Prop Firm EA claims to pass the trading challenge offered by the proprietary companies. The company claims that it can be used on any company and broker. The robot does not use the martingale strategy and will pass the requirements set on the prop firms. We will cover all the details of the robot to see if we can use it on our live account and get through the challenge and verification stages.

The highlights of Prop Firm EA

The EA has the following features, according to the provider:

Challenge and verification stages

The robot can pass the challenge and verification stages set by the prop firm companies. This includes keeping the drawdown below 10% and making 10% each month. It also has a news filter that avoids economic factors that influence the market heavily.

Funded accounts

The robot claims that it can provide traders with funded accounts that value up to $200000. Traders can generate passive income from their trading accounts.

Trading strategy of Prop Firm EA

The robot trades on 25 currency pairs and uses a grid approach. It employs a top-bottom reverse approach to the trades with internal smart indicator signals and uses a news filter to avoid trading during highly volatile conditions. The robot can determine the lot size based on the account value, or traders can enter one manually.

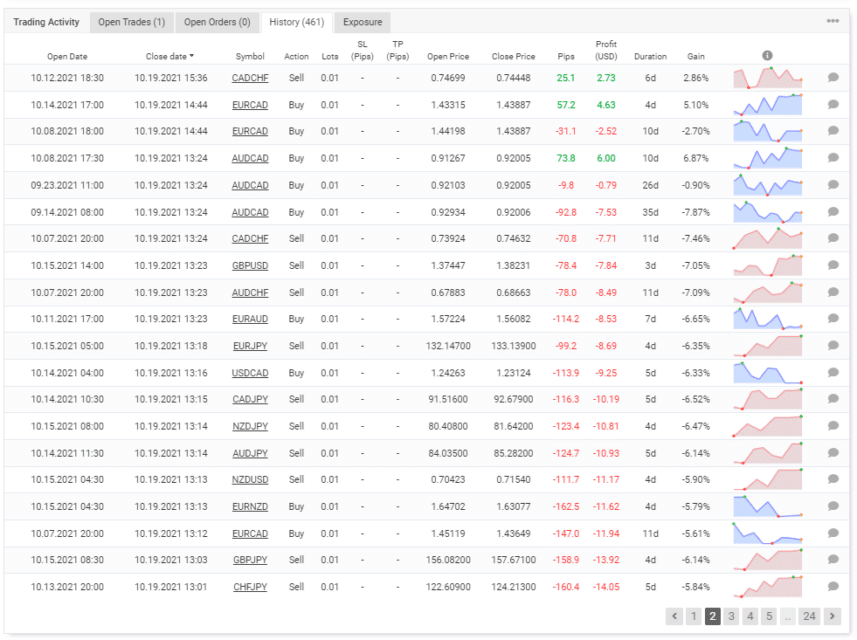

From Myfxbook trading history, we can see that the average trade duration is three days which means it has an intermediate approach between day and swing trading. It will not close trades when they are in a loss; rather will wait for the market to reverse.

Backtesting reports

Backtesting results are not available for the robot, which gives us a negative vibe about the system’s performance. The algorithm might have failed during extensive historical testing, which might be why the developers do not provide us the statistics.

Trading results in real time

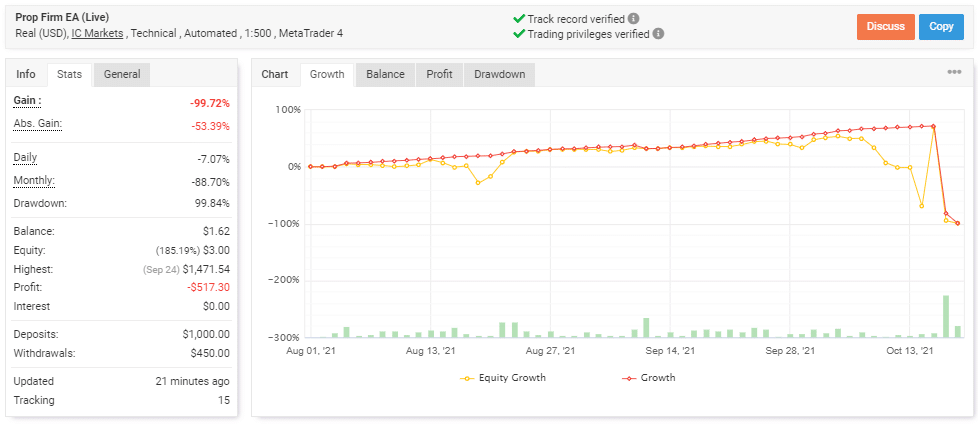

Verified trading records on Myfxbook show performance from August 01, 2021, till October 13, 2021. The system made an average monthly gain of -88.70%, with a drawdown of 99.84%. This is terrific output which shows that the algorithm wipes out the account balance while trading. The winning rate stood at 67%, with a profit factor of 0.66.

The best trade was $17.29, while the worst was -$50.57 in a total of 474 trades. The developer made $1000 in deposits and $450 in withdrawals.

Prop Firm EA price

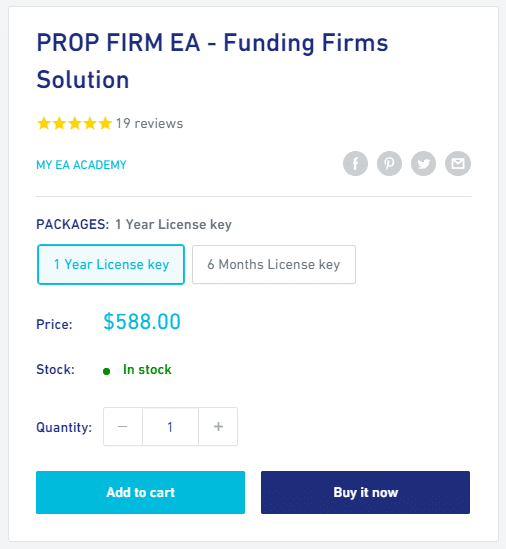

The company gives the algorithm for $588 and $388, with one license available for a single account. There is a 14-day refund policy if the robot does not perform up to the task.

Customer support

The developer provides customer support through an email id and via their social media platforms. They claim to get back to traders within 24 hours after they receive the message.

Are traders happy with Prop Firm EA?

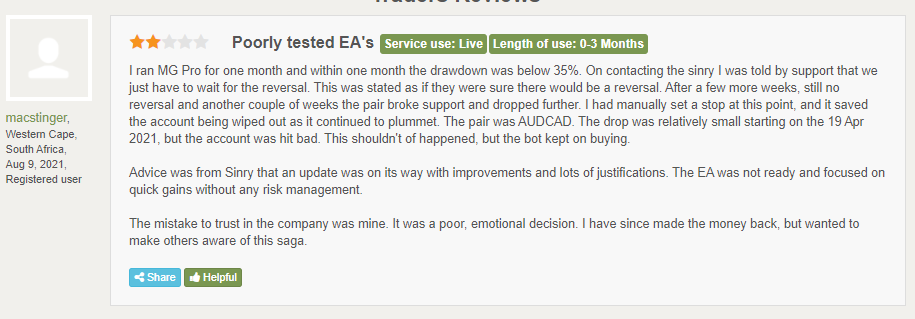

There is a single review present on Forex Peace Army. The trader complains that the algorithms provided by Sinry Advice are poorly tested and that he is facing a high drawdown after using the MG Pro robot. He says that it was his own fault to trust in the company.

Prop Firm EA

Prop Firm EA-

Profitability1/5 Awfully

-

Strategy2/5 Bad

-

Reliability3/5 Neutral

-

Price1/5 Awfully

-

Customer Testimonials2/5 Bad

Advantages

- It has live records on Myfxbook

Disadvantages

- No backtesting records are available

- No transparency of developer

- Uses risky grid strategy