Robinhood FX EA claims to possess a unique trading algorithm that supposedly makes it one of the most profitable Forex robots for the Metatrader 4 platform. According to the vendor, it helps you earn the maximum profits while minimizing losses.

There is a stark lack of vendor transparency for this robot. We don’t know anything about the company’s service history, and the vendor has not shared the official address for the headquarters. Also, there is no information available on the team members. It is unknown whether this team has built other systems in the past.

The highlights of Robinhood FX EA

According to the developer, these features make Robinhood FX EA one of the best robots in the market:

Capital management

The vendor has mentioned this feature on the official website without providing an explanation for it. We assume it has something to do with the calculation of trading lots based on the size of the trader’s account.

Stop-loss technology

Robinhood FX EA uses tight stop losses waved within a small frame. According to the vendor, this helps it maintain profits. Again, we don’t have a proper explanation for this feature.

Hidden stop loss

When you begin trading, your broker is not able to see the stop-loss levels. The purpose of this feature is to stop brokers from manipulating the prices so that you hit the stop loss and close the order.

Trading strategy of Robinhood FX EA

We know virtually nothing about the trading strategy used by this Forex EA. While the vendor has mentioned that it is a non-martingale system, there is very little to go on. Experienced Forex traders place a lot of emphasis on strategy insight since it helps them determine whether the system will suit their trading style. The lack of strategy insight, therefore, is a huge red flag.

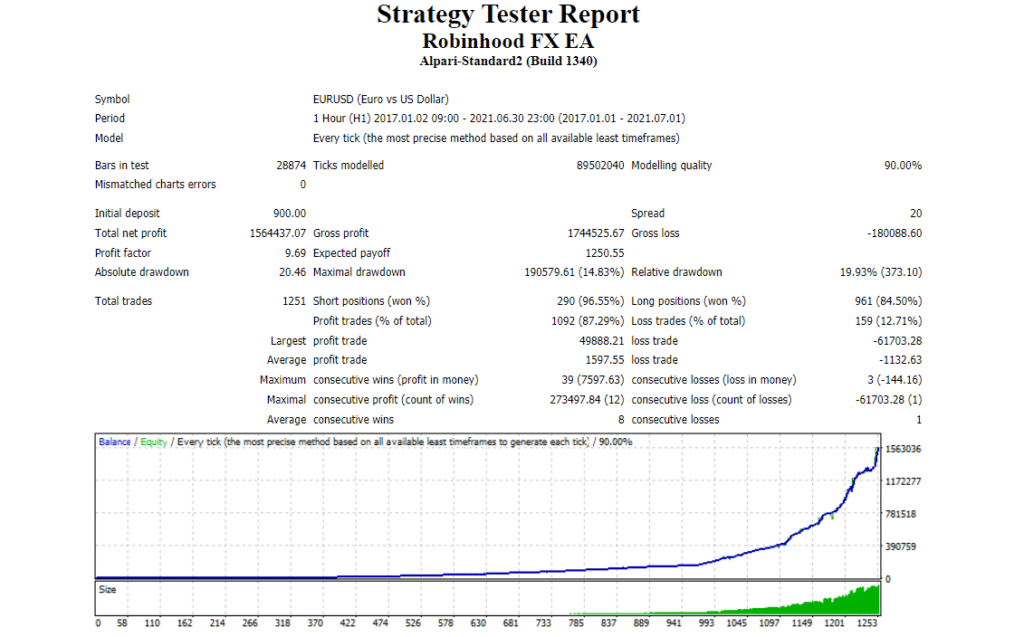

Backtesting reports

This backtest was conducted from 2017 to 2021 with 90% modeling quality. The EA used an initial deposit of $900 to place 1251 trades. It won 87.29% of all trades, thus making a profit of $1564437.0. There were 39 maximum consecutive wins and 3 maximum consecutive losses during the testing period. The profit factor for this backtest was 9.69.

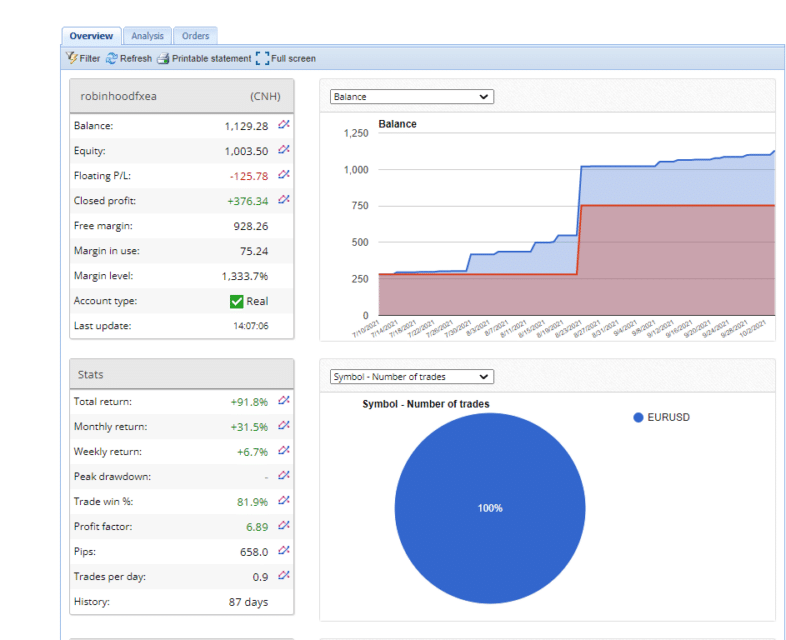

Trading results in real time

Here we have a live trading account for Robinhood FX EA on FXBlue. This account has been active for only 87 days, which means it hasn’t dealt with different market scenarios. The weekly and monthly returns are 6.7% and 31.5% respectively, while the profit factor is 6.89. Out of 73 trades, it has won 59 and lost 13. This means the account has a profitability of 81.9%.

Because of the short trading history, we cannot accurately analyze EA’s profitability. The Forex market is highly volatile and for a system to be considered trustworthy, it must have a long track record of winning profits at a steady rate. As such, we cannot consider Robinhood FX EA a profitable robot.

Robinhood FX EA price

There are three distinct pricing plans for this EA, with all of them offering the same features. The only difference between the plans is the number of real and demo accounts they allow you to access. For the Basic plan, you can access 1 real and 1 demo account for $127. The Regular plan costs $147 and it lets you access 2 Real and 2 Demo accounts. Finally, there is the Business plan, priced at $167, that provides you with 3 real and 3 demo accounts.

In case your account has a drawdown exceeding 50% even after using the recommended settings, you can ask for a refund within 30 days of purchasing.

Customer support

You can contact the support team 24 hours a day, 5 days a week. For this, you can use the phone number or the email address shared on the website.

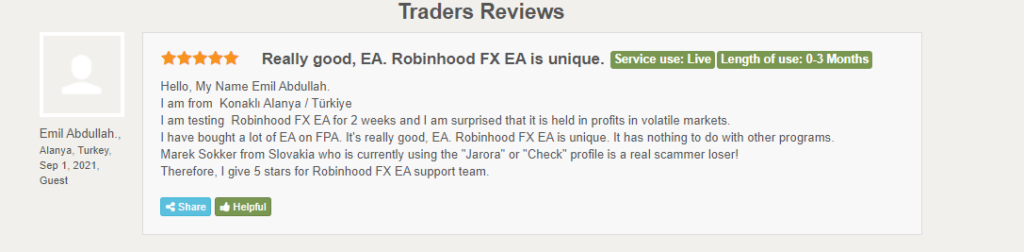

Are traders happy with Robinhood FX EA?

There is only a single user review for this robot on the Forex Peace Army website, and none on Trustpilot. This tells us that most traders are either not aware of this system or do not trust it enough to use it for live trading.

Robinhood FX EA

Robinhood FX EA-

Functionality1/5 Awfully

-

Trading Strategy1/5 Awfully

-

Live Results1/5 Awfully

-

Customer Support2/5 Bad

-

User Reviews1/5 Awfully

Advantages

- Money-back guarantee

Disadvantages

- Lack of vendor transparency

- Undisclosed trading strategy

- Short trading history