EA Black Dragon has multiple settings that enable it to use hedging techniques, adjust the stop loss, or take profit on trades. The algorithm can trade with a fixed number of orders and has a spread filter to avoid trading during volatile conditions.

Ramil Minniakhmetov is the author of the product who resides in Russia and has 11 products published in the MQL 5 marketplace. His other publications include Asia Trend EA, Element Gold, Black Dragon and more. We will review the backtesting and live records of EA Black Dragon to see if the system is profitable.

The highlights of EA Black Dragon

According to the provider, the EA has the following features that set it apart from other algorithms in the market.

Black Dragon indicator

The algorithm uses a custom indicator developed by the author. It opens trades corresponding to the color of the indicator and can trade on multiple instruments.

Settings

The robot comes with multiple settings that can be tweaked according to the trader’s choice. It is possible to adjust the lot multiplier and the hedging options on or off.

Trading strategy of EA Black Dragon

According to the developer, the robot trades using a custom black dragon indicator that identifies trends on the market and provides built-in levels for stop loss and profit. From the trading history on MQL 5 records, we can observe grid and martingale strategies with an average trade duration of 1 day. There is no stop loss or take profit attached with any position, and the trades are only closed when they are in profit.

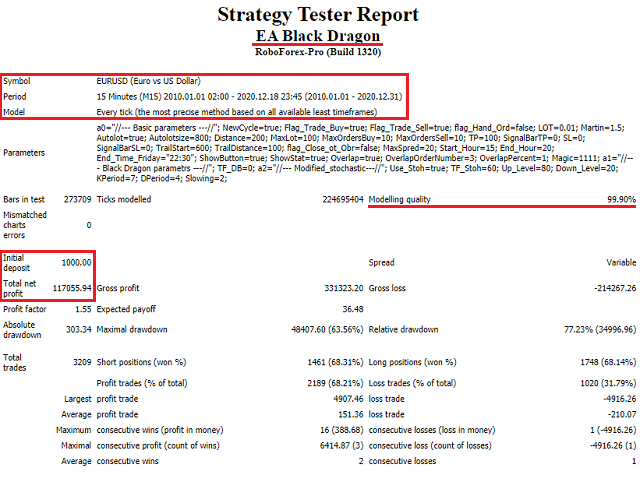

Backtesting reports

Backtesting results are available for EURUSD for a total duration of 10 years. The developer presents backtesting results by showing multiple images. There is no detailed statement present which is a big turn-off.

For the period, the robot had a maximum drawdown of 77.23% and turned an initial deposit of $1000 into $117055.94. It had a winning rate of 68.21% with a profit factor of 1.55. The average amount of profitable trades was $151.26, while the average amount of losing deals was -$210.07. There were a total of 3209 trades executed during this period.

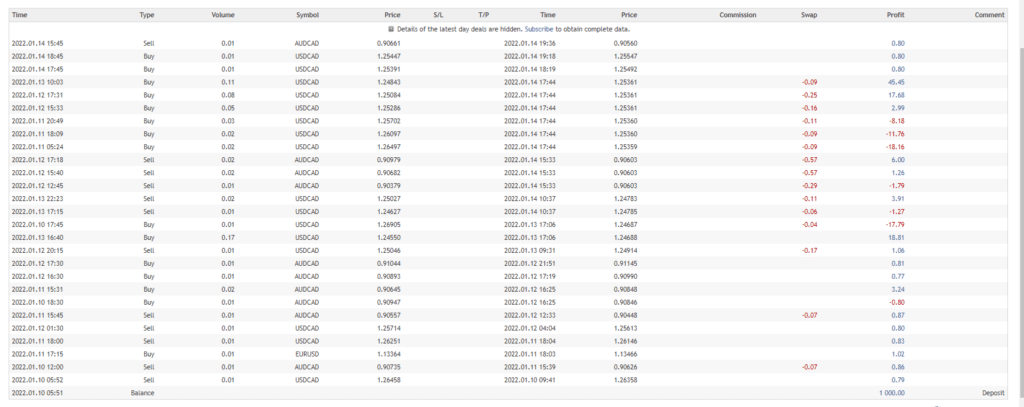

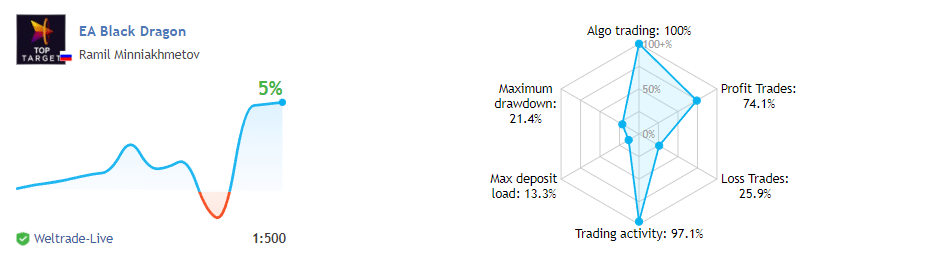

Trading results in real time

Verified trading records are available on MQL 5. From January 10, 2022, till the current date, the system made an average monthly gain of 4.71%%, with a 21.4% drawdown. This shows us that the algorithm has a poor risk-reward ratio while trading.

The winning rate stood at 74.1%, with a profit factor of 1.78. The best trade was $45.36, while the worst was -$18.25 in a total of 27 trades. The developer made $1000 in deposits on a live account.

EA Black Dragon price

The author sells the algorithm for $30 for a single account. There is no money-back guarantee, and there are no renting options at hand.

Customer support

Traders can contact the developer through the MQL 5 marketplace. They do not state the available hours or provide an email address for customer support.

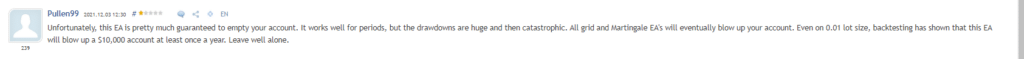

Are traders happy with EA Black Dragon?

The robot has a total rating of 4.91 based on 115 reviews on the MQL 5 marketplace. One trader says that the robot can cause a good drawdown on the account. It works only for a short duration, and then the grid and martingale strategies wipe up the portfolio.

EA Black Dragon

EA Black Dragon-

Functionality3/5 Neutral

-

Trading Strategy2/5 Bad

-

Live Results2/5 Bad

-

Customer Support3/5 Neutral

-

User Reviews2/5 Bad

Advantages

- Live records are available

Disadvantages

- Small information on the strategy

- Lack of vendor transparency

- Uses grid and martingale