Volatility Factor 2.0 promises to enhance your profits dramatically without exposing your account to risks. But this is just another empty statement that is meant to lure traders into purchasing it. As you will see in this review, the EA’s strategy is not lucrative.

Volatility Factor 2.0 is the product of FXautomater. The company claims that its main focus is to develop very profitable and reliable automated trading systems. The firm has been in this business since 2009, and so far, it has created numerous products for trading. Some of these tools include Smart Scalper Pro, Grid Master Pro, Omega Trend EA, and BF News Trader EA.

The highlights of Volatility Factor 2.0

The developer believes that the below listed features should assure us that his product is the best one in the FX market:

Optimal money-management

The EA tracks all open trading positions methodically to ensure that they will be closed with profits.

NFA and FIFO compatibility

The system strictly adheres to US currency trading regulations and rules.

Spread and price slippage protection

Volatility Factor 2.0 has in-built protections which reduce price spread and slippage. As a consequence, every trade is implemented with laser-sharp precision.

Trading strategy of Volatility Factor 2.0

According to the devs, this EA is based on a very potent volatility-based market algorithm that has undergone a battery of real-world tests. In essence, the software identifies trading opportunities when the market is volatile. It particularly signals trades in the direction of the medium-term market impulse.

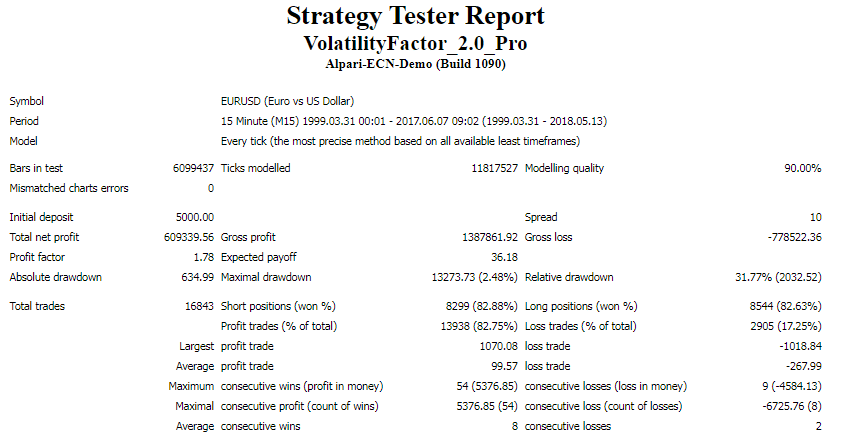

Backtesting reports

These are the results of an 18-year backtest on historical data. The EURUSD currency pair was the main trading instrument utilized. A capital of $5000 was used to conduct 16843 trades on the 15-minute chart. In the end, the EA won 13938 trades, which brought in a profit of $609339.56.

The average loss trade (-$267.99) value surpassed the average profit trade ($99.57) value by a huge margin. This is not a good sign. It tells us that the robot had a tough time identifying profitable opportunities. So, it is hardly surprising that a large relative drawdown of 31.77% was produced.

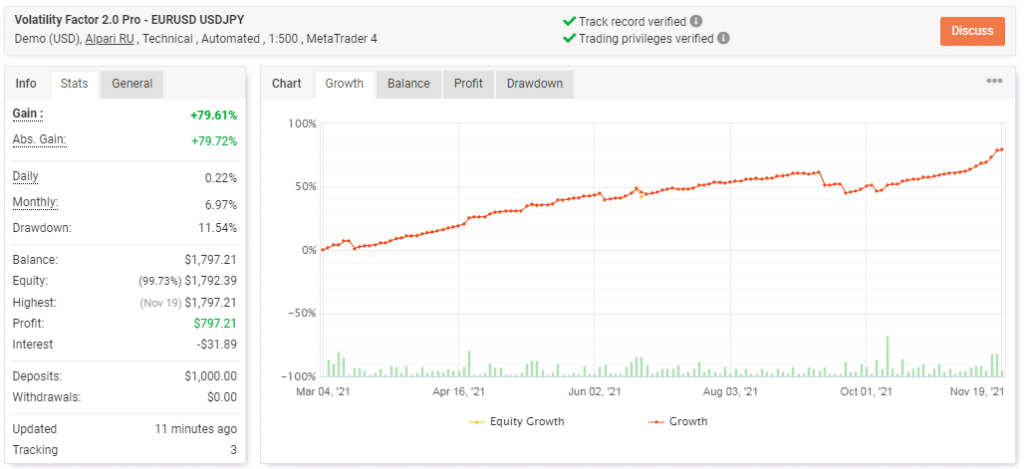

Trading results in real time

Although the vendor boasts that the EA is lucrative, a look at these results shows us otherwise. In 8 months, the system has only made a profit of $797.21 from a $1000 deposit. So, it has not even returned the money invested. The only good news is that little risks are involved in trading going by the drawdown value of 11.54%.

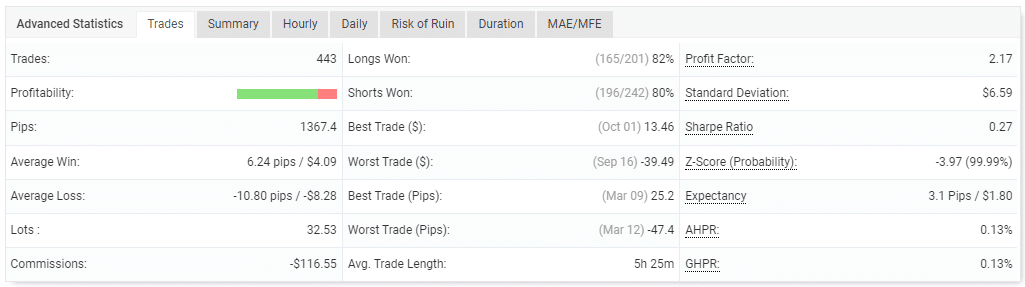

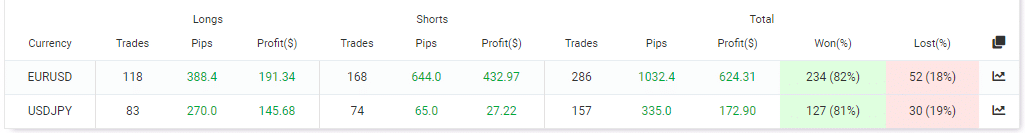

The software has an average trade length of 5h 25m, and so far, 443 trades have been instigated. They have produced win rates of 82% for long positions and 80% for short ones. There’s a profit factor of 2.17, which means that the EA can bring twice as much the money invested. The average win is 6.24 pips, whereas the average loss is -10.80 pips.

The EURUSD was the most traded and profitable pair.

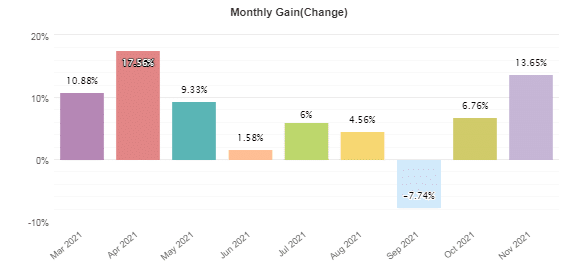

Since it began trading in March to date, the system has only been unprofitable on one occasion — September.

Volatility Factor 2.0 price

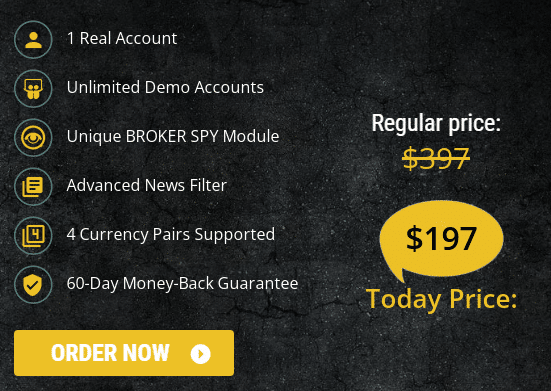

The vendor has reduced the price of this product from $397 to $197. This price allows you to access 1 real account, unlimited demo accounts, and a 60-day money-back guarantee, among other features.

Customer support

You can get in touch with support through email in case you have any query or feedback about the services provided. The team promises to respond to you as soon as possible. However, there are no other avenues provided for contacting the vendor. A phone number is not even featured in the presentation.

Are traders happy with Volatility Factor 2.0?

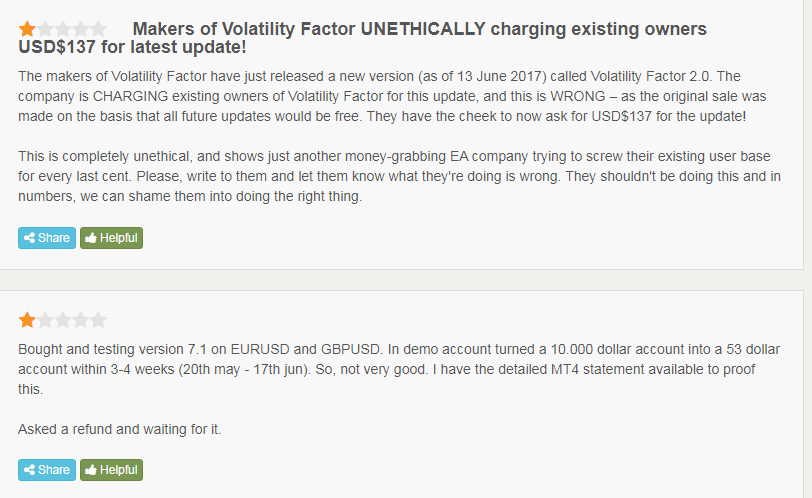

No, they are not. This is because the system has a 1.863 rating out of 5 on FPA. According to one of the traders, Fxautomater is another money-grabbing EA company that is hell bent on collecting money from customers. This client concluded this after the firm asked him to pay for updates, which are marketed as free. The other trader implies that Volatility Factor 2.0 makes numerous losses, and though he asked for his money back, he has not been refunded yet.

Volatility Factor 2.0

Volatility Factor 2.0-

Profitability2/5 Bad

-

Strategy3/5 Neutral

-

Reliability3/5 Neutral

-

Price4/5 Good

-

Customer Testimonials2/5 Bad

Advantages

- A 60-day money-back guarantee is offered

- Customer support is available

Disadvantages

- Unsatisfied customers

- Low profitability rate

- The results are for a demo account