Companies must invest money now to realize a profit in the future. Your company’s performance in this area is easy to track using a cash flow statement.

Determining your cash flow related to investments involves performing a simple arithmetic calculation. For example, if your total sales for the quarter are $100,000 while your total investments are $50,000, that means your investing activities result in a gain of $50,000.

Whatever the result of the cash flow, it will give you an idea of what to focus on to improve your bottom line. If the result is negative, it can help you devise plans to recover. Let us look into some of the investing activities your company may engage in the next section. Later, we will cover five sample investing activities you can partake.

What are investing activities?

Investing activities refer to the company’s investments in fixed assets and other securities within a given period. Such activities include the following purchase and sale of:

- Buildings

- Equipment

- Shares of another company

- Financial securities (e.g., bonds, stocks, etc.)

- Partnership with another company

How to calculate the cash flow from investing activities?

If your company uses an accounting system to record financial transactions, the cash flow information should be readily available. If this is not the case, its computation is fairly straightforward. Just use a simple arithmetic formula similar to the one shown in the image below.

First, take the sum of all sales of fixed assets and securities. Second, add up all the purchases made in assets and securities. The cash flow is simply the difference between the two values. A positive cash flow means that the company earns more money than it spends.

Examples of investing activities

This section lists down five investing activities you can engage in, as well as tips on how to go about each activity. Read on and make an informed investment decision.

Example 1. Purchase of a building

Purchasing a building involves a significant investment. That is why it requires due diligence. When you buy a commercial building, see that it is worth your company’s investment.

Here are some of the things you must look into when making such a purchase:

- Location. The neighborhood and infrastructure surrounding the building can impact its value. Check out if there are businesses around operating in the same industry as yours. Find out if you can avail of any support services in the neighborhood such as parking space. Of course, you must know about the zoning laws in the area where the building stands.

- Building classification. Does the building belong to class A, B, or C? Be aware that class A buildings are less risky than class C.

- Building condition. You have to know the age of the building and what type of operation has been done in the past. You have to consider how much cost is needed to refurbish the building to make it suitable for your use.

- Financing options. You have the following options when considering taking out a commercial loan: bridge loan, conventional mortgage, hard money loan, and SBA 504 loan.

Example 2. Sale of a building

It is so easy to list your building in marketplaces to find potential buyers. However, it is often difficult to sell the property at a premium price. Once you decide to put the property up for sale, think about ways to sell it at the best price possible.

Below are some tips to help you sell your building successfully:

- Boost the curb appeal. Making minor improvements to your building can have a huge impact on its valuation. Therefore, this is one area you must look into and invest in. Consider remaking your landscape by adding trees, flowers, benches, etc., before putting your building up for sale. Consider the building shown in the image below. It is the kind of curb appeal you must achieve.

- Highlight the great features of your building. Understand the best features of your property and highlight them in your marketing material and property tours.

- Price your property competitively. Do not sell your building for less than its value. Find buildings in your area similar to yours in size, location, condition, and age. That will give you a clue on what price you should sell your building.

Example 3. Sale of equipment

Before you put your equipment on the market, try to understand if repair or upgrade is necessary. Once done, you have to figure out how much you are going to sell the equipment. When you are ready to sell your equipment, here are the marketplaces where you can list your item:

- Machinery trader

- Craigslist

- Facebook groups dedicated to selling equipment

- Email marketing

- Local dealers

- Your website

- Facebook ads

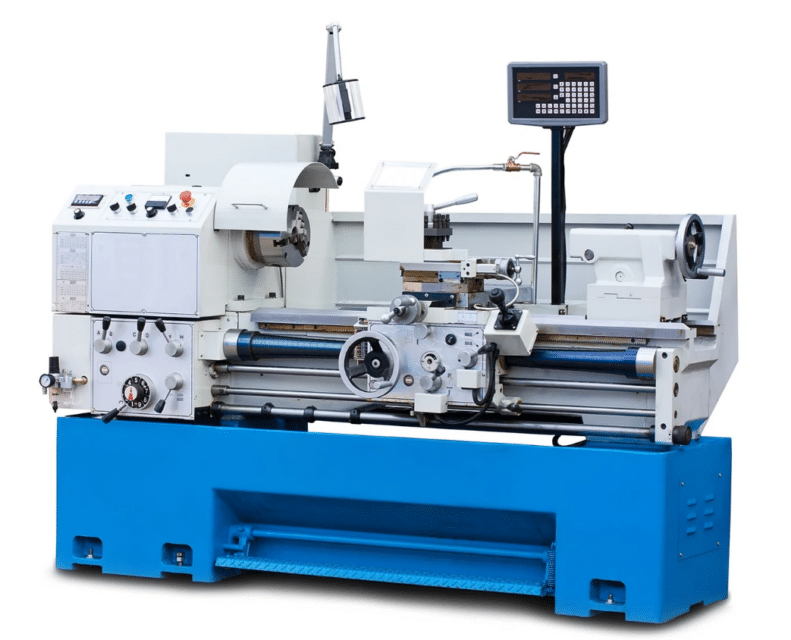

Example 4. Purchase of equipment

Having the right equipment can lead to improved productivity and efficient operation. For example, if your business falls under the manufacturing industry, you might need a lathe machine. If you need to buy one, consider the tips below. These tips apply when you buy any piece of equipment.

- Determine your business needs. Why do you need a new piece of equipment? Will it help you get ahead of the competition or make your business more successful? You might need a business case to find the answer.

- Get external help. You might need the service of a consultant to help evaluate your needs.

- Consider getting digital equipment instead of analog equipment. Research shows that digital technologies provide lower operating costs, better productivity, and improved output.

- Do comparative shopping. Find suppliers that offer competitive pricing, good reputation, and reliable after-sales service.

- Decide whether to rent or buy equipment. Renting may be the better choice if you will use the equipment in the short term, have no personnel capable of maintaining the equipment, etc.

Example 5. Partnership with another company

Investing in another company’s business can be a good idea. The advantage of this investment is that you just put money into the venture, and you do not spend time running the business yourself. This will allow you to do something else that is worth your time.

Before you put money in this investment:

- Make sure you understand the risks involved.

- Do not blindly accept any business offered to you.

- See if the investment meets your standard.

- Read the business plan yourself.

- Never consider joining a business without a business plan.

Final thoughts

Computing your cash flow is crucial in understanding the financial status of your company. This will allow you to make a decision that could improve your bottom line. A positive cash flow means you earn money from your investments. However, a negative cash flow is not bad. It could mean you are investing money today to see your business grow in the future.