Previously relegated to the sidelines as dangerous substances, psychedelics are now gaining recognition for their potential to cure mental ailments. Research shows that psychedelic drugs could relieve advanced mental illnesses such as PTSD, addiction, anxiety, depression, and OCD.

One drug that is given the green light for clinical trials is psilocybin after the FDA recognized this drug as a breakthrough therapy in 2018 and 2019. In the following year, Oregon made psilocybin for medical treatment legal and became the first US state to make this move.

Whether psychedelics, in general, should be legalized or not is a subject of much debate in recent times. The psychedelic sector is just starting to see momentum. The number of publicly-traded psychedelic stocks is less than 50, and most of them are traded in Canadian stock exchanges. Buying psychedelic stocks now could be a wise move given the recent developments in this field.

You may call psychedelic stocks by the other names psilocybin stocks, shroom stocks, or mushroom stocks. They all mean one thing, and they are getting a lot of attention from investors. You will learn three of the best mushroom stocks later in this article, so keep reading.

What are mushroom stocks?

Mushroom stocks are companies engaged in the production and marketing of various types of drugs aimed at curing mental problems. These companies also invest capital in research and development to treat anxiety and depression to find novel ways.

Think of the psychedelic sector as an enormous pharmaceutical industry subset. The number of companies operating in this industry is getting bigger every year. At present, you can find close to 50 publicly traded mushroom companies and close to 40 private psychedelic firms.

Mushroom stocks are called this way about magic mushrooms, cultivated or wild mushrooms containing the powerful substance psilocybin.

How to buy mushroom stocks?

Buying mushroom stocks works in the same manner as purchasing any stock. The basic process involves creating a brokerage account and selecting stocks to buy. Alternatively, you can do it the other way around. Decide which stocks to invest in first and then find which brokers offer such stocks.

When selecting mushroom stocks, prepare a list of candidate stocks and examine the merits of each. You may arrange stocks based on specific criteria. One such criterion is market cap. You can keep a list of top five or top ten mushroom stocks in terms of market cap. Selecting stocks this way ensures you are putting money where considerable money is being pooled in.

Another thing you can consider is the position of stock in the industry. Are there projects lined up in the pipeline? Is it leading on a specific front?

Top three mushroom stocks to buy in 2022

Below are the three biggest mushroom stocks in terms of market cap. Keep these stocks on your radar as you go about your investing journey in 2022 and onward.

Atai Life Sciences (ATAI)

Atai was established in 2018 and became a publicly-traded company in June 2021. This stock is among the leaders in the psychedelic sector in light of the support it received from large venture capital firms. As a biotech company, Atai invested in many other companies involved in developing psychedelic drugs. Atai has ten programs in its pipeline, with four undergoing clinical trials.

As you can see in the image below, the technical aspect of Atai is not remarkable as the stock price plummeted from left to right. From the IPO price of $21, the share price went straight down to $7.33, losing 65 percent of its original value. Despite this fact, Atai is still the number one stock in this sector in terms of market cap. It means investors still have confidence in this stock. You might just be seeing a bargain right now that you can take advantage of.

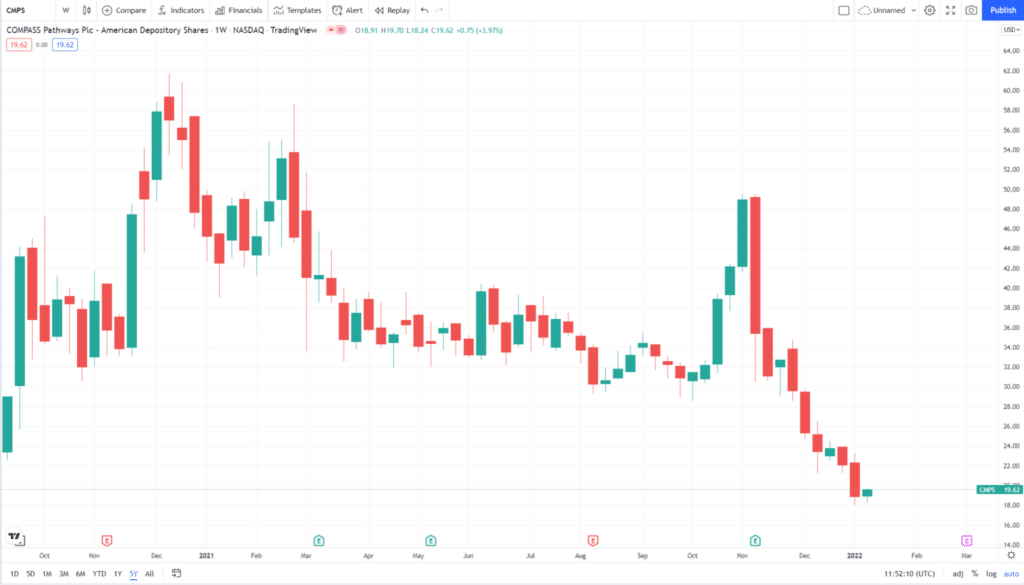

Compass Pathways (CMPS)

Like the previous stock, the technical aspect of Compass is not appealing. The current price was close to the IPO price in September 2020. In fact, the $21.81 stock price right now is 8 percent lower than the original $23.4 price. There is still hope for recovery as long as the price does not plunge toward zero. The technical outlook of this stock is pretty much the same as that of Atai.

Like the previous stock, the technical aspect of Compass is not appealing. The current price was close to the IPO price in September 2020. The $21.81 stock price right now is eight percent lower than the original $23.4 price. There is still hope for recovery if the price does not plunge toward zero. The technical outlook of this stock is pretty much the same as that of Atai.

Mind Medicine (MNMD)

Founded in May 2019, Mind Medicine is a US stock with international partners working toward providing mental health services using psychedelic-based products. At this point, the firm is running tests for MDMA, ibogaine, ayahuasca, and LSD to develop psychedelic medications that doctors can prescribe, and patients can take at home.

MNMD stock started its public journey five years earlier than the first two stocks under discussion. The price history of MNMD goes back to 2016. The stock’s performance over five years looks good overall. The stock experienced massive growth in 2019 and 2020, with 2020 being the most profitable. In 2020, MindMed gained a sizable 226 percent from the previous year. At the current price of $1.57 per share, the stock is still very affordable for any investor to take advantage of.

Final thoughts

As psychedelic products gain widespread use, the cannabis industry receives another boost and gains further momentum. Whether these drugs become part of the mainstream depends on public opinion, legislation, and investor sentiment.

The mushroom stock sector is still an emerging market but is already getting a lot of support from various participants. Early investors willing to buy into speculation could reap bountiful harvests soon when the sector explodes in popularity and adoption.