iProfit EA is a Forex expert advisor that works on the Metatrader 4 trading platform. It has 7 years’ worth of verified live track record and the developer claims that it has gained more than 8000 pips since its launch. They also claim that the robot is profitable in different market scenarios.

The parent company behind this robot is known as Phibase Technologies. We don’t know when this organization was founded, and there is zero background information on it. The vendor has not revealed the identities of the team members or shared the official address. Additionally, we don’t know whether the dev team has built other automated trading systems in the past.

The highlights of iProfit EA

Some of the principal features of this system include:

Average monthly equity gain of 5%

The vendor claims that the average gain potential of this robot is over 170 pips per month. At medium risk level, it is able to maintain a monthly equity gain of about 5%. However, the live trading results tell us that this is a false claim.

12 years backtest

iProfit EA is supported by 12-year tick backtesting data with 99.9% accuracy. This test data shows the longevity of the strategy. The vendor has also shared the comparative results of backtest vs forward test for the last six years.

Risk management

This robot uses take profit, hidden stop loss, and server-side stop loss. It closes all trades on Friday and keeps no orders open over the weekend. Also, it avoids using risky strategies like hedging, grid, and martingale.

Multiple risk levels

This EA has three risk levels, namely low, medium, and high. The total gain or loss is calculated by multiplying the pip difference between the opening and closing price by the number of currency units traded. For low risk, the equity growth and drawdown are lower while high risk leads to higher gains and drawdown.

Trading strategy of iProfit EA

This EA uses a neural network-based short-term strategy for the H1 time frame. It looks to generate small gains while limiting the losses. The neural network dynamically adapts to price shifts witnessed within the last 4-52 hours. It also involves decisions being made based on historical data.

The neural network model trades the usual price shifts within the H1 bars and forecasts the maximum and minimum prices for the subsequent bars. iProfit EA makes buy and sell decisions on the basis of price action and success probability. It assesses the current market scenario using stochastics, support and resistance, and multiple moving average cross-over.

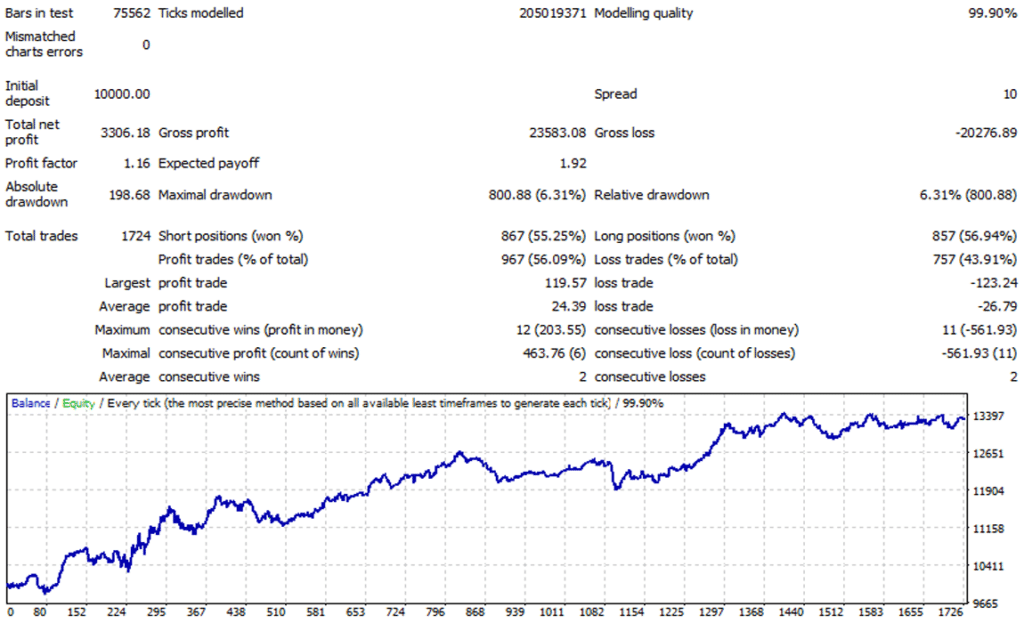

Backtesting reports

This backtest was conducted from May 2007 to May 2019. The EA used an initial deposit of $10,000 to place a total of 1724 trades, winning 56.09% of them and generating a total profit of $3306.18. There were 12 maximum consecutive wins and 11 maximum consecutive losses during the testing period. The profit factor and relative drawdown were 1.16 and 6.31%, respectively.

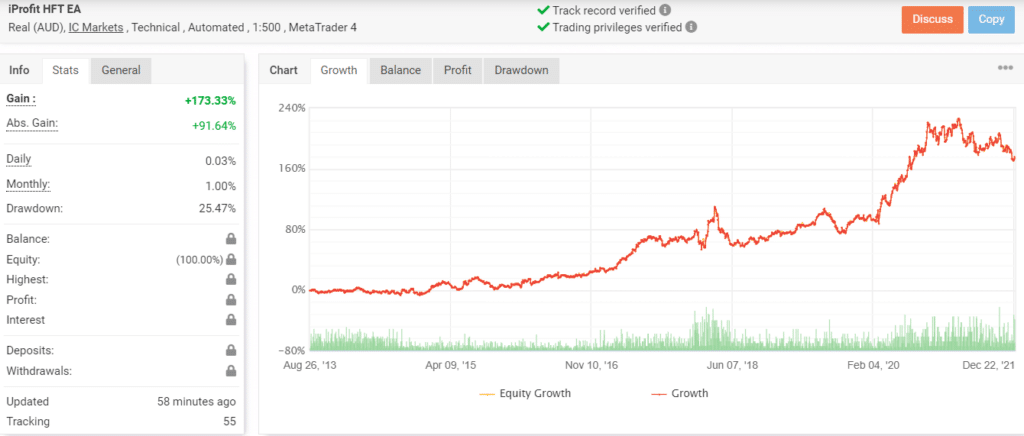

Trading results in real time

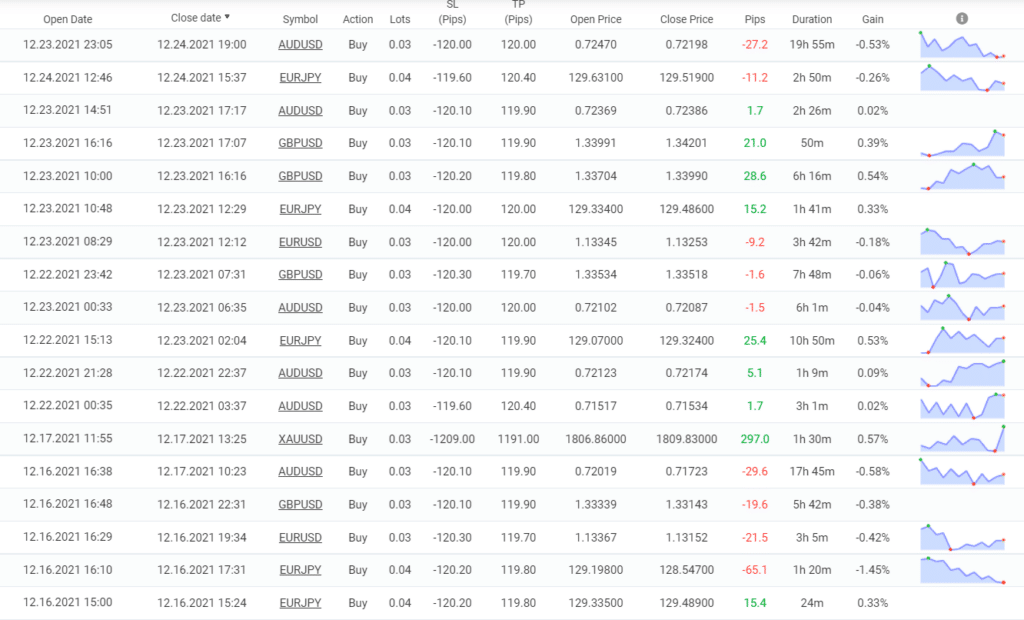

This live trading account was launched on August 26, 2013. To date, the EA has placed a total of 5473 trades through this account. It currently has a win rate of 58%, which is slightly higher in comparison to the backtesting results. However, the drawdown is much higher and stands at 25.47%.

It is evident from the trading history that the robot is prone to suffering consecutive losses. Also, it follows a low-profit strategy, placing multiple trades on a daily basis.

iProfit EA price

The annual subscription plan for this robot costs $470/year, while the lifetime license costs $899. For the iProfit Cloner MT4 EA, the prices for these plans are $299/year and $630, respectively. The vendor offers a 30-day money-back guarantee for the annual subscription plans.

Customer support

You can message the support team 24/7 using the official email address or the contact form.

Are traders happy with iProfit EA?

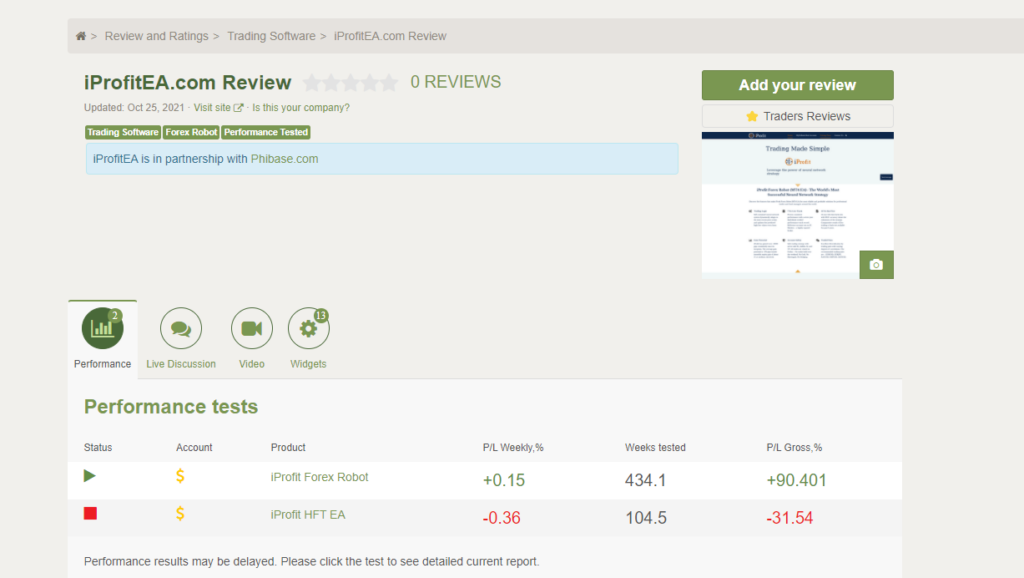

There are no user reviews for this EA on third-party websites. On FPA, it has two accounts, one of which has been closed. The other one has a weekly profit/loss of 0.15%.

iProfit EA

iProfit EA-

Functionality3/5 Neutral

-

Trading Strategy3/5 Neutral

-

Live Results3/5 Neutral

-

Customer Support3/5 Neutral

-

User Reviews2/5 Bad

Advantages

- Verified trading statistics

Disadvantages

- High drawdown

- Lack of vendor transparency

- No customer reviews