Not all of us have a large amount of cash to invest with JP Morgan and Goldman Sachs. These firms turnover billions of dollars annually. For novice investors choosing an investment manager is critical; after all, they are responsible for ensuring your money grows.

You, therefore, have to take careful consideration when choosing the appropriate investment manager. If you wondered what constitutes the right one, read the further six steps to select the best one.

Who is an investment manager?

Investment or financial manager is a person who takes care of your investment portfolio by making the right decisions on your behalf and taking them guided by your goals and expertise in the particular assets.

Some responsibilities include:

- Day-to-day buying and selling activities

- Performance management

- Research market trends

- Reporting to client

- Fulfilling legal compliance

An investment manager would have a recognized qualification or extensive background in the financial sector plus experience managing financial assets. Main financial assets can include stocks, mutual funds, and ETFs.

Top six steps for choosing the best investment manager

You have to choose the right investment manager since these financial advisors will ultimately be making the decisions regarding your investments. You are entrusting your money with a firm or individual, and you rely on the investment managers to make appropriate decisions regarding your investment.

Let’s go through six steps that help you choose the best investment manager.

Step 1. Learn the qualifications and expertise

Qualifications and experience in the financial markets are critical as their knowledge and understanding of the particular assets indicate how capable they are of managing your fund. Capabilities include not only academics and work experience but also regulatory compliance. It’s vital that you associate with an investment firm regulated by a financial authority, and their legal compliance status is above board.

Step 2. Identify the historical performance

A good rule is to evaluate the last five years’ performance regarding investment returns and compare them to other firms within the same sphere. However, only considering historical returns is not ideal; the risk of achieving the results is equally important.

Points to consider regarding performance:

- Their performance during turbulent economic times like a recession.

- The volatility of returns: how much risk is the manager taking during the year.

- Diversification of fund: how well is the manager diversifying your funds across different assets and position sizing.

Step 3. Notice manager’s income

A manager’s salary that’s linked to the fund’s performance is a good sign, as well as their contribution to the fund. This indicates their confidence since they wouldn’t invest their own money if they didn’t believe the investment to be fruitful.

Step 4. Learn an information ratio

The information ratio of a fund measures how close the fund has performed against the benchmark. It also indicates the duration at which managers have outperformed the benchmark. A high information ratio indicates a manager who consistently generates returns.

Step 5. Check fund turnover

Another factor to consider is fund turnover, as this is a sign of the fund manager’s trading style. If they buy and sell frequently, the fund’s turnover will be high; in addition, transaction costs and taxes increase. You would want a manager who doesn’t trade too often, with fund turnover ratios below 100%, thereby not driving up costs which will eat away your returns.

Step 6. Learn fee structure

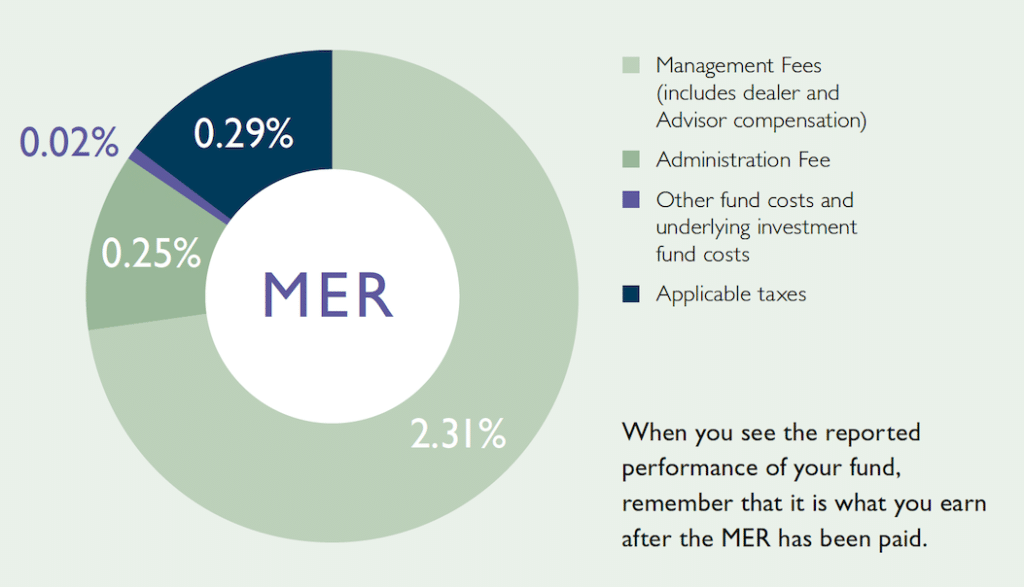

The fee structure is also indicative of an investment manager’s abilities. Guard against investment managers who charge low fees, which correlates to the quality that they can provide you. Typical management fees charged are:

- Fees charged for financial advice

- Commission fees

- Administration fees

Rather than focussing on the individual fee structure, a good measure of the management fee is the management expense ratio (MER), an indicator of the total expense for managing the fund:

Management expense ratio = operating expenses + management fees + taxes

A good MER is 0.5% – 0.75% , with a ratio greater 1.5% being considered too high.

Pros & Cons

Investment managers are a pretty big deal; considering all the factors that make up a good one, there are pros and cons to evaluate.

Pros

- Customer service

Good investment fund managers provide dedicated customer service and support, ensuring your best interests.

- Take decisions under pressure

Investment managers can adapt their strategies and make calculated decisions during uncertain economic times.

- Legal compliance

When using a regulated investment manager, you will have peace of mind that they are legally compliant, meaning that your funds are safe and protected against malicious activities.

- Grow wealth

If you decide to work with an investment manager, you enhance your chances of growing consistent wealth since their responsibility is to ensure they meet your objectives.

Cons

- Less control

When you use an investment manager, you give them control over your portfolio; the disadvantage is that you are not making all the decisions regarding your money.

- Fees

Investment fund managers can charge hefty fees since you are paying for their sought-after services and expertise. The better their performance, the more expensive this service becomes.

- High turnover

High turnover is associated with frequent trading, which increases your investment costs and indicates that your investment manager’s trading style is erratic.

Final thoughts

Considering all we’ve shared, choosing an investment manager is not such a challenging task, perhaps more straightforward than attempting to manage your portfolio yourself. If you think about it, the services rendered are probably justified, given that the stock markets are much more complex.

Managing other people’s money is not an easy task, more so under unstable economic conditions. Therefore, it would be wise to follow the advice we have shared when choosing the right investment manager.