The Great Resignation has put workers in a position to do what they want from their jobs. Along with better benefits and flexibility, a new perk is making its way into the workplace — the option to receive payments in digital currency.

Employers can attract young talent by offering them crypto as a salary, but there are risks and rewards to it as well. First, the decision has been criticized as a marketing stunt when global interest in technology is high. Furthermore, it is risky: the volatile currency declined last week but has rebounded more than 50%.

Crypto as legal tender

Bitcoin ranks among the most popular and expensive. Over 23,000 establishments worldwide accept crypto as payment for goods and services. Even though businesses increasingly accept Bitcoin, it is difficult to predict its value.

Employers must pay wages in legal currency in the United States and elsewhere. The tokens are reportedly a suitable payment method for independent contractors and freelancers. If you pay payroll in it, you are breaking the law.

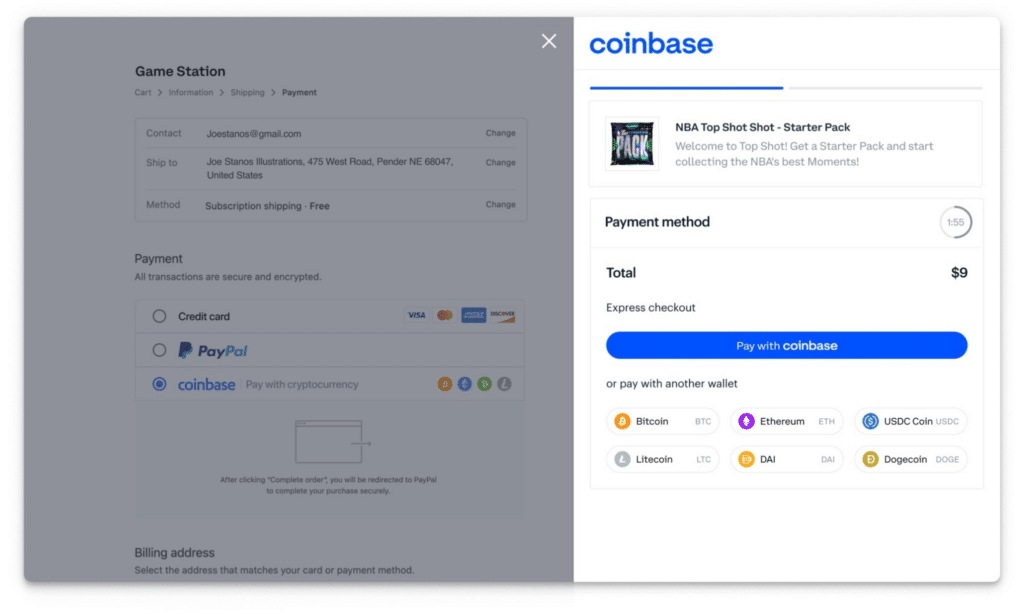

Setting up an account with digital currency exchange, such as Coinbase, is required to get paid in BTC. Bitcoin can then be stored in digital wallets by the recipients of crypto payments. You can then exchange tokens for legal tender on digital currency exchanges.

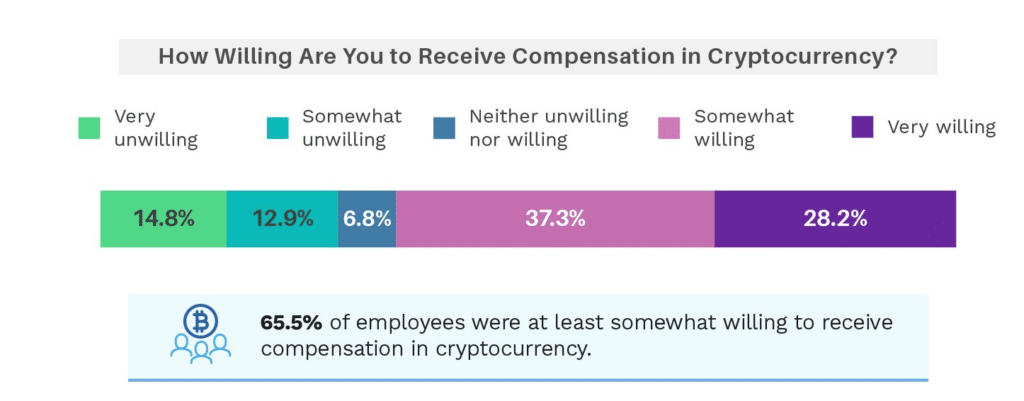

What will it take to draw your salaries in crypto?

The value of Bitcoin is usually calculated based on the digital currency’s value at a predetermined time and date. For example, according to the simple math, if the Bitcoin price was $10,000 and an employee chose to receive $1,000 in BTC, they would receive 0.1 BTC.

If an employee chooses to sell immediately, they will receive the same amount in cash they received. However, keeping crypto for an extended period will alter its value for a week, a month, or a year. For example, it could be worth $5,000 instead of $1,000. Or it could be worth absolutely nothing. Thus, people are further encouraged to gamble if wages are paid in Bitcoin.

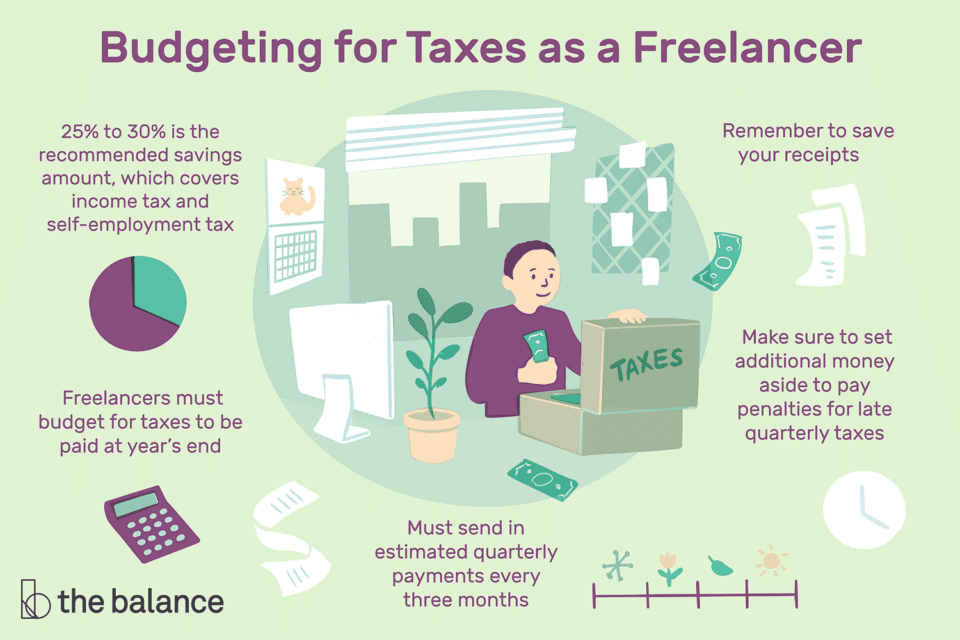

The tax rules for this industry are notoriously tricky to generalize, and it seems inevitable that they will change as the industry grows. Regardless of where they reside, employees will usually owe income tax on their Bitcoin salaries, based on the currency’s value when the salary is paid.

However, as with stock options, employees may have to pay capital gains tax if their Bitcoin has appreciated, according to their tax jurisdiction.

Tips to start accepting Bitcoin salary

Try to use freelance marketplaces

The number of cryptos available to freelancers today makes it possible to earn money from anywhere globally, regardless of where they are based. Cryptos being sought after makes it easier to find who to trade with or exchange them for local currency on cryptographic money exchanges. PayPal, Square, etc., involve many external costs and taxes.

How does this happen?

It incredibly takes a lot of effort to be a successful freelancer since the market is demanding. However, freelancers in the crypto industry have vast earning potential. There is no limit to the amount of work one can take on. Using this method carries virtually no risk.

Try to procure crypto through Coinbase

Bitcoin exchange Coinbase recently launched an online training program for digital currencies, including training on how to pay them. Accordingly, a fixed percentage of crypto is transferred into the user’s wallet address upon completing DAI, blockchain, and EOS courses.

Depending on the regulations in your country, you may have to use a licensed exchange, like Netcoins, if you live in a country like Canada.

How does this happen?

Generally, this strategy generates very little income. The use of such plans does not involve any risk.

Try to describe a signature campaign

A signature space is rented, which is an easy process to understand. Every quality post you make in the discussion forum is rewarded by the sponsor. Your position in the discussion forum determines how much cash you receive.

Bounties, in comparison, are payment methods that permit individuals to earn cash for completing tasks such as translating technical data or locating bugs in a startup’s code research places to invest in cryptocurrencies before opening a new account with them.

Check if the company is legit before you open an account with them. For example, if you want to use Bitcoin Revolution, search for the phrase “is Bitcoin Revolution legit?” before opening an account.

How does this happen?

Utilizing bounty programs entail a negligible amount of effort. Depending on various factors, signature campaigns and bounties may be able to earn substantial amounts (ranging from $0.01 to $500). Utilizing such methods entail practically no risks. Don’t receive crypto salaries if volatility is high.

A popular cryptocurrency like BTC isn’t immune to wild price fluctuations. The crypto market is known for its volatility. In November, it has plummeted more than 40% from a record high of about $69,000. Although BTC’s value has grown over the past decade, since it started as “a couple of dollars,” Jarvis says.

“If you get your salary payments by the week or month, its value is a fixed amount today and grows over time. So you can have some serious returns.”

Try to avoid higher taxes

You need to know the country’s tax laws in which you live regarding crypto. The law is relatively lenient in some countries, Jarvis said.

“Based on how much these assets have increased over time, it is likely to be a significant gain if you save taxes. In Portugal, for example, there is no tax on Bitcoin, making it a crypto tax haven. Further safeguards may be put in place for digital assets shortly “to ensure consumer safety and trust.

How does this happen?

Employees who earn a crypto income should know how these policy changes affect their ability to own and use crypto assets. In addition, staying abreast of policy changes will allow them to respond quickly to developments.”

Try to earn crypto as an influencer

Most of our readers know that tweets from the vast online audience can play a significant role in helping crypto startups gain market exposure.

Crypto experts, just like any other domain influencer, can earn a great deal when they have a rich following on social media platforms such as Twitter, Facebook, and Instagram. You can use that potential in various ways, including by offering crypto grants every time you can earn many followers interested in VCs.

How does this happen?

Anyone who hopes to become a famous crypto character must put in a great effort. However, profits included in these reports tend to be medium to high. So the issue is not risky.

Final thoughts

We assume you will find this guide helpful in helping you earn Bitcoin in a practical and long-lasting way. There is no harm in buying some BTC. At the same time, we are still unsure about the future of the crypto market — especially since finance experts and analysts agree that leading crypto will inevitably be used for large-scale transactions sooner rather than later.

As well, one can exchange crypto for fiat if the need arises. Finally, since the advent of crypto/blockchain technology about ten years ago, it is now apparent that all the present DeFi platforms will drastically change the global financial engine.