Companies keep records for a reason. They need data to evaluate performance and streamline operations. Traders could use the same method to assess trading results and fine-tune strategies. Without the help of a trading journal, you might spend years learning the trading process without success.

Keeping a trade journal could mean distinguishing between the 90 percent of traders who consistently lose money and the ten percent who regularly make money. Guess what? Several losing traders do not maintain a journal.

Many struggling traders move from one system to another in search of the perfect strategy. Understanding your state of mind at certain points of a trade entry is very helpful in figuring out your ability as a trader. Doing this will allow you to pinpoint areas for improvement and gradually fine-tune your strategy.

This article will show what you should keep in your trade journal and generate metrics. This way, you can unleash the trader in you that was kept in shackles for so long.

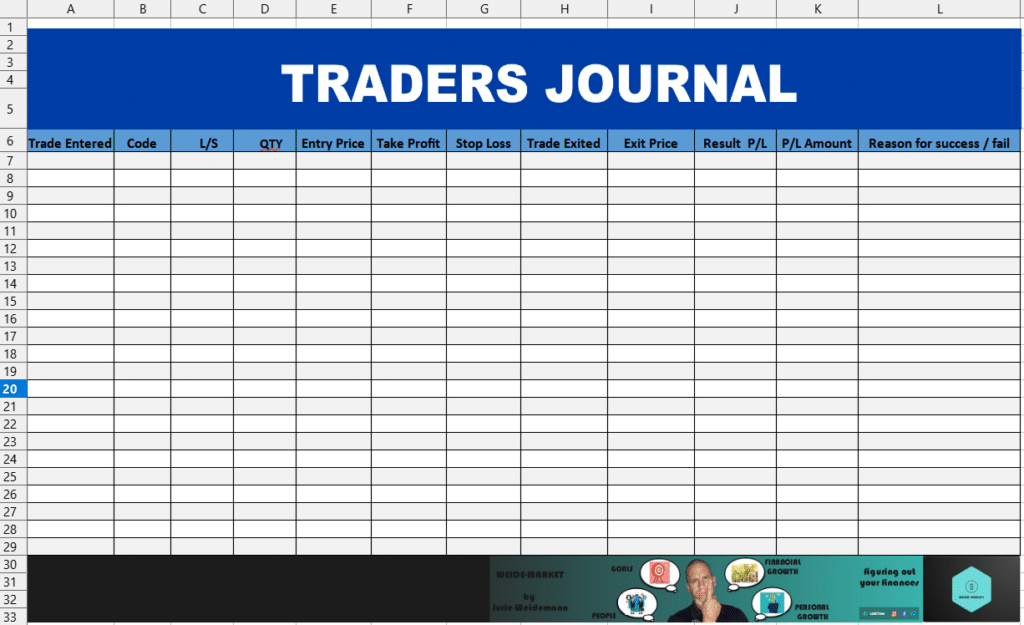

What trading data should you track?

The amount of data you decide to record depends on your trading method and liking. While some traders may want to simplify things by tracking a little data, other traders may choose to maintain more. Below are some of the trade information you can put in your trade journal.

- Date

This is the date when you take the trade.

- Market

This is the traded currency pair.

- Order type

This is the type of order you executed.

- Open price

This is the price you bought or sold a pair.

- Stop loss price

This is the price at which you want your trade to close at a loss to stop wreaking havoc on your account.

- Take profit price

This is the price at which you want your trade to close in profit.

- Risk-reward ratio

You get this value by quoting the number of pips targeted and the pips risked.

- Trade trigger

This is the trigger for trade entry. Examples include a candlestick pattern, price pattern, divergence, breakout, etc.

- Status

This is the status of the trade, i.e., open or closed at any point in time.

- Result

This is the result of the trade, i.e., win or loss.

- Profit/loss amount

This is the amount lost or won in a trade entry.

Another trick that is very helpful in your trade assessment is keeping chart screenshots before and after the trade entry. This will allow you to see the trade context long after the trade is closed. This way, you can quickly figure out what went well or wrong with the trade. Adding notes to the chart is another way to improve your grasp of the chart setup.

Which trading metrics are crucial?

The previous section outlines the data you must collect while trading. However, these data do not have value if you do not understand their implications to your trading. Below are essential metrics that can help evaluate your trading results.

Total number of trades

Count the number of trades taken using a strategy in a matter of one week, one month, or one year. You can compare this number with that of a similar strategy. This way, you can evaluate if you have taken too many or too few trades in a given system.

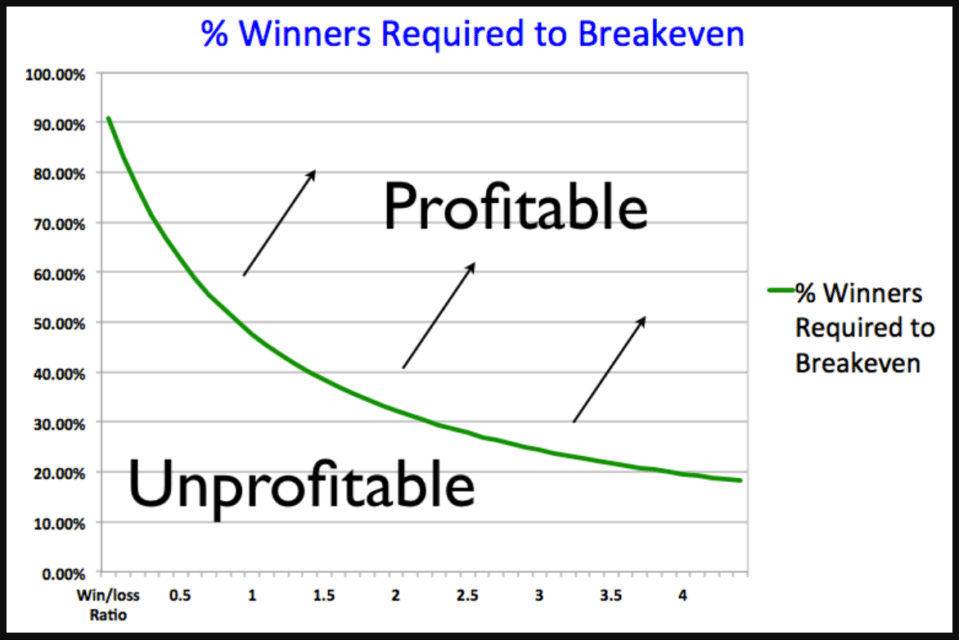

Win rate

It is one measure of the effectiveness of your strategy. However, if you use stop trailing, the win rate has no value. While the trailing stop allows you to win more trades, you could have many winning trades with minimal profits. The win rate becomes essential when you pair it with a strategy that uses a fixed reward-risk ratio per trade. The image below shows the relationship between win rate and reward-risk ratio.

Average reward-risk ratio

It refers to the ratio of the amount targeted and the amount risked. While this trade metric is vital, knowing the average reward-risk ratio over a series of trades is more critical to your profitability. For example, if you risk $2 in a deal to aim for $4, your reward-risk ratio is 2 ($4/$2).

Average holding period

This metric allows you to understand your propensity to keep trades open. Are you holding your trades in less than one day, more than one day, more than one week, or more than one month? That information can help you improve your strategy.

Maximum drawdown

Max. drawdown is the amount in your deposit currency representing the change between the highest account balance reached and the lowest account balance that follows after some losses.

Let us say you fund your account with $5,000. After a string of winning trades, your balance goes up to $6,000. Then a series of losses ensue, causing your balance to go down to $4,500. For this example, your max drawdown is $1,500 ($6,000 – $4,500). Meanwhile, the percentage drawdown is 75 percent ($4,500/$6,000).

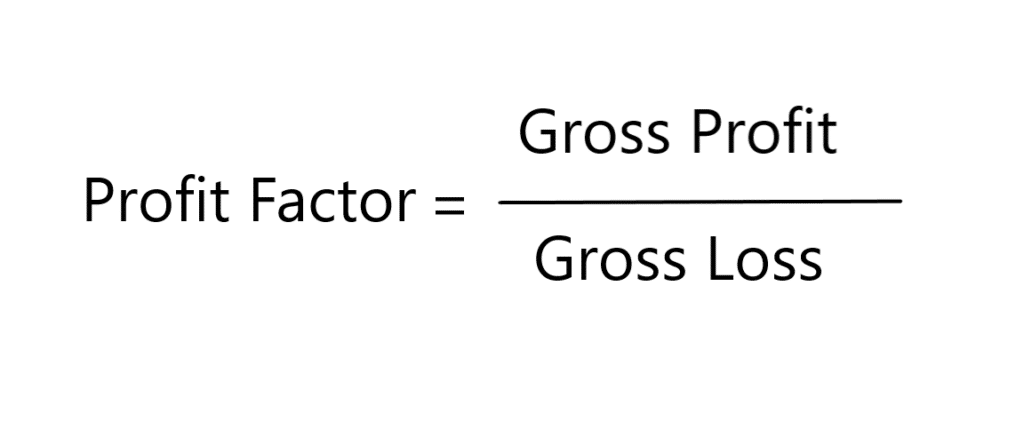

Profit factor

It helps you quickly understand if your trading method works or not. A profit factor greater than one means that your system is profitable. If less than one, you are losing money.

To get the profit factor, follow the steps below and refer to the image that follows:

- Add the number of profits for all the winners.

- Add the number of losses for all the losers.

- Divide the first value by the second value above, and you will get the profit factor.

How long does it take to update your trade journal?

Keeping a trade journal is a tiresome task. However, it is undoubtedly beneficial to your success. A trade journal allows you to look at your trades the same way business owners look at their financial and other operations.

What turns off most traders when it comes to maintaining a trade journal is the demanding nature of this task. It requires you to dedicate time and thoughts whenever you update your journal. This is to make sure you put the correct data in. Documenting a short trade that runs only for an hour may take you 15 minutes at minimum. It does not even end there. After the deal is closed, you will have to revisit the journal and update data.

Final thoughts

Keeping a record of your trading allows you to examine your results, remediate weaknesses, and emphasize strengths. The result is an optimized strategy, increased performance, and optimum profits. You will appreciate the importance of this diary in your trading campaigns as you begin tracking your trades. If you are not using a trade journal yet, now may be a great time to start.