In recent weeks, spatial computing stocks have received a lot of attention. These firms are at the forefront of disruptive ideas that connect the physical and digital worlds. As a result, investors’ attention has been drawn to spatial computing equities. Technology may be defined as “the digitalization of machine, human, and object activities and the surroundings in which they occur, to facilitate and optimize actions and interactions.”

In other words, spatial computing takes advantage of the three-dimensional (3D) space surrounding an item to interact with the rest of the world independent of its position.

Why is it worth investing in spatial computing stocks?

Analysts believe that investing in small spatial computing stocks might be as lucrative as engaging in Apple. Investment potential in spatial computing is similar to those in Apple’s early years, immense.

The mainline is that those who get in on this tech revolution while it’s still in its early stages might put themselves up for long-term returns of around 10,000%.

How does spatial computing work?

Spatial computing uses augmented reality (AR), virtual reality (VR), and mixed reality to provide seamless machine-to-machine or human-machine interaction in a three-dimensional world.

Spatial computing technology is not a new concept, although it is less well-known. Spatial computing technology includes ridesharing applications, GPS, and smart wearables.

How to start investing in spatial computing stocks?

If you are ready to begin investing in these assets, you must consider the company’s financial soundness. Investing in spatial computing stocks, when done well, is among the most effective ways to build long-term wealth.

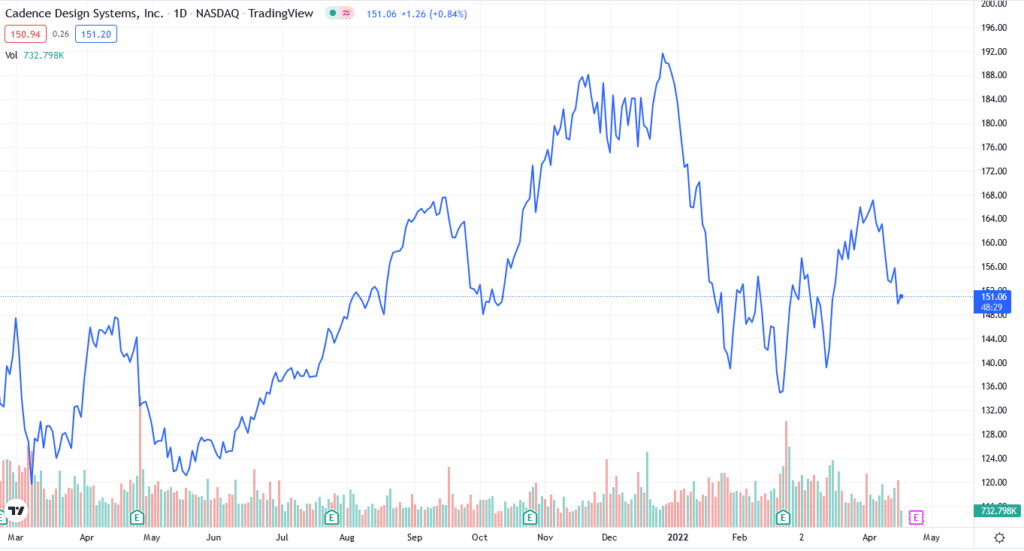

Cadence is a company that creates digital twins for the automotive and aerospace sectors. Early investors in the firm achieved a spectacular 1,230% gain in only ten years by purchasing shares at only $7.50 each in 2010.

Things will change in the following years because spatial computing has a promising future. Experts predict that this industry will expand by 41% by 2026, generating $196.21 billion in sales.

Now that you know why spatial computing stocks are worth investing in, it’s time to move on to the top three spatial computing stocks that you should know about.

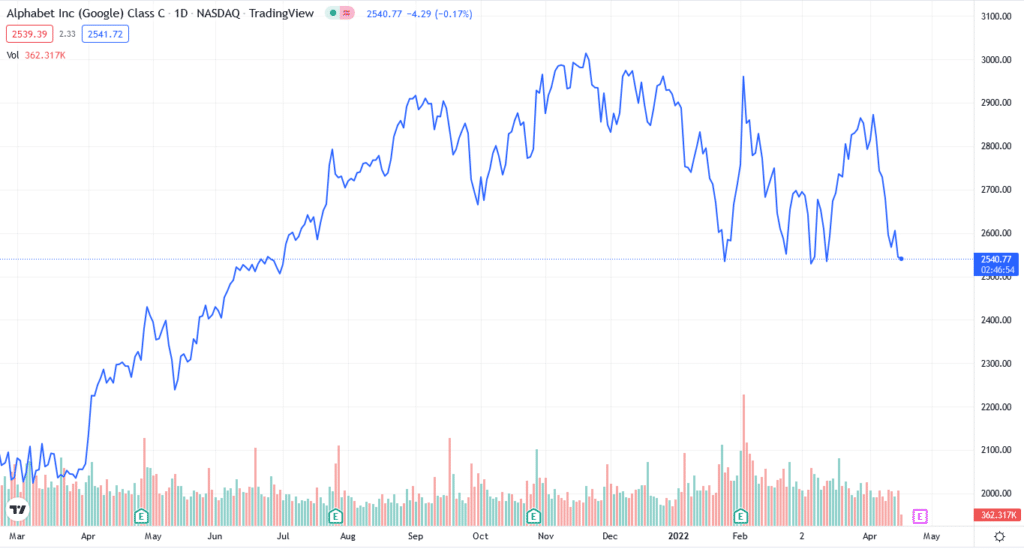

Alphabet (GOOG)

Alphabet is a tech behemoth with a strong foundation in machine learning and AI. These technologies serve as the foundation for spatial computing. With Google Lens, Google is already working on spatial computing initiatives. Google is also developing self-driving cars, and as more businesses explore spatial computing, the demand for storage and computational capacity will grow. Google Maps also contributes to spatial computing by allowing other businesses to utilize their maps and build spatial data for other applications.

52-week range: $2230-$3042.

1-year price change: over the past year, the stock has increased more than 10%.

Forecast 2022: after the Fourth of July in 2022, the over $3000 stock is expected to trade for approximately $150. While a stock split does not affect the firm, stocks frequently perform strongly when a split is announced. The company isn’t at its valuation top, but it still has strong growth potential, which we’ll see further following the split.

Apple (AAPL)

Apple is a pioneer in developing technology to make people’s lives simpler. It is increasingly employing augmented reality to improve the physical environment. Apple possesses its largest AR platform with hundreds of millions of AR-enabled devices and thousands of AR apps accessible on its App Store.

Apple just introduced AirTags. These are little beacons that you may use to track your gadgets. It may appear to be just another gadget, but the U1 chip designed by Apple for this smartphone is revolutionary. This chip employs a system that enables devices to communicate spatial and directional information.

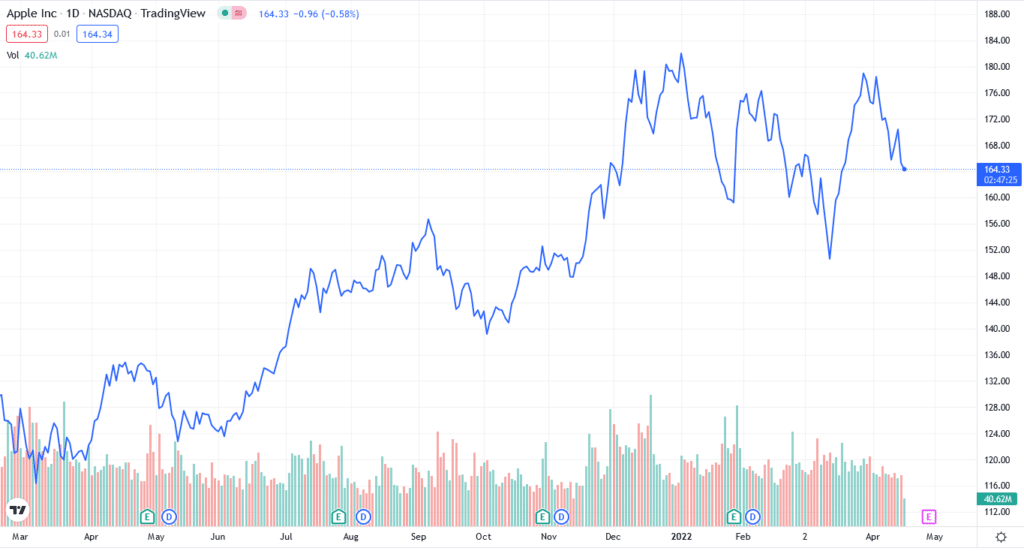

52-week range: $122-$182.

1-year price change: over the past year, the stock has increased by more than 22%.

Forecast 2022: Apple’s stock performance in 2022 has been hit and miss. According to the chart below, the stock dropped by 15% by mid-March. After that, it rebounded significantly and is presently trading in the red. Apple stock has historically been a stronger purchase after a decline. As a result, the recent drop in share price may be viewed as an opportunity in the long run.

Amazon (AMZN)

Few firms have had a more significant impact on consumers’ daily lives than Amazon during the last two decades. The company has evolved from an online book store to a one-stop shop for nearly anything. Before Amazon Prime, two-day shipping was an unknown luxury. It’s impossible to live without it now.

Amazon might become a key player in the worldwide spatial computing business with autonomous delivery. The store has already begun using Prime Air for drone deliveries. In addition, Amazon may potentially deploy IoT technology to automate order fulfillment in its facilities.

Amazon’s management stated on March 9 that the company’s shares would be divided 20-for-1 beginning June 3. While a stock split is primarily aesthetic, it gives certain short-term benefits.

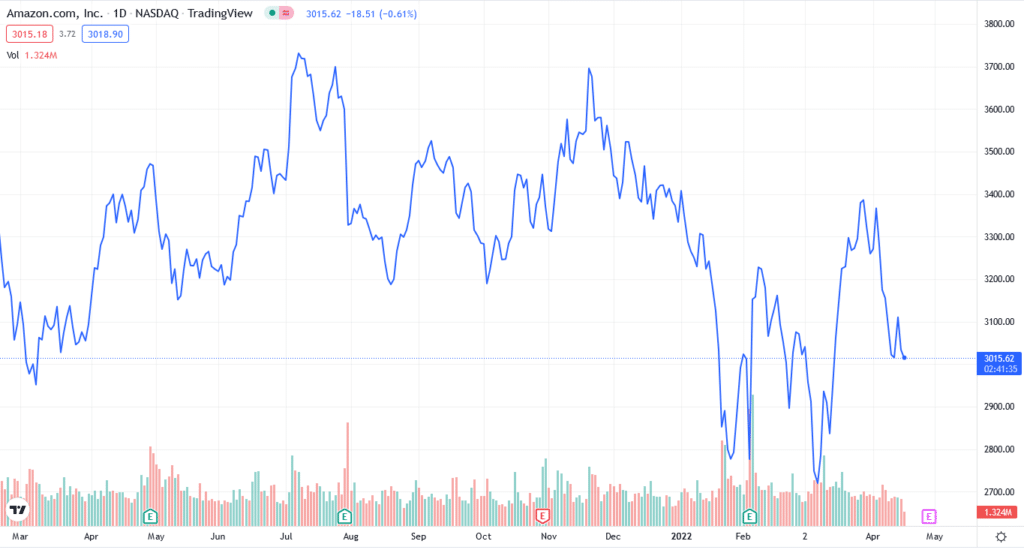

52-week range: $2671-$3773.

1-year price change: over the past year, the stock has decreased by more than 8%.

Forecast 2022: investors who do not have access to fractional shares can acquire the stock without risking their holdings. Second, because the Dow Jones Industrial Average is price-weighted, and an almost $3,000 stock would knock the index out of balance, Amazon may become a contender for inclusion.

Upsides and downsides of investing in spatial comping stocks

| Upsides | Downsides |

| These assets have massive growth potential. | These assets don’t provide short-term trading opportunities. |

| There are a lot of industry giants, so they provide a good diversification option. | Compared to others, they are high in price. |

| With growth potential and compounding, such stocks provide a valuable investment option. |

Final thoughts

Spatial computing stocks involve a lot of giants. In addition, the companies have grown significantly over the past decade and will continue doing so. Therefore, it’s essential to do your market research before investing in these assets.