |

| A large number of cryptocurrencies are available. | Low retail leverage and higher minimum deposits. |

Final thoughts

Those interested in the financial markets but lack time to trade can use copy trading as account management. Numerous authorities are investigating the possibility of reclassifying platforms as financial advisors. It is essential that copy traders constantly review their accounts and never totally trust a platform to avoid losing money. Therefore, pick a platform that fits your needs. Do thorough market research before choosing one.