Most savvy investors opt to invest in bond ETFs as a way to hedge their portfolios. Instead of investing in individual stocks or mutual funds, investing in a bond exchange-traded fund allows them to gain exposure with less risk since bonds are fixed-income investments.

The US stock market is valued at slightly above $30 trillion, while the bond market’s value is about $43 trillion. And as the stock market falls, tense investors look to ETFs for sanity and protection.

Many novice investors only focus on one asset class since they tend to follow the herd or what seems popular. Putting all your eggs in one basket comes with high risk. In addition, you have all your capital tied to a single asset. On the other hand, your returns are low, or in some cases, you incur high losses as well as exorbitant management fees.

Let’s see what investing in bond ETFs can offer you.

What are bond ETFs?

An ETF is an exchange-traded fund, and there are many different investment types. ETFs can be a way to invest in commodities, stocks, mutual funds, and bonds.

In this case, bond ETFs consist of a group of bonds that are tradeable on an index. The fund invests in a group of high-performing and stable bonds, intending to earn short-to-medium-term returns.

The ETF would track the performance of an index of bonds; thereby, it is a passively managed portfolio. Bond ETFs can also be traded on the stock exchange as you would stock, and the market has high liquidity.

Why should you invest in bond ETFs?

Bond ETFs are stable investments because the rules of the fund are transparent. Investors know what the risks are as well as the composition of the portfolio.

In terms of pricing, bond ETFs’ pricing is like an index that allows instant access to fixed income markets. And thirdly, bond ETF fees are much lower than actively managed mutual funds because there are fewer management fees.

The best five bond ETFs in 2021

Therefore, if you want to invest in a stable, low-risk, and passive yielding fund, you should consider these bond ETFs which are trending right now.

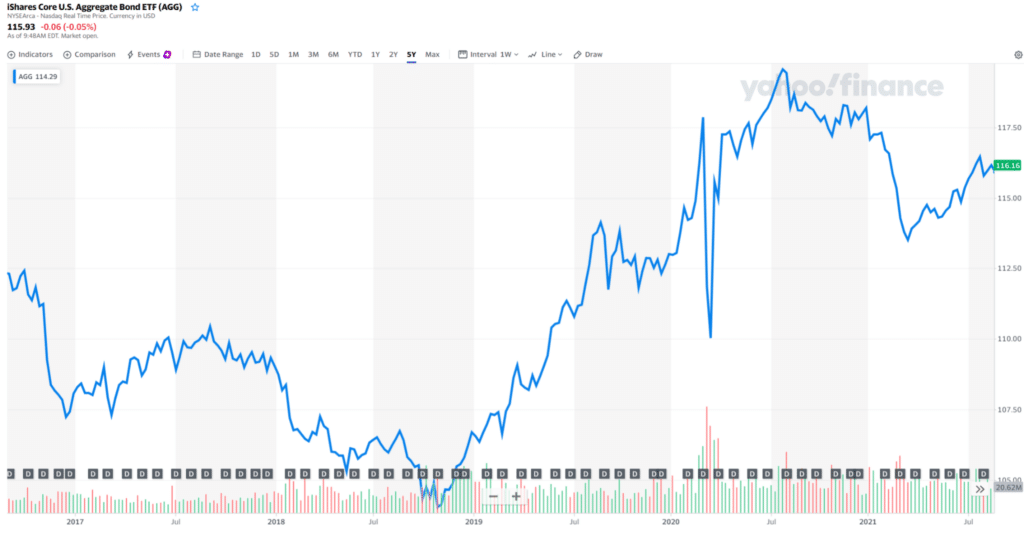

1. iShares Core US Aggregate Bond ETF (AGG)

AGG bond ETF is the largest in this category and has an asset holding of $89 billion. The 10,000 individual bond holdings have exposure to the US Treasury bonds and top-notch corporate debt firms like JPMorgan Chase & Co.

The fund has an expense ratio as low as 0.04%, which means for every $10,000 you invest, you only pay $4 in fees. Not only is it one of the most affordable bonds, but it has yielded 5.3% in the last three years. The current yield is around 1.26%.

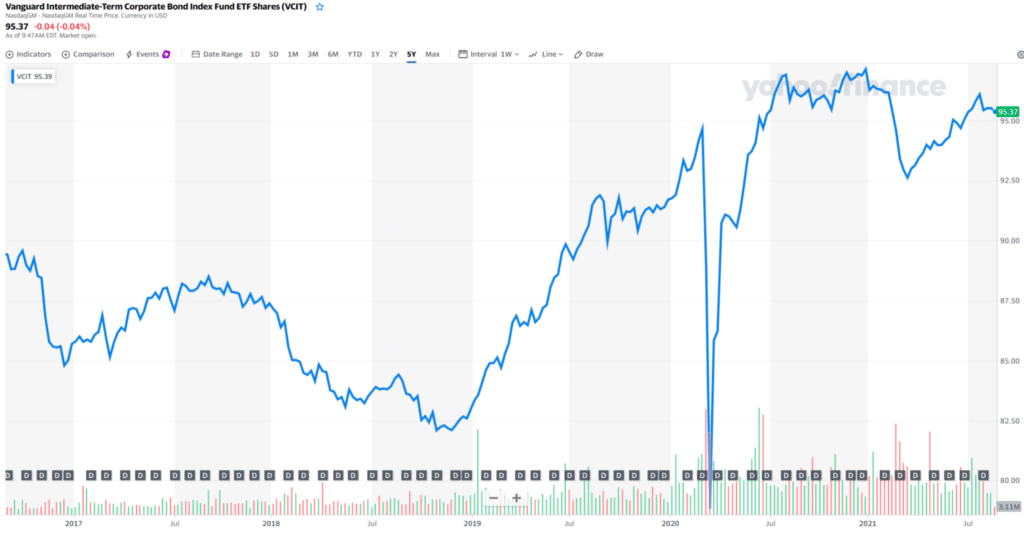

2. Vanguard Intermediate-Term Corporate Bond ETF (VCIT)

The VCIT gives you access to invest in corporate bonds. This fund provides a little higher yield. However, the risk is slightly more than the aggregate government bonds.

This fund only has top-ranked firms like Bank of America, Allstate Corp., UnitedHealth Group Inc., to name a few blue-chip stocks. In addition, the ETF has a value of $46 billion, ranking it as one of the largest on Wall Street. The fund has a yield of about 1.86%.

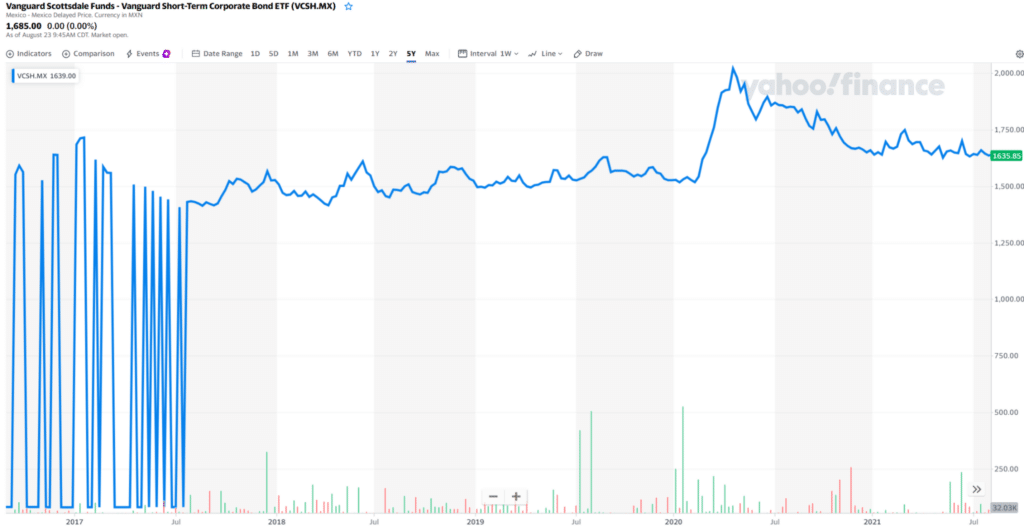

3. Vanguard Short-Term Corporate Bond ETF (VCSH)

The VCSH matures in three years. The fund focuses on high-quality debt, meaning the debt will be paid entirely by the end of the term. This fund has low risk.

Returns are lower than an average dividend-paying stock; however, due to the stable yield, it has low returns — the fund boasts assets of $41 billion. The current yield is 0.84%, and it has an expense ratio of 0.05%.

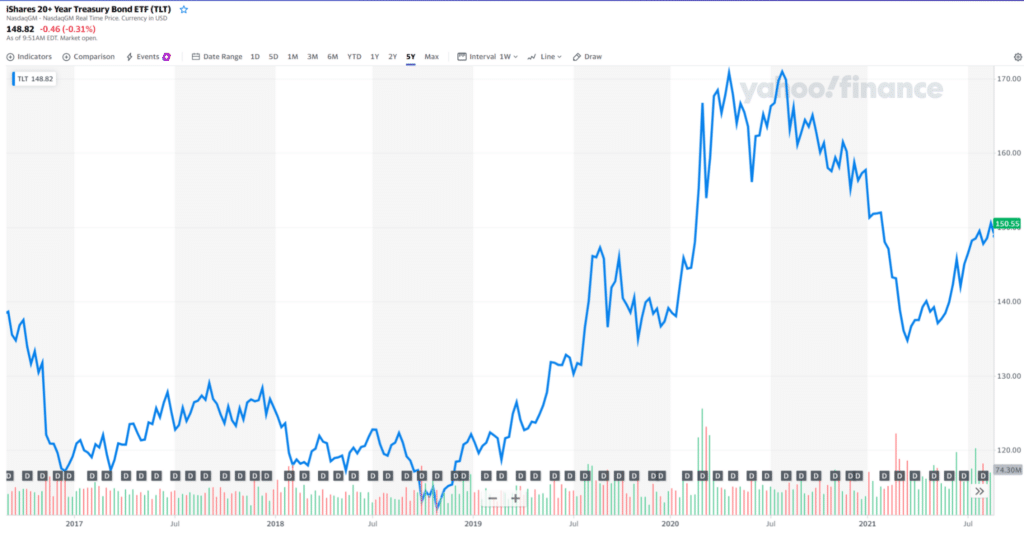

4. iShares 20+ Year Treasury Bond ETF (TLT)

This bond ETF’s complete portfolio focuses on the US Treasury bonds. It is a low-risk fund but gives moderately high yields. Since it’s investing in the US government, so to speak, it is probably the most stable investment in the world. The bond ETF matures after twenty years.

Current returns are 1.77%. The fund’s expense ratio is higher at 0.15%, compared to the other funds. And the fund holds $17.27 billion worth of assets under management. The expected yield to maturity is 2.05%.

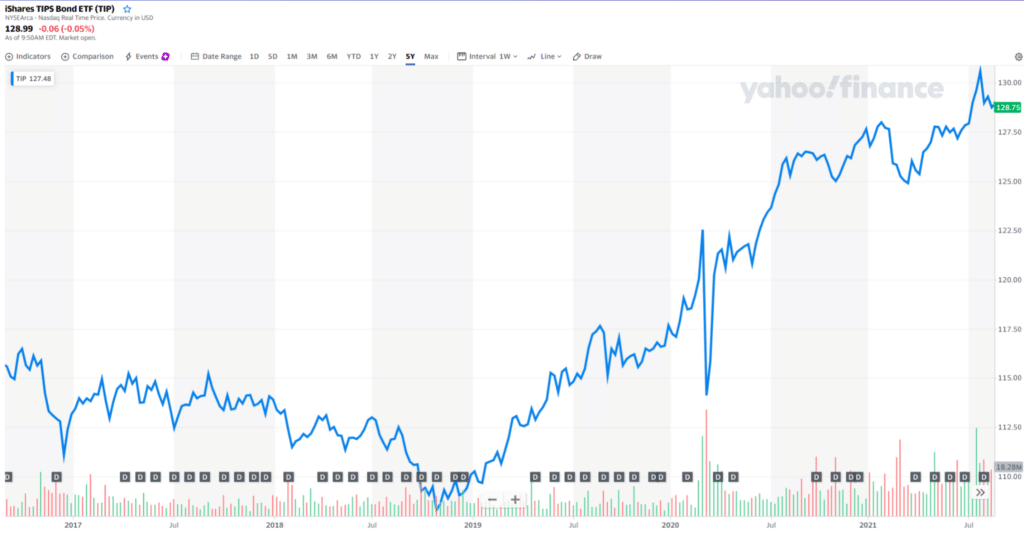

5. iShares TIPS Bond ETF (TIP)

TIP stands for Treasury inflation-protected securities. The US government issues these securities, which tracks inflation. It is a way to protect investors from high inflation, which is a decline in purchase power.

If inflation increases, the yield on this fund increases as well. It is, therefore, a good hedge against inflation. However, if inflation decreases, the TIPS fund also underperforms. The fund has an asset holding of $32.30 billion and an expense ratio of 0.19%. Thanks to the recent surge in inflation, it yielded 8.37%.

Final thoughts

To conclude, these are not the only funds you can invest in, but they are ranking as the best performing right now. They give consistent yields, and with the backing of the US government and top-tier corporates, you can be sure that your risk is relatively low.

Of course, you will require a good amount of capital since the yields are not very high, but these investments are mid to long-term with fixed income over the tenure, allowing you to compound your returns.