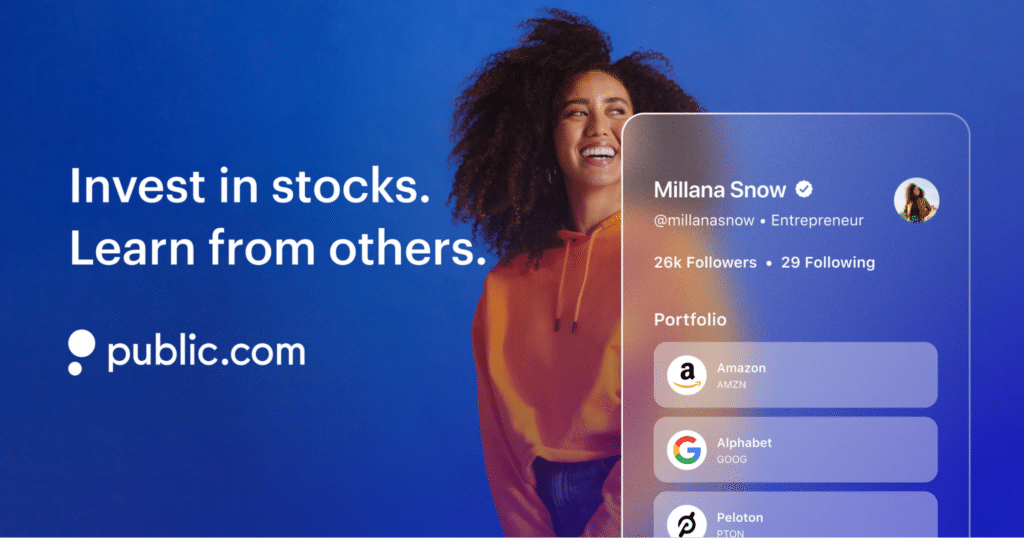

As a social and brokerage trading platform, Public.com hopes to open the stock market to various investors. Public allows users to buy full or partial shares of stock or popular ETFs for as little as $1, and there are no commission expenses. In addition, users may communicate ideas and identify companies, follow other investors, and, ultimately, increase their financial literacy using Public, a social investing platform.

Members of the Securities Investor Protection Corporation and the Financial Industry Regulatory Authority (FINRA) have granted Public permission to operate as licensed securities brokers. A New York City-based company, it was founded in 2017.

Now let’s take deeper insights of the app about what it is offering and a few of its unique features.

What services does the Public app have to offer?

Trading stocks or ETFs in small units called slices may be done without paying a public fee. In this case, you pay for each dollar rather than by the amount. By dividing stock shares into smaller units, the stock market becomes more accessible.

1. Safety and security

Your money is safe and secure with the app since we’ve implemented all the necessary precautions and regulations. To safeguard individual investors, it uses SIPC insurance, for example.

2. Membership plans

The app does not now offer a paid premium membership; they plan to do so in the future.

3. Budgeting and goals

A single share of stock or the whole firm may be purchased using the app. For example, it is possible to buy 0.1 percent of a corporation that costs $1,000 per share for $100. Spending $500 buys 2.5 shares in a stock that costs $200 a share.

To purchase stock slices or fractional shares, enter the amount of money you’re prepared to pay. Then, your slice/fractional share is calculated automatically by the computer based on your input. In the beginning, it’s tough to understand anything on a stock options list, especially if you’re starting.

On the other hand, it promises to make stock investment accessible to all users. They do this because they want you to invest in firms based on your interests. So it is possible, for example, to choose a new-age industry and hunt for companies to invest in.

4. Special features

- It’s not uncommon for some investors to utilize stock shorting as part of their overall investment strategy. Someone will take stock from the lender to sell it at the current market price before purchasing it back at a lower price and returning the borrowed shares to them. A loan refund is also a way for the Public to benefit from this service.

- There is now a 0.2 percent interest rate on uninvested cash balances at the Federal Reserve.

- When you use smart order routing to complete the transaction, you get a refund from Public.

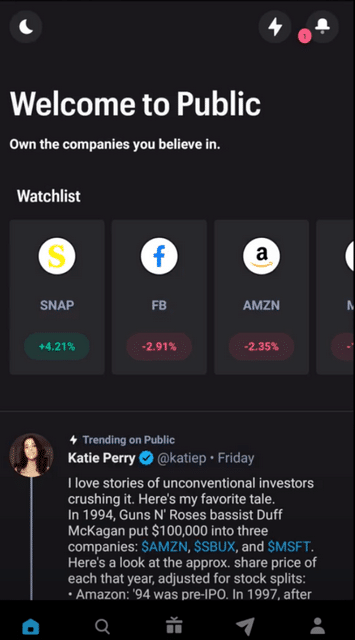

5. Alerts

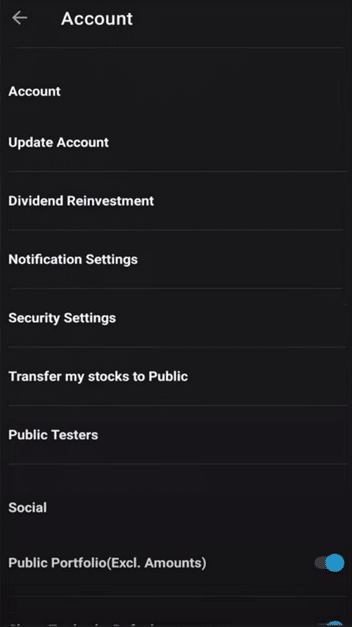

You can turn on notifications by going in account settings, scrolling down to accounts, and clicking notification settings to turn them on.

6. Transactions and reporting

The Public is commissions free. You may use it for free if you’re new to investing or on a low budget, making it ideal for those just starting. But here’s the most significant part. The app doesn’t charge a fee when you invest in any stock, and you may move money freely into and out of your account.

For specialized services, there are a few additional fees to consider, such as:

- Over the phone, dealing with a broker will set you back $30.

- A domestic wire transfer costs $30.

- Overnight checks in the US cost $35.

- $30 for checks that have been returned or payments that have been discontinued.

- An outgoing ACAT of $75.

- A $35 fee is charged for each paper statement.

7. Support

It may not seem like a big deal at first, but having in-app chat support is a game-changer.

There will be specific questions on your mind if you are a new investor. There’s also 24/7 live chat help for investors who have questions or encounter technical issues.

Public App’s mobile app offers a variety of resources. You’ll find a wide range of information about the stock market and investing here. It is possible to go through the FAQs, send an email, or utilize the app’s live chat to get in touch with them.

Pros and cons of using the Public.com app

Now let us take a look at its pros and cons.

| Pros | Cons |

| To use the app, you don’t have to pay anything. There aren’t any monthly fees, commissions on stock trades, or other expenditures to be concerned about using this service. | All transactions must be made using the app. There is no desktop version available. You can’t invest when using a computer with Public.com, which some people don’t mind. |

| The app also offers a sign-up bonus for new clients. | For the time being, the app only enables you to create taxable brokerage accounts, so you can’t open an IRA. |

| Since the app does not have any minimum investment requirements, everyone may engage in the stock market, regardless of their financial position. | The app does not provide margin trading, which is a risky activity that involves borrowing money against your stock portfolio to invest more money. |

| Even if you invest $1 into the app, you may purchase fractional shares in several companies, including household brands like Amazon, Apple, Tesla, and more. | Auto-investment is not available on the app. Before making a trade, you must first manually put money into your account. As a result, creating a long-term investing strategy and portfolio would be complicated and time-intensive. |

Final thoughts

If you’re looking for a low-cost method to start investing, the Public app could be a good option. In addition, first-time investors who lack substantial investment will find this perfect since they may acquire fractional shares.