Long-term investors must regularly assess who pays for a company’s products or services. Even if a company is the most innovative and cutting-edge globally, it will never succeed if its customers cannot pay for its products. It is one of the primary reasons aerospace and defense companies are so attractive, since its largest customer, the United States government, has almost unlimited resources.

These firms produce a wide range of airplanes and defense-related gear and equipment. It’s clear that the House of Representatives passed a $768 billion defense policy bill in September, which serves as a timely reminder to investors about the importance of these firms in the overall scheme of national security, and there will be plenty of contracts awarded to the industry’s top names in the future. Moreover, several of these firms have surged in the wake of recent market turmoil, signaling that they are ready to take off once the market stabilizes.

The following is a list of three aerospace and defense businesses stocks to assist you in broadening your portfolio’s exposure. A deeper look at these particulars is provided in the next section.

Why is it worth investing in aerospace and defense stocks?

Investors in defense and aerospace companies have outperformed the broader stock market regarding returns. According to our forecast, the value of defense stocks is anticipated to rise in 2022, and investors might consider taking a position.

The Invesco Aerospace and Defense ETF has experienced an upsurge in activity (PPA). It’s remarkable to note how assets under management levels have leveled out and stayed steady across the different ETF products available in this market. Everyone who wants to sell probably has this. The industry seems to be waiting for consumers to rediscover it. That sentiment is shared by Goldman Sachs, which has listed it as one of its top sector bets for 2022.

How does it work?

Aerospace and military assets are always the focus of attention to assessing their value. Fighter aircraft simply has more horsepower than commercial jetliners. Despite this, the most successful companies in this industry have found a solid balance between commercial and military usage. Due to economic and political constraints, military spending may become much more difficult to strike in the future. Although important to all investors, aerospace and military companies should be given particular consideration by those looking to place their money in the stock market.

For one thing, this market segment requires a significant investment. Second, no one has any idea how the Covid-19 outbreak will end up playing out. As an example, lingering consumer concerns might create roadblocks for businesses. But on the other hand, companies with strong balance sheets are better equipped to withstand the storms.

How to start?

With a few exceptions, aerospace and military stocks tend to be well-capitalized and well-known blue-chip companies. This industry is difficult to break into because of its mission-critical nature and high entry barriers.

Consequently, you don’t have to worry about a newcomer damaging your business model. Moreover, you may choose your online broker according to your preferences and interests in this challenging market.

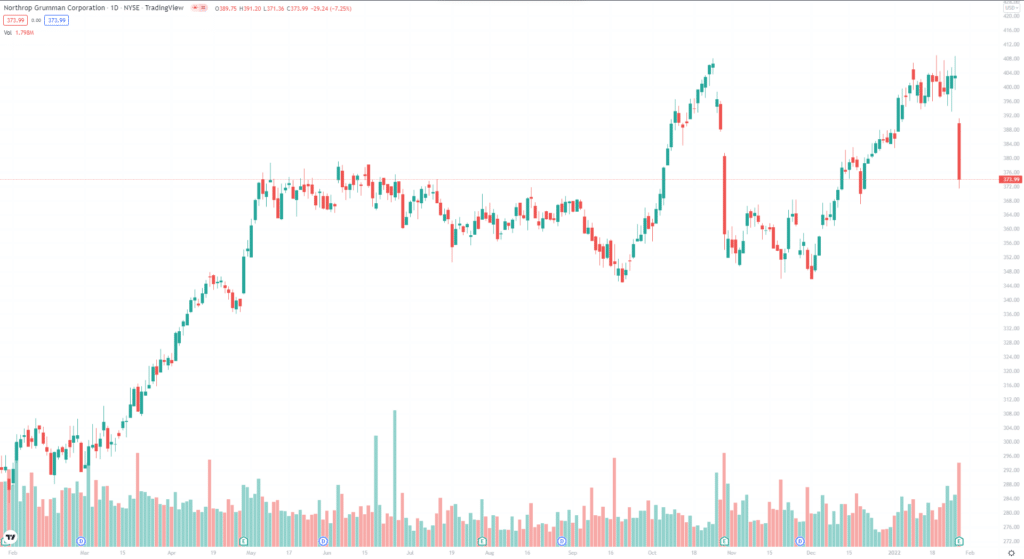

Northrop Grumman (NOC)

52-week range: $282.88-$408.97

1-year price change: $397.38

Forecast 2022: $387.23-$392.52

NOC is the second-largest military contractor in the US. It is one of the highest-quality stocks in the aerospace and defense business. So, it should be one of the first names on your radar for this sort of exposure. The company’s diverse business sectors, including aeronautics, military, mission, and space systems, make Northrop Grumman a good choice.

Northrop’s numerous operational industries are expected to be in high demand in the next years. In addition, investors may be confident that the Pentagon will award major contracts due to the increasing military budget.

This iconic defense company’s Q2 EPS growth of seven percent and a recent dividend increase of eight percent are two additional reasons to purchase Northrop’s stock. In addition, Northrop is known as a high-tech military contractor, which offers them an advantage in the marketplace. It has helped the business get contracts like the Ground-Based Strategic Deterrent program and the B-21 bomber program, providing substantial growth potential.

Raytheon Technologies (RTX)

52-week range: $66.11-$92.48

1-year price change: $145.56

Forecast 2022: $94.63-$112.28

The commercial aviation industry may see a significant recovery when the epidemic fades. We can see this in the instance of Raytheon Technologies, which includes Collins Aerospace Systems and Pratt and Whitney. They provide aerostructures, including avionic and mechanical systems, interiors, and mechanical systems for aircraft. While Raytheon’s commercial air travel division is vulnerable to a slower-than-anticipated recovery, the company’s military and intelligence divisions generate substantial revenue, which should put investors at ease.

The US Navy has ordered $1.3 billion worth of Evolved Seasparrow Missile (ESSM) Block 2 ship-defense missiles from the company until March 2025.

Reminders to investors about military contracts’ value come from this. Raytheon is another significant aerospace and defense company to purchase right now, which pays a 2.33 percent dividend and is about to hit new all-time highs.

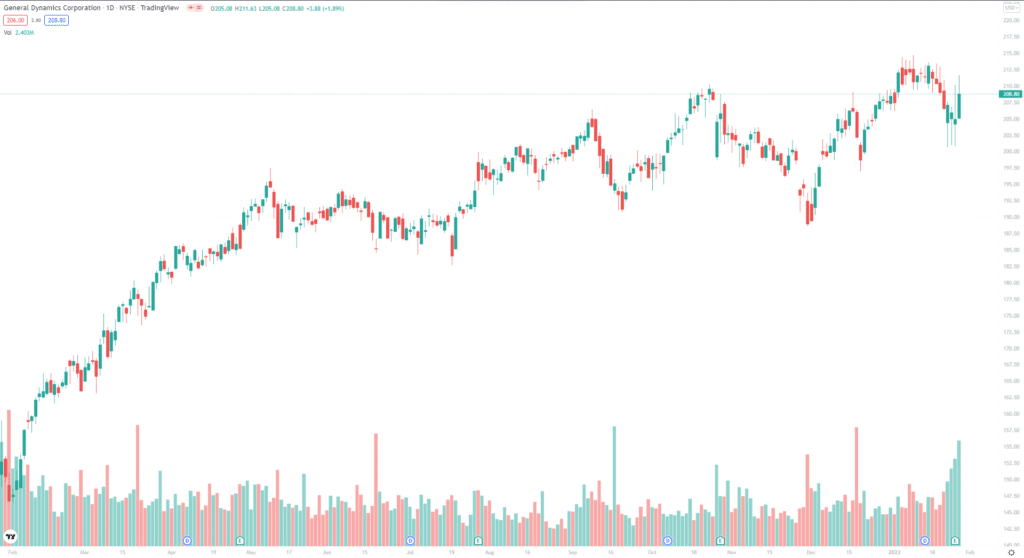

General Dynamics (GD)

52-week range: $146.53-$214.70

1-year price change: $368.05

Forecast 2022: $224.4-$345.71

It’s always a good idea to pay attention to industry-leading brands, and General Dynamics is a shining example. Various aerospace and military products are Gulfstream jets, nuclear submarines, Abrams tanks, and IT solutions. Such a company like General Dynamics, which receives 68% of its revenue from the US government, can be a good investment if you are concerned about escalating global tensions.

You may be familiar with the Gulfstream business jet line from the firm, the world’s largest corporate and private jet aircraft manufacturer. The pandemic has taken a toll on this area of the company, but vaccines will help it recover fast in the coming months. In addition, investors have a lot to look forward to from the company’s marine division, which includes a contract to build Columbia-class submarines until 2042.

Upsides and downsides

Let’s look at the upsides and downsides of aerospace and defense stocks.

| Upsides | Downsides |

| It has a lot of slow-moving yet growth-oriented companies for investors to choose from. | There aren’t many fast-moving equities available for active trading. |

| There is an actual trading floor there. | It has a greater cost of listing. |

| It primarily trades the equities of the world’s most giant publicly listed corporations. |

Final thoughts

The contrast between aerospace and defense equities is an intriguing one. Because of which provided the potency of the underlying components, the defensive component is constantly a matter of debate.

While military advancements promote civilian uses, the reverse is also true. Investors get two investments for the price of one in aerospace and the army stocks. Aeronautical components are in great demand during bull markets since people travel worldwide. Put another way, this sector is always worth keeping watch and investing in.